Inflation and wages are type of a rooster or egg difficulty.

Do greater costs trigger greater wages or do greater wages trigger greater costs?

I suppose it’s in all probability a bit of of each.

There’s an apparent relationship while you take a look at the information.

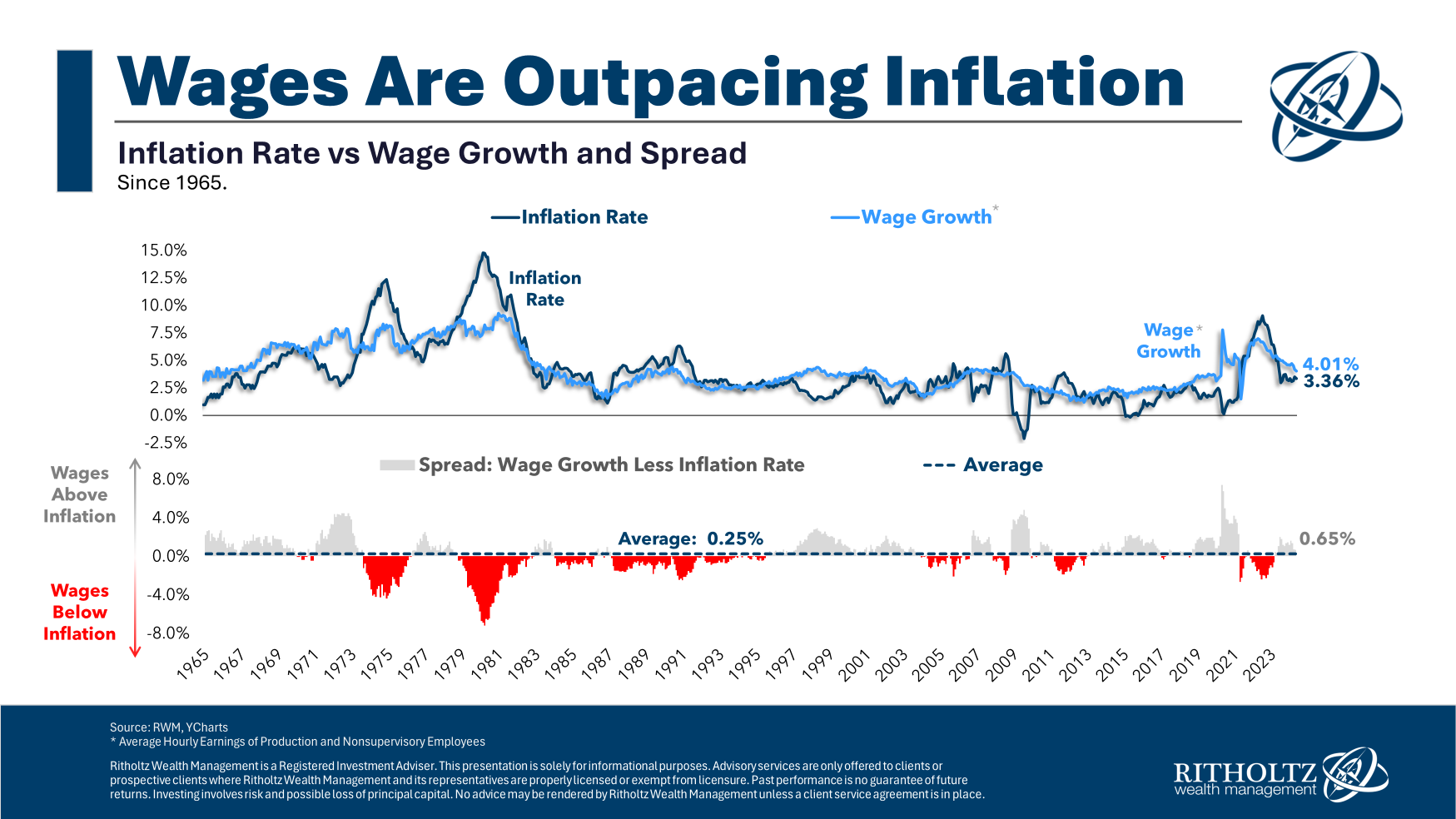

Right here’s a take a look at year-over-year wage development versus trailing twelve-month inflation going again to 1965:

Wages develop quicker than costs more often than not, however not at all times. Since 1965, wages have been rising above the speed of inflation rather less than 60% of the time.

The worst interval by far for wages falling behind costs was the Nineteen Seventies.

From 1973 to 1976, wage development was slower than inflation for 36 months straight. Then, from late 1978 by means of the tip of 1982, actual wage development was destructive for 50 consecutive months.

And it wasn’t simply the size of time however the magnitude of the distinction. On the worst level in 1980, inflation was outpacing wage development by greater than 7%.

Surprisingly, there was a protracted stretch from the mid-Nineteen Eighties by means of the mid-Nineties when wages have been rising slower than inflation. From 1984 by means of the summer season of 1995, costs have been rising at a quicker clip than incomes 88% of the time.

You don’t hear a lot about that timeframe producing financial distress however possibly that’s as a result of at the least it was higher than the Nineteen Seventies.

This time round, wage development was decrease than the inflation charge for 21 out of 23 months from 2021 by means of early 2023.1

We’re presently on a streak of 14 straight months the place wages have outpaced inflation.

The excellent news is wages are rising quicker than inflation. The dangerous information for a lot of households is nobody’s life ever matches up precisely with financial averages.

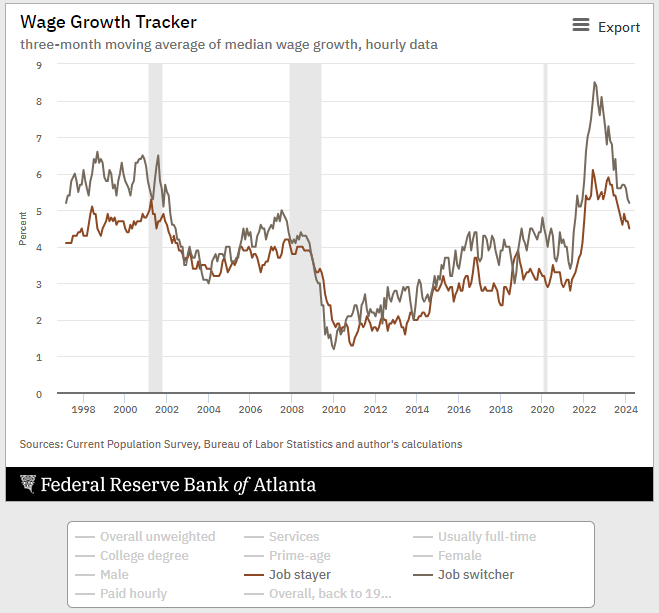

The individuals who modified jobs through the pandemic noticed far greater wage development than those that stayed with their present employer:

As at all times, some individuals are doing higher whereas others are falling behind.

The issue with this relationship is individuals see greater wages as one thing they earned whereas greater costs are a type of theft.

This is likely one of the large cause financial sentiment has been off these previous couple of years. Individuals actually despise excessive inflation.

However you may’t discuss in regards to the influence of inflation with out speaking in regards to the different facet of the ledger.

Wages have been rising too they usually’re an enormous cause the financial system has remained so resilient.

Additional Studying:

The Psychology of Inflation

1It’s additionally price noting that massive spike we had in wage development on the outset of the pandemic is one thing of a fable. The one cause you see that huge rise (and subsequent fall) within the information is as a result of so many individuals with decrease incomes have been laid off (assume service professions).

This content material, which incorporates security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There could be no ensures or assurances that the views expressed right here shall be relevant for any explicit info or circumstances, and shouldn’t be relied upon in any method. You must seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding advice or supply to supply funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.