You will have tens of millions of {dollars}. You’re 40ish years previous. You’re financially impartial. Not less than, you assume you’re. However that every one is determined by not taking an excessive amount of cash out of your funding portfolio. So, how a lot are you able to spend and nonetheless be “secure”?

We work with lots of younger(ish) individuals who grew to become financially impartial (roughly) by way of IPOs. They confront a query most individuals don’t confront for a number of extra a long time: “I’ve numerous cash. I assume I can dwell solely off of my investments. However how a lot can I safely spend from it?”

[Please note that in this blog post, when I talk about “spending,” what I really mean is “withdrawing money from your investment portfolio.” If you have additional sources of income, then spending <> withdrawals. I address the idea of living partly on portfolio withdrawals and partly on job income in this other blog post. In this blog post, spending and withdrawals are synonymous.]

That query is tough sufficient whenever you’re 65 and your retirement time-frame is extra…”regular.” However whenever you’re 35 or 40 or 45, it kind of hurts your mind.

It seems, I don’t assume “How a lot can I safely spend?” is the most effective query for individuals at this stage of life. There are different questions which can be extra useful in making (particularly huge) spending and portfolio-withdrawal choices!

The Traditional Approach to Decide How A lot You Can “Safely” Spend

In “conventional” retirement (i.e., planning to dwell off of your portfolio for 30 years, normally ages 65-95), there’s this factor name the “4% rule,” which isn’t really a rule and as an alternative a discovering, primarily based on reviewing historic knowledge, that you would be able to withdraw 4% of your portfolio in Retirement 12 months #1, alter that greenback quantity up for inflation in every subsequent yr, and never run out of cash after 30 years. (I speak about it extra on this publish about how necessary it’s to be versatile whenever you attain Monetary Independence whenever you’re nonetheless fairly younger.)

I additionally talked about in that publish that, in case your retirement will probably be a long time longer than 30 years, that 4% “secure withdrawal charge” seemingly must be adjusted downwards. By how a lot? Once more, there’s a rule of thumb:

Alter that secure withdrawal charge down 0.5% for every extra decade you need to dwell off of your portfolio. Should you have been retiring at 65 (30 yr time-frame) with $1M, you possibly can withdraw $40,000/yr (4% withdrawal charge). Should you have been as an alternative retiring at 55 (40 yr time-frame), you possibly can withdraw $35,000/yr (3.5% withdrawal charge).

Should you’re retiring in your 30s (three a long time previous to age 65), your withdrawal charge, if we even assume we are able to extrapolate that rule of thumb out that far (I’m not conscious of any analysis for timeframes that lengthy, and I’m additionally unsure if historic knowledge over such a very long time interval would even be helpful), could be 2.5%.

The quantity you’ll be able to “safely” withdraw is getting preeeeetty low at this level. Although, hell, if a 2.5% withdrawal charge is sufficient to assist the sort of life you like and provides you that means, extra energy to you! You’ve actually made it!

Our Shoppers Are Spending A lot Extra. Is It Nonetheless “Secure”?

A few of our purchasers of their 30s or 40s, dwelling off of their funding portfolios, withdraw way over 2.5%, 3.5%, and even 4%. The truth is, in some years, they’ve withdrawn over 5%.

One factor we are able to confidently say: They’ll’t depend on withdrawing that a lot each yr for the remainder of their probably 100-year-long lives. (Against this, the entire level of the 4% secure withdrawal charge is that you just can confidently withdraw that a lot yearly, for a 30-year time-frame.)

Now we have recurring conversations with these purchasers about withdrawal charges and {dollars}. We often hear, “Is it okay for us to withdraw this a lot? Would you advocate it? What do you assume?”

I usually say Sure, although that withdrawal charge isn’t sustainable. (Not less than, we are able to’t rely on it being sustainable. Years sooner or later, if now we have good inventory and bond market returns in the fitting years, we would uncover that they might have certainly withdrawn 5%+ annually and nonetheless have loads of cash! That’s the essence of “secure withdrawal charges”: they clear up for security upfront of figuring out how your funding portfolio will really develop.)

Why do I say Sure? How can I say Sure?

As a result of there’s One Large Distinction between “retirees” of their 30s and 40s and retirees of their 60s and 70s:

The youthful you’re, the extra simply you’ll be able to return to work and earn significant revenue if issues don’t work out in addition to you’d hoped and deliberate.

A Totally different Psychological Framework for Being Financially Impartial When You’re Younger

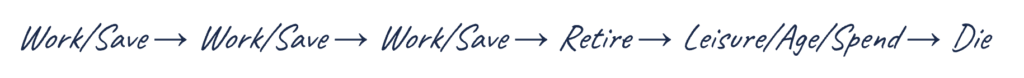

Most individuals nonetheless have a profession+retirement psychological framework that has us working working working…till we don’t anymore:

Most of our purchasers are in a stage of their lives the place everybody needs they’d extra money and time to spend on Not A Job. There are homes being purchased. Infants being had. Kids being raised. Getting older dad and mom being loved or taken care of. Journey being travelled. Levels being attained.

Possibly you, too, are on this section of life.

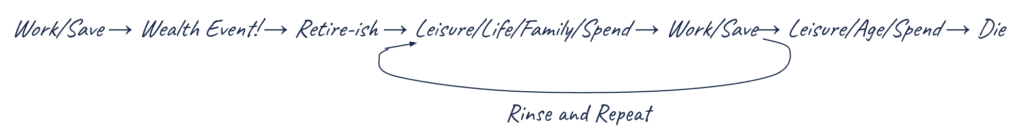

I subsequently invite you, particularly if you have already got significant wealth (which provides you extra safety and extra flexibility), to as an alternative consider your profession+retirement this fashion:

(And earlier than any fellow planners get shirty with me (I do know you’re on the market!): Sure, we must always all acknowledge that even that second trajectory remains to be a simplistic method of representing our lives and careers.)

My fundamental level is that getting important wealth earlier in life can assist you extra simply reorganize your work/life/retirement chronology beginning at a really early age. Should you settle for the “Rinse and Repeat” a part of this chronology, then you’ll be able to in all probability afford to “go more durable” throughout the Leisure/Life/Household/Spend half.

Ask Your self These Questions As a substitute

If we settle for that your ace within the gap is the flexibility to return to work for significant revenue, and that you just don’t subsequently essentially need to abide by “secure withdrawal charges,” then the query “How a lot can I safely spend?” is sort of a non-starter.

Particularly with regards to making huge spending choices, attempt these questions:

- How necessary is it that you just by no means need to work once more?

- Should you went again to work, how shortly may you earn sufficient to cowl this spending? Would that be price this factor/expertise you need to purchase?

- Let’s say you spend this cash. Describe the sort of life will you might have afterwards.

- What offers you a way of function or that means in your life? How would this spending show you how to assist that? and maybe my favourite:

- Think about that it’s 5 (ten) years from now, and also you didn’t spend this cash (to purchase this factor or expertise). How is your life totally different? What, if something, have you ever missed out on? How do you are feeling?

I do know it’s arduous to take some huge cash out of your funding portfolio whenever you’ve been given this wonderful present of great wealth at such a younger age. And I’m positively not saying you ought to! Retaining wealth means retaining flexibility and security. These are superb issues.

I imagine that determining what would (or may) convey true that means and happiness to your life, and considering by way of how one can reply if the funds don’t work out in addition to hoped, can assist you make the fitting spending decisions for you now, whereas nonetheless caring for you years sooner or later.

If you wish to ask higher questions that can assist you design a greater life—even amongst all of the uncertainty!—attain out and schedule a free session or ship us an e mail.

Join Move’s twice-monthly weblog e mail to remain on prime of our weblog posts and movies.

Disclaimer: This text is supplied for academic, basic info, and illustration functions solely. Nothing contained within the materials constitutes tax recommendation, a advice for buy or sale of any safety, or funding advisory companies. We encourage you to seek the advice of a monetary planner, accountant, and/or authorized counsel for recommendation particular to your state of affairs. Copy of this materials is prohibited with out written permission from Move Monetary Planning, LLC, and all rights are reserved. Learn the total Disclaimer.