What’s the Value Inflation Index (CII) for FY 2024-25 (AY 2025-26)? CBDT notified Rs.363 because the Value of Inflation Index for FY 2024-25 (AY 2025-26) on Could 24, 2024.

The price of merchandise rises as time goes on, resulting in a lower within the shopping for energy of cash. As an illustration, if Rs 1,00,000 may buy two items of products right now, tomorrow the identical quantity would possibly solely be capable of purchase one unit because of inflation. The Value Inflation Index (CII) is utilized to calculate the escalation in costs of products and belongings yearly on account of inflation.

Within the Finances 2017, the Authorities proposed a modification within the base yr for calculating the indexation profit. Beforehand, the bottom yr was set at 1981, however now it has been modified to 2001. It is very important notice that this modification applies to all asset lessons, however the impression will range relying on the belongings that get pleasure from indexation advantages for long-term capital features, resembling actual property, unlisted shares, gold, and bond funds.

Earlier than thirty first March 2017, the capital acquire was decided utilizing the acquisition value based mostly on the truthful market worth of 1981. This meant that for belongings bought earlier than 1st April 1981, the acquisition value could possibly be calculated utilizing the truthful market worth of 1981. Nevertheless, ranging from 1st April 2017, the acquisition value will likely be calculated utilizing the truthful market worth of 2001. Consequently, capital features on belongings acquired earlier than 1st April 2001 may even be calculated utilizing the truthful market worth as of 2001.

What’s the Value Inflation Index (CII)?

It’s a metric for inflation utilized within the calculation of Lengthy Time period Capital Positive factors (LTCG) from the sale of capital belongings in accordance with IT Part 48. This metric is said yearly for every Monetary Yr.

Due to this fact, the relevant CII charge will correspond to the particular monetary yr in query. Calculating the LTCG is essential in figuring out a capital acquire, and the Value of Inflation Index (CII) is crucial for this function. An instance can illustrate how the listed price of acquisition is computed utilizing the CII.

Listed Value of Acquisition=(Value of Acquisition/Value of Inflation Index (CII) for the yr during which the asset was first held by the assessee OR FY 2001-02, whichever is later)* Value of the Inflation Index (CII) for the yr during which the asset was offered or transferred.

Allow us to assume that you simply bought the property in FY 2005-06 at Rs.50 lakh and offered the identical in FY 2017-18 at Rs.1.5 Cr. Now the listed price of acquisition will likely be as per the above method i.e.

Listed Value of Acquisition=(Rs.50 lakh/117)*272=Rs.1,16,23,931. So the Lengthy Time period Capital Achieve=Promoting Value-Listed Value of shopping for property = Rs.33,76,069.

(Observe- As per the beneath Value of Inflation Index (CII), the CII charge for FY 2017-18 is 272, and for FY 2005-06, it’s 117).

Nevertheless, neglecting the listed price would end in a simple acquire of Rs.1 crore (Rs.1.5 crore – Rs.50 lakh). Nevertheless, with regards to taxation, the Lengthy-Time period Capital Positive factors (LTCG) on capital belongings will likely be calculated after adjusting the acquisition price for inflation utilizing the Value of Inflation Index (CII).

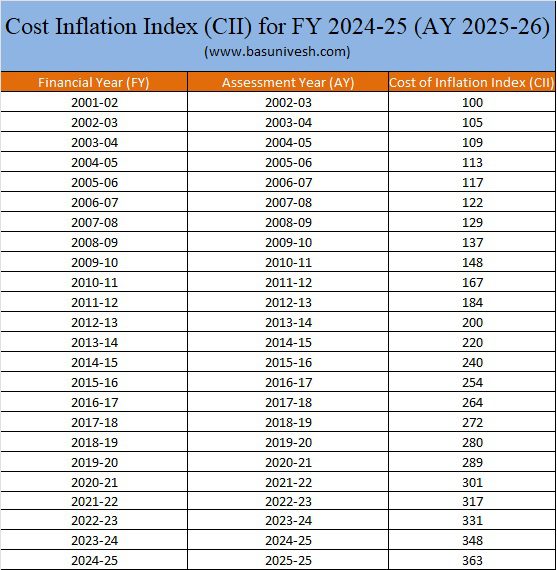

Value Inflation Index (CII) for FY 2024-25 (AY 2025-26)

Let me share with you the Value Inflation Index (CII) from FY 2001-02 to FY 2024-25.

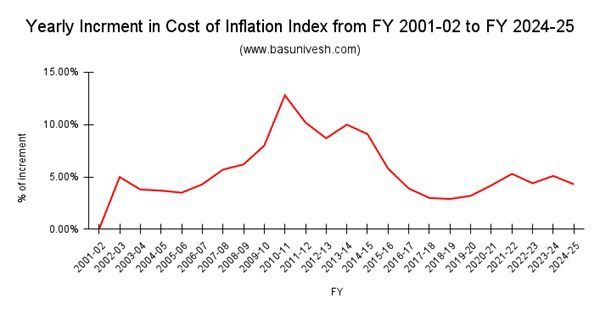

Now allow us to see how this price of inflation index is growing yr on yr from the bottom yr to the most recent FY 2024-25.

You seen that from final yr to this yr, the increment is round 4.3%. Hope this data will show you how to in arriving at your capital acquire tax.