TreasuryDirect is the U.S. authorities’s web site that lets you purchase treasuries instantly from the federal government. If you should buy treasuries from the federal government, is there any cause to make use of a dealer?

On this article, you’ll discover out the variations between going direct vs. with a dealer.

Plus, we’ll share another choices (like Constancy or Schwab) the place you’ll be able to make investments free of charge.

Shopping for from TreasuryDirect

The TreasuryDirect web site might be discovered at https://www.treasurydirect.gov. As you’ll be able to see from the .gov area, the web site is owned by the federal government. You should buy treasuries instantly from this web site. Though, you’ll be able to’t promote them on the identical web site. Extra on that a bit of later.

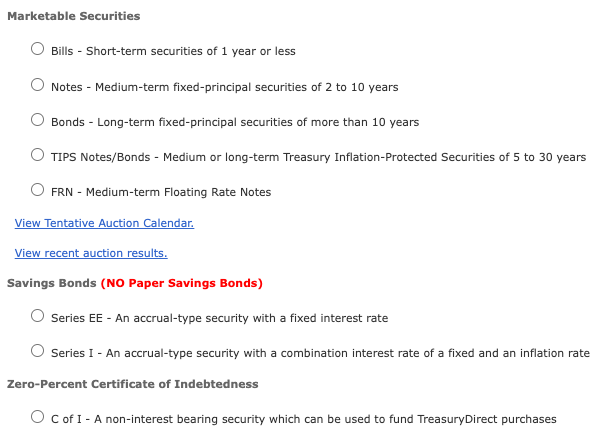

TreasuryDirect lets you buy any of the next marketable securities:

- Treasury payments

- Notes

- Bonds

- TIPS

- Financial savings bonds

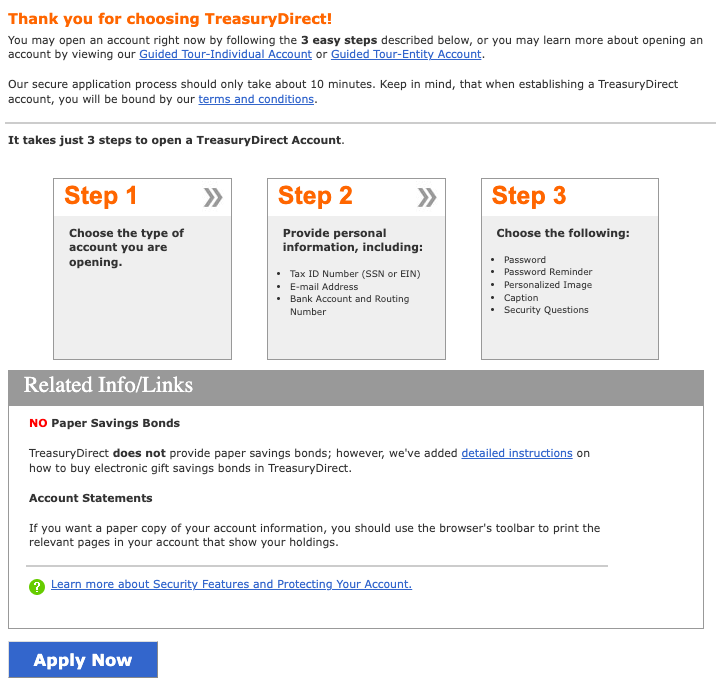

Step one in shopping for marketable securities on TreasuryDirect is to open an account. You’ll want the next:

- Social Safety quantity or taxpayer identification quantity for entities

- Driver license quantity

- Checking or financial savings account quantity and routing quantity

- Electronic mail tackle

- To have a U.S. tackle

- To be over the age of 18

With that data in hand, you’ll be able to go right here https://www.treasurydirect.gov/indiv/indiv_open.htm to open an account as a person. The method is pretty prolonged.

When you’ve created an account, you’re prepared to purchase treasuries. This half isn’t a lot completely different from how you buy treasuries on brokerage websites. Not like brokerages although, there isn’t a price for buying treasuries. To buy, you’ll want to attend till an public sale is out there, since treasuries are offered at public sale.

Public sale frequency depends upon the precise kind of safety however can happen every week or a selected time throughout the month. The Federal Reserve does recurrently change public sale dates so that you’ll have to examine the public sale calendar to search out out when the following public sale is out there in your particular safety.

Apart from no charges, TreasuryDirect additionally removes any third-party danger. The federal government is much less more likely to exit of enterprise than a brokerage agency. Moreover, you personal your treasuries and have full management over them.

Additionally, there is no such thing as a minimal quantity to buy. Some brokerages would require a sure quantity or quantity of bonds to be bought per transaction.

How To Place A Commerce

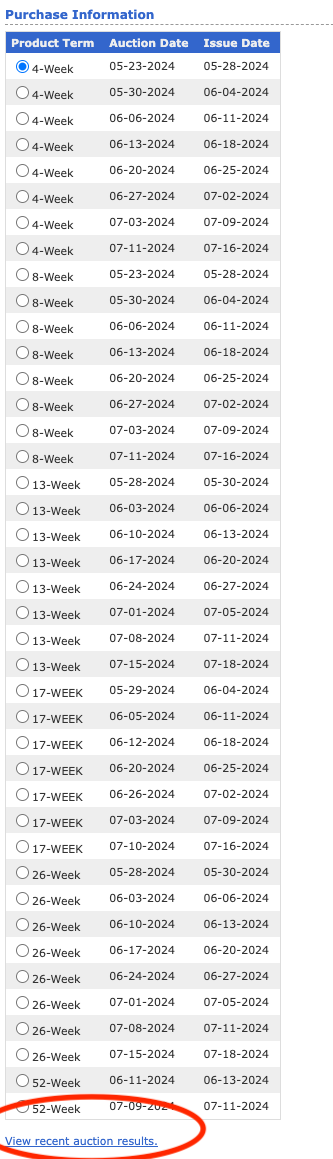

Truthfully, it is simple, but not simple, to position a commerce on TreasuryDirect. While you need to place a commerce, you merely choose the bond you need to purchase. However this is not for inexperienced persons – it’s a must to know precisely what you need… it is form of overwhelming the primary time.

This is what that appears like:

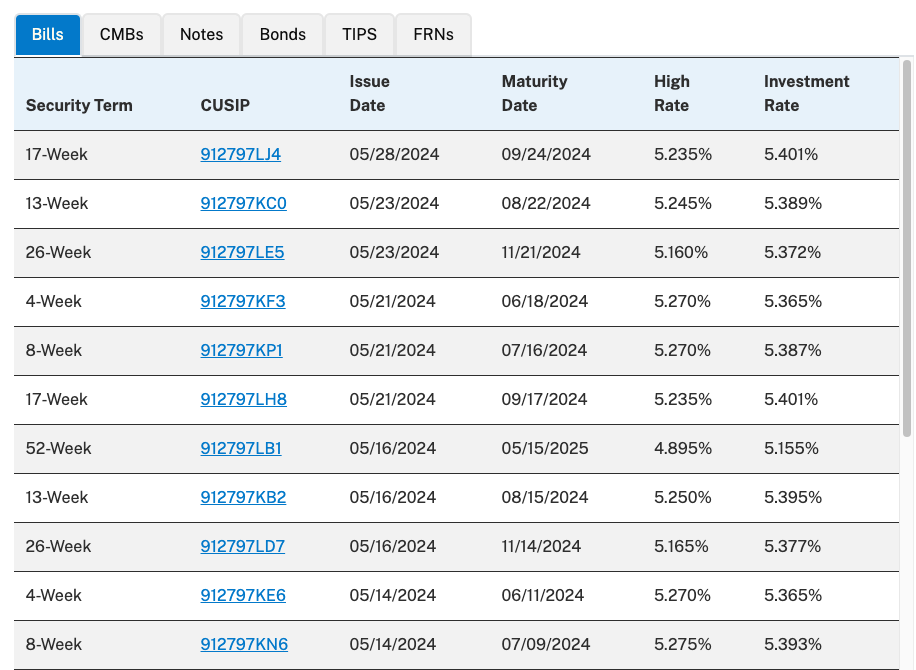

The one approach to know what the speed of the bond you might be shopping for is to click on the “View Current Public sale Outcomes”, which then opens a brand new tab and reveals you the charges.

With this knowledge mixed, you can also make a choice and purchase. It is a bit of tedious.

Promoting Marketable Securities Bought on TreasuryDirect

Whereas shopping for treasuries from TreasuryDirect is much like that of a brokerage, what’s completely different is the truth that you’ll be able to’t promote your treasuries on TreasuryDirect. In different phrases, they’ll’t be redeemed earlier than maturity. This doesn’t imply you’ll be able to’t promote treasuries bought from TreasuryDirect. You possibly can. However you’ll want to enter the secondary market to do it.

To promote securities bought on TreasuryDirect within the secondary market, you first switch them to a dealer, financial institution, or supplier — an entity able to promoting treasuries. There’ll doubtless be a fee price on the sale.

TreasuryDirect works very well if you happen to intend to purchase and maintain till maturity since there is no such thing as a approach to promote your treasuries by way of them.

One thing else to concentrate on is the TreasuryDirect web site: it’s safety is a bit of overkill. This may make the positioning troublesome and cumbersome to make use of since safety is often all the time in the best way. For instance, you might be prompted for solutions to your authentication questions extra typically than you’d like. Clicking the again button will often lead to your session being killed. This implies, you’ll need to log again into the positioning.

TreasuryDirect Options: Shopping for At Your Personal Dealer

Many brokerages enable shopping for and promoting of treasuries. The method is a bit more concerned than the shopping for and promoting of shares however this isn’t something particular to brokerages. Treasuries and bonds require buying at an public sale, choosing particular sorts, maturities, and even low cost charges. It’s necessary to grasp the lingo so precisely what you’re shopping for.

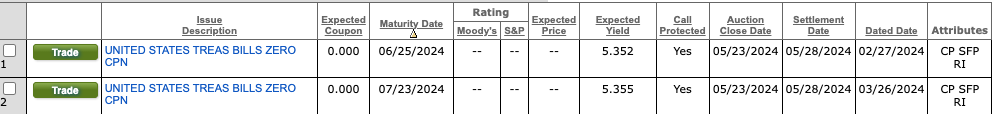

This is what it appears to be like like on Constancy, the place you’ll be able to really see the yield and different necessary data all on one display.

Along with new points, brokers have entry to the secondary market. This implies the next availability of treasuries from others who’re attempting to promote their treasuries earlier than maturity.

Additionally, since you might be more likely to have already got a brokerage account, it can save you your self time by not having to arrange a TreasuryDirect account.

Who Is TreasuryDirect For?

Should you don’t have a brokerage account and trying to maintain treasuries till maturity, you might be most likely the right candidate for TreasuryDirect. If you have already got a brokerage account and need to purchase and promote treasuries, TreasuryDirect doesn’t supply a lot benefit.

For these shopping for numerous treasuries, there could also be a financial savings benefit on commissions. Promoting earlier than maturity means transferring any securities out of TreasuryDirect and paying a sell-side fee to a dealer; however relying on quantity, it might be price it to first purchase your treasuries at TreasuryDirect.