Right here’s a take from Dave Portnoy:

Lots of people share these views. It’s the form of factor that will get folks riled up.

The market is rigged!

It’s one large on line casino the place the home all the time wins!

That narrative tends to accompany tales like this:

Traders who jumped into the most recent on-line frenzy over shares of the struggling online game retailer misplaced $13.1 billion in simply three days from the mania’s excessive, says an Investor’s Enterprise Every day evaluation of information from S&P International Market Intelligence and MarketSurge. That loss from the Could 14 excessive now far exceeds GameStop’s (GME) complete worth of $6.8 billion.

I’m unsure that measuring market cap losses from the height of a meme inventory mania is the best approach to consider good points and losses. However some folks will use tales like this as proof the inventory market is rigged towards the little man.

Look, if you happen to’re seeking to get wealthy in a single day, the inventory market in all probability does really feel like a on line casino the place the home all the time wins. The inventory market is rigged towards you if you happen to’re in search of straightforward cash

The large cash has extra brainpower, extra computing energy and higher data than you. And it’s nonetheless troublesome for a lot of of them to beat the market.

Positive, there are one-off lottery tickets however the inventory market is for affected person folks.

After I was in center college each month or so we might have an meeting within the fitness center.

These beefy guys who would tear phonebooks in half. Somebody from the D.A.R.E. program. Possibly a musical act if we had been fortunate.

One time, a man got here in to shoot free throws and provide motivational recommendation. This man didn’t even appear like a basketball participant, extra like a middle-aged dad with a polo shirt tucked into his Nineties-era Nike warm-up pants.

However he stepped as much as the road and knocked down free throw after free throw as all of us watched sitting cross-legged across the three-point line and baseline.

He shot lots of of free throws, all whereas giving a well-thought-out speech about the advantages of apply and course of. There wasn’t a single miss. Not even shut.

It was the identical precise kind each time. The identical arrange. The identical launch level. The identical follow-through. It was spectacular how he by no means deviated from that course of.

The identical principle applies to the inventory market.

In the event you don’t deviate within the short-run, you’re certain to be higher off within the long-run.

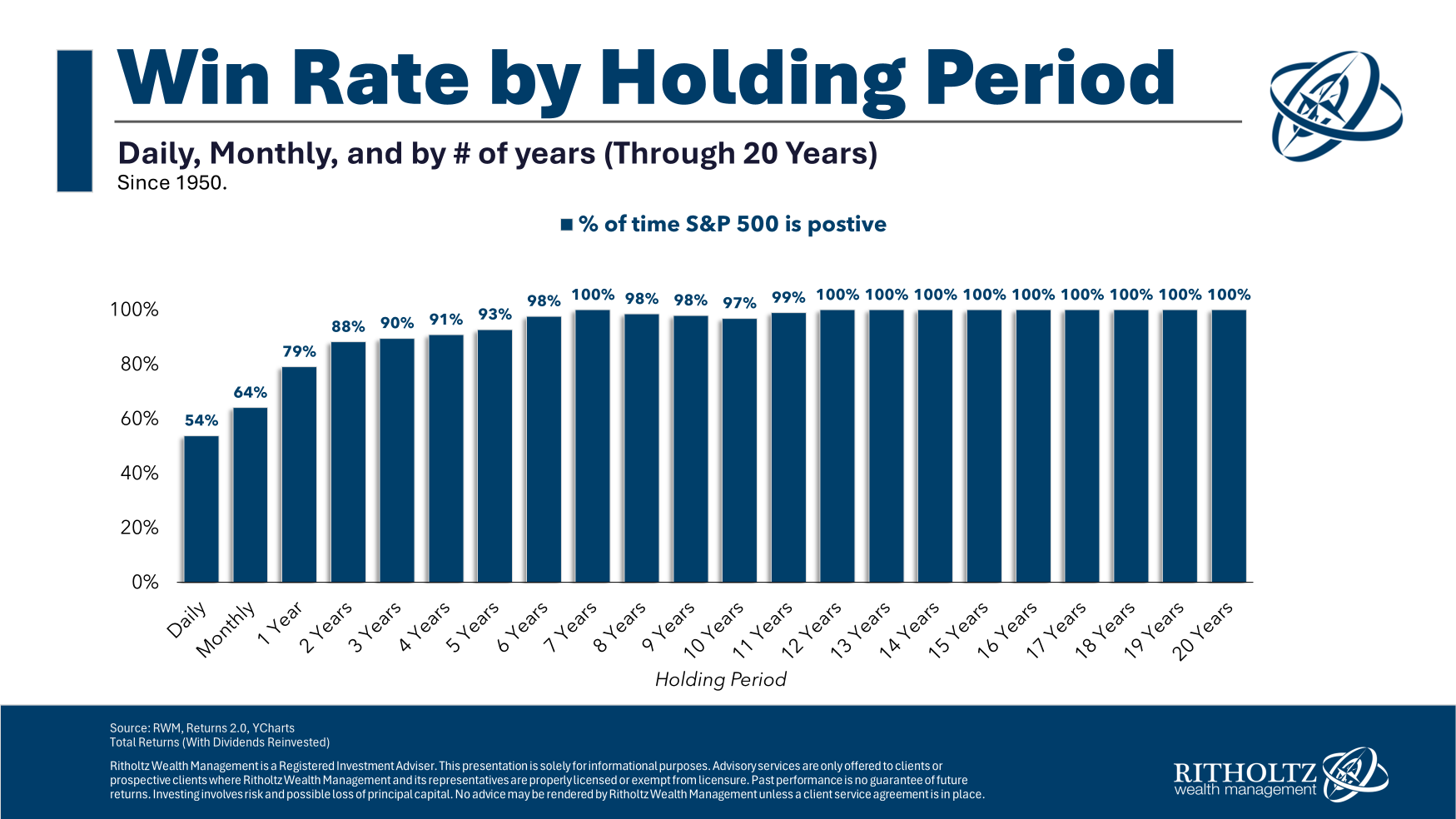

That is the historic win price for the S&P 500 since 1950 over numerous holding intervals:

If the inventory market is a on line casino, it’s the one one on the planet the place your odds of success enhance the longer you play the sport.

Every day, the inventory market is barely slightly higher than a coin toss by way of good points and losses. The additional you prolong your time horizon traditionally, the upper the possibility of seeing good points.

In the event you attempt to outsmart the inventory market over the short-term, it’ll really feel rigged towards you.

Satirically, there has by no means been a greater time to be a person investor — index funds, ETFs, targetdate funds, tax-deferred retirement accounts, zero greenback buying and selling commissions, automated investing and entry to extra data than ever earlier than.

In some ways, people have a leg up on Wall Road.

You don’t have a benchmark that you must beat. No committees or donors to maintain pleased. You don’t must reply to exterior traders about meaningless short-term efficiency numbers.

The market is rigged towards Wall Road over the long term in favor of the little man! They’re those who’re compelled to play the brief recreation.

The one dumb cash is these traders who assume there’s straightforward cash obtainable within the short-run.

Making a living isn’t alleged to be straightforward. The inventory market is tough.

However it works for affected person traders with an extended sufficient time horizon.

Additional Studying:

The Inventory Market is Not a On line casino