Mounted charges improve, variable secure

Canstar has reported on the varied actions in dwelling mortgage charges amongst Australian lenders for the week of Might 6 to 13.

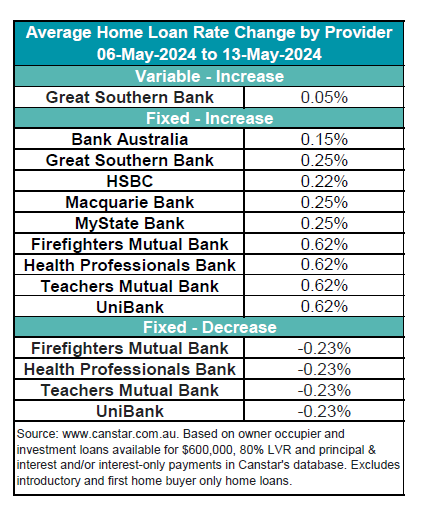

Nice Southern Financial institution raised two owner-occupier and investor variable charges by a mean of 0.05%. Throughout the business, no variable charge reductions have been reported.

When it comes to fastened charges, 9 lenders elevated a big 183 owner-occupier and investor fastened charges by a mean of 0.40%. Conversely, 4 lenders lower 64 owner-occupier and investor fastened charges by a mean of 0.23%.

See the abstract of charge changes within the desk under.

Present charge panorama

The common variable rate of interest for owner-occupiers paying principal and curiosity presently stands at 6.88%.

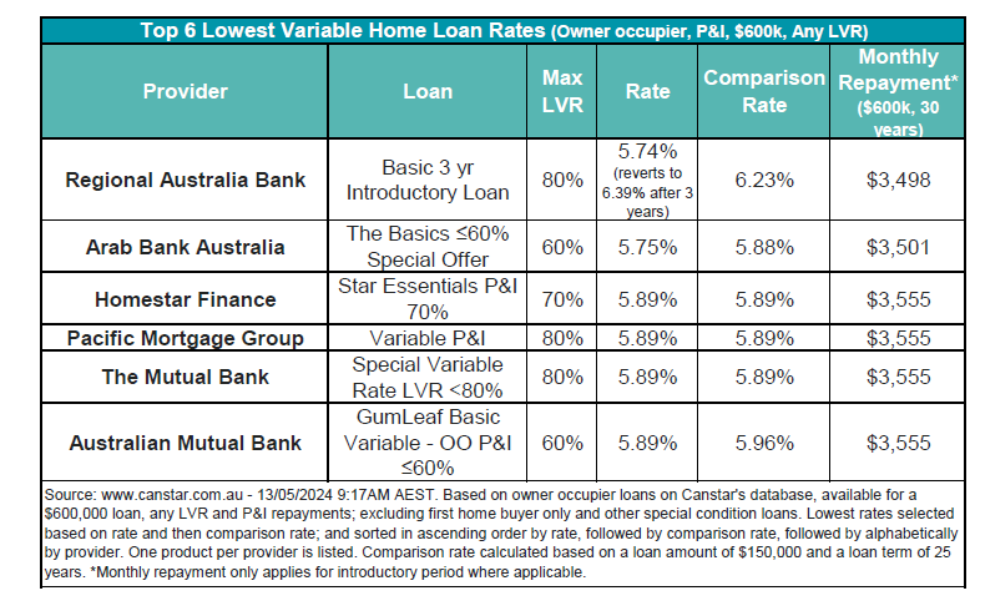

The bottom variable charge accessible is 5.74%, supplied by Regional Australia Financial institution as a three-year introductory mortgage.

Notably, there at the moment are 22 charges under 5.75% on Canstar’s database, a slight lower from 24 the earlier week. These charges can be found at Australian Mutual Financial institution, Financial institution Australia, Horizon Financial institution, LCU, Individuals’s Selection, Police Credit score Union, RACQ Financial institution, Regional Australia Financial institution, The Mac and Unity Financial institution.

See desk under for the bottom variable charges on the Canstar database.

Canstar’s market evaluation and funds expectations

Josh Sale, Canstar’s group supervisor for analysis, rankings, and product knowledge, supplied insights into the latest tendencies.

“Whereas analysing the fastened charges on supply from lenders is an imperfect science, the development in the direction of charge will increase over the previous week suggests a market sentiment leaning in the direction of larger charges for an prolonged interval,” Sale stated. “This isn’t stunning, given the more and more hawkish undertones in latest statements from the Reserve Financial institution.”

“This week, the main target shifts from Martin Place to Parliament Drive with the upcoming federal funds launch,” he stated. “Preliminary data means that the Treasury’s inflation forecasts are extra optimistic than the Reserve Financial institution’s, purportedly because of the anticipated impacts of their forthcoming funds measures.”

The Canstar skilled stated lenders’ responses to the upcoming funds particulars will probably be essential, probably indicating whether or not they lean in the direction of the Treasury’s optimism or the Reserve Financial institution’s warning.

“As we await the small print, one query looms: Will the doves fly, or will a flock of inflation hawks choose aside the funds?” Sale stated.

Get the most well liked and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE every day publication.

Associated Tales

Sustain with the most recent information and occasions

Be a part of our mailing record, it’s free!