In case you’re in search of further funds to pay for school, it’s possible you’ll be taking a look at Federal vs. non-public pupil loans.

After you are admitted to school, you’ll obtain a monetary assist bundle that breaks down your value of attendance minus any grants, scholarships, or different sources of economic assist you’re eligible for. This monetary assist bundle contains federal pupil loans.

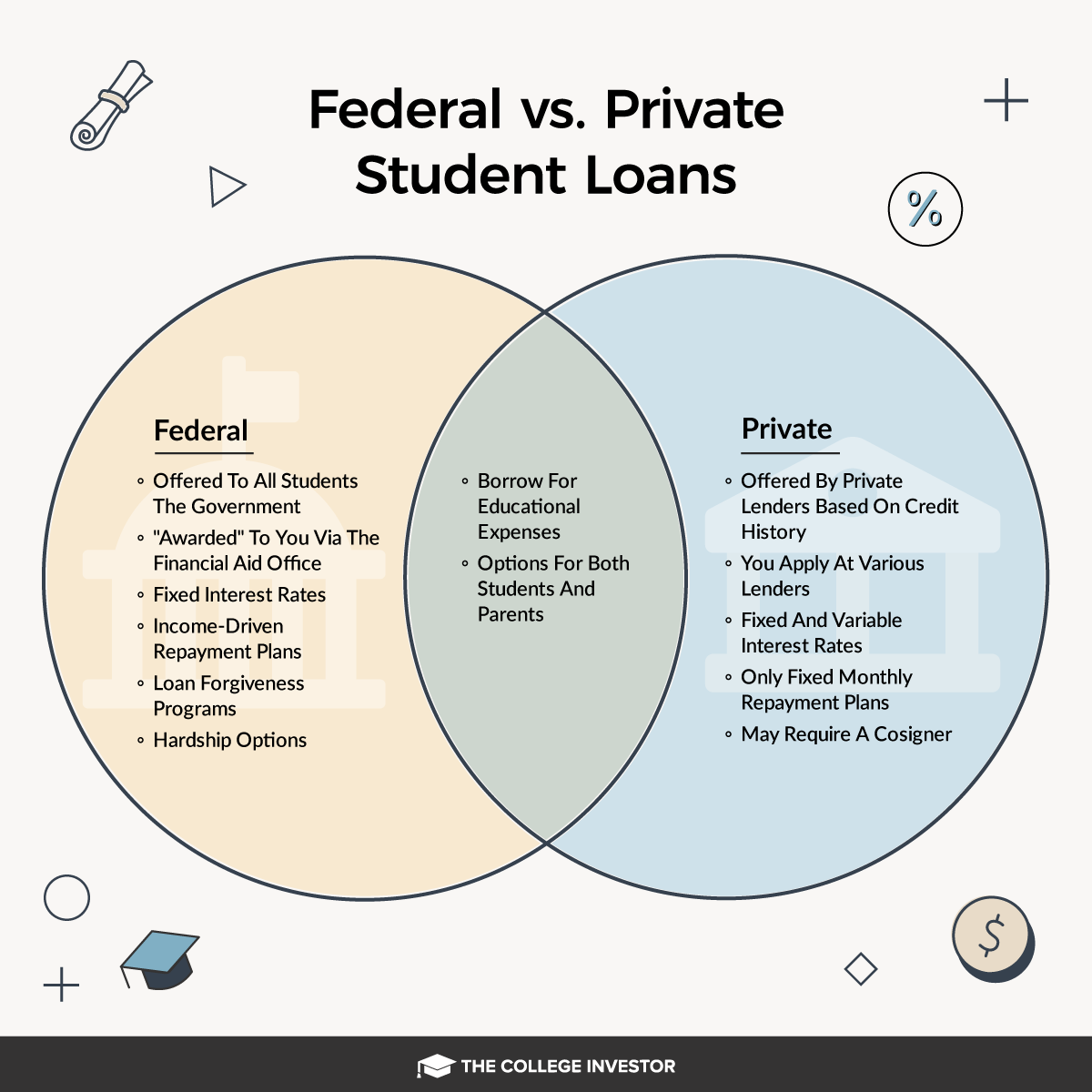

Many college students select to cowl their school bills with Federal pupil loans, nevertheless it’s not the one method (or it’s possible you’ll must borrow greater than Federal loans provide). You may also use non-public pupil loans. There are professionals and cons to think about earlier than going the non-public route, nevertheless it is likely to be the precise determination relying in your monetary scenario.

We discover the variations between federal vs. non-public pupil loans and what you must think about earlier than signing on the dotted line.

Federal Pupil Loans

Federal pupil loans are provided by the federal authorities and are managed by a number of totally different service suppliers by the Division of Schooling. Federal loans are often the primary choice college students select to finance their schooling. That’s as a result of government-backed loans include a number of advantages, making them an interesting choice.

There are two kinds of federal loans college students are eligible for: sponsored and unsubsidized. Sponsored pupil loans are provided to college students with monetary want. The federal government covers the curiosity that accrues on these loans whereas a pupil is in class. Unsubsidized loans, alternatively, are provided to all college students no matter want. Curiosity on these loans accrues whereas a pupil remains to be in class.

There are strict Federal pupil mortgage borrowing limits. There are annual limits and combination limits. Undergraduate college students are eligible for as much as $31,000 in federal pupil loans of which $23,000 will be sponsored. That principally means the federal government is keen to fund as much as $31,000, after that you simply’re by yourself. Graduate college students are eligible for as much as $138,500 in federal pupil loans.

In case you’re dealing with a funding shortfall, there’s a third kind of federal mortgage referred to as the Direct PLUS mortgage. College students can’t take out this mortgage immediately but when their mum or dad claims them as a dependent, then their mother and father can take one out on their behalf – referred to as a Mother or father PLUS Mortgage. Grad college students can take out a Grad PLUS Mortgage.

The restrict on PLUS Loans depends upon the place you attend college and the way a lot different assist you obtain. In case your value of attendance is $50,000 and also you obtain $30,000 in different assist, mother and father are eligible to take out the distinction – or $20,000. Principally, you may borrow PLUS loans as much as the whole value of attendance.

Federal Pupil Mortgage Forgiveness

One of many main advantages of federal pupil loans is the potential for forgiveness sooner or later. This contains applications like Public Pupil Mortgage Forgiveness, which forgives pupil mortgage balances of people working for presidency organizations or in nonprofits. That is necessary to think about in case your profession path may make it troublesome so that you can repay your pupil loans sooner or later.

Compensation Choices

Federal pupil loans additionally include quite a lot of reimbursement choices. You may entry income-based reimbursement choices that may make pupil mortgage reimbursement extra manageable, particularly if you won’t have a big revenue in the beginning of your profession.

Loans backed by the federal government sometimes include decrease rates of interest and for undergraduates, don’t have any underwriting necessities. That makes them extra accessible than non-public pupil loans which college students and not using a credit score historical past won’t be eligible for.

The most important draw back of federal pupil loans are the borrowing limits. In case you don’t have a mum or dad that’s in a position or keen to take out PLUS Loans in your behalf, you may end up in a shortfall, requiring you so as to add non-public loans to the combination.

FAFSA

To entry federal pupil loans, you first should qualify for them. You may decide your eligibility by finishing the Free Software for Federal Pupil Support (FAFSA).

This utility determines your loved ones’s Pupil Support Index (SAI) and can let whether or not you’re eligible for federal pupil loans and the way a lot you may take out. It’s going to additionally make it easier to qualify for different monetary assist choices like grants and like work examine.

Associated: How To Take Out A Pupil Mortgage (Step-by-Step)

Non-public Pupil Loans

When federal pupil loans aren’t sufficient – or for those who don’t qualify – non-public pupil loans are an alternative choice. These loans are provided by lenders specializing in pupil loans in addition to banks and credit score unions. They’re provided with variable and glued charges that adjust throughout lenders.

Key Options

Not like federal pupil loans, non-public loans do not have a restrict – besides the price of attendance of the varsity you are attending. Mortgage phrases are usually longer, with many lenders providing reimbursement as much as 20 years. When you’ve got good credit score and end up attending an costly college, non-public loans could also be preferable for masking the prices.

Nonetheless, the most effective charges will at all times be offerer to short-term (5 12 months) variable price loans.

Non-public loans can also be the popular choice for graduate college students. Whereas federal loans exist for people pursuing superior levels, there are limits to how a lot a pupil can borrow. In some instances, a non-public mortgage might provide higher phrases than a federal mortgage, particularly if a graduate pupil has established credit score and may get higher phrases.

Non-public loans can also be the one choice for some colleges – particularly vocational colleges or coding camps.

Downsides to Non-public Pupil Loans

Non-public loans will be dearer and more durable to entry than federal loans. They sometimes include greater rates of interest which can be primarily based on a borrower’s creditworthiness reasonably than their monetary want. To find out charges and eligibility, lenders will do a credit score test. This may be problematic for college kids who don’t but have a credit score historical past or meet different eligibility phrases, like having an revenue.

One other draw back of personal loans is that they lack the versatile reimbursement choices and forgiveness eligibility provided by federal pupil loans. In case you had non-public loans throughout Covid-19, for instance, you weren’t eligible for cost pauses.

Non-public lenders are identified to be aggressive for those who do fall into collections, and it isn’t unusual to be sued by a lender for those who fail to repay the mortgage.

Federal vs. Non-public Pupil Loans In contrast

|

Non-public lenders, banks and credit score unions |

||

|

Approval |

||

|

Graduate Pupil Eligibility |

Is It Higher To Have Federal Or Non-public Pupil Loans?

So, that are higher: federal pupil loans or non-public pupil loans? College students might default to picking federal loans as a result of they’re the best and will be accessed as a part of their monetary assist bundle. That being mentioned, you may select whether or not or to not use federal loans or non-public loans. That alternative will come all the way down to your private monetary scenario.

In case you determine to enroll at an costly college, you may hit the restrict of federal loans you’re capable of take out. Non-public loans could also be essential to cowl any gaps.

You additionally need to store round to search out the most effective price. Whereas federal loans include some advantages and charges are sometimes decrease, you may discover a non-public lender providing a greater deal. They sometimes don’t include origination charges that you simply’ll be anticipated to pay for those who go for federal pupil loans.

You’ll additionally need to take a look at your profession targets earlier than selecting which pupil loans to take out. In case you plan to take a job with a non-profit, it’s possible you’ll be eligible for sure reimbursement applications provided by the federal authorities. Non-public loans don’t include the identical alternatives for forgiveness. That is one thing you’ll need to take into consideration earlier than committing to at least one kind of mortgage over one other.

Associated: Greatest Pupil Mortgage Charges

How To Apply For Pupil Loans

To use for pupil loans, begin by finishing your FAFSA. You may submit your FAFSA anytime between October and June. It will decide your eligibility for quite a lot of authorities applications, like grants, along with pupil loans.

When you’ve accomplished your FAFSA and acquired your pupil assist bundle out of your college, crunch the numbers. When you’ve got a shortfall, you may apply for personal loans. Full your utility with the lender you’d prefer to borrow from and work with them to get your mortgage disbursed to your college to cowl your prices.

Non-public loans have totally different phrases, rates of interest, and reimbursement necessities than federal loans. Whether or not you select non-public or federal, you’ll need to consider all the necessities so what’s anticipated of you if you end your diploma and if you’re accountable to start making funds.

How Do I Know If My Pupil Loans Are Federal Or Non-public?

College students who pay for school with non-public pupil loans sometimes want to take action on their very own phrases. You’ll have a separate mortgage account from the monetary assist you obtain by the federal authorities or your college.

To see your federal pupil mortgage stability, you’ll need to test the Federal Pupil Support web site. You are able to do so by logging in together with your ID. Your loans will sometimes be listed there. In case you’re nonetheless in class or have lately graduated, the corporate servicing your pupil loans will doubtless attain out to you when it’s time so that you can start making funds.

You may also pull a duplicate of your credit score report. Any loans you may have will probably be listed there. That is typically a great apply to do at the least yearly to watch for id theft.

Pupil Mortgage Alternate options

Whereas pupil loans are an apparent approach to finance a school schooling, they aren’t the one choice. Listed below are some widespread pupil mortgage options:

- Apply for scholarships. Tens of millions of {dollars} are provided to college students yearly within the type of scholarships. That is free cash that doesn’t require reimbursement. You may apply for scholarships earlier than you begin college and whilst you’re enrolled.

- Search for grants. One other type of free funding are grants. These are provided by federal authorities applications in addition to privately by universities themselves. Grants aren’t at all times publicly marketed so that you might need to do some looking to search out them and decide for those who’re eligible to use for them.

- Work part-time. Some college students could also be provided a piece examine as a part of their pupil assist bundle. This may grant you a job on campus nevertheless it isn’t the one approach to earn cash. Taking a job delivering pizzas or ready tables can put you in good monetary well being if you graduate. You need to use your earnings to cowl small prices whilst you’re a pupil like textbooks or you can begin paying your loans instantly to stop curiosity from accruing.

There isn’t a proper or mistaken approach to pay for school. Whether or not you go for federal pupil loans or non-public, consider your scenario and think about all choices earlier than taking up debt.

Extra Tales: