There’s a lot we will’t clarify:

What’s the universe product of? (Trace: it doesn’t truly appear to be “matter and power”)

What lives within the ocean’s “twilight zone”? (“It’s distant. It’s deep. It’s darkish. It’s elusive. It’s temperamental,” based on Woods Gap … maybe probably the most mysterious and very important house on the planet)

What killed Venus? (The planet, not the goddess. Greatest guess is that it as soon as had a water ocean and now has a 900-degree floor temp … nearly scorching sufficient for Florida to grant warmth breaks to staff!)

Who thought it was a good suggestion to solid John Wayne as … Genghis Khan? (The Conqueror, 1956, was filmed on a fallout-contaminated set close to a nuclear bomb testing vary and featured traces like “I really feel this Tartar lady is for me, and my blood says, take her. There are moments for knowledge and moments once I hearken to my blood; my blood says, take this Tartar lady.”)

Who thought it was a good suggestion to solid John Wayne as … Genghis Khan? (The Conqueror, 1956, was filmed on a fallout-contaminated set close to a nuclear bomb testing vary and featured traces like “I really feel this Tartar lady is for me, and my blood says, take her. There are moments for knowledge and moments once I hearken to my blood; my blood says, take this Tartar lady.”)

Why do people have such huge butts? (No different mammal managed the feat.)

How does Tylenol kill ache? (And why does it induce loopy risk-taking habits?)

Why do traders want low-return / high-volatility shares to their opposites?

The High quality Anomaly

In dissecting the drivers of funding efficiency, researchers level to a set of six or seven components that specify what’s occurring. Momentum. Worth/progress. Excessive/low volatility. Small cap/massive cap.

By far probably the most highly effective and puzzling of the components is High quality. Morningstar’s Ben Johnson (2019) described it as “the fuzziest issue you’ll discover within the investing world.” Ben Inker, head of asset allocation at GMO (2023) referred to as it “the weirdest market inefficiency on the planet.”

The broadest sense of a high quality firm is one which makes use of its sources prudently: high quality corporations are inclined to have little or no debt, substantial free money flows, regular and predictable earnings, and maybe excessive returns on fairness. Passive methods and plenty of lively ones have a powerful backward focus: they restrict themselves to companies which have shiny pasts, with out actively inquiring about their future prospects.

Nonetheless, the proof is compelling that high-quality shares bought at affordable costs (Mr. Buffett’s “great corporations at honest costs” excellent) are concerning the closest factor to a free lunch within the investing world. Typically, it’s a must to pay on your lunch a method or one other. The one rationale for getting crazy-volatile investments (IPOs, as an example) is the prospect of crazy-high returns. The one rationale for getting modest returns (three-month T-bills) is the promise of low volatility.

With high quality shares bought at an inexpensive worth (name it QARP), that tradeoff doesn’t happen. QARP shares provide each greater long-term returns and decrease volatility than run-of-the-mill equities. GMO’s analysis bears this out throughout a span of three a long time:

- Excessive-quality shares provide 60% greater returns and 30% decrease volatility than low-quality shares.

- Excessive-quality cyclical shares provide 200% of the returns with 30% decrease volatility than low-quality cyclicals.

- Excessive-quality small-cap shares provide 150% of the return of low-quality ones with 30% much less volatility.

- Excessive-quality worth shares provide 150% of the returns of low-quality ones with 30% much less volatility.

- Excessive-quality (BB) junk bonds provide 300% of the returns and 50% decrease volatility than low-quality (CCC) junk bonds.

(Supply: GMO, “The High quality Anomaly,”2023, reveals 1-3, 5 and 6. In every case we approximated share values from their graphs)

Different researchers discover an equivalent sample in rising Europe and in rising markets typically: “The standard basket generated a compounded annual return of 15.0% as in comparison with 8.4% for MSCI EFM Normal index. What’s extra, annualized commonplace deviations of month-to-month returns had been decrease for the standard basket at 14.2% as in comparison with 23.4% for the benchmark index” (Ramraika and Trivedi, “Excessive High quality Shares in Rising Markets,” 2015). In “most [world] areas and dimensions … our high quality issue delivers a statistically important alpha that can not be defined by loadings on typical fairness components corresponding to market, worth, measurement, and momentum (Amundi Institute analysis staff, “Revisiting High quality Investing,” 2024).

There isn’t a clear clarification for why high quality is so extensively, badly, and persistently mispriced. Some individuals declare that “high quality” wins simply because it’s a attribute of the tech sector (not true: because it additionally holds in the old fashioned cyclical corporations, too) or that it wins due to the facility of mega-cap monopolies (not true: because it additionally holds in small caps) or that it wins as a result of progress corporations are all shiny (likewise, not true: the connection holds amongst worth corporations, too). Briefly, just about in every single place we glance high quality wins however sketchy shares draw consideration. The very best that GMO’s Tom Hancock and Lucas White may provide you with is, “traders routinely overpay for the thrilling lottery ticket prospects of speculative, junky enterprise fashions whereas neglecting the tangible however boring attributes of High quality” (“The High quality Spectrum,” 2023). Mr. Inker laments, “I’ve bother arising with something in any respect believable that doesn’t come to down ‘traders are weirdly silly.’”

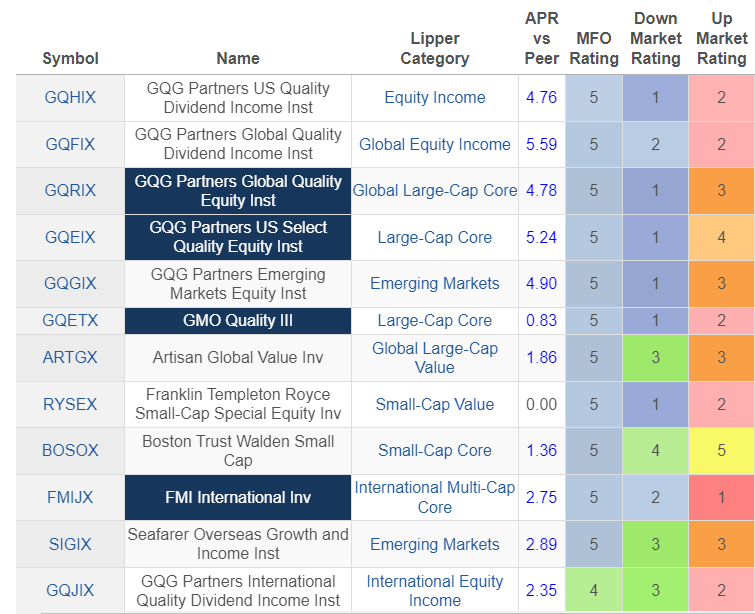

However not all the time. High quality tends to lag, nevertheless, in the course of the mid-to-late phases of a bull market as traders (bless their hearts) begin treating low-quality / high-beta shares as lottery tickets. For visible learners, right here’s the efficiency of a wide range of funds that maintain high-quality shares. We’re charting efficiency since inception. The primary information column exhibits how they’ve carried out in opposition to their friends (+2% means, as an example, that the fund has outperformed its friends by 200 bps/12 months). The subsequent three columns illustrate how the fund carried out within the long-term (MFO ranking), throughout months when the market was falling (down seize ranking), and through months when the market was rising (up seize ranking). Right here’s the important thing: blue/inexperienced = good, crimson/pink/orange = dangerous.

Lifetime efficiency for choose high quality funds, by March 2024

With out exception, these high-quality portfolios crushed their friends in the long run and crushed their friends when markets had been at their worst. In rising markets, they made robust absolute positive aspects whereas nonetheless trailing the overwhelming majority of their quality-agnostic friends.

High quality wins over full market cycles, partially by crushing the efficiency of low-quality shares when the dangerous instances hit. GMO’s Ben Inker notes “high-quality shares outperform low-quality shares in down months by over thrice the quantity they underperform in up months!” Certainly, high-quality corporations use crises to their benefit: they are usually debt-free and cash-rich, in order that they will transfer opportunistically in crises when lesser corporations are folding.

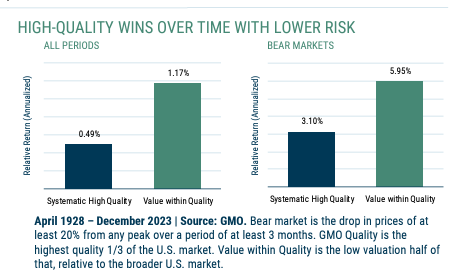

Lastly, worth issues. Overpaying for a high quality firm cuts your returns and reduces your margin of security. GMO has tracked the relative outperformance of high quality shares in opposition to the broader market again to 1928, then pulled out the efficiency of the most affordable half of the standard universe for a similar interval. The distinction is dramatic.

The brief model: high quality wins. High quality at an inexpensive worth wins by rather a lot.

Choices for Including High quality to your portfolio

MFO recognized a number of distinctive high-quality funds which may permit you to reap the benefits of this investing anomaly. We centered on two of probably the most distinguished households whose work mixed commitments to each high quality and worth. (We additionally partnered with the parents at Morningstar to hunt their assist in figuring out funds in a wide range of niches which may assist diversify your portfolio.)

MFO commends:

GMO US High quality Fairness ETF (QLTY), a newly launched, actively managed ETF, that operates with the identical self-discipline and identical administration staff because the $10 billion, five-star Nice Owl GMO High quality (QGETX) fund. GMO grounds its High quality Technique within the work achieved by its founders within the Seventies and formalized in 2004.

In 2004, GMO launched the High quality Technique with the mandate to personal attractively valued shares throughout the high quality universe. The creation of the technique was the end result of a long time of GMO analysis on high quality enterprise fashions. Whereas the technique’s origins date again to GMO’s earliest days, our course of continues to evolve to make sure sustained relevance in addition to our funding edge.

Since its launch in November 2023, the ETF has truly outperformed its elder sibling, returning 17.0% to QGETX’s 15.3%. The ETF, which prices 0.50% for its providers, has shortly gathered $600 million in property, a win that portends extra GMO ETF launches. (Full disclosure: Chip, MFO’s cofounder, added QLTY to her private portfolio shortly after its launch.)

GQG Companions US Choose High quality Fairness (GQEPX), which launched in 2018, is managed by the GQG staff headed by Rajiv Jain. Mr. Jain is among the many world’s most profitable fairness traders, having constructed an enormous following at Vontobel earlier than transferring to discovered GQG: International High quality Development. The core self-discipline is similar throughout all of their methods:

GQG’s funding philosophy is rooted within the perception that earnings drive inventory costs.

The pursuit of sturdy earnings ignores the concept of conventional progress and worth investing and as an alternative focuses on discovering corporations we consider have the best chance of compounding capital over the following 5 years. This funding type centered on high-quality, sturdy companies, is taken into account by GQG to be extra suitably named as “Ahead-Wanting High quality”.

The agency launched its now-$20 billion Rising Markets Fairness fund initially then added US Choose High quality Fairness and International Choose High quality Fairness about 5 years in the past. All have persistently earned five-star scores from Morningstar, all have completed within the prime 1-2% for whole returns of their Morningstar peer teams over the previous 5 years, and all outperformed their Lipper peer teams by a mean of 500 bps per 12 months. Each US Choose and International Choose earned MFO’s Nice Owl designation for persistently top-tier risk-adjusted efficiency. These have been complemented by three high quality + dividend funds launched just below three years in the past, every of which has additionally simply outpaced their friends. Briefly, GQG will get it proper persistently, over time and throughout international markets.

GMO and GQG may symbolize a rock-solid core for an investor’s portfolio. We reached out to Morningstar, asking for his or her tackle the best high quality fairness funds {that a} quality-sensitive investor may add to such a portfolio. Robby Greengold, a Morningstar strategist, supplied a dozen prospects. He defined his technique this manner:

I chosen these funds for the comparatively high-quality metrics of their portfolios (e.g., high-profit margins, low debt) and Morningstar Medalist Rankings (one of many fund’s share courses should obtain both a Bronze, Silver, or Gold Morningstar Medalist Score, which specific our conviction within the fund’s capacity to outperform on a risk-adjusted foundation over a full market cycle). The funds wanted to be coated by one in all Morningstar’s analysts, and the analysts wanted to explicitly level out that the fund intentionally targets high-quality shares.

Herewith are a dozen high quality funds with Morningstar’s tackle them and our occasional asides.

|

|

Morningstar’s take |

MFO’s gloss |

|

Boston Belief Walden Small Cap Fund (BOSOX), small cap mix |

This staff focuses on figuring out well-managed small-cap companies with sustainable and predictable earnings profiles that even have affordable valuations. This technique additionally has a sustainability mandate, screening out companies deriving important income from alcohol, coal mining, gaming, manufacturing unit farming, weapons, tobacco, and jail operations (although not fossil fuels). 70-100 names within the portfolio. The place the strategy actually shines is in threat administration. The staff has a high quality focus and is valuation-conscious … to a portfolio that persistently ranks among the many least-volatile choices within the small-blend class, a powerful feat contemplating its minimal money stakes. |

It’s a fantastic small-cap core fund with a ticker celebrated by readers in New England. It additionally closed to new traders in March 2023. |

|

Royce Small-Cap Particular Fairness Fund (RYSEX), small cap worth |

This technique has a conservative, risk-aware strategy. Managers Charlie Dreifus and Steven McBoyle depend on analysis and a wholesome dose of accounting cynicism to seek out small caps whose monetary studies are free from earnings manipulation. Dreifus and McBoyle hunt for clear steadiness sheets, low debt, excessive returns on invested capital, and rising free money stream that exceeds earnings. The managers will sit on money, which regularly reaches double digits, making a buffer in downturns however a drag when shares rise. 35-55 names, low turnover. the fund usually has rather a lot in micro-caps. |

The lead supervisor, Mr. Dreifus, has been investing for 55 years, is 80 years outdated, and has no plans for retiring. Mr. McBoyle is about 20 years his junior and has an extended tenure with Royce. Nonetheless … |

|

MFS Worldwide Fairness Fund (MIEIX), massive mix. |

The managers depend on broad and thorough bottom-up analysis and a disciplined concentrate on reasonably rising, established corporations with shares buying and selling at respectable costs. The managers depend on their very own analysis and that of MFS’ huge and skilled basic analysis staff to seek out rising corporations with aggressive benefits and administration groups that encourage predictable earnings and money flows, wholesome steadiness sheets, and robust returns on capital. The managers focus additional up the market-cap ladder than most international large-blend and large-growth friends, so the portfolio’s common market cap is often greater than the class norm. |

$20 billion in AUM with main inflows in 2023-24. Steady two-person administration staff. About 75 massive cap shares with actually low turnover. |

|

John Hancock Funds Worldwide Development Fund (GOIOX), massive progress |

Lead supervisor John Boselli and his staff concentrate on corporations with excessive natural progress charges, low share costs relative to free money stream, and most significantly, high quality enterprise fashions. In addition they like corporations that return capital to shareholders through share repurchases and dividends and shun these with the worst earnings revisions. They emphasize business fundamentals, progress and stability, free money stream era, capital allocation, incentive compensation, and valuation surprises. |

The fund continues to be managed by Wellington Administration, however long-time lead supervisor John Boselli retired on the finish of 2023. He was, by all accounts, a celebrity and recipient of a number of “Supervisor of the 12 months” awards. His two co-managers, who had been added in August 2021, now have sole accountability. |

|

Artisan International Worth Fund (ARTGX), massive worth |

This staff consists of worth traders who emphasize high quality companies with monetary power and shareholder-oriented administration. They leverage qualitative and quantitative screens to slim the funding universe to a manageable stage [and] shun companies with poor accounting and company governance requirements, in addition to these working in markets with insufficient legal guidelines and rules. It invests in companies of all sizes that commerce at reductions to their intrinsic worth estimates, though the main focus is overwhelmingly on large-cap shares. 40–60 shares, with place sizes weighted by conviction. Commensurate with administration’s long-term mindset, portfolio turnover is often beneath 30%. When the managers can’t discover alternatives that meet their strict requirements, money can construct as much as 15% of property. |

Our final profile replace was a decade in the past, reflecting a draw back of our concentrate on newer, smaller distinctive funds. We reviewed the fund repeatedly when it fell inside our ambit and concluded, in our final assessment, “We reiterate our conclusion from 2008, 2011 and 2012: ‘there are few higher choices within the international fund realm.’” This fund and its sibling Worldwide Worth had been initially managed by David Samra and Daniel O’Keefe. In 2018, they determined to divide their prices with Mr. Samra main Worldwide Worth and Mr. O’Keefe main this fund. Over the previous six years, Worldwide Worth has handily outperformed its friends whereas International Worth has barely stored tempo with them.

|

|

FMI Worldwide Fund (FMIJX), massive mix |

FMI Worldwide isn’t your typical international large-blend Morningstar Class providing, however it’s top-notch. It appears for corporations with sturdy enterprise fashions and robust administration that generate superior profitability by a full financial cycle. The fund’s coverage of hedging non-U.S. foreign money publicity highlights administration’s concentrate on underlying enterprise fundamentals. They sometimes draw back from companies with excessive debt ranges however will purchase these whose regular money flows can help their leverage. Annual portfolio turnover has been beneath most international large-blend Morningstar Class friends. The staff’s pickiness and valuation sensitivity present within the technique’s high-conviction portfolio, which additionally stands out. It at present holds solely 40 shares, which is lower than half the roughly 100-stock peer median. |

We profiled this fund shortly after launch, predicting “All of the proof obtainable means that FMI Worldwide is a star within the making. It’s headed by a cautious and constant staff that’s been collectively for an extended whereas. Bills are low, the minimal is low, and FMI’s portfolio of high-quality multinational shares is prone to produce a smoother, extra worthwhile experience than the overwhelming majority of its rivals.” Ten years later the one factor so as to add is “Yep, nailed it.” |

|

JPMorgan Rising Markets Fairness Fund (JMIEX), rising markets |

The strategy favors high quality progress corporations. The staff seeks companies that boast high quality franchises, constant earnings streams, and stable returns on fairness. They conduct in-depth basic analysis on potential concepts and assign five-year anticipated return targets. Analysts additionally classify shares on their protection lists as premium, high quality, or commonplace, based on the agency’s strategic classification framework, which relies on a 98-point questionnaire. Premium and high quality names function in enticing industries with restricted exterior dangers and possess robust steadiness sheets, good administration groups, and stable cash-flow-generation prospects whereas buying and selling names lack sustainable aggressive benefits. The overwhelming majority of property are allotted to premium and high quality names, with buying and selling names making up solely a small portion. The staff’s valuation framework helps to make sure managers pay the proper worth for the chance, though they’re ready to pay up for high quality and progress. |

The fund’s efficiency has been no higher than “okay” for an extended whereas, maybe reflecting a willingness to pay extra for shares and to emphasize valuations much less. Relative to its friends and benchmark, the portfolio has stronger progress but in addition – by just about each measure – greater valuations. One-, three- and five-year returns are comparatively weak, and it’s essential to exit to the 10- and 15-year home windows to see robust efficiency. |

|

GQG Companions Rising Markets Fairness Fund (GQGRX), rising markets |

Lead supervisor Rajiv Jain continues to depend on the identical inventive and profitable “high quality progress” strategy right here that he has used because the late Nineties. He desires reliably rising corporations, however provided that they’re on stable monetary footing and have demonstrated the flexibility to climate sluggish economies. Sectors or nations could be closely chubby or underweight. Although Jain sometimes has held shares for a few years, he’ll change route shortly and decisively if he considers it acceptable. Just a few years in the past he sharply diminished his stake within the shopper staples sector when he noticed circumstances changing into more difficult, after which elevated it once more prior to now couple of years because the metrics modified. And from early 2021 to late 2022, the fund’s power stake soared, whereas the know-how stake plummeted. Jain and his staff concentrate on huge corporations and search for excessive returns on fairness and property and low to average leverage. Then they use basic evaluation to analysis future progress alternatives, estimate dangers, analyze the accounting to make sure its accuracy and transparency, after which estimate an inexpensive worth. 4 former journalists use their investigative abilities to hunt info or traits which may not be obvious within the numbers. The technique is reasonably concentrated, with 50-70 holdings and substantial (4% to eight%) weightings within the prime shares. |

Within the seven years since its launch, GQGRX has been one of many prime ten EM funds or ETFs in existence. It has the fourth-highest returns of any diversified EM fund (5.4% APR) however, extra importantly, the most effective Sharpe ratio (a measure of risk-adjusted returns). Throughout a wide range of threat measures, together with draw back deviation and bear market deviation, It’s clearly a prime 10 performer. This displays Mr. Jain’s self-discipline: forward-looking high quality is the primary display screen, valuation is the second, and every thing else trails. |

|

T. Rowe Worth Worldwide Discovery Fund (PRIDX), small/mid progress |

The managers concentrate on corporations with market caps between $500 million and $5 billion with compelling enterprise fashions and the flexibility to generate returns above the price of capital. They search shareholder-oriented administration groups with good capital allocation abilities. They favor companies in industries which might be rising sooner than the general financial system, which might be addressing unmet wants and including worth for purchasers, and which have rational aggressive buildings. The managers make use of this self-discipline with an interesting mixture of bolder and tamer traits. On the bolder aspect, they readily put money into shares within the growing world that meet their standards and usually construct average nation and sector overweightings. On the reserved aspect, they pay numerous consideration to valuations, unfold the portfolio throughout 200-250 names, and transfer at a measured tempo. This strategy gives ample upside potential with out assuming extreme threat, and it has earned good long-term outcomes at a European smaller-cap providing for non-U.S. traders in addition to this technique. |

Snowball holds about 2% of his retirement portfolio in PRIDX, a place constructed a long time in the past below supervisor Justin Thomson who guided the fund for 22 years. T Rowe Worth does an distinctive job in managing supervisor turnover, partially as a result of they’ve a powerful, team-oriented tradition. New supervisor Ben Griffiths has been with the agency since 2006 and has managed a small cap fund for European traders since 2016. The fund has not been a disappointment below his watch, however neither has it been compelling. Over the previous 4 years, the fund has outperformed its Lipper peer group by 0.1% per 12 months with exactly the identical Sharpe ratio (0.46). |

|

Constancy Worldwide Discovery (FDKFX), massive progress |

Supervisor Invoice Kennedy desires to personal rising corporations, however he isn’t going to pay any worth for them. He appears for corporations with robust three- to five-year earnings prospects, accountable administration groups, stable steadiness sheets, and enormous potential markets. However he desires to personal companies which might be buying and selling at enticing valuations. Whereas numerous class rivals received swept up out there euphoria of 2020 and 2021, shopping for up high-multiple, low-quality names, Kennedy stayed true to his strategy. The truth is, throughout these two years, his portfolio appeared cheaper versus friends than ever earlier than, as he didn’t observe the group into the more-speculative waters. |

Mr. Kennedy has managed the fund since its inception (2006) and has invested greater than 1,000,000 of his personal cash in it. |

|

Constancy Diversified Worldwide (FKIDX) |

Supervisor Invoice Bower’s funding course of has a number of strengths. He appears for shares with long-term earnings progress potential, sturdy enterprise fashions, and deep aggressive benefits. Bower is prepared to pay a modest premium for these desired traits, however not as a lot as many international large-growth class friends, highlighting his valuation sensitivity. He can even allocate a small portion of property to shorter-term, opportunistic concepts that won’t have sturdy progress prospects however are nonetheless compelling. |

Mr. Bower has been managing the fund since 2001 and has invested greater than 1,000,000 of his personal cash in it. The portfolio holds about 140 names with modest turnover. The fund tends to have returns within the prime third of its friends |

|

Constancy Abroad Fund (FOSFX), massive progress |

Supervisor Vince Montemaggiore employs a smart strategy with a twin concentrate on high quality and valuation, although high quality comes first. With out it, he received’t personal an organization, regardless of how low cost it might appear. To him, high quality means having a novel edge, like, amongst others, excessive boundaries to entry, a low-cost benefit, or excessive switching prices. Ideally, the corporate has excessive recurring revenues and low debt ranges. He desires to personal these shares which might be buying and selling at 15% or extra reductions to his estimated intrinsic worth. |

|

|

Seafarer Abroad Development and Revenue Fund (SIGIX), rising markets |

The staff has all the time centered on companies with sturdy progress prospects and dependable revenue streams whereas contemplating money flows, steadiness sheets, working histories, liquidity, and valuations. The method is risk-conscious, distinctive, and enticing. The staff nonetheless pursues corporations with sturdy progress prospects and dependable revenue streams, invests broadly throughout the market-cap spectrum, and readily permits its safety choice to lead to atypical nation and sector weightings. |

One of many core holdings in Snowball’s portfolio, with FPA Crescent. Supervisor Andrew Foster’s hope is to outperform his benchmark (the MSCI EM index) “slowly however steadily over time.” His technique is grounded within the structural realities of the rising markets. A defining attribute of rising markets is that their capital markets (together with banks, brokerages, and bond and inventory exchanges) can’t be counted on to function. In consequence, you’re greatest off with companies who received’t want to show to these markets for capital wants. Seafarer targets (1) companies that may develop their prime line steadily within the 7-15% every year vary and (2) these that may finance their progress internally. Seafarer tries to marry that target sustainable average progress “with some present revenue, which is a key instrument to understanding high quality and valuation of progress.” We now have profiled SIGIX however would additionally commend the youthful Seafarer Abroad Worth on your consideration. |