Effectively people, as anticipated, bidding wars are again with a vengeance, at the very least right here in San Francisco.

If I have been an actual property agent, I might by no means encourage my purchasers to have interaction in a bidding battle. Successful such a battle typically results in what’s referred to as the “winner’s curse.” This time period signifies paying a value that exceeds what anybody else within the bidding battle was prepared to pay, placing your funds at better threat if the true property market takes a downturn.

Personally, I keep away from bidding wars as a result of I do know my feelings can cloud my judgment. It is akin to my strategy to poker—I chorus from heavy consuming to maintain a transparent head for rational decision-making. And for these on the lookout for love, take off these beer goggles!

This put up delves into the the reason why individuals enter property bidding wars. I intention to understand why potential property house owners disregard my recommendation of looking for properties in the course of the gradual winter months. It baffles me why extra potential house owners would not decide to underbid on a poorly marketed, mispriced, or stagnant itemizing quite than one which’s offered completely.

I search to grasp as a result of I’ll have a blind spot that requires fixing. Let me share some bidding battle examples adopted by suggestions from an actual property agent and three homebuyers on why they engaged in a bidding battle.

Why I At the moment Care So A lot About The Housing Market

I have been intently following the housing market since buying my new residence on the west aspect of San Francisco within the fall of 2023. For months, I skilled each a liquidity crunch in addition to doubt on whether or not I had made the correct choice to slash my passive revenue for a nicer home.

Because the inventory market marched greater after I bought shares to purchase the home, I felt conflicted. On the one hand, I used to be lacking out on inventory market beneficial properties. Then again, my household was having fun with a nicer place to stay. The house buy might grow to be the most important or worst monetary mistake of my life.

Greater than seven months later, I am relieved to say that purchasing this home has turned out superb to date. The house withstood heavy rainstorms in the course of the winter with out leaks or main issues, which is my most regarding home upkeep situation. In the meantime, housing costs have rebounded in spring 2024 because of pent-up demand, an increase in tech shares, and a continued dearth of stock.

Listed below are some examples of properties that bought method above asking. If considered one of these properties occurs to be yours and also you need it taken down, be at liberty to depart a remark or shoot me an e-mail. I am going to achieve this instantly to respect your privateness.

Examples Of Property Bidding Wars In San Francisco

1615 Funston Avenue (Inside Sundown/Golden Gate Heights border)) – 2 beds, 1.5 baths, 1,230 sqft, asking $1,495,000, bought for $1,675,000, or $180,000 over asking (12%). Though a small home, it’s properly transformed in and out. Paying below $2 million for a transformed single-family residence in San Francisco is what numerous households need.

220 Magellan Avenue (Forest Hill) – 3 mattress, 2.5 bathtub, 2,455 sqft, asking $2,795,000, bought for $3,125,000, or $330,000 over asking (11.8%). Good-looking residence on a tree-lined block within the greatest neighborhood on the west aspect of San Francisco. The value level between $2 – $3.5 million is frequent for twin revenue, mid-career households with youngsters.

68 Madrone Avenue (West Portal) – 3 mattress, 3.5 bathtub, 2,836 sqft, asking $2,495,000, bought for $3,125,000, or $630,000 over asking (25.25%). Though it bought for 25.25% over asking, the worth appears cheap for its measurement and placement.

80 San Pablo Avenue (St. Francis Wooden ) – 3 beds, 2.5 baths, 2,190 sqft, asking $2,295,000, bought for $2,500,000, or $205,000 over asking (9%). A quaint home at an inexpensive value on a comparatively quiet road. St. Francis Wooden is considered one of my favourite neighborhoods with solely single-family homes. The one unfavourable is that the neighborhood is bordered by some very busy streets in addition to a high traffic intersecting road.

A number of Actually Large Overbids

120 Lenox Approach (West Portal)- 4 beds, 2.5 baths, 2,221 sqft, asking $1.795 million, bought for $2.56 million, or $765,000 over asking (42.6%). The home obtained 15 gives and is throughout from a playground and faculty. Relying on the person, this is usually a good or unhealthy factor. The home is barely a block away from the MUNI station, and two blocks away from outlets and eating places.

3782 twenty first Road (Dolores Heights) – 2 beds, 2.5 baths, 1,844 sqft, asking $2,395,000, bought for $3,225,000, or $830,000 over asking (34.6%). This was actually an incredible sale given how small the home is, in addition to the lot measurement of just one,410 sqft. Normal lot sizes in San Francisco are 2,500 sqft. It is a charming home for positive. However wow.

150 Santa Paula Avenue (St. Francis Wooden) – 5 beds, 3 baths, 3,585 sqft, asking $4,795,000, bought for $5,705,000, or $910,000 over asking (19%). The home sits on a big 8,659 sqft lot, which is extraordinarily uncommon in San Francisco. It was in the marketplace for under every week and obtained a preemptive provide, which I am guessing was all money. For a household with youngsters, this enclosed yard is particular.

The gross sales value of $5,705,000 blows previous Redfin’s estimate, which is per most of those latest gross sales.

240 Santa Paula Avenue (St. Francis Wooden) – 3 beds, 2.5 baths, 2,298 sqft, asking $2,695,000, bought for $3,325,000, or $630,000 over asking (23.4%). A singular home that jogs my memory of properties in Hansel and Gretel. I am undecided why somebody needed to pay a lot over asking given its common measurement. It is also bordering the playground/park, which might be each good and unhealthy, relying on who you ask.

Some Spectacular Gross sales Beneath Asking

In the event you go up the worth curve, you may usually get higher offers. Bidding wars are extra uncommon at greater value factors just because fewer individuals can afford these properties.

565 Ortega Road (Golden Gate Heights) – 5 beds, 3.5 baths, wonderful transform asking $5,950,000, bought for $5,550,000. This was one of many coolest homes I’ve ever seen as a result of design. It felt like a prized murals with a separate unit and panoramic ocean views. I like this home.

The itemizing agent did not checklist the estimated sqft probably as a result of it could put the home at an all-time excessive value/sqft based mostly on the asking value. If you should buy a single-family residence with a water view, I feel you are going to outperform the market for a very long time. Golden Gate Heights is considered one of my favourite areas to purchase single-family properties in San Francisco.

This home was a intestine transform that took what looks as if over 5 years. My most important concern is fixing customized gadgets and sourcing customized supplies when one thing inevitability breaks.

The earlier proprietor bought the home for $2,650,00 in July 2016. Discover how the gross sales value of $5,550,000 utterly obliterates the Redfin estimate as a result of transform. Now Redfin’s algorithm must recalculate different properties within the space.

3846 twenty fifth St. (Noe Valley) – 4 beds, 3.5 baths, newly transformed asking $6,495,000, bought for $6,375,000. Spectacular excessive finish transform and landscaping. These sort of transformed properties used to promote for nearer to $4.5-$5 million.

3898 Washington Road (Presidio Heights) – 7 beds, 6 baths, 8,765 sqft, asking $14,950,000, bought for $14,700,000. Good-looking residence on a nook lot that will get numerous mild. Personally, I would quite not stay on the nook resulting from extra site visitors publicity. Presidio Heights is likely one of the costliest neighborhoods in all of San Francisco.

As soon as extra, you may observe how the gross sales value considerably exceeds the Redfin estimate. Redfin would require a while to regulate its pricing algorithm to precisely replicate the rising costs within the neighborhood.

The inaccuracy in housing estimates offered by Zillow and Redfin presents a possibility for each sellers and patrons. If a purchaser can discern that on-line housing valuation estimates are inclined to lag behind in a bullish market, they could endeavor to persuade a much less astute vendor to conform to a decrease market value.

Suggestions From Homebuyers And Actual Property Brokers Who Obtained Into Property Bidding Wars

To grasp why individuals get into property bidding wars, I made a decision to survey my Twitter followers and e-newsletter readers. Right here is a few of their suggestions:

Nameless suggestions on getting right into a bidding battle in 2022:

Two years in the past, we purchased a small rental in a school city for my daughter to stay in whereas she attends college. I grew up close to that city, so I’m aware of and I like the realm.

Sure, I perceived it as a bit dangerous to compete in a bidding battle for the rental. Nevertheless, we heard horror tales about so many faculty college students in that space who struggled to find appropriate housing. We didn’t wish to search and compete for a spot each college yr.

Additionally, my daughter could be very non-public and choosy and hasn’t accomplished properly with roommates. I intend to maintain the property for the long run, so I wasn’t as nervous in regards to the precise buy value. We wanted the property, since I might have needed to pay lease at one other place if I didn’t purchase it.

There had been a stagnant itemizing out there that winter. Nevertheless, it wanted extra work accomplished to it and had authentic home windows and home equipment. Additionally, the stagnant itemizing didn’t have a southern orientation and peaceable view.

Within the latest previous, we had bought a home with a northern publicity in our metropolis the place we reside full time. We have been dissatisfied with how chilly and darkish our home is throughout winter months with out working the heater lots. Operating the heater doesn’t present the nice heat of daylight.

I had determined that I might not buy a spot for household use and not using a southern publicity. I suppose I used to be prepared to pay 8% extra to have southern daylight and never be trying right into a neighbor’s place.

Up to now two years, I’ve by no means regretted coming into into and prevailing in a bidding battle for my daughter’s peaceable, sunny rental. Additionally, I knew that if circumstances change, I can simply lease the rental out to varsity college students for a profitable quantity.

Protecting property for the long run requires a giant dedication of time and ongoing expenditures. In case you have an emotional connection to the property, it helps you climate the draw back of long run property possession like a nightmare tenant scenario or a serious plumbing situation.

Thanks in your terrific articles!

Jaime Meraz, Realtor based mostly in Phoenix, Arizona

Marcus, 40, purchaser in San Francisco, California

Earlier than shopping for our home, my spouse and I resided in a one-bedroom, one-bathroom house. However with a child on the way in which, we would have liked more room. Having labored as a software program engineer at Tesla for 5 years, I used to be lucky to stroll away with roughly $2 million in fairness after taxes.

Contemplating my present wage of $200,000, together with inventory choices, and my spouse’s wage of $150,000, we are able to comfortably put down $500,000 for a $2.5 million home. This implies we might be a month-to-month mortgage cost of $13,700 at a 7.3% mortgage price with over $1.5 million in money and liquid investments left over.

We anticipate a window to refinance to a decrease mortgage price throughout the subsequent 5 years. By then, we anticipate our revenue to have elevated as properly.

Janet, 38, purchaser in Northern Virginia suburb

In the course of the winter, the housing stock wasn’t notably interesting, and we have been decided to solely make a purchase order if we stumbled upon one thing actually distinctive. Then, in March, our dream residence appeared—a spacious property with a shocking view. What made it much more interesting was that the sellers had lately renovated the home, sparing us from potential renovation complications we might heard about.

With our youngsters aged 8 and 10, and plans to reside within the space for at the very least a decade, we felt assured in our choice. The colleges are glorious, and there are respected public universities close by. Even when we could have barely overspent, our long-term dedication to the home reassured us. Who is aware of, we’d even make it our without end residence.

With a mixed revenue of about $280,000, we bought a $1.2 million residence that was listed for $1.1 million in Fairfax County. Admittedly, we deviated out of your 30/30/3 residence shopping for rule, however we managed to place down $350,000. Our mortgage is a 6.5%, 30-year mounted price, amounting to $6,000 monthly. Nevertheless, with a gross month-to-month revenue of $23,333, we really feel it’s reasonably priced.

To this point we love the home and don’t have any regrets.

Ideas On the Property Bidding Struggle Suggestions

There are two key takeaways from the owners who shared why they engaged in a property bidding battle.

1) They will comfortably afford the costs they pay.

There appears to be a false impression that solely determined or financially inexperienced patrons take part in bidding wars, stretching themselves skinny. Nevertheless, it seems that well-educated patrons with robust monetary profiles are those prepared to overbid on properties.

Reflecting alone expertise, I notice I lack the arrogance to overbid resulting from a previous setback in 2007 once I ended up paying an excessive amount of for a rental in Palisades, Lake Tahoe. That have left an enduring affect, shaping my future decision-making.

2) All of them have youngsters.

Each purchaser talked about having youngsters, starting from these but to be born to varsity college students. The need to supply a cushty residence for one’s youngsters is a robust motivator. Certainly, I consider the perfect time to personal the nicest home you may afford is when you’ve got probably the most relations below one roof.

Involved in regards to the future value of housing when my youngsters are prepared to purchase properties in 20-25 years, I’ve chosen to hedge my bets by investing in at the very least one rental property per member of the family. Whereas my major actual property purpose is to generate semi-passive revenue for retirement, I additionally intention to supply my youngsters with reasonably priced housing choices sooner or later.

3) All of them plan to stay of their new homes for a very long time.

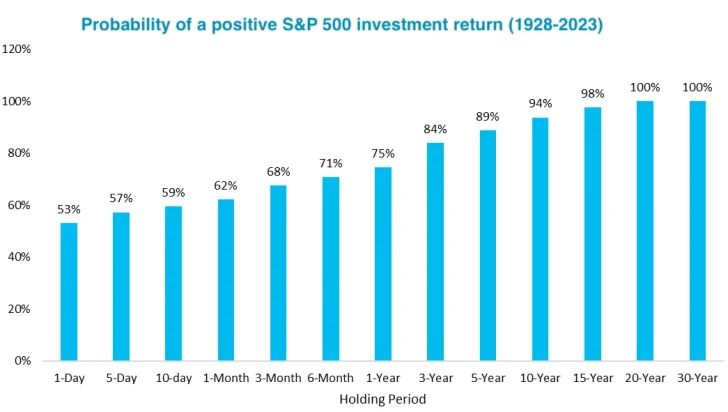

The longer a property bidding battle winner lives of their residence, the better their possibilities of constructing fairness. It is the identical thought with proudly owning shares.

At the moment, the median homeownership length is about 12 years. If bidding battle winners can maintain for at the very least the median length, they’ll probably nonetheless make a revenue after they promote.

Please Nonetheless Be Cautious About Overbidding On a Property

After going by way of this train, I nonetheless maintain reservations about participating in property bidding wars. At coronary heart, I am a discount hunter, all the time looking out for worth resulting from mispricing, unhealthy timing, or ineffective advertising and marketing. As a result of actual property transactions closely depend on individuals, I consider savvy patrons can exploit inefficiencies to safe a greater deal.

I’ve documented varied methods I’ve employed to barter decrease buy costs, comparable to delaying escrow, writing heartfelt actual property love letters, making gives with no financing contingencies, and pursuing twin company routes. All these techniques have confirmed efficient in my 21+ years of actual property investing. Therefore, I discover it troublesome to deviate from my established strategy.

Nevertheless, for many who have emerged victorious in property bidding wars, there’s reassurance within the relative effectivity of the true property market.

Merely underbidding on a property does not robotically translate to a greater deal; maybe the property was initially priced too excessive. Conversely, paying 20% over asking does not essentially equate to overpayment; it could point out the property was initially underpriced.

There’s All the time One other Good Residence Ready To Be Bought

In the long term, the market will decide the honest value of a house. My concern is that heightened feelings typically cloud the judgment of potential homebuyers. Many envision an idyllic life of their future residence, main them to consider it is price paying extra for perfection.

The truth is, when you miss out on one residence, there’ll all the time be one other equally appropriate possibility for your loved ones. It is important to acknowledge this and train persistence.

Set up a definitive most value you are prepared and in a position to pay, and keep on with it, it doesn’t matter what. Following this recommendation will decrease the danger of purchaser’s regret and safeguard your monetary well-being within the course of.

Better of luck on the market!

Reader questions

Why do you assume patrons are prepared to have interaction in property bidding wars, regardless of the danger of paying an excessive amount of? In the event you’ve ever gained a property bidding battle, please share your expertise and reasoning to assist us perceive why. Why not simply wait till the 4th quarter to purchase given there’s much less competitors and extra wiggle room for value changes?

Make investments In Actual Property Extra Strategically

As a substitute of getting right into a bidding battle, think about investing in passive actual property investments throughout the nation for diversification, passive revenue, and probably higher returns.

Contemplate Fundrise, a number one non-public actual property funding agency with over $3.3 billion in belongings below administration. Fundrise primarily focuses on residential and industrial actual property within the Sunbelt area, the place valuations are usually decrease and yields are usually greater.

Personally, I’ve allotted $954,000 to non-public actual property funds, primarily focusing on properties within the heartland. With distant work changing into extra frequent, it is cheap to anticipate that Individuals will more and more gravitate towards lower-cost areas of the nation.

Fundrise is a sponsor of Monetary Samurai and Monetary Samurai is an investor in Fundrise.