With faculty turning into dearer, how can mother and father afford to ship a child to highschool?

Greater than a decade after finishing faculty, 7% of Millennials nonetheless have greater than $50,000 in scholar mortgage balances. Dealing with our actuality of digging out of debt and understanding our buddies’ horror tales, many millennials are motivated to assist their children get via faculty debt-free.

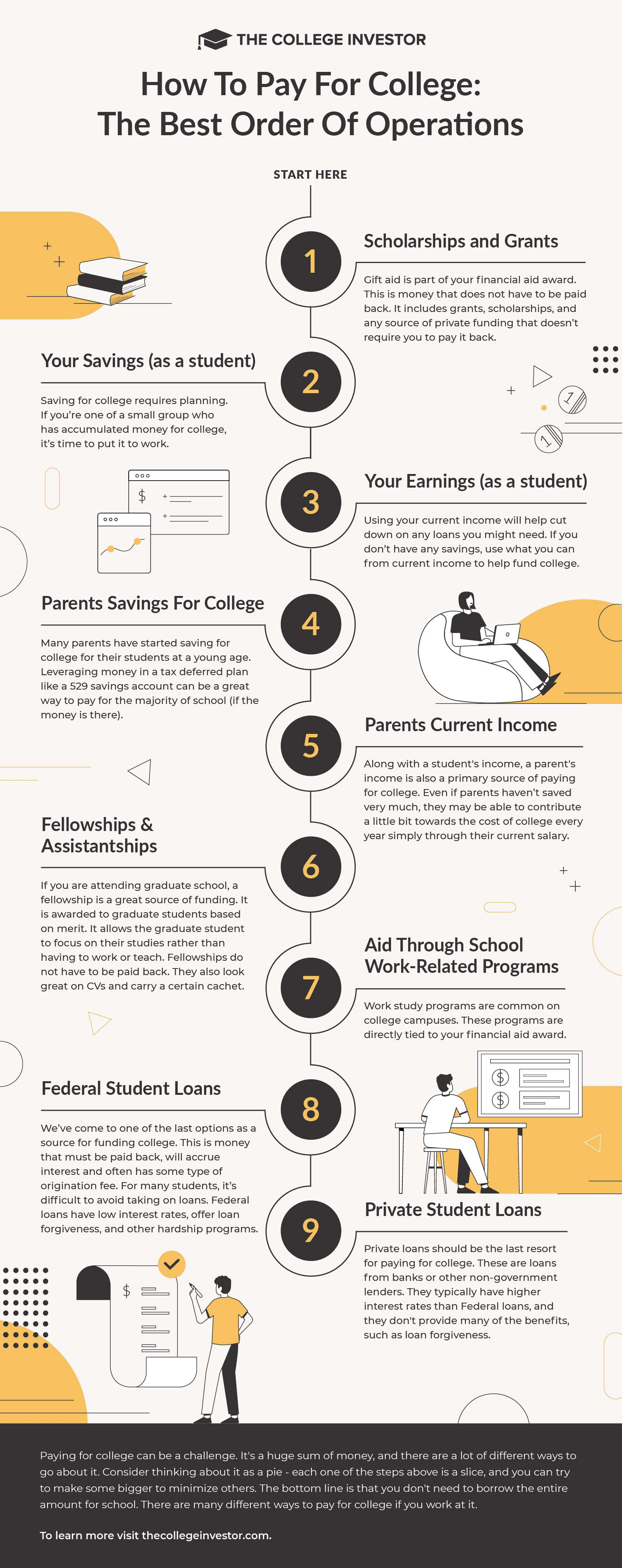

Whereas we are able to’t promise that you just’ll be capable of assist your little one keep away from debt, we’ve acquired sensible tricks to cowl the price of faculty from the day your little one is born to after they graduate.

How To Save For Faculty When Your Child is A Child

When you’ve got a new child snuggling in your arms, faculty looks as if it is a lifetime away. And with the brand new prices of being a guardian, saving for faculty might not appear to be a precedence. With a child, cash is undoubtedly tight. You’ve both began paying for little one care, otherwise you’re working much less to care in your toddler. Nonetheless these are some things you are able to do to assist your child graduate from faculty debt-free.

Open a 529 Account. A 529 Account lets you make investments cash in your little one’s training. Any cash that you just put within the account will develop tax-free, and also you don’t must pay taxes or penalties if the cash is spent on training prices. When you occur to place an excessive amount of cash into the account, your little one can put as much as $35,000 right into a Roth account after they flip 18.

Arrange an automated $10 weekly contribution to the account. Your funds might really feel prefer it’s squeezed, however most individuals can afford $10 per week, and in the event you contribute this a lot to the 529 accounts, and get a 7% return, you’ll have $18,000 within the account by the point your little one begins college.

Put any monetary presents into the account. Folks usually give small monetary presents to children for birthdays, Christmas, or main milestones. It’s straightforward to spend this cash however make investments it within the 529 as a substitute. Between a $250 preliminary contribution and $10 weekly deposits, you’ll have near $20,000 to pay for college when your little one turns 18.

The following pointers aren’t going to get your little one via faculty with out debt, however they go a good distance towards serving to them. And mixed with a few of the methods later in life, you could possibly put your child via faculty with out debt.

Faculty Financial savings Throughout Elementary Faculty

When your little one first hits elementary college, you’ll have simply over a decade earlier than they begin faculty. By the top of fifth grade, they’ve simply seven college years left earlier than faculty. Your focus is probably going on having fun with artwork tasks, Lego creations, soccer video games, and playgrounds along with your child, however you possibly can take these steps to avoid wasting for faculty within the again half of your child’s childhood.

Use a UPromise Credit score Card. A UPromise bank card lets you save cash-back into your little one’s 529 account. It gained’t add as much as a ton of cash, however each little bit helps.

When you’re not paying for childcare anymore, improve your weekly contribution to your 529 account. Assuming you begin contributing $10 per week when your little one is born, you’ll have $3900 by the point your little one is 6. When you can enhance your contribution to $50 per week at that time, you’ll have almost $58,000 by the point you ship them to school.

Begin instructing your children about monetary fundamentals comparable to incomes, spending, and saving cash now.

Faculty Financial savings Throughout Center Faculty

Whereas a lot has modified since I used to be in Center Faculty, it nonetheless looks as if these early adolescents are desperate to spend their mother and father’ cash on the most recent tech, new sneakers, and junk meals. Throughout center college, it could be straightforward to let faculty financial savings take a again seat as you negotiate extra every day cash administration along with your newly minted teenager. These are some things you are able to do to spice up your faculty financial savings because it probably appears so much nearer now than it did on the finish of fifth grade.

Proceed automated contributions to the 529 account. When you haven’t been contributing, it’s nonetheless worthwhile to begin saving for faculty when you’ve got a center schooler. You gained’t see dramatic development, however it is going to give them a hand up when it comes time to begin college.

Emphasize alternatives to earn cash. Center schoolers can’t have part-time jobs, however they will sometimes discover loads of odd jobs to assist them earn cash. Teenagers who spend time babysitting, shoveling snow, mowing lawns, cleansing home windows, or serving to with the household enterprise could have an appreciation for cash that different children gained’t have.

Educate your teen about investing by permitting them to open a brokerage account if they’ve further money. As a warning from private expertise, your teen might not be desirous about classes about prudent investing in a diversified funding portfolio. Let’s hope that comes afterward.

Faculty Financial savings Throughout Excessive Faculty

By the point you’ve got a excessive schooler, it’s best to know whether or not they’re more likely to attend faculty after commencement. If they appear college-bound, you’ll need them to begin taking up a few of the work related to paying for faculty. These are some things you possibly can encourage your excessive schooler to do to assist pay for faculty.

Begin wanting into scholarships. I’m at all times stunned by the variety of scholarships out there to excessive schoolers, particularly juniors and seniors. Many of those scholarships are native scholarships value $50-$250, however a majority of these scholarships can add up.

Take into account dual-enrollment choices. Sometimes, dual-enrollment includes taking courses at a local people faculty or college. You get credit score for each highschool and faculty on the identical time. More often than not, the credit are straight transferable to a four-year college.

Speak about faculty affordability. For many years, most individuals inspired highschool college students to attend the very best faculty they might. However with the rise of scholar debt, college affordability is lastly in vogue. Faculty affordability isn’t nearly record worth. So encourage your excessive schooler to use to expensive colleges like Harvard or NYU. However be sensible in regards to the prices. If they’re accepted however don’t get benefit help from the college, these costly colleges could also be out of attain for you.

Encourage your highschool scholar to save cash. Most excessive schoolers can deal with a part-time job together with their tutorial and extracurricular obligations. When you’re overlaying most of their wants, your children ought to be capable of avoid wasting cash. Saving just a few thousand {dollars} throughout highschool may enable your little one to purchase a laptop computer, books, and different necessities that they should begin faculty with minimal debt.

Paying for Faculty Throughout Faculty

Faculty financial savings doesn’t cease when highschool ends. Mother and father can (and infrequently do) assist their child’s training prices throughout faculty as nicely. These are some things mother and father can do to assist their college-aged children pay for faculty.

Full the FAFSA. Most schools require you to full the FAFSA to obtain benefit or need-based help. And in the event you can’t utterly cowl the price of faculty, you might qualify for sponsored scholar loans from the Division of Schooling.

Select your faculty based mostly on affordability. There’s no disgrace in selecting a college you can afford. If the flagship college in your state prices twice as a lot as regional campuses, you might need to attend the regional campus. Use the group faculty system to get your basic training necessities out of the way in which for a minimal value. In case your scholar desires to attend a pricier college, be certain they’ve loads of scholarships to cowl the majority of the prices (you can’t cowl).

Speak about loans along with your scholar. Scholar loans might enable your little one to get a invaluable diploma, however scholar loans are nonetheless debt. You will have your little one to know that loans aren’t free cash. Encourage them to reduce the debt they take out.

Get inventive about overlaying prices. Assist your scholar create a funds that can decrease the necessity for debt. In the event that they dwell at residence, go car-free, or get scholarships they could not have to work as a lot throughout faculty. However, if they’ve a number of income-earning alternatives, they are able to deal with tuition and residing bills with out burdensome debt. As a guardian, you could possibly assist them get inventive too.

Pay for training prices out of your 529 account. In case your little one’s 529 account has cash, that is the time to make use of it. Even in the event you don’t have sufficient to cowl tuition, books, room, and board for 4 years, you could possibly hold your scholar out of debt for a 12 months or two, and that’s an enormous blessing.

Don’t tackle Guardian PLUS loans. A certain signal {that a} faculty is unaffordable is that if it’s worthwhile to take out Guardian PLUS loans to cowl the prices. Undergraduate college students ought to be capable of cowl prices with financial savings, scholarships, and loans of their names. If they will’t, a lower-cost choice is so as.

Don’t neglect your retirement financial savings. Most monetary specialists advise prioritizing your retirement financial savings above saving in your youngsters’s training. By investing in your retirement, you possibly can keep away from turning into a monetary burden to your youngsters in your later years.

Paying for Faculty After Faculty

In case your scholar took out loans to cowl undergraduate prices, you might need to assist them pay again their loans. These are just a few methods you could possibly assist.

Allow them to dwell at residence. In case your child spends just a few years at residence, they are able to get rid of their debt burden earlier than shifting out. Just be sure you and your little one each agree that the purpose is to get out of debt.

Direct your earlier financial savings to their debt. Any cash you possibly can direct in the direction of your little one’s debt will probably be an enormous assist to them. When you’re used to giving them $50 per week, begin directing that $50 per week in the direction of their debt. It is a smart way to assist them get out of debt rapidly.

Rigorously contemplate massive money transfers. When you attain retirement age, you can begin to withdraw cash from retirement accounts with out penalties. You probably have some huge cash stocked away in these accounts, you might need to liquidate some investments and repay your children’ scholar loans. That is an space the place you need to tread rigorously. A fiduciary monetary advisor will help you determine if that is the fitting factor so that you can do.

Conclusion

Serving to your children via faculty is a noble purpose, and you’ll take steps to assist them keep away from or decrease scholar debt. It doesn’t matter what age your children are, you could possibly assist them afford their post-secondary training.