Regardless of my in depth expertise of 13 years working in worldwide equities, dwelling overseas for a similar period, and visiting roughly 60 nations, I do not allocate a lot of my investments to worldwide shares. I imagine the danger outweighs the potential reward, particularly when there are already quite a few profitable funding alternatives out there in the USA.

When you’ve been experiencing some investing FOMO by not investing in worldwide shares, I say don’t fret about it. You have not missed a lot. When you’ve been questioning whether or not it is best to begin investing in worldwide shares, I say it is in all probability pointless.

This submit goals to make clear why investing in worldwide shares is likely to be overrated, advocating for focusing solely on U.S. shares. This is a concise abstract of the explanations behind this attitude:

- Abundance of U.S. shares and different danger property out there for diversification functions.

- Consolation and familiarity in investing in what one is aware of, understands, and may relate to.

- Challenges in valuing worldwide shares as a consequence of heightened company governance and geopolitical dangers.

- Restricted availability of best-in-class firms with various accounting requirements outdoors the U.S.

- Problem in predicting which worldwide shares or nations will outperform.

Efficiency Of Worldwide Shares Versus Home Shares

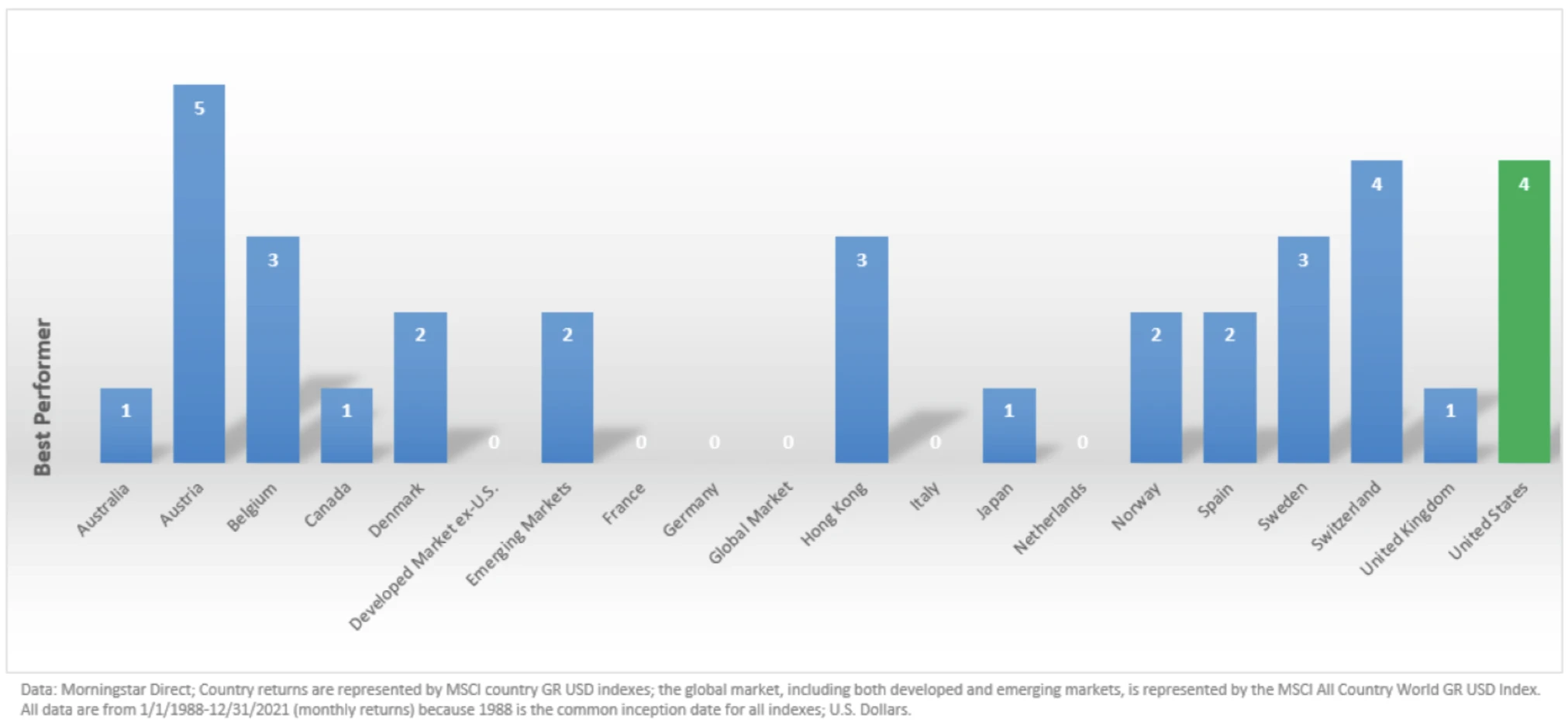

Beneath is a 2021 graph offered by Morningstar that illustrates inventory market returns since 1988. Surprisingly, the USA has solely been the highest performer 4 instances throughout this era. In distinction, Austria has claimed the highest spot 5 instances, whereas Switzerland has matched the USA’ efficiency 4 instances.

This information means that solely investing in U.S. shares might have resulted in underperformance in comparison with worldwide shares. Nevertheless, is it so dangerous to return in second or third with robust positive factors? I do not assume so and this information would not go into additional element.

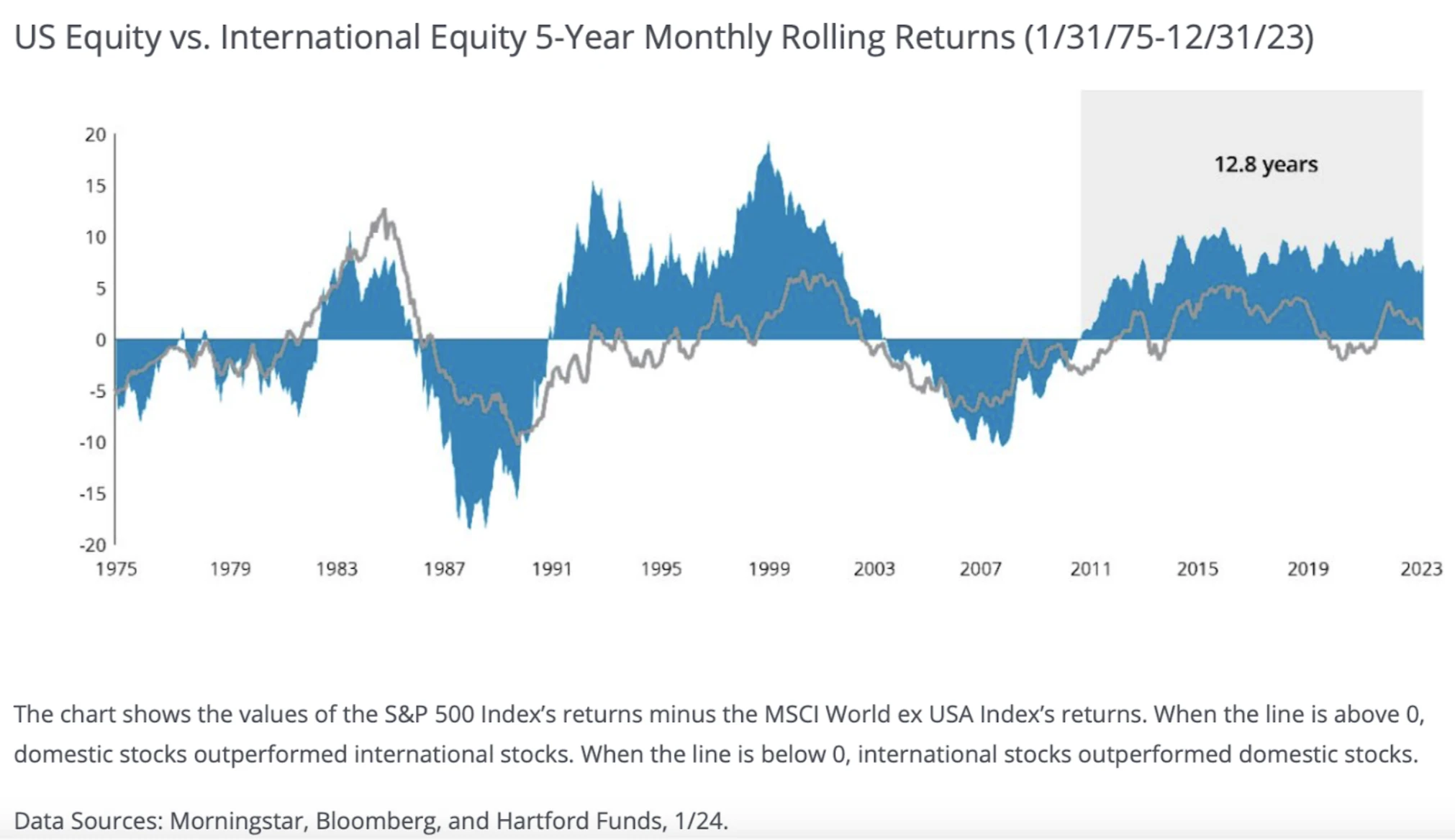

Beneath is a chart compiled by the Hartford Funds, using information from Morningstar and Bloomberg as of 12/31/2023. It illustrates that the S&P 500 underperformed worldwide shares in the course of the Nineteen Seventies, the late Eighties, and from 2003 to 2011. Nevertheless, it additionally demonstrates that the S&P 500 has outperformed worldwide equities for the previous 12.8 years.

Challenges in Persistently Figuring out Outperforming Worldwide Shares

The charts above reveal that U.S. shares don’t at all times outperform worldwide counterparts. Therefore, having worldwide shares can function a hedge in opposition to potential underperformance of U.S. shares.

Nevertheless, two vital challenges come up with this strategy.

1) Uncertainty in Timing and Period of Outperformance

Figuring out when and for a way lengthy worldwide shares will outperform U.S. shares poses a problem. As an illustration, in 2011, investing 40% of a portfolio in worldwide shares might need appeared prudent as a consequence of their decrease debt burden, which outshone U.S. shares in the course of the 2008-2009 monetary disaster. But, this technique would have led to a 13-year interval of underperformance in comparison with investing solely within the S&P 500.

Equally, growing publicity to worldwide shares now, given their 13-year underperformance, might sound logical. U.S. shares cannot outperform worldwide shares without end, can they? Nevertheless, predicting a imply reversion the place the S&P 500 begins to lag is unsure.

Popping out of COVID, the U.S. confirmed it was a world-leader in navigating by way of a disaster. Now, many worldwide traders want to chubby the U.S. consequently. Issue

2) Uncertainty in Figuring out Outperforming Worldwide Shares or Nations

Figuring out which worldwide shares or nations will outshine the U.S. market provides one other layer of complexity.

As an illustration, closely investing in Hong Kong shares as a consequence of their decline since COVID-19 might sound interesting. But, ongoing challenges stemming from China’s insurance policies might perpetuate Hong Kong’s struggles.

Conversely, France, Germany, and Italy would possibly outperform as a consequence of favorable elements equivalent to a aggressive foreign money, decrease inflation prompting faster fee cuts, and stronger company and authorities steadiness sheets.

Introducing worldwide shares right into a portfolio introduces myriad variables to contemplate. Alternatively, why not spend money on the S&P 500 and choose particular person development shares that you just imagine will outperform? There is no have to enterprise to worldwide shares the place you could have little-to-no understanding.

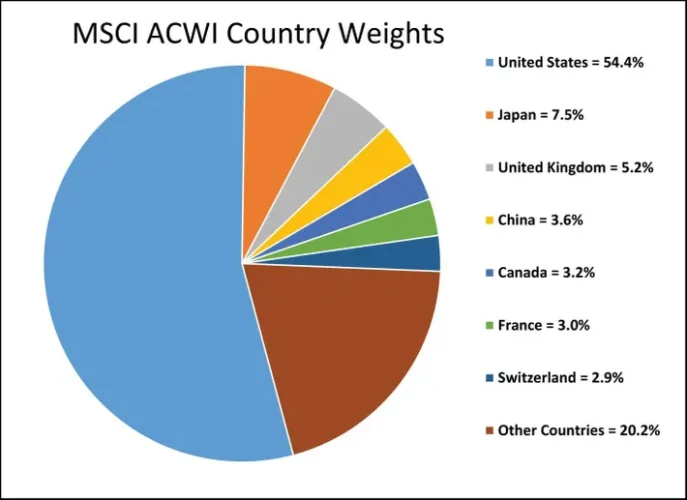

One of many commonplace worldwide inventory indices is the MSCI All Nation World Index. You may spend money on it by way of the ETF, AWCI, to entry worldwide inventory publicity alongside majority U.S. inventory publicity, as depicted beneath.

Beneath is the efficiency of the ACWI since 2009. Not too dangerous with a 22.3% return in 2023.

However once you evaluate ACWI to SPY, an S&P 500 ETF, you may see the numerous underperformance over the previous 5 years. The factor is, there are a plethora of worldwide ETFs to select from. How have you learnt which one to decide on that is greatest for you? You do not.

Worldwide Shares Provide Pure-Play Publicity

As a substitute of choosing a knock-off “Bolex” watch from a doubtful avenue market in New York Metropolis, you would possibly desire the genuine Rolex from Geneva, Switzerland. Whereas the real Rolex might come at the next worth, it presents high quality and sturdiness commensurate with its worth.

Quite a few worldwide nations produce distinctive merchandise. Examples embody Louis Vuitton purses from LVMH, semiconductor chips from TSMC, and cars from BMW. Proscribing oneself to home investments might imply lacking out on vital development alternatives overseas.

Don’t fret as a result of there are two options if you wish to achieve worldwide publicity.

Purchase American Depository Receipts (ADRs) of Worldwide Shares

As a substitute of investing in a complete worldwide market by way of an ETF, one can go for the ADR of a most popular worldwide inventory. Many main worldwide firms, though not all, supply ADRs. As an illustration, TSMC’s ADR is TSM, LVMH’s ADR is LVMUY, and BMW’s ADR is BMWYY.

Selecting and selecting particular worldwide shares to spherical out your portfolio could also be a greater determination.

Enough Worldwide Publicity Amongst U.S. Firms

For publicity to worldwide shares, you can additionally take into account investing in main U.S. multinational companies like Chevron, Pfizer, and Apple. These firms derive no less than 25% of their income from abroad markets, capitalizing on elevated demand overseas. As an illustration, if iPhone gross sales surge in China, Apple stands to learn.

Nevertheless, U.S. multinational firms usually focus on particular sectors equivalent to expertise or healthcare. Relying solely on U.S. multinationals might restrict diversification throughout varied industries.

The Principal Dangers Of Investing Worldwide Shares

Worldwide shares could appear engaging on any given 12 months, nevertheless, it is essential to pay attention to all of the dangers related to investing internationally.

Geopoliticial Danger

Dwelling overseas or investing in worldwide shares gives a perspective on the soundness of the U.S. authorities as compared.

As a worldwide superpower, neither Canada nor Mexico would dare to assault the U.S. Furthermore, being a rustic with a worldwide reserve foreign money leads to much less foreign money and capital account volatility. Our functioning democracy has so far prevented navy coups, making the USA some of the secure nations globally.

Geopolitical stability is essential for traders. Investing in property liable to quite a few unknown exterior elements could be dangerous. As an illustration, when Russian President Putin invaded Ukraine, the Russian inventory market plummeted by 39% in a single day. The Russian ruble additionally hit file lows as residents rushed to transform their foreign money into different extra secure ones like USD.

Assessing non-company elementary dangers is difficult for traders. Figuring out whether or not to pay a ten%, 20%, or 70% low cost for a global firm inventory relative to its U.S. friends is advanced and unsure. If you cannot predict a danger, you then would possibly as properly not make investments in any respect.

Forex Danger

If the native foreign money weakens compared to your property foreign money, your returns might diminish when transformed again to U.S. {dollars}.

As an illustration, let’s take into account buying a Chinese language tech firm the place one U.S. Greenback buys 7.24 Chinese language Yuan. All appears properly till the Chinese language authorities decides to invade Taiwan, inflicting a pointy depreciation of the Chinese language Yuan to fifteen per one U.S. Greenback as traders flee Chinese language Yuan-denominated property. In such a situation, you’d incur a big loss in your organization’s earnings when changing them again to U.S. {Dollars}.

Equally, for those who spend money on Apple inventory, you can be adversely affected by a considerable devaluation of the Chinese language Yuan, given that just about 20% of Apple’s income comes from China. The conversion of Chinese language Yuan earnings again to U.S. {Dollars} would considerably impression Apple’s subsequent quarterly earnings report.

S&P 500 Firms With Excessive International Income Publicity Underperformed In A Bear Market

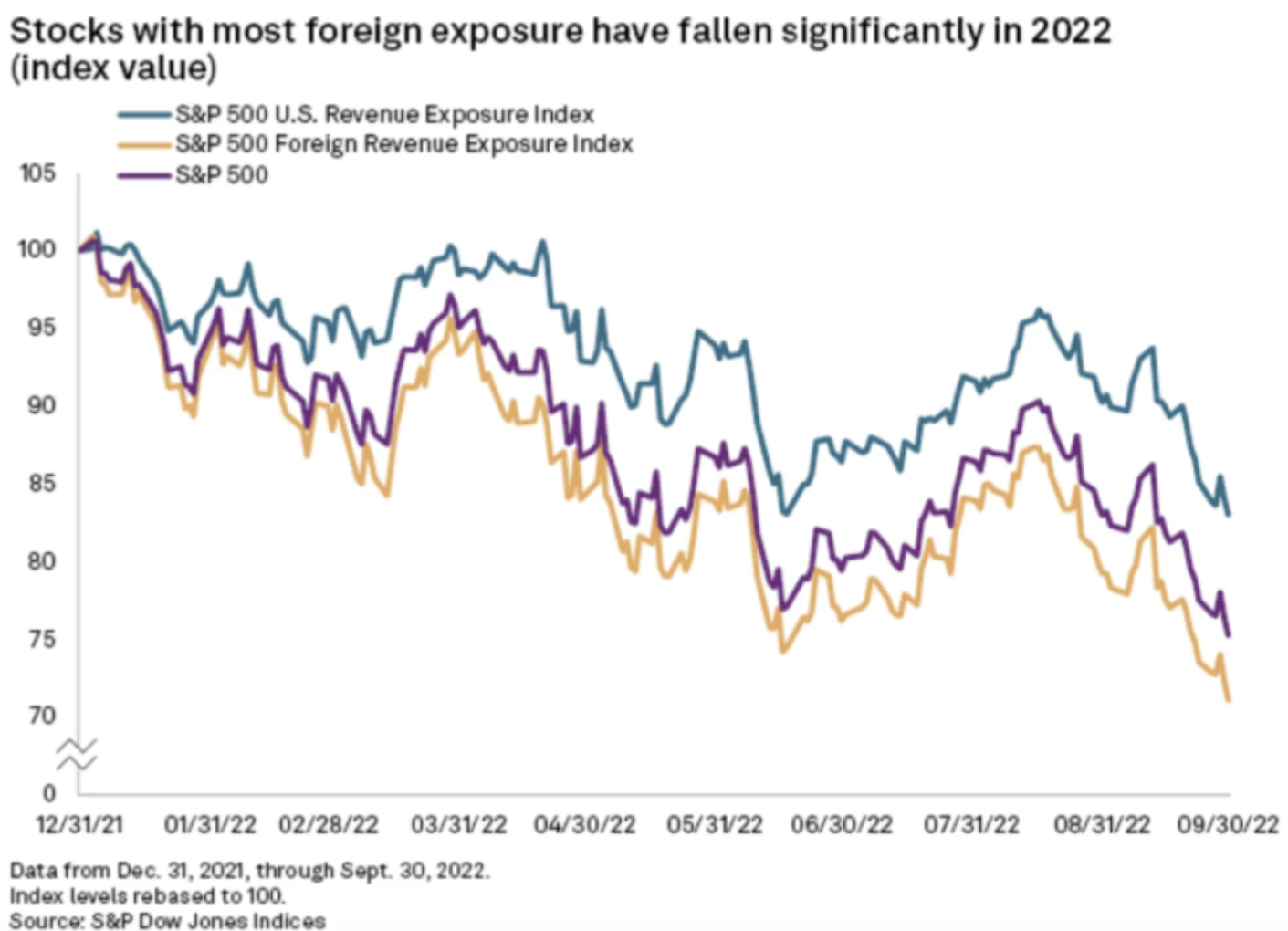

The chart beneath illustrates how the S&P 500 International Income Publicity Index (represented by the gold line) skilled a extra pronounced decline than the S&P 500 Index (represented by the purple line).

Throughout the 2022 bear market, the place the S&P 500 fell by 19.6%, the S&P 500 International Income Publicity Index fell even additional. This decline coincided with the start of the Fed’s aggressive 11 fee hikes in 2022. As U.S. rates of interest rose, so did the worth of the U.S. Greenback, as U.S. property turned comparatively extra engaging.

S&P 500 Outperformed MSCI ACWI In 2023

Now, let’s study the efficiency of the S&P 500 in comparison with the MSCI All Nation World Index (ACWI) in the course of the 2023 bull market. The S&P 500 outperformed the ACWI by greater than 10%. When an asset class permits you to reduce losses throughout downturns whereas maximizing positive factors throughout upswings, it turns into an interesting funding possibility.

Financial Dangers

In relative phrases, the USA boasts a secure economic system. Since 1960, the GDP development fee has fluctuated modestly, starting from -2.5% to +7.5%. Moreover, apart from 2022, inflation has remained comparatively secure, fluctuating between 1% and 4% for many years.

Now take into account Argentina for instance. Its governmental insurance policies have led to hyperinflation, leading to financial instability, hovering unemployment charges, and substantial actual monetary losses.

Over the previous 42 years, Argentina’s shopper worth inflation fee has fluctuated dramatically, starting from -1.2% to a staggering 3,079.8%. In 2022, the inflation fee reached 94.8%, whereas by November 2023, it surged to 160.92%.

From 1980 to 2022, the typical annual inflation fee in Argentina stood at 206.2%, with costs hovering by an unbelievable 902.38 billion p.c total. To place it into perspective, an merchandise that value 100 pesos in 1980 would have skyrocketed to 902.38 billion pesos by early 2023.

Investing in such an atmosphere presents vital challenges and dangers. Why trouble?

Decrease Market Liquidity With Worldwide Nations

Most worldwide markets have decrease liquidity in comparison with main home markets. Because of this, any kind of geopolitical danger might trigger a lot larger draw back motion as traders head for the exit doorways.

The New York Inventory Change, for instance, is about 4 instances larger than the Japan Change Group, and 25 instances larger than the Brazilian inventory change when it comes to market capitalization of firms. Bigger inventory exchanges present extra liquidity and higher buffers throughout troublesome instances.

Beneath is the estimated market capitalizations of the world’s prime 20 inventory markets. Discover how the NYSE and Nasdaq dwarf all different worldwide inventory markets.

Now zero in on the Taiwan Inventory Change with an estimated $1.6 trillion market capitalization. Not solely is the Taiwan Inventory Change about 93% smaller in dimension than NYSE, Taiwan Semiconductor Manufacturing accounts for between 35% – 40% of the nation’s complete market capitalization! Discuss focus danger.

As a substitute of shopping for the Taiwan Inventory Change, you can simply purchase TSM as a substitute.

Worldwide Company Governance Requirements Could Be Decrease

When investing overseas, company governance standards won’t conform to the requirements anticipated by U.S. traders. This encompasses parts like shareholder privileges, openness, duty, board effectivity, danger mitigation, shareholder engagement, and adherence to rules.

In the USA, there’s all kinds of guidelines and rules, such because the Sarbanes-Oxley Act to stop company fraud. We talked about this after I was in a position to join the dots with a non-public development firm’s plans to go public.

Publicly traded firms within the U.S. most report earnings each quarter, and such studies have to be publicly disclosed all on the identical time. Different worldwide inventory market exchanges might have totally different reporting requirements.

Certain, in America, now we have had scandals with huge names equivalent to Enron, Worldcom, and FTX. Nevertheless, the frequency of our company governance scandals are fewer in comparison with those in worldwide markets. And if one is occurring, as a global investor, you is likely to be the final to know.

Some latest worldwide inventory market scandals:

- Volkswagen Dieselgate: In 2015, Volkswagen admitted to putting in unlawful software program in thousands and thousands of diesel automobiles worldwide to cheat emissions assessments. The scandal resulted in a large drop in Volkswagen’s inventory worth, vital fines, and reputational injury for the corporate.

- Wirecard: Wirecard, a German fee processing firm, collapsed in 2020 following revelations of accounting irregularities. It was found that the corporate had overstated its income and property by billions of euros. The scandal led to Wirecard submitting for insolvency and quite a few investigations into fraud and misconduct.

- Satyam Pc Companies: Satyam, certainly one of India’s largest IT companies firms, was embroiled in a large accounting scandal in 2009. The corporate’s founder admitted to inflating earnings and falsifying accounts to the tune of over $1 billion. The scandal severely impacted investor confidence in India’s company governance requirements.

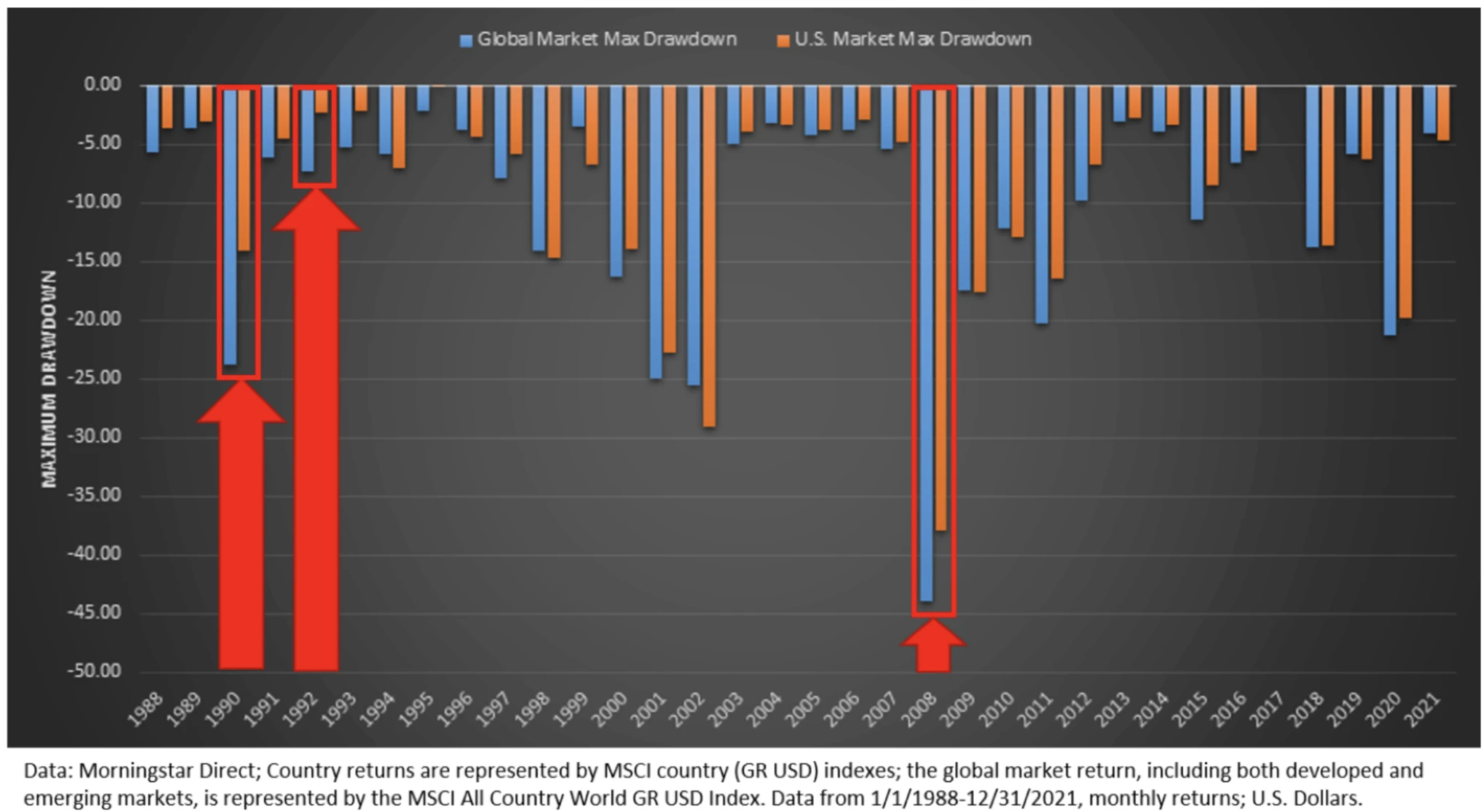

World And U.S. Market Drawdowns

In two charts above, you noticed how the S&P 500 fared in opposition to worldwide shares throughout a bear market in 2022 and a bull market in 2023. The S&P 500 outperformed each years.

Now let’s zoom out additional to see the historic draw back danger of investing in worldwide shares and home shares. The blue represents worldwide shares and the orange represents the U.S. market.

Discover how the drawdown in worldwide shares has traditionally been a lot larger than the drawdown within the U.S. market. The primary motive why is as a result of throughout a world bear market, there tends to be a flight to developed nations with extra monetary stability.

An area analogy can be promoting your pointless trip property earlier than you promote your major residence. On this analogy, the holiday property is worldwide shares as a result of you do not want them. Because of this, trip property valuations and worldwide inventory valuations are likely to undergo essentially the most throughout downturns.

How A lot Worldwide Shares To Maintain In Your Portfolio

Based mostly on my arguments above, you would possibly agree that proudly owning worldwide shares in your portfolio is pointless. There’s an excessive amount of danger and never sufficient reward. You could possibly allocate 0% of your portfolio to worldwide shares and just do advantageous. In addition to, U.S. multinational companies already present worldwide publicity with higher company authorities.

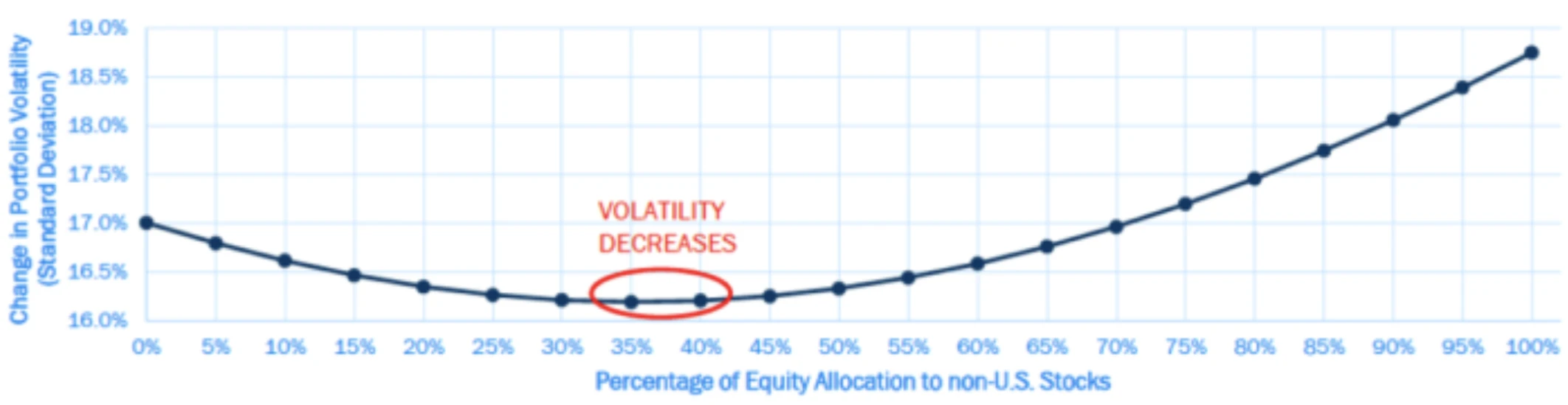

One methodology to find out the suitable degree of worldwide inventory publicity in your portfolio is thru Trendy Portfolio Principle (MPT). MPT advocates for a method that includes investing throughout the worldwide market, with every asset class weighted in accordance with its market capitalization. Because the U.S. market makes up roughly 60% of the worldwide market, MPT suggests {that a} U.S. investor ought to allocate roughly 60% of their portfolio to U.S. shares and the remaining 40% to non-U.S. shares.

This strategy gives a balanced perspective on the allocation of worldwide shares in a portfolio. By incorporating worldwide shares right into a portfolio primarily composed of U.S. property, MPT goals to doubtlessly scale back volatility. Historic information means that optimum diversification happens when non-U.S. fairness constitutes between 35% and 40% of the whole fairness publicity, indicating a possible level of minimal portfolio danger.

However this is the factor, MPT is a suggestion that hasn’t performed out since 2011. If MPT was the reality, then everyone would comply with it and all be mega wealthy!

Why Not Simply Personal Shares In The Finest Nation As a substitute?

Drawing from my in depth expertise dwelling overseas and dealing in worldwide markets, I maintain a robust conviction that the USA stands because the preeminent nation for wealth accumulation. Regardless of not having the world’s largest inhabitants, America hosts nearly all of the globe’s Most worthy firms for good motive.

The unparalleled company governance, innovation, expertise, work ethic, and ingenuity exhibited by People set them aside. Consequently, I desire investing on the planet’s prime innovators and operators quite than venturing into worldwide shares the place my understanding could also be restricted or missing.

Sure, I’m undoubtedly displaying residence nation bias, which includes a need to allocate the next proportion of 1’s public funding portfolio to U.S. shares than the U.S. market capitalization weighting within the world market. Nevertheless, I additionally logically imagine that if I am to spend money on a danger asset, I’d as properly make investments essentially the most in the perfect nation.

Range is commendable for societal causes. However in terms of maximizing monetary returns, the main focus needs to be on investing in the perfect individuals working at the perfect firms, that are headquartered in the perfect nation on the planet.

I acknowledge that this viewpoint could also be perceived as smug. Nevertheless, it solely appears prudent to allocate a larger portion of capital to America given its observe file and potential for producing superior returns.

However Worldwide Shares Are Cheaper!

Sure, many worldwide shares might seem cheaper in comparison with their counterparts and inventory markets in the USA. Nevertheless, these decrease valuations typically mirror underlying dangers, with company governance being a major concern.

As an illustration, Alibaba is usually likened to the Amazon of China. Nevertheless, Alibaba trades at a fraction of Amazon’s valuation as a consequence of company governance and geopolitical points. The Chinese language authorities has taken a agency stance in opposition to its founder prior to now for being too vocal, resulting in setbacks such because the shelving of its Ant Monetary subsidiary’s IPO.

Proven beneath is an outline of Alibaba’s free money circulation (orange) alongside its share worth. Regardless of a big rebound in free money circulation in 2023, BABA’s inventory stays lackluster as a consequence of elements like a slowing Chinese language economic system, company governance considerations, and uncertainty relating to authorities actions.

BABA appears like a BUY to me. But it surely is also a price entice, one wherein I have been trapped and starved to loss of life earlier than. Many worldwide shares are cheaper for a motive. Beware.

Differentiating Between Developed Worldwide vs. Rising Markets

As I discussed above, there may be the MSCI AWCI (ETF: AWCI), which is an index of developed worldwide markets. Then there may be the MSCI Rising Markets Index (ETF: EEM), which consists of “growing” worldwide markets.

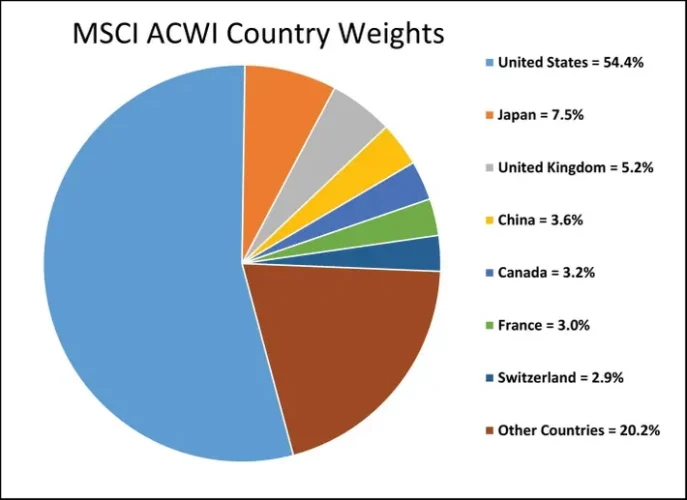

MSCI ACWI Nation Weightings

Developed markets are characterised by sturdy infrastructure, mature capital markets, and elevated dwelling requirements. These markets are mainly present in North America, Western Europe, and Australasia, encompassing nations equivalent to the USA, Canada, Germany, the UK, Australia, New Zealand, and Japan.

In different phrases, a bunch of individuals at MSCI considerably arbitrarily determined which nations are thought-about developed and what their weightings within the index can be. Now the MSCI ACWI is an ordinary index many developed nation worldwide funds comply with and attempt to outperform.

Rising markets are experiencing fast growth and improvement, but they characteristic decrease family incomes and fewer developed capital markets in comparison with their developed counterparts. These markets are characterised by swift financial development alongside weaker infrastructure and decreased family incomes.

At the moment, rising markets embody the “BRIC” nations (Brazil, Russia, India, and China), together with Portugal, Eire, Italy, Greece, and Spain. For traders in search of higher-risk alternatives, investing in rising markets might maintain larger attraction. The acronym “BRIC” was coined by a Goldman Sachs economist.

MSCI Rising Markets index composition

Make investments In Rising Markets Is Even Riskier

You would possibly discover investing within the MSCI Rising Markets Index interesting when you think about its composition. China and India, each experiencing fast development, stand as vital worldwide rivals to the USA. Moreover, nations like Brazil, Poland, Mexico, the Philippines, and Thailand present appreciable promise when it comes to development potential.

Nevertheless, for those who had invested within the MSCI Rising Markets Index again in 2009, over fifteen years later, you’d have skilled a loss. Are you able to think about taking up all that worldwide publicity danger, solely to considerably underperform the returns of a median checking account? As soon as once more, a budget valuations of worldwide shares and nations typically mirror underlying causes.

EEM = Purple line

Do not Want To Make investments In Worldwide Shares

You may discover worldwide shares by way of ETFs like EEM, ACWI, and plenty of others. You should buy country-specific ETFs and ADRs. These investments have the potential to mitigate your portfolio’s volatility and yield greater returns over time. Nevertheless, there’s additionally the likelihood that investing in worldwide shares might hinder efficiency.

Contemplating the plethora of choices out there within the American market—together with shares, bonds, actual property, and various investments—you might discover little necessity to delve into worldwide investments that you just’re not totally acquainted with.

Very like what number of search emigrate to America for a greater life, a good portion of worldwide capital seeks to spend money on American shares. If in case you have the chance to dwell and spend money on one of many prime nations globally, why trouble wanting elsewhere? There’s is loads of fortunes to be discovered proper right here in U.S.A.

Reader Questions

How a lot of your portfolio is in worldwide shares? How have they carried out for you? Why do you spend money on worldwide shares if there are already so many high-quality American shares to personal? Do you assume investing in worldwide shares is value it?

To diversify your U.S. inventory portfolio, you may merely add Treasury bonds, company bonds, and actual property. Actual property is my favourite asset class to construct wealth turns into it gives utility, is much less unstable, and generates earnings.

Try Fundrise, a number one non-public actual property platform at the moment with over $3.3 billion in property below administration. Fundrise invests predominantly in residential and industrial properties within the Sunbelt area, the place valuations are usually decrease and yields are usually greater. Fundrise is a sponsor of Monetary Samurai and Monetary Samurai is an investor in Fundrise.

To expedite your journey to monetary freedom, be a part of over 60,000 others and subscribe to the free Monetary Samurai publication. Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009.