As at all times with my longer write-ups, I’ll connect the total PDF beneath. Within the submit itself I’ll concentrate on the Exec abstract, Professional’s and Con’s and the conclusion. And the Bonus Monitor in fact on the finish.

Govt Abstract

Hermle AG is a typical “Hidden Champion” Mittelstand firm from Southwestern Germany (Baden Wuerttemberg, the “Ländle”) that managed to carve out a really good area of interest in 5- Axis CNC machines and related manufacturing automation. The corporate is ready to earn business main EBIT margins (>20%) and Returns on Capital (>30%), has a Fortress Steadiness sheet and trades solely at a comparatively modest valuation of round 7,7x EV/EBIT.

The enterprise is uncovered to the financial cycle, however a mixture of aggressive benefits, a versatile value base and a structural tailwind (Automation) make the inventory enticing within the mid- to long run

Full PDF might be learn & downloaded right here:

Professionals/Cons

As at all times, a fast run down of optimistic and never so optimistic elements of Hermle:

+ Business main margins and returns indicating vital aggressive benefits

+ very affordable valuation

+ Fortress Steadiness sheet & capital environment friendly enterprise mode, extremely versatile value base

+ long run oriented household possession and administration

+ structural tailwind Automation

+ further a number of imply reversion potential

+/- Reporting may very well be extra granular, however no changes

+/- Enterprise momentum has slowed down

+/- no share purchase backs, solely dividends

– vital publicity to enterprise cycle

– upcoming full generational change

– solely non-voting shares listed

Valuation /return expectation

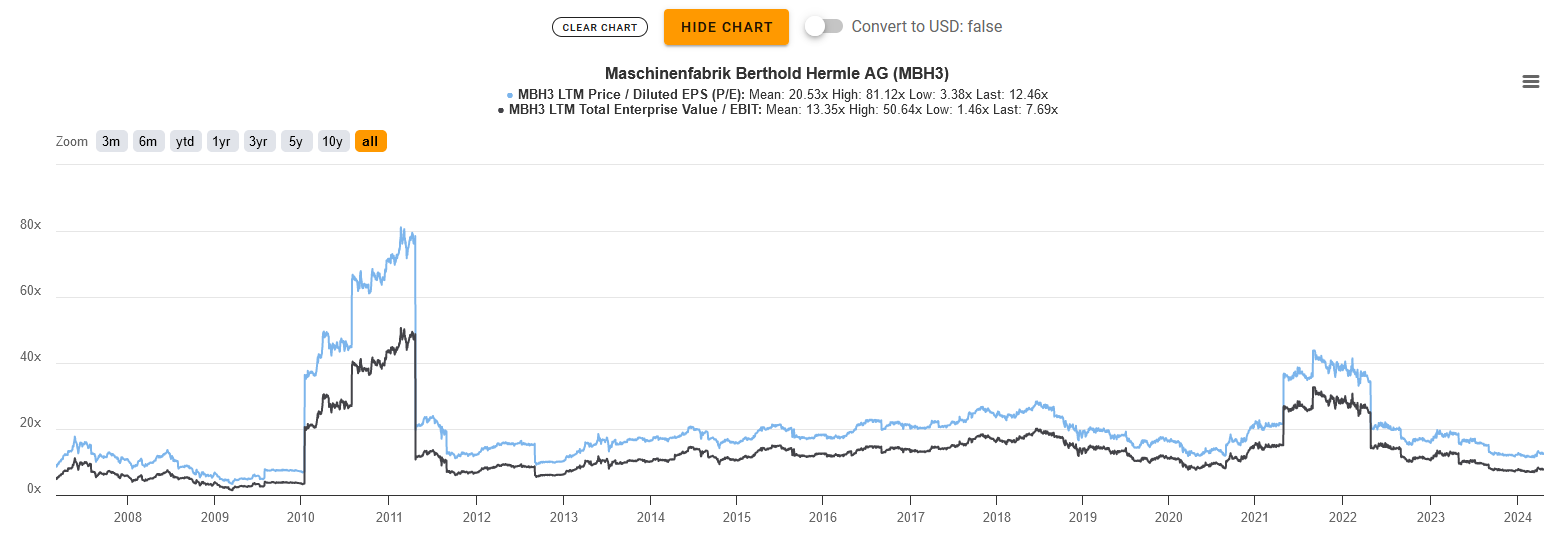

The present P/E of ~13 (or 11 ex Money) and EV/EBIT of seven,7x is clearly beneath the place Hermle has been buying and selling over the previous 17 years, the place on common the P/E was round 20 and EV/EBIT at round 14x.

In comparison with its friends, the inventory is priced like the common, however the margins and returns on capital are a lot a lot better. Industrial corporations with comparable margins are often valued a lot a lot larger.

The present dividend yield is sort of excessive at 7%. Even when we normalize this to five% and suppose over the subsequent years Hermle ought to be capable to develop on the historic 10 yr CAGR of seven%. First, inflation is larger and second, the demand for automation won’t go away.

Very roughly this is able to imply an anticipated return of 12%-14% p.a. plus any a number of imply reversion potential.

As we’ve got mentioned, the enterprise as such is cyclical however Hermle has a really versatile value foundation, so I’m really greater than OK with that anticipated return in comparison with the standard of the enterprise and the “Fortress stability sheet”.

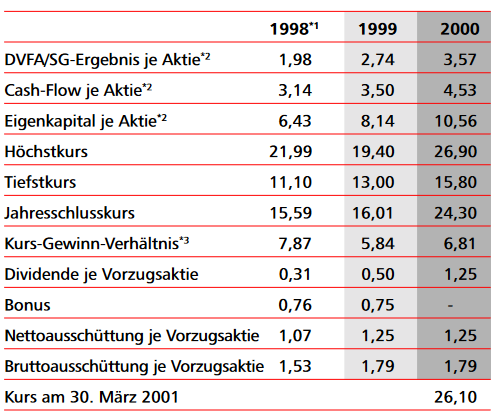

Nonetheless we must always not neglect {that a} potential cyclical inventory like Hermle can commerce even decrease. It is a desk from the annual report 2000 displaying that throughout the Dot.com increase in 1999/2000, Hermle traded at a PE of 6 and 8x regardless of doubling earnings over a 2 yr time span from 1998-2000.

Nonetheless, for my the cyclical threat is greater than mitigated by the far beneath histaorical averages valuation of the inventory.

Abstract & Sport plan

As outlined above, I do suppose that Hermle presents a good threat/return profile for the affected person investor. The present dividend yield is nearly 7%, there’s a good likelihood of some progress going ahead and any a number of imply reversion comes on high.

However, the order e-book at yr finish 2023 was weaker than in 2022 and the corporate already talked about that the primary few weeks in 2024 have been harder. The large query is in fact to what extent that is priced in or not.

Due to the present weak enterprise momentum, I made a decision to begin with a 3% place at a mean value of 222 EUR/share. Based mostly on its high quality, Hermle would justify a bigger place, however I’m “speculating” right here that I can possibly improve the place cheaper throughout 2024.

We are going to see if this works out our. Not. Funnily sufficient, within the final 18-24 months, my smaller positions have virtually at all times carried out higher than my bigger “conviction buys”.

Bonus Monitor: Don’t carry me down – Digital Mild Orchestra

As in my previous couple of pitches, here’s a Bonus monitor that for my part matches very properly to a hidden German Mittelstand Champion like Hermle: Don’t carry me down from ELO.