A reader asks:

I don’t work in finance however I do know sufficient math to get me into bother (I’m an engineer). All else equal, the next low cost fee ought to imply a decrease current worth of future money flows. I do know all is just not at all times equal however with charges rising once more and the prospect of upper for longer now firmly on the desk, shouldn’t that be a headwind for shares? What am I lacking right here?

Good query.

Finance idea does state that the current worth of an asset is the longer term stream of money flows discounted by an inexpensive fee of curiosity.

If PV = CFs / (1+fee)time and the speed goes up, all else equal, the current worth ought to go down.

The issue with this line of pondering is there’s a big distinction between idea and actuality. Plus, all isn’t ever equal.

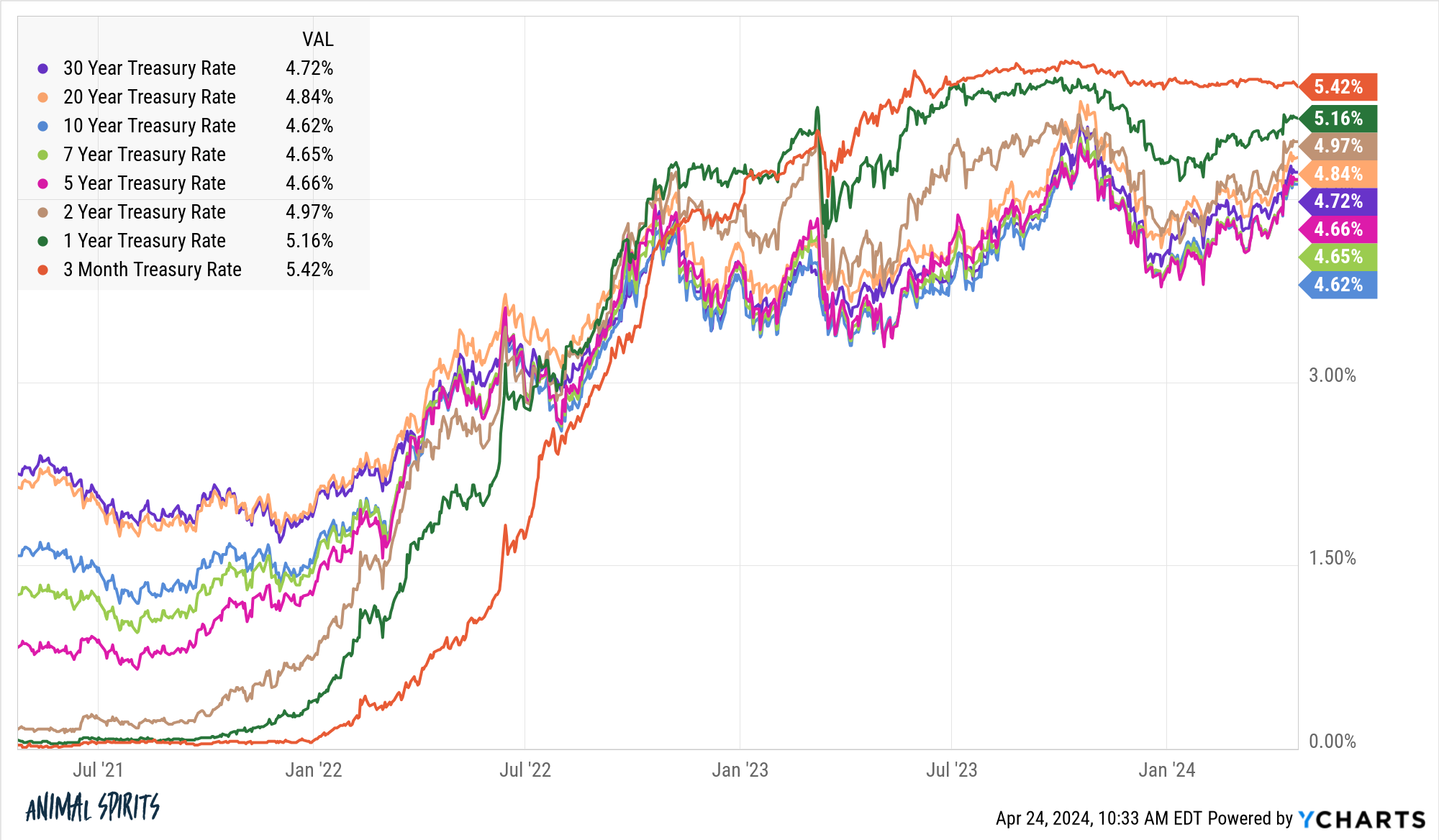

After rising at a quick clip final fall, rates of interest dipped however they’re now going again up once more:

The unfold between the quick and lengthy ends of the curve is compressing.

This ought to be dangerous for the inventory market, proper?

Sure, in idea, however the historic observe file suggests rising rates of interest are usually not the tip of the world for the inventory market.

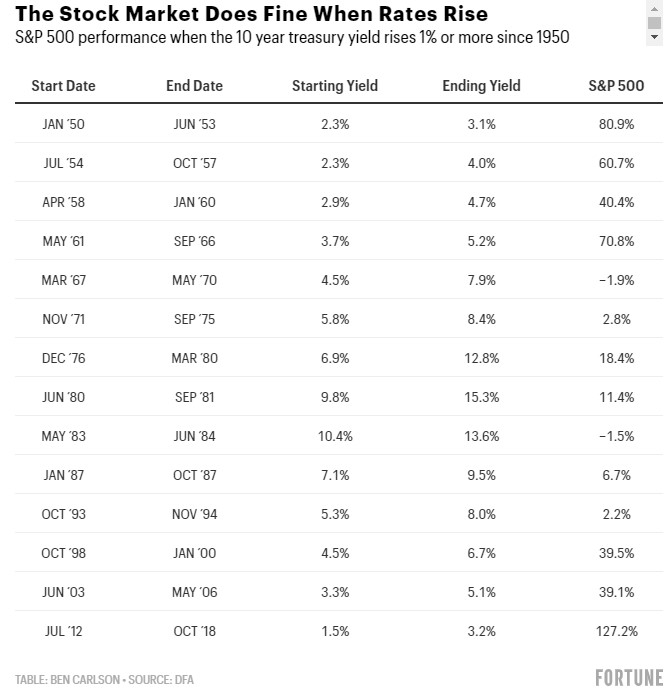

In actual fact, the S&P 500 has achieved simply positive throughout rising rate of interest cycles up to now. I’ve written concerning the inventory market vs. rising charges up to now:

From 1950 by means of the pre-pandemic period, the common annualized return when the ten yr yield jumped 1% or extra, was simply shy of 11%. That’s mainly the long-term common efficiency for the U.S. inventory market. It was solely down twice when this occurred and the losses had been minimal.

That’s rising charges however how does the precise stage of charges impression future inventory market returns? Certainly, investing when charges are greater ought to result in decrease returns, proper?

The connection between rates of interest and inventory market efficiency is murky at greatest.

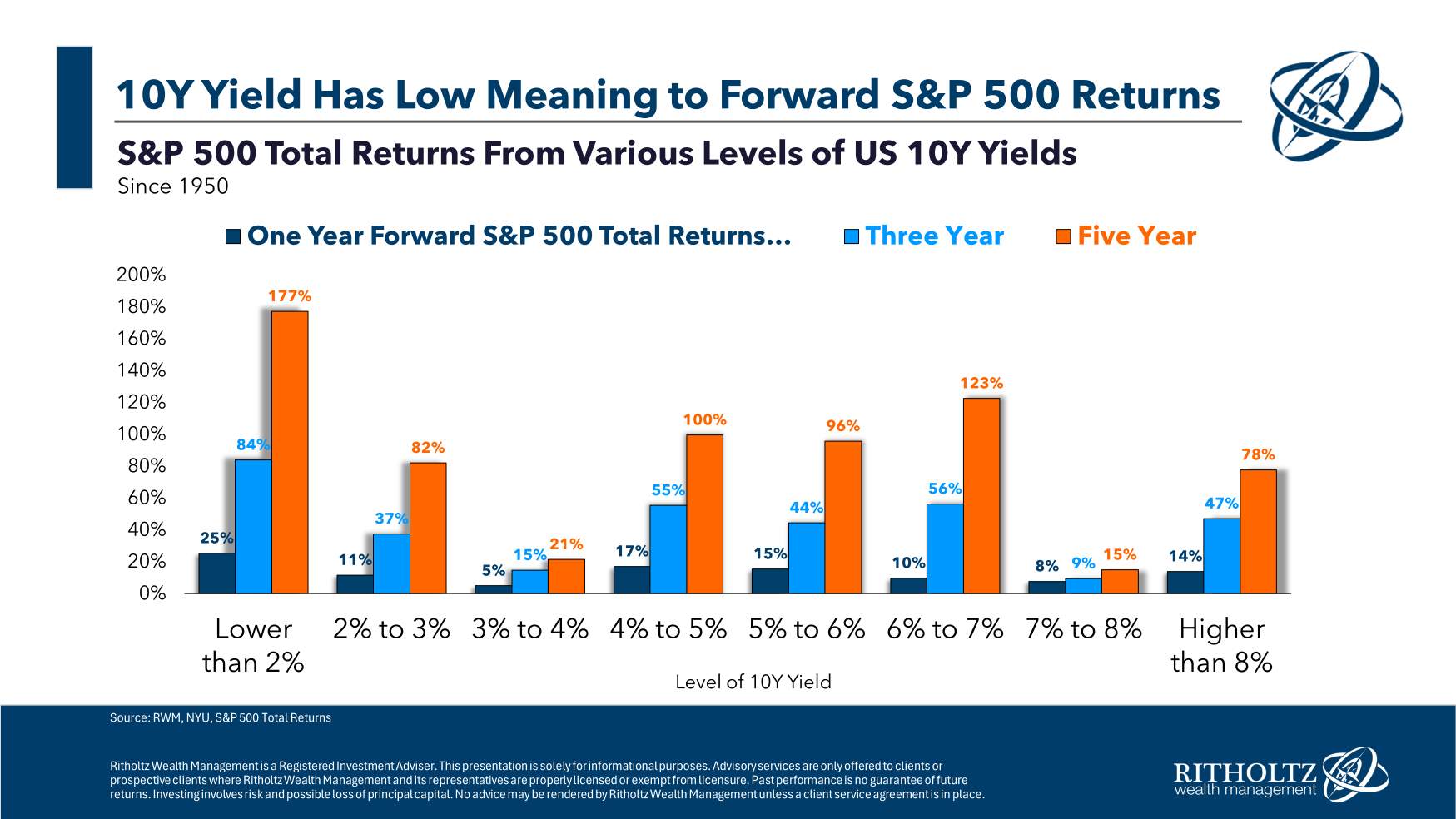

Going again to 1950, I broke down the ahead 1, 3, and 5 yr common returns from varied rate of interest ranges:

It’s definitely not a one-to-one correlation the place greater charges result in decrease returns. The bottom returns have come within the 3-4% and 7-8% ranges. One of the best returns have come when charges are 2% or much less, which is smart when you think about charges had been solely that low throughout two of the most important crises this century (the GFC and Covid).1

Have a look at the 4% to six% vary, which is the place we are actually. The returns have been fairly good. Possibly one of many causes for it is because the common 10 yr yield since 1950 is 5.4% (the median is 4.7%). Charges like this happen throughout regular instances (if such a factor exists).

There’s actually no rhyme or motive to the connection between rate of interest ranges and ahead inventory market returns.

You may slice and cube this information in 1,000,000 alternative ways (charges rising/falling, inflation rising/falling, progress rising/falling, and so forth.), however a very powerful query is that this: Why are charges greater within the first place?

Within the Nineteen Seventies, greater charges had been a headwind to shares as a result of inflation was uncontrolled and the economic system was experiencing stagflation.

The largest upside shock to the economic system on this cycle is charges are greater for longer as a result of financial progress is greater for longer. The Fed hasn’t needed to lower rates of interest but as a result of the economic system stays comparatively robust. Charges have been greater for some time now but financial progress accelerated on the finish of 2023.

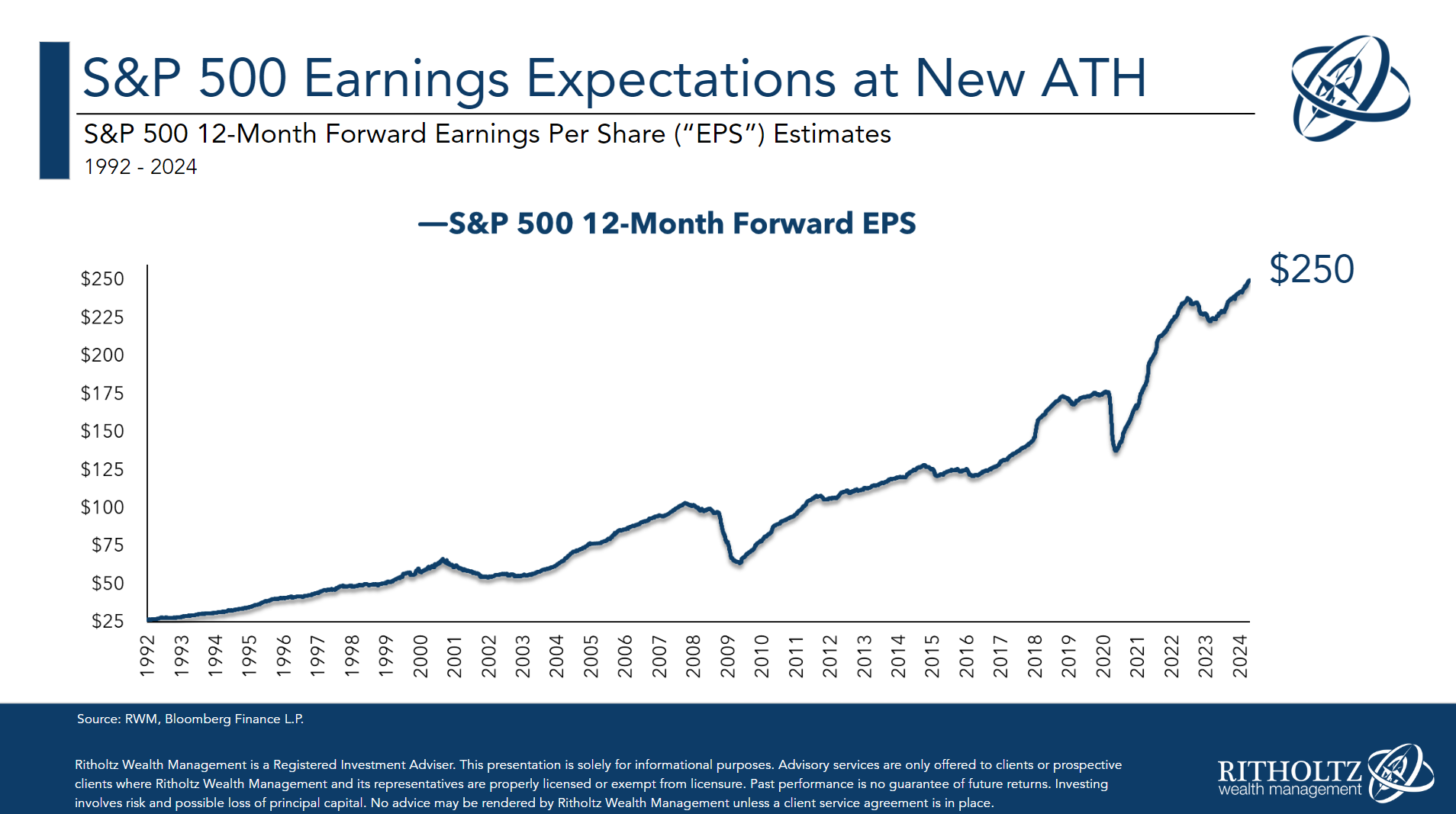

If you mix greater financial progress with inflation and pricing energy by firms, guess what you get?

Greater earnings!

The inventory market likes greater earnings.

Greater charges with greater financial progress are higher for the inventory market than decrease charges with decrease financial progress. If charges fall considerably from present ranges, that’s in all probability a nasty signal if it’s occurring due to an financial slowdown.

It doesn’t at all times work out like this and I don’t know the way lengthy the present state of affairs will final.

The purpose right here is you could’t merely study any variable in isolation. Financial and market information require context.

We spoke about this query on the most recent version of Ask the Compound:

Invoice Artzerounian joined me once more this week to deal with questions on automating your funds, the tax implications of an organization sale, methods to offset RWM taxes and the professionals and cons of a Roth 401k.

Additional Studying:

Inflation Issues Extra For the Inventory Market Than Curiosity Charges

1It’s additionally price declaring that rates of interest below 2% have been uncommon traditionally. Charges have been at these ranges lower than 7% of the time since 1950.