A reader just lately requested, “What mortgage charge can I get with my credit score rating?” So I figured I’d attempt to clear up a considerably complicated query.

With mortgage charges not at all-time lows (sigh), debtors trying to refinance a mortgage or buy a house are going through an uphill battle.

At the moment, it’s way more frequent in your charge to start out with a 6 or 7 versus a 2 or 3. Whereas these greater charges aren’t dangerous traditionally, the rate of change over the previous few years has been dramatic.

This contrasts these Eighties mortgage charges, which had been already excessive earlier than merely shifting even greater.

However regardless of the place mortgage charges are, your credit score rating will play an enormous function in figuring out whether or not you get , common, or not-so-good charge.

What you see marketed isn’t all the time what you get, and will in truth be so much greater for those who’ve acquired marginal credit score scores.

Conversely, you may have the ability to rating a below-market charge for those who’ve acquired a superb FICO rating.

Let’s discover why that’s so you may set the proper expectations and keep away from any disagreeable surprises if you lastly communicate to a lender.

Mortgage Charges Are Based mostly on Your Credit score Rating

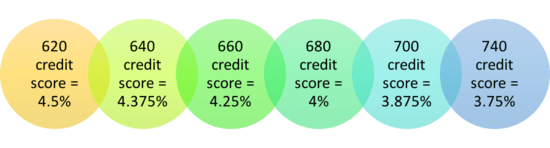

- The illustration above ought to offer you an concept of the significance of credit score scores

- In relation to mortgages even a small distinction in charge can equate to hundreds of {dollars}

- Somebody may have a charge 0.75% greater (or extra) primarily based on credit score rating alone

- So be certain all 3 of your credit score scores are as excessive as potential earlier than you apply!

The graphic above was primarily based on actual marketed charges from Zillow’s market for a $400,000 mortgage quantity at 80% loan-to-value (LTV) for a 30-year mounted on an owner-occupied, single-family residence.

Whereas rates of interest are fairly a bit greater in the present day, the identical sliding scale rule applies.

These with greater credit score scores will get the bottom mortgage charges obtainable, whereas these with decrease credit score scores should accept greater charges.

Discover that the rate of interest is a full 0.75% greater for a borrower with a 620 FICO rating versus a borrower with a 740+ FICO rating. That may equate to some huge cash over time. And mortgages can final a very long time, generally 30 years!

One factor that determines what mortgage charge you’ll in the end obtain is credit score scoring, although it’s simply one in every of many components, generally known as mortgage pricing changes, used to find out the worth of your mortgage.

Together with credit score scoring is documentation kind, property kind, occupancy kind, mortgage quantity, loan-to-value, and a number of other others.

Every pricing adjustment is basically utilized primarily based on threat. So a borrower with a high-risk mortgage should pay the next mortgage charge than a borrower who presents low threat to the lender.

That is how risk-based pricing works.

Debtors with Decrease Credit score Scores Current Extra Danger to the Lender (And Should Pay Extra!)

Merely put, the much less threat you current to your mortgage lender, the decrease your mortgage charge can be. And vice versa.

That’s as a result of they’ll fetch the next value in your lower-risk residence mortgage after they promote it on the secondary market.

Lenders take into account quite a few issues to measure threat, as talked about above.

Utilizing credit score rating alone, it’s unattainable to inform a potential borrower what they might qualify for with out understanding all the opposite vital items of the puzzle.

However I’ll say that your credit score rating is unquestionably some of the vital (if not crucial) issue that goes into figuring out your mortgage rate of interest.

And as I all the time say, it’s one of many few issues you may principally management. Pay your payments on time, hold your excellent balances low, and apply for brand new credit score sparingly.

For those who comply with these easy ideas, your credit score scores ought to strong. It’s not rocket science.

How A lot Does Credit score Rating Have an effect on the Mortgage Curiosity Charge?

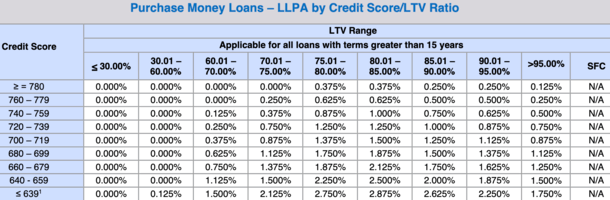

- There are pricing changes particularly for credit score scores

- They will increase your mortgage charge considerably in case you have poor credit score

- The changes develop bigger as credit score scores transfer decrease

- And are particularly impactful for those who additionally are available with a small down cost

Usually talking, a credit score rating of 780 or above ought to land you within the lowest-risk bracket (it was 740 and earlier than that 720). So it has gotten tougher.

If all different areas of your distinctive borrowing profile are additionally in good standing, you’ll qualify for a mortgage on the lowest potential rate of interest.

After all, you’ll have to comparability store to seek out that low charge too. It received’t essentially come in search of you. However you need to at the least be eligible for the very best a financial institution or lender has to supply.

This decrease month-to-month mortgage cost will let you save on curiosity over the whole mortgage time period.

As talked about, credit score rating will be massively vital in figuring out pricing as a result of lenders cost large changes in case your rating is low.

Simply check out the chart above from Fannie Mae. In case your credit score rating is 780 or greater, you’ll solely be charged 0.375% (this isn’t a charge adjustment however quite a pricing hit) at 80% LTV (20% down cost).

Conversely, in case your credit score rating is between 640 and 659, you’ll be charged 2.25% in pricing changes.

For the borrower with a 650 credit score rating, this may equate to an rate of interest that’s 0.75% greater on a 30-year mounted mortgage versus the 780-score borrower.

That distinction in charge may persist with you for years for those who maintain onto your mortgage.

This implies greater funds month after month for many years, all since you didn’t observe good credit score scoring habits.

Not solely can credit score rating prevent cash month-to-month and over time, it is going to additionally make qualifying for a mortgage so much simpler.

For these causes, your credit score rating ought to be your prime concern when making use of for a mortgage!

What Credit score Rating Do You Want for Greatest Mortgage Charge?

- Most mortgage charge advertisements you’ll come throughout make a lot of assumptions (for those who learn the nice print)

- You’re typically required to have a credit score rating of 740 or greater for the very best charge

- In case your credit score scores aren’t that good, anticipate the next charge when acquiring a quote

- Fannie Mae and Freddie Mac now require a 780 FICO rating for the bottom mortgage charges

For those who’ve ever seen a mortgage commercial on TV or the Web, the lender assumes you’ve acquired a superb credit score rating.

This might imply a credit score rating of 720, 740, or presumably even greater. And so they use that assumption to supply a good mortgage charge of their advert.

For instance, Wells Fargo’s mortgage charge web page has a disclaimer that reads, “This charge assumes a credit score rating of 740.”

However with out that nice credit score rating, your mortgage charge might be considerably greater when all is alleged and achieved.

And now that Fannie Mae and Freddie Mac have added new credit score scoring tiers, these credit score rating assumptions might rise to 780 for the bottom marketed charges.

Lengthy story brief, goal for 780+ credit score scores any longer if you wish to qualify for the very best charges.

Debtors With Low Credit score Scores Might Have Bother Getting Accredited

On the different finish of the spectrum, debtors with credit score scores of say 660, 640, and 620 could have larger difficultly securing a mortgage.

Assuming they can get authorised for a house mortgage, they may obtain greater mortgage charges.

Sadly, I can’t say you’ll get X or Y mortgage charge in case you have Z credit score rating, there are simply too many components in play suddenly. And credit score rating is only one of them, albeit a vital one.

However I can say that your credit score rating is massively influential in figuring out each the mortgage charge you’ll obtain and whether or not you’ll efficiently acquire residence mortgage financing to start with.

So it’s really helpful that you just examine your credit score rating(s) 3+ months earlier than making use of for a mortgage to see the place you stand. And proceed to watch them up till you apply.

This shouldn’t be a lot of a chore and even an expense now that so many corporations present free credit score scores, together with main banks and bank card issuers.

For instance, the various banks and bank card corporations I do enterprise with supply free scores. And it’s really fascinating to see the divergence in scores throughout totally different corporations.

[How to get a mortgage with a low credit score.]

Test Your Credit score 90+ Days Earlier than Purchasing for a Mortgage!

- Don’t likelihood it – examine your credit score scores 3+ months upfront

- This lets you see the place you stand credit-wise and offers you time to sort things

- It could take months to show issues round if it is advisable enhance your scores

- Issues like disputes might take 90 days or longer to finish and replicate in your scores

- Purpose for a 780 FICO rating to qualify for the very best mortgage charges

For those who don’t know your credit score scores a number of months upfront of making use of for a mortgage, you could not have sufficient time to make any vital modifications.

Belief me, surprises come up on a regular basis relating to credit score.

An misguided (or forgotten) late cost may deflate your credit score scores considerably, even when it’s reporting in error.

And that decrease rating may enhance your mortgage charge a proportion level or extra. Sure, credit score scores could make that a lot influence!

Disputing errors and/or addressing different credit score missteps can take many months to finish, so don’t hesitate to examine your credit score for those who assume you’ll be making use of for a mortgage at any level within the close to future.

It’s good to know the place you stand always, however particularly earlier than making use of for a house mortgage. Don’t simply assume you’ve acquired glorious credit score. Confirm it!

And when you’re at, don’t make a number of purchases earlier than making use of for a mortgage. That can also sink your scores.

The excellent news is poor credit score scores will be improved. You’re aren’t caught with them. In case your credit score scores want some TLC, take the time to enhance them as an alternative of settling for the next charge in the present day.

In case your scores are already glorious, don’t overlook to buy round! Merely evaluating a number of totally different lenders will be simply as vital as sustaining good credit score.

Learn extra: What credit score rating do I have to get a mortgage?