Mortgage Q&A: “Why are refinance charges greater?”

When you’ve been evaluating mortgage charges currently in an effort to avoid wasting cash on your house mortgage, you’ll have seen that refinance charges are greater than buy mortgage charges.

This appears to be the case for lots of massive banks on the market, together with Chase, Citi, and Wells Fargo, which whereas monumental establishments, aren’t essentially the leaders within the mortgage biz anymore.

In reality, as we speak United Wholesale Mortgage within the #1 spot, adopted by Rocket Mortgage, then a mixture of these huge banks and nonbanks, together with CrossCountry Mortgage, Fairway Impartial Mortgage, and others.

So why is that among the huge guys listing “buy charges” and “refinance charges” individually, with completely different pricing, factors, and APRs?

Effectively, for starters a house buy will not be the identical as a mortgage refinance, regardless of each processes being very related, and the underlying loans themselves not a lot completely different.

Finally, a house buy mortgage is for somebody who has but to purchase a property, whereas a mortgage refinance is for an present house owner who needs to redo their house mortgage.

We all know they’re completely different aims, but when the underlying loans are each 30-year fastened mortgages with the identical mortgage quantities, the identical borrower credit score scores, and the identical property varieties, why ought to charges be any completely different? Let’s discover out.

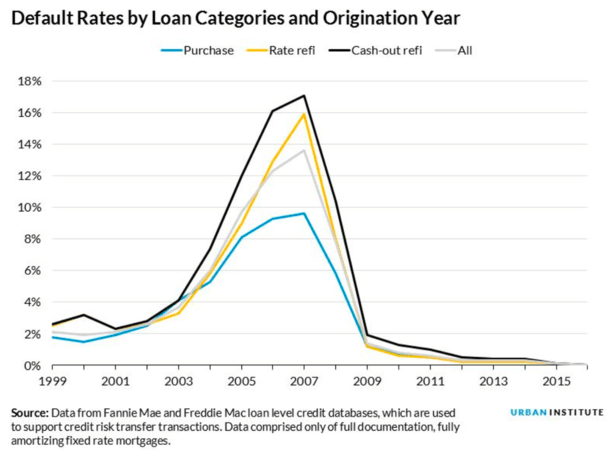

Dwelling Buy Mortgages Default the Least

There are three principal sorts of mortgages, together with house buy loans, fee and time period refinances, and money out refinances.

The primary is self-explanatory and was already defined above, the second is solely redoing your present mortgage by acquiring a brand new rate of interest and mortgage time period, with out altering the mortgage quantity.

The third kind ends in a bigger mortgage quantity at closing since you’re pulling fairness from your house, which a layman ought to assume can be the riskiest transaction.

In spite of everything, if a borrower owes extra debt consequently, and perhaps even has a better month-to-month mortgage cost, their hypothetical default threat ought to rise.

Merely put, once you pull money out of your house, you enhance your excellent mortgage stability, enhance your loan-to-value ratio (LTV), and cut back your obtainable house fairness.

That’s inherently riskier, and explains why there are particular mortgage pricing changes for such loans.

This in idea ought to lead to a better mortgage fee to compensate for elevated threat. And guess what – that’s certainly the case!

Money out refinance charges are the very best, all else being equal, for principally all banks and lenders. Not less than one thing is sensible round right here…

A Fee and Time period Refinance Sounds the Least Dangerous, Doesn’t It?

Now, a fee and time period refinance ought to end result within the least quantity of default threat as a result of the borrower is probably going lowering their month-to-month cost within the course of. That’s typically the cause to refinance within the first place.

This occurs by way of a decrease rate of interest and probably a decrease excellent stability (paid down since origination) unfold out over a brand-new mortgage time period.

That leaves us with house buy loans, which you’d suppose can be much less dangerous than a money out refinance, however not as dangerous as a fee and time period refinance, because it’s ostensibly a first-time house purchaser or somebody in a brand new property.

When you have been the financial institution, you’d most likely need to give a brand new, cheaper mortgage to the seasoned house owner who has been paying their mortgage for years versus the first-time purchaser or perhaps a move-up purchaser taking over extra debt.

However for one cause or one other, some banks and mortgage lenders provide the bottom mortgage charges on house buy transactions.

The Lowest Mortgage Charges Are Provided on Dwelling Buy Loans

The rationale boils right down to DATA. Although the precise mortgage traits (reminiscent of FICO rating, LTV, and DTI) would point out the bottom default charges on fee and time period refinances, it’s buy loans that carry out the very best.

One doable cause why is due to defective value determinations on refinances, which maybe overvalue properties.

Regardless, buy mortgages default the least, adopted by fee and time period refinances, and at last money out refinances, the final of which really is sensible.

Curiously, the mortgage traits additionally point out that money out refis and buy mortgages ought to default at about the identical fee, but they’re priced the furthest aside.

And once more, that’s as a result of in actual life, not anticipated default charges, buy loans default the least and money out refis default probably the most.

Lowest: Dwelling buy charges

Barely Larger: Fee and time period refinance charges

Highest: Money out refinance charges

So once you evaluate mortgage lenders, you usually may discover that buy charges are the most affordable, adopted by fee and time period refi charges, and at last money out mortgage charges.

There’s no query money out refinances price probably the most – that is the norm amongst all banks and lenders to my data.

However not all banks/lenders provide completely different charges for purchases and fee and time period refis. Typically they’re simply priced precisely the identical.

How A lot Extra Costly Are Refinance Charges?

- Massive banks are likely to promote greater refinance charges vs. buy charges

- Some lenders don’t differentiate between buy charges and fee and time period refi charges

- Or just cost barely greater closing prices on refinance transactions

- Charges could also be .25% to .375% greater on refis however take note of factors charged and mortgage assumptions

I appeared round and located that Chase, Citi, and Wells Fargo provide decrease house buy charges, whereas Quicken Loans affords the identical actual charges for purchases and fee and time period refis.

Quicken even says this of their wonderful print: “Primarily based on the acquisition/refinance of a major residence with no money out at closing.”

In different phrases, a purchase order and fee and time period refi are priced the identical.

Clearly this issues when procuring round for a mortgage, so take discover of who’s charging extra/much less for sure transaction varieties and select accordingly primarily based on what you’re searching for.

The identical is likely to be true of an FHA mortgage vs. standard mortgage. Relying on what you want, one lender could provide a significantly better value.

One final thing – take note of the assumptions lenders make once they listing their charges. It is also that you simply’re not evaluating apples to apples, if there are completely different mortgage quantities, LTVs, credit score scores, mortgage factors, and so forth.

However know refinance charges are greater as a result of they default greater than buy loans, and that requires a better value to compensate for heightened threat, plain and easy.