Finance individuals spend a whole lot of time worrying.

In regards to the subsequent recession. The following bear market. The following Black Swan occasion. The extent of rates of interest and inflation and valuations and the Fed and mainly every thing else.

This is sensible. The unhealthy stuff hurts greater than the great things feels good so danger administration guidelines the day.

I’m a finance man so I fear about loads of these items too. However there are specific dangers individuals fear about an excessive amount of.

Listed below are two issues a whole lot of different persons are apprehensive about however not me:

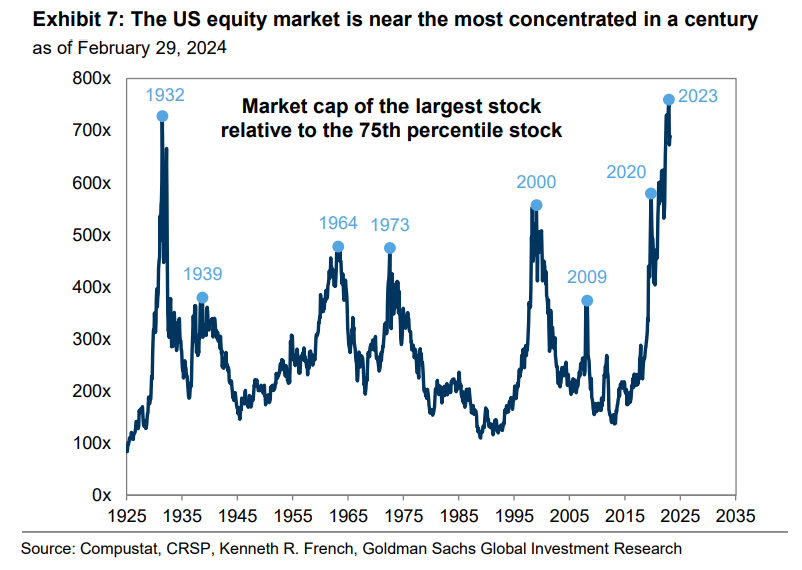

Inventory market focus. Right here’s a chart from Goldman Sachs that reveals by one measure, the U.S. inventory market is as concentrated because it has ever been:

To which my reply is: So what?

Sure, the highest 10 shares make up greater than one-third of the S&P 500. All this tells me is that the largest and finest corporations are doing rather well. Is {that a} unhealthy factor?1

Inventory markets across the globe are way more concentrated than the U.S. inventory market. Rising markets rose to their highest degree since June 2022 yesterday. Out of an index that covers 20+ nations, a single inventory (Taiwan Semiconductor) accounted for 70% of the transfer.

Inventory market returns over the long term have at all times been dominated however a small minority of the largest, best-performing corporations.

Pay attention, massive cap development shares will underperform ultimately. No technique works at all times and perpetually.

In the event you’re actually that apprehensive about focus within the inventory market, then purchase small caps, mid caps, worth shares, dividend shares, prime quality shares, international shares or another technique.

However inventory market focus just isn’t a brand new factor and it’s not going away anytime quickly.

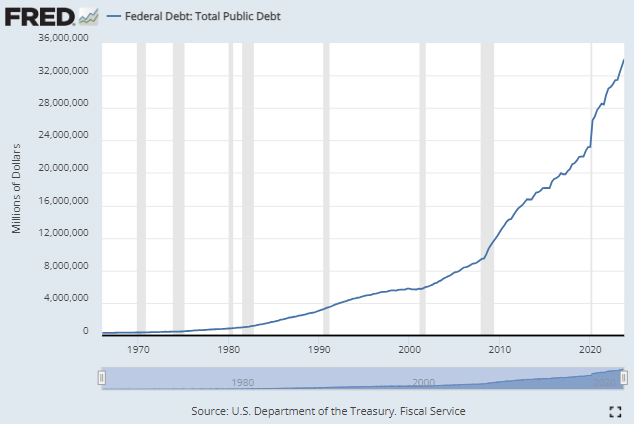

Authorities debt. Bloomberg is out with a brand new report that sounds the alarm on U.S. authorities debt ranges:

With uncertainty about so most of the variables, Bloomberg Economics has run 1,000,000 simulations to evaluate the fragility of the debt outlook. In 88% of the simulations, the outcomes present the debt-to-GDP ratio is on an unsustainable path — outlined as a rise over the subsequent decade.

In the long run, it might take a disaster — maybe a disorderly rout within the Treasuries market triggered by sovereign US credit-rating downgrades, or a panic over the depletion of the Medicare or Social Safety belief funds — to pressure motion. That’s taking part in with fireplace.

I’ll imagine it after I see it.

Folks have been sounding the alarm on authorities debt on this nation for many years. There was no panic. No monetary disaster. No debt default.

We clearly added a ton of debt in the course of the pandemic:

I’m not ignoring this reality. One thing needs to be executed ultimately.

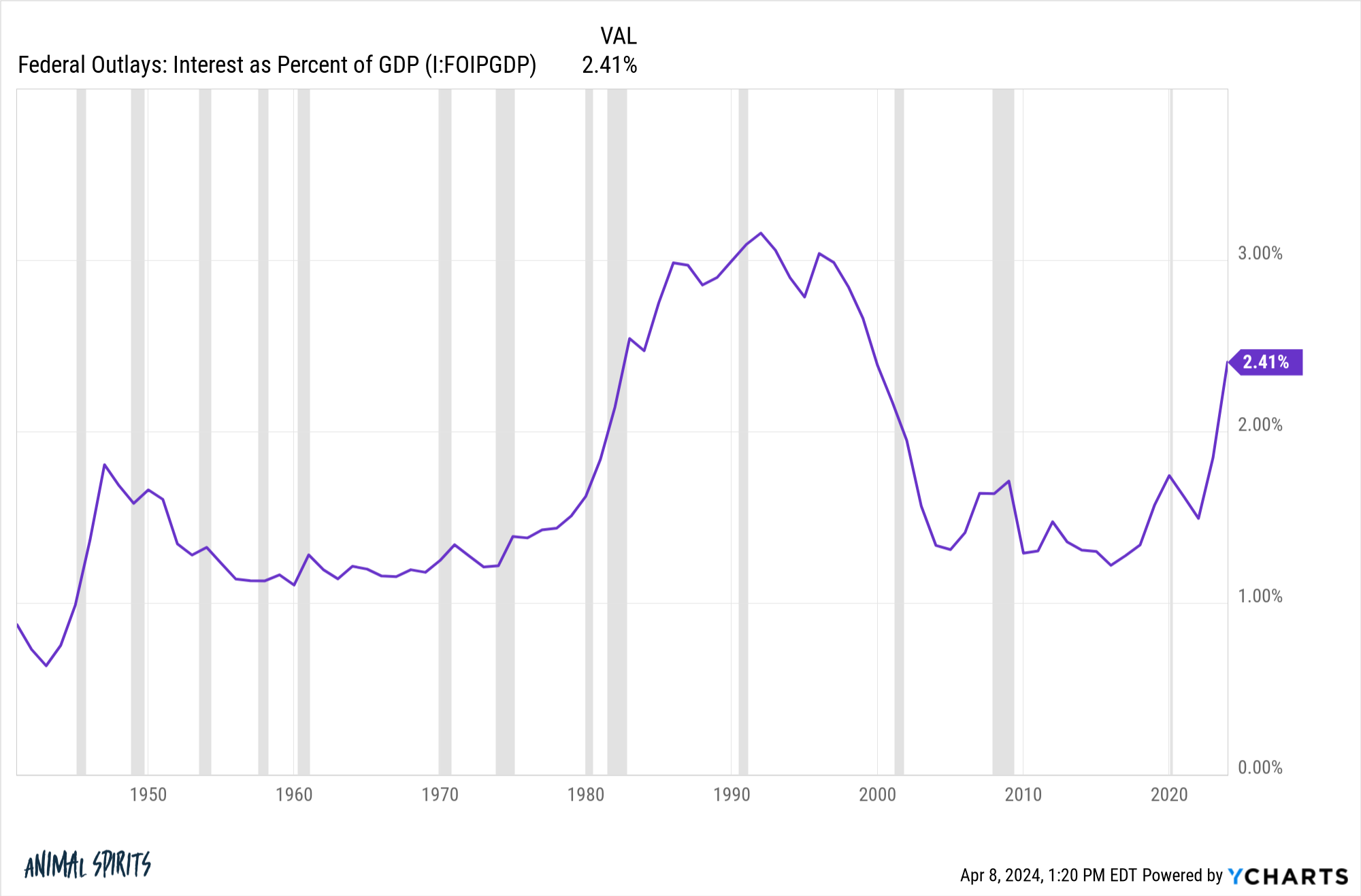

Probably the most legitimate concern is what occurs if the curiosity expense on our debt obligations crowds out spending in different areas. Curiosity expense relative to the scale of the financial system has shot increased in recent times from the mixture of extra debt and better charges:

However we’re nonetheless effectively beneath the highs from the Nineteen Eighties and Nineties. And whenever you take a look at absolutely the numbers right here, going from 1.5% of GDP to three% of GDP isn’t precisely the top of the world.

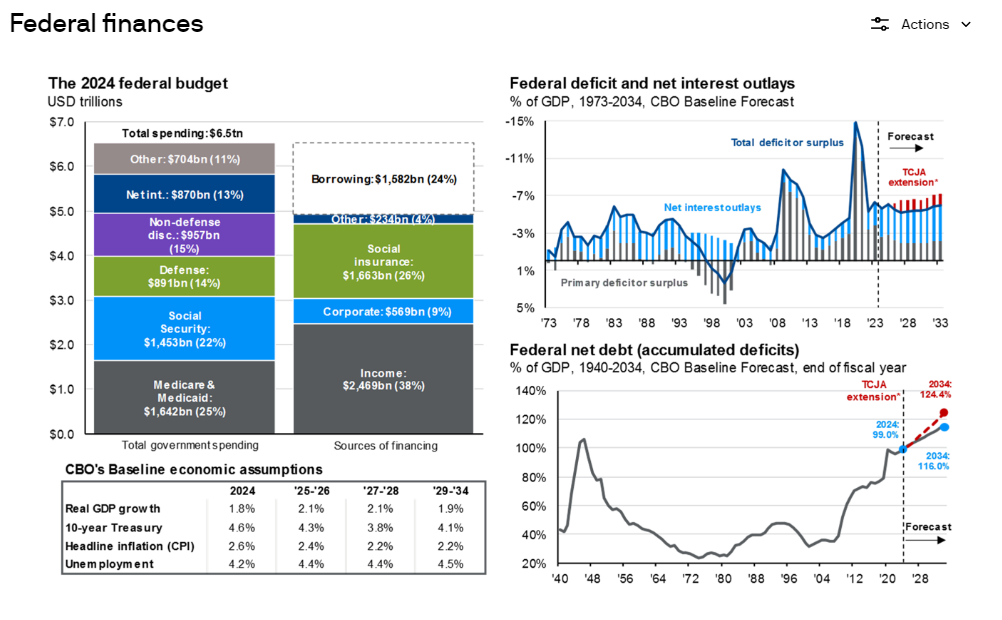

The factor is that if the financial system continues to develop so too will authorities debt.2 That’s merely a operate of the pie getting larger.

One of many smartest issues we do as a rustic is print debt in our personal foreign money. We will’t default on authorities debt until a loopy politician does one thing silly.

And whereas authorities debt does appear unsustainably excessive, we’ve various built-in benefits on this nation.

We have now the world’s reserve foreign money. We have now the largest, most liquid monetary markets within the globe (and there isn’t a detailed second place). We have now the biggest, most revolutionary firms on the planet. We have now the largest, most dynamic financial system on this planet.

Debt-to-GDP is now as excessive because it was in World Battle II:

That appears scary till you understand in Japan, debt-to-GDP is nearer to 300%. I’m not saying we must always check our limits however there isn’t any pre-set line within the sand on these items.

You additionally must keep in mind that whereas debt is a legal responsibility to the federal government, it’s an asset for another person — retirees, pension plans, insurance coverage funds, international consumers. Is there the next high quality mounted earnings possibility on the market than Treasuries?

If there’s a disaster, the Fed and Treasury can get inventive as effectively. It’s not like they’d simply sit round and let our funding supply blow-up.

Churchill as soon as quipped, “Individuals will at all times do the correct factor, solely after they’ve tried every thing else.”

That’s my feeling on authorities debt as effectively.

You may name me naive for not worrying extra about these subjects however everybody else is already doing it for me.

Invoice Miller as soon as wrote:

When I’m requested what I fear about out there, the reply often is “nothing”, as a result of everybody else out there appears to spend an inordinate period of time worrying, and so the entire related worries appear to be lined. My worries gained’t have any impression besides to detract from one thing far more helpful, which is making an attempt to make good long-term funding choices.

I’m not a type of nothing issues guys. Generally, there are respectable dangers to the monetary markets. The issue is that more often than not, you’ll be able to’t or gained’t see the true dangers coming.

I favor to fret in regards to the stuff I can management.

Let the market and different traders fear in regards to the different stuff for you.

Additional Studying:

Can Anybody Problem the Financial Dominance of america?

1Some individuals assume anti-trust regulation is a danger with the behemoth tech shares if the federal government breaks them up. They haven’t proven any need to take action however that’s a chance. However even when they did break them up it’s potential that may unlock worth. Are you able to think about if AWS, YouTube or Instagram had been standalone corporations?

2And client debt.