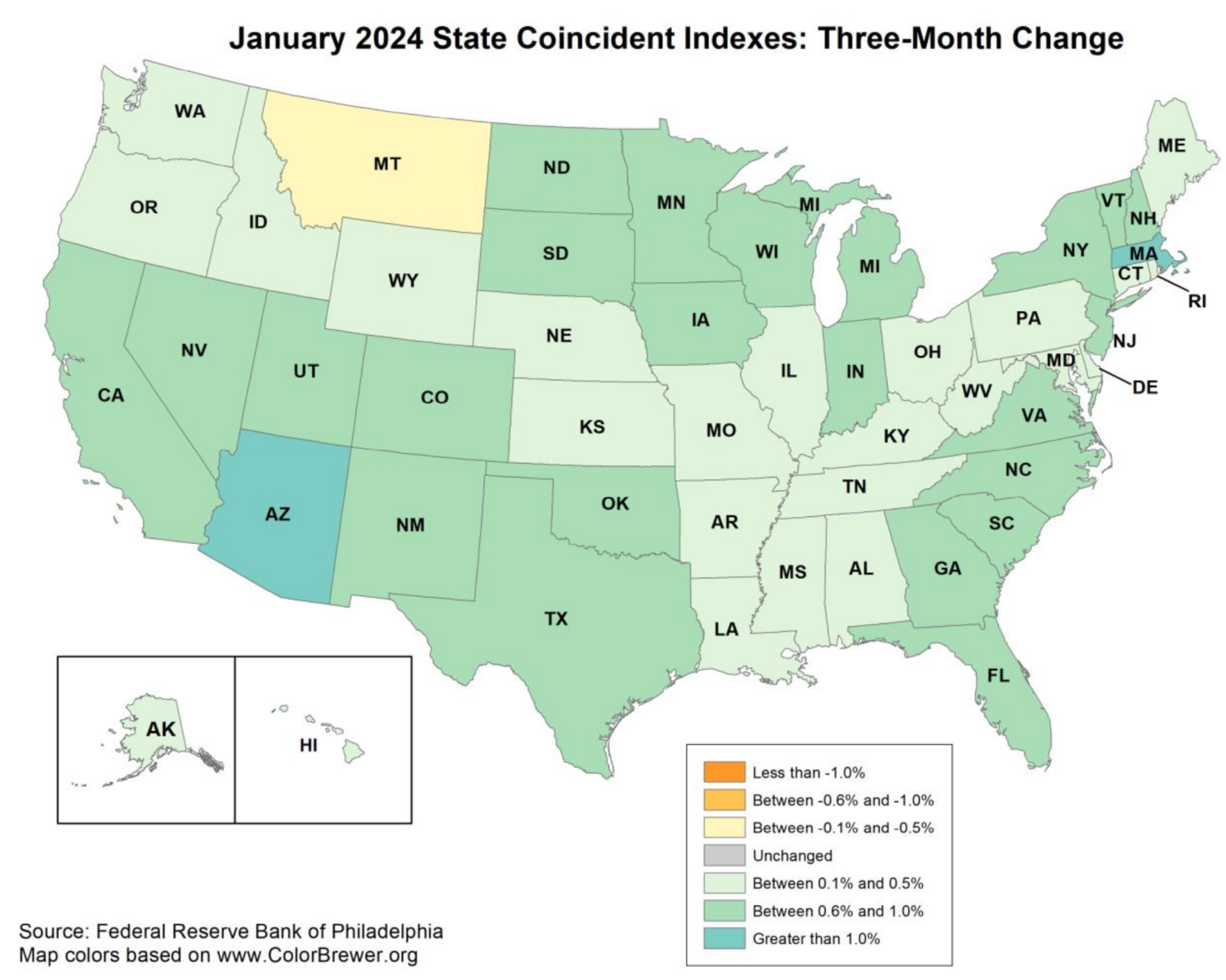

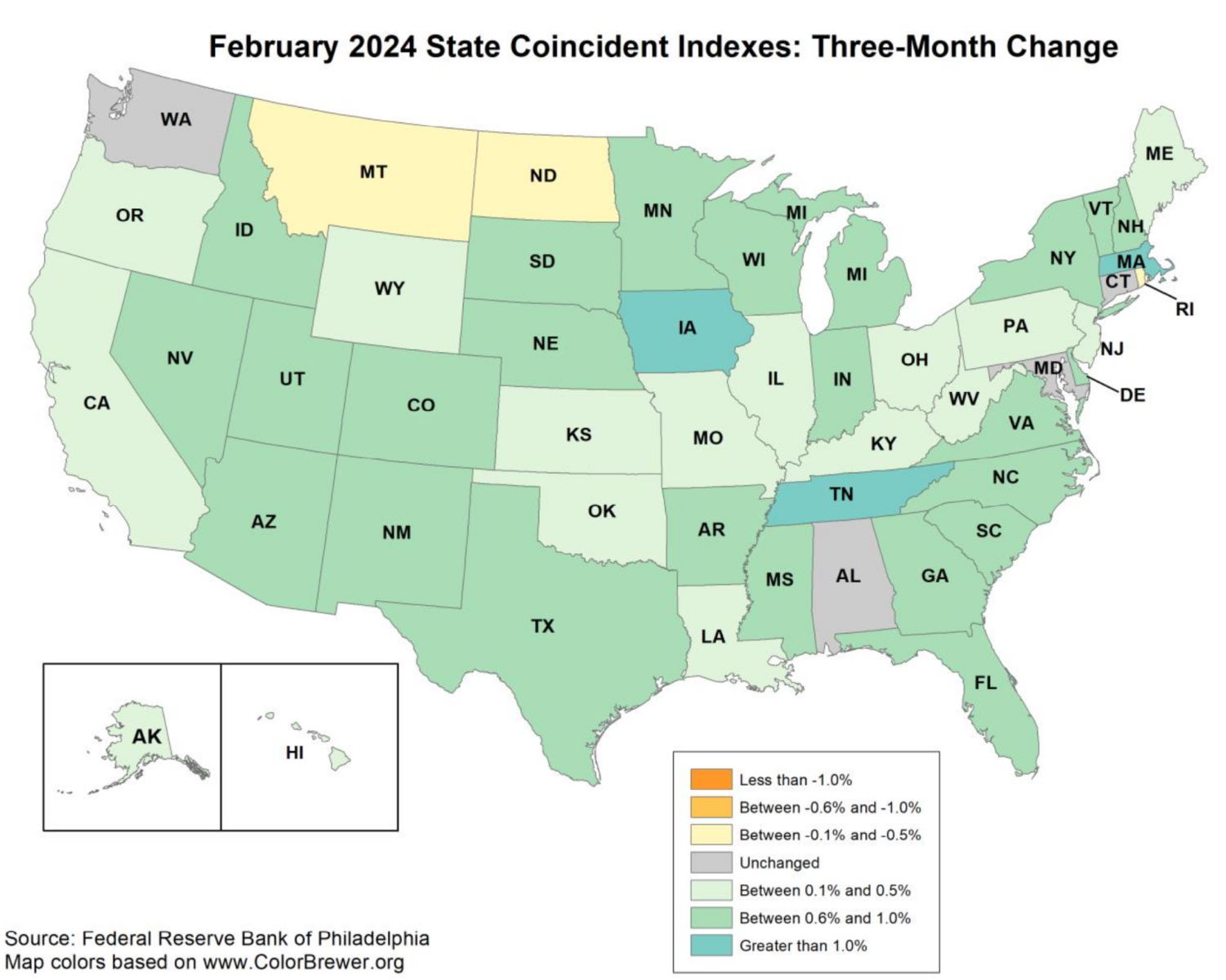

Between e-book go away and COVID I’ve been fairly quiet currently. Because it’s been a couple of months, I assumed we may take a fast have a look at the Federal Reserve Financial institution of Philadelphia’s State Coincident Indicators out for each January and February 2024.1

Because the charts above present, the financial system on a state-by-state foundation has markedly improved from This autumn 2023’s softening. I might go so far as to recommend it’s strong.

In January, the 3-month common of “the indexes elevated in 49 states and decreased in a single state, for a three-month diffusion index of 96.” In February, the 3-month common “elevated in 43 states, decreased in three states, and remained secure in 4, for a three-month.” The 12-month change is +2.9%

Observe in November 2023, the indexes solely elevated in 25 states.

The expectations of a recession proceed to be belied by robust progress within the majority of states, powered by hiring, wage features, and client spending,..

Sources:

State Coincident Indexes: Launch

The Federal Reserve Financial institution of Philadelphia, January/February 2024

Beforehand:

State Coincident Indicators Slipping (January 2, 2024)

State Coincident Indicators: November 2022 (January 4, 2023)

Indicators of Softening (July 29, 2022)

Why Recessions Matter to Buyers (July 11, 2022)

__________

1. The State Coincident Indicators are composed of 4 state-level variables: 1) Nonfarm payroll employment; 2) Common hours labored in manufacturing by manufacturing employees; 3) Unemployment fee; and 4) Wage and wage disbursements deflated by the buyer worth index.