I received a brand new bank card this week.

What can I say?

I’m a sucker for a very good sign-up bonus and the free luggage on American flights will mainly pay for the annual payment.

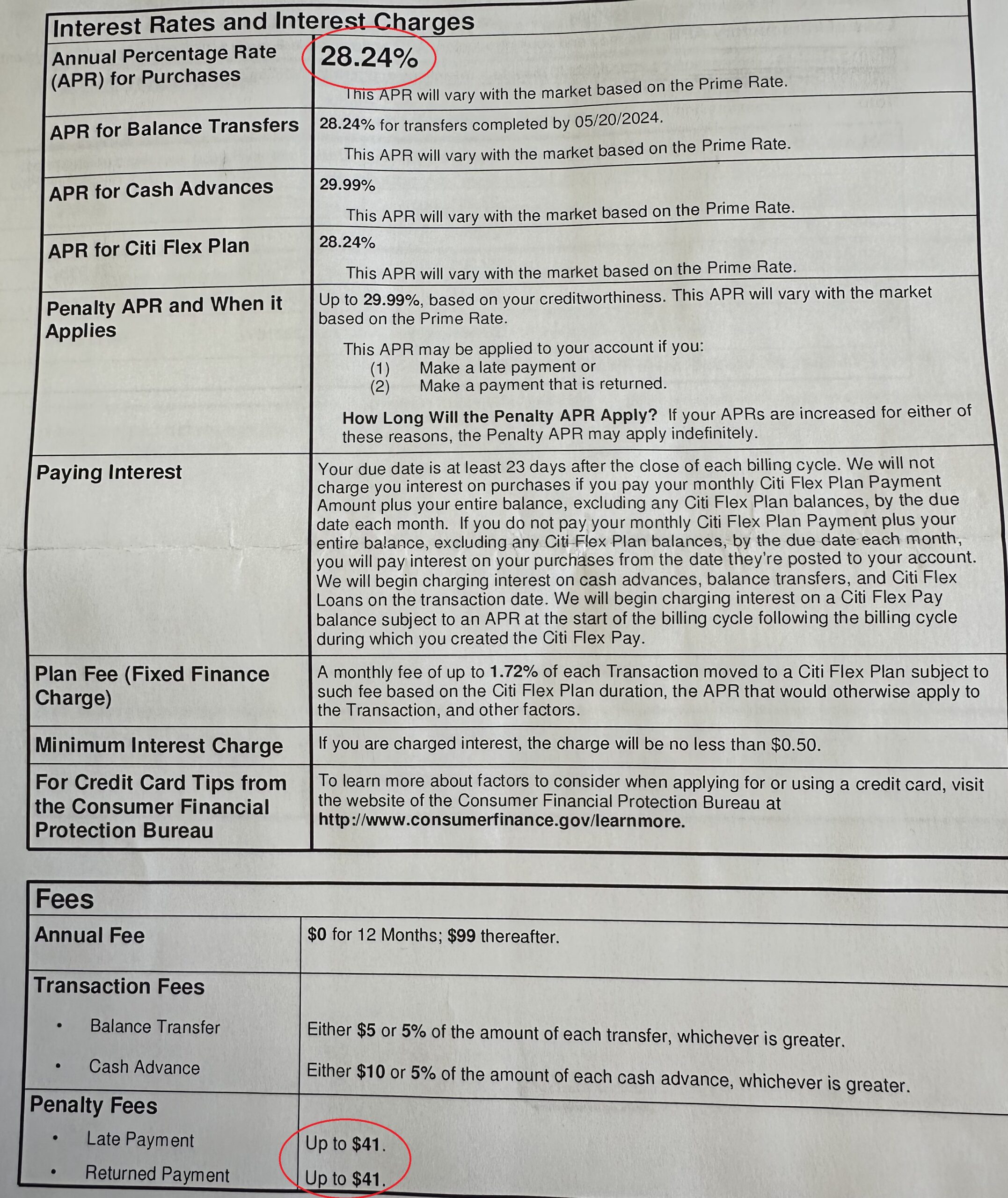

A brand new card at all times comes with plenty of paperwork. They’ve all kinds of numbers to run by you, together with loads of high-quality print.

As a private finance junkie, I at all times prefer to thumb by way of these items. This one caught my eye:

28%?!

Jeez.

I get it–unsecured debt and all. Charges are increased, however that’s a ridiculously excessive borrowing price.

With charges that top it appears like bank card debt must be an enormous downside on this nation. Is it?

It’s not nice however the scenario isn’t horrible both.

Let’s dig into the numbers.

The Federal Reserve has all kinds of information on bank cards.

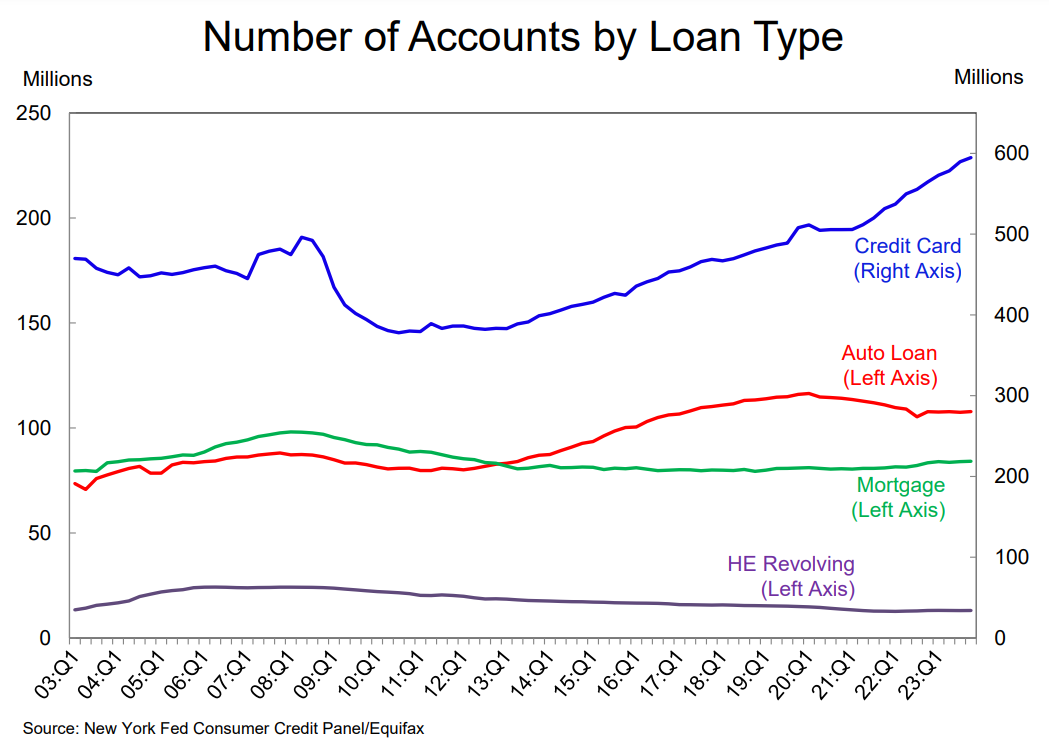

There’s actually extra bank card utilization of late:

Whereas different varieties of debt are comparatively steady, the variety of bank card accounts continues to develop.

This might be as a result of extra individuals are going into bank card debt or folks like me who open extra accounts to earn rewards and offers.

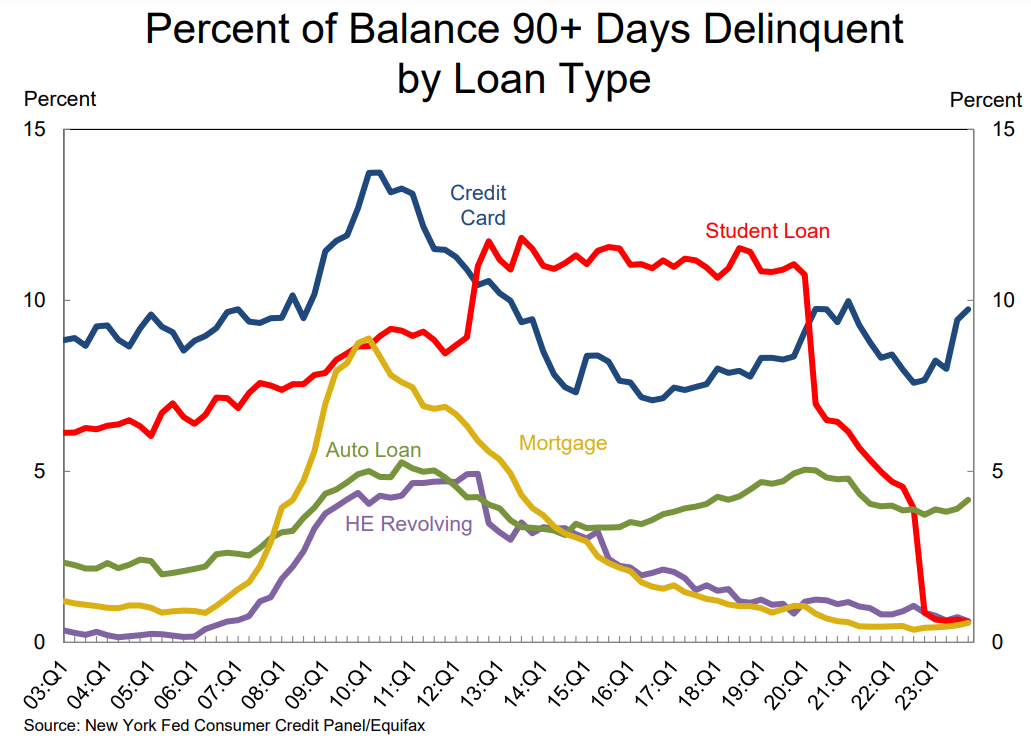

Bank card delinquencies are on the rise however not in panic territory by any means:

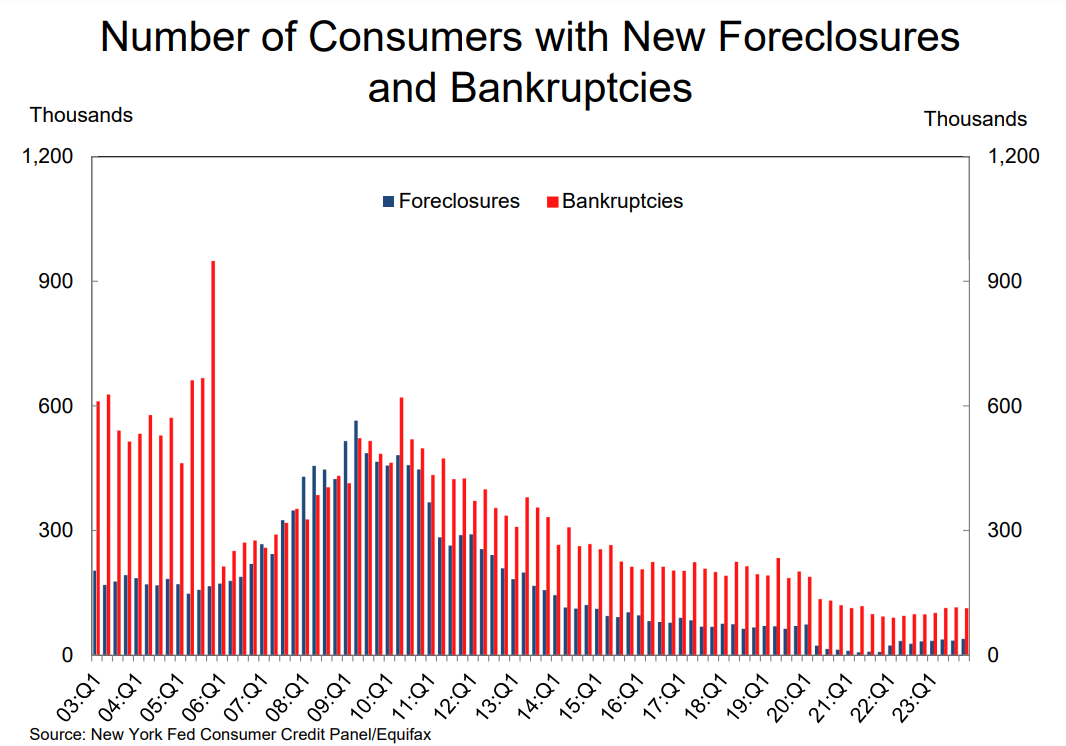

Bank card debt isn’t placing folks within the poor home both judging from the low degree of bankruptcies:

The variety of bankruptcies is way decrease than it has been this century.

There are, nevertheless, nonetheless loads of folks in bank card debt.

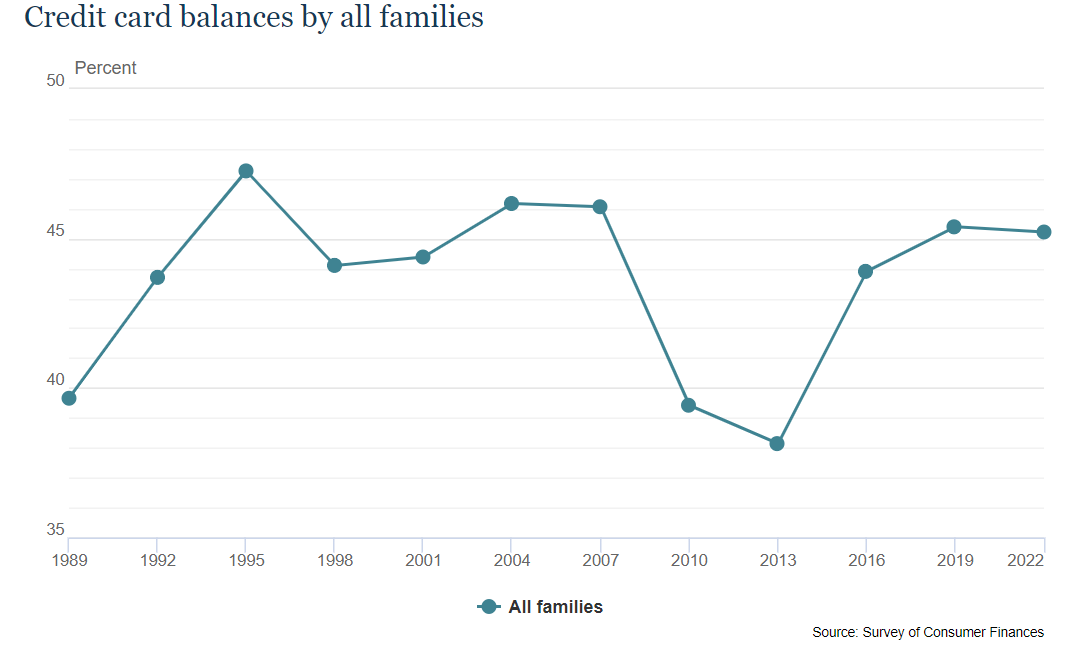

In line with the Fed, 45% of American households have bank card debt. That quantity has been comparatively steady over time:

The median steadiness is round $2,700 (the typical is $6,100). Once more, not the tip of the world however that may actually add up when you think about how egregious the borrowing charges are.

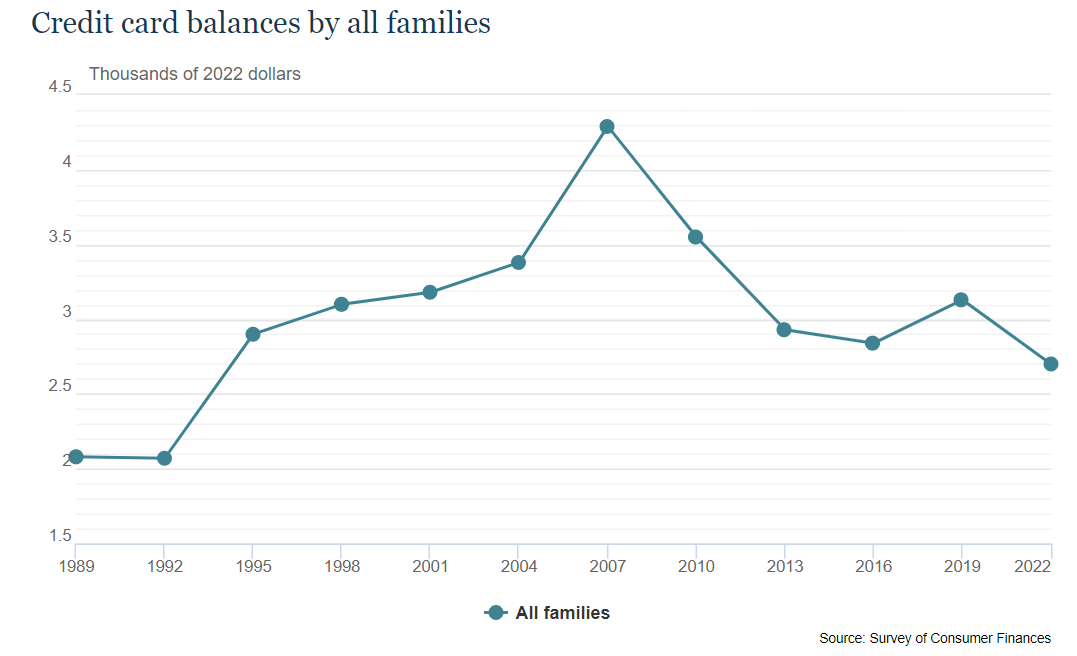

Surprisingly, the median family steadiness has really been falling for a while now:

The median family bank card steadiness was a lot increased heading into the Nice Monetary Disaster than it’s now. Modify that quantity for inflation, and issues look even higher proper now.

We reside in a bifurcated world in terms of bank card debt.

The 45% of people that carry a steadiness are paying a number of the highest borrowing prices possible. It’s the most important type of anti-compounding in all of finance.

The opposite 55% of households use bank cards merely for his or her comfort and rewards and repay their steadiness every month. The rewards they earn are primarily being backed by the 45% of people that pay curiosity.1

I repay my steadiness each month and use the bank card firms for rewards and sign-up bonuses. It’s a fairly whole lot.

However I perceive how bank card debt can spiral uncontrolled for sure households. It’s handy. Swiping or tapping that card doesn’t really feel like actual cash. Typically you haven’t any different alternative nevertheless it must be your final resort.

In the event you’re paying 20% on a $6,000 steadiness that’s $100 a month in curiosity expenses. That may not look like a lot nevertheless it provides up. Even if you happen to make a $30 minimal fee, your steadiness after 12 months is sort of $6,900.

Holding a bank card steadiness from month to month is without doubt one of the worst monetary choices you may make.

The primary rule of non-public finance is you repay your bank card steadiness each month.

The second rule is don’t overlook rule primary.

Michael and I talked about bank cards and way more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Why I’m Not Fearful About $1 Trillion in Credit score Card Debt

Now right here’s what I’ve been studying these days:

Books:

1Plus, the service provider swipe charges.

This content material, which incorporates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here might be relevant for any specific information or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or supply to supply funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from numerous entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.