Company leaders oversee relationship administration on many fronts, together with worker engagement and buyer satisfaction, and company gift-giving is an efficient technique to deal with it. In any case, 57% of workers and 52% of customers usually tend to be loyal to corporations that present items.

Nevertheless, corporations should give items pretty and responsibly for them to have the specified impact—and that’s the place company gift-giving legal guidelines are available. On this information, we’ll cowl every part you want to learn about these insurance policies on presents, together with:

Let’s start by taking a better take a look at gift-giving fundamentals!

Company Present-Giving Legal guidelines FAQS

What are company gift-giving legal guidelines?

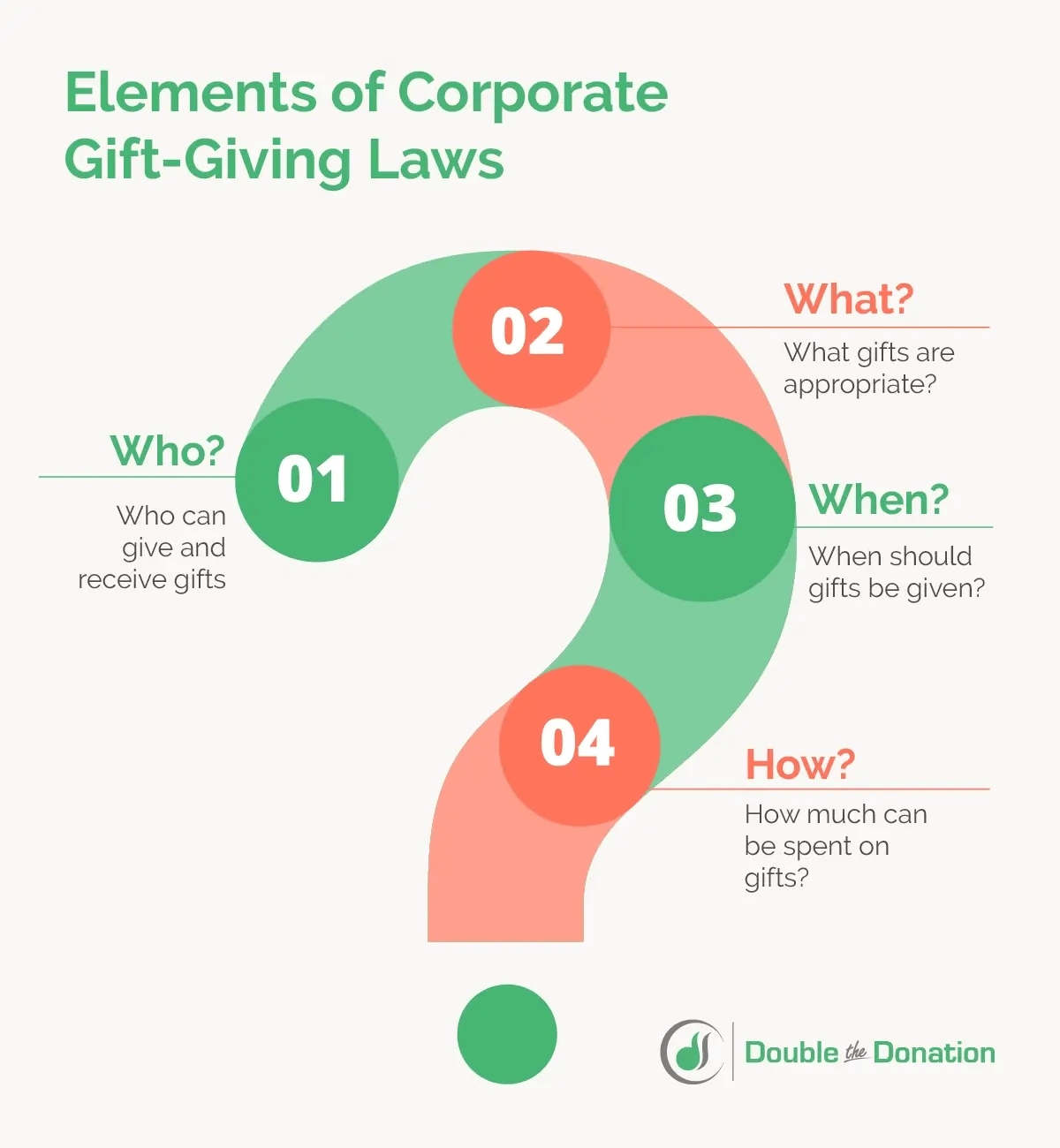

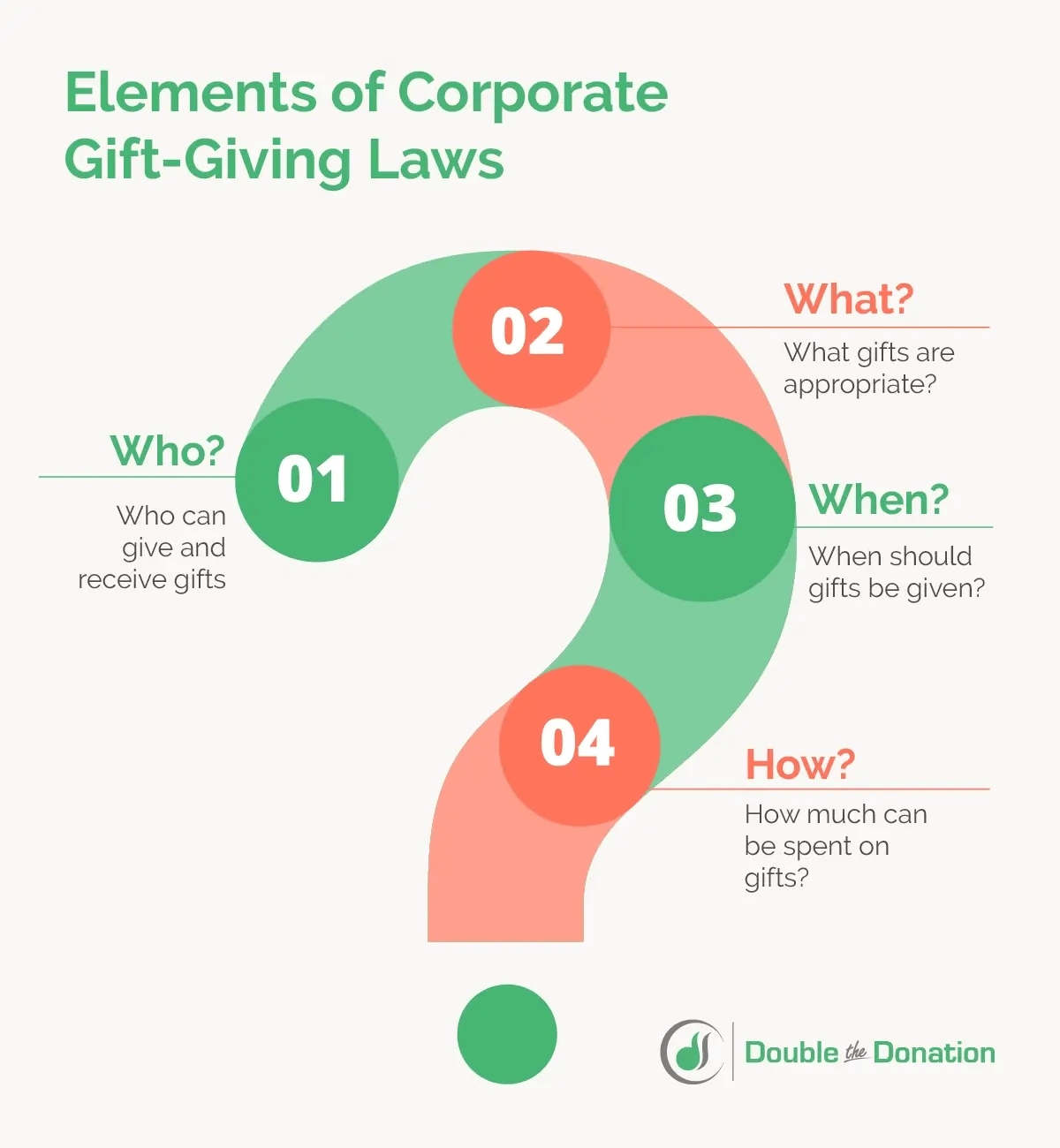

Company gift-giving legal guidelines are insurance policies created by an organization to standardize inner and exterior gift-giving, serving to forestall bribery, favoritism, and different conflicts of curiosity. These insurance policies usually define the circumstances through which the corporate’s workers can provide or obtain items, together with:

- Who can provide and obtain items? Company gift-giving legal guidelines define reward exchanges between friends, superiors, and shoppers.

- What items are acceptable? Insurance policies regarding company gift-giving might outline the forms of items that may be given or acquired, similar to particular tangible gadgets or financial items.

- When ought to items be given? Company gift-giving legal guidelines ought to specify how typically items might be given to watch the quantity of items which can be despatched or acquired.

- How a lot might be spent on items? A well-planned coverage outlines the funds for gift-giving, figuring out how a lot might be spent on a present.

With a coverage that lays out these particulars, your organization will likely be geared up to begin exchanging items with shoppers, workers, enterprise companions, and different contacts to strengthen relationships along with your skilled community. Let’s break this down additional by inspecting the necessities of gift-giving and receiving.

What’s an worker reward coverage?

Giving workers items can have a major impression in your firm’s efforts to acknowledge, have interaction, and retain workers. Generosity may improve productiveness, with 81% of workers stating they’re extra more likely to work more durable when an employer appreciates their efforts.

This implies your organization ought to craft an worker reward coverage that outlines the way you’ll present appreciation by items and beneath what circumstances. This coverage will depend upon the next parts:

Tax implications of worker items

The IRS states companies can deduct $25 of the reward worth per recipient per tax yr. For instance, let’s say management offers every worker a $35 snack field. $25 of that value could be tax-deductible for every reward.

To deduct these bills, your organization should have data that embrace the main points of the quantity spent and show the enterprise goal of the reward. This additionally applies to items given not directly to an worker, similar to to a partner or member of the family.

Nevertheless, some forms of items, similar to items that may be thought of leisure, will not be tax deductible. For instance, when you had been to reward shoppers bottles of wine and take them to an orchestra efficiency, the wine bottles could be tax deductible however the orchestra tickets wouldn’t.

Worker reward reporting

For the sake of accountability and to maintain your books so as, decide how your organization will report the items it offers. This will likely be an necessary a part of your coverage, which not solely lays out the gift-giving course of but additionally the way you’ll report and monitor items.

You should definitely hold thorough data together with:

- The worth of the reward

- When the reward was given

- Who the recipient was

- The explanation for the reward

Decide who will likely be answerable for recording worker items and the place these data ought to stay.

What are company reward acceptance insurance policies?

Other than giving items, your organization may additionally obtain items from shoppers, prospects, or different firms. To account for this, create a present acceptance coverage that determines which items are given and beneath what circumstances they’re acceptable on behalf of your organization.

Tips on how to Create Company Present-Giving Legal guidelines

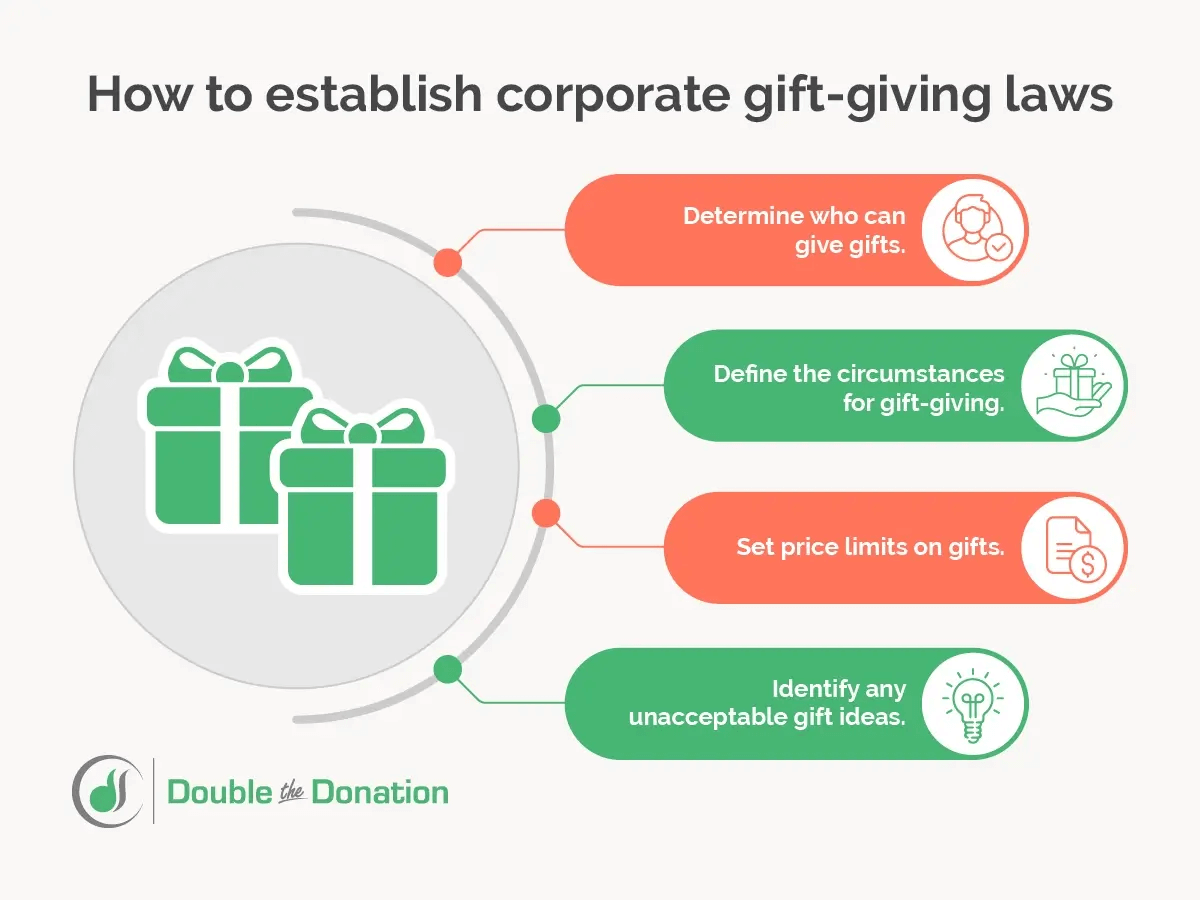

So how do you get began, and what must you embrace? Create company gift-giving legal guidelines on your firm utilizing the next steps:

- Decide who can provide items. Determine which members of your organization’s management have the authority to buy and provides items. For instance, ought to managers have the authority to provide worker items, or ought to they advocate sure workers for rewards and depart the gift-giving to management?

- Outline the circumstances for gift-giving. Write out the aim of gift-giving and beneath which circumstances items are acceptable. For instance, if your organization seeks to provide items as a part of its worker recognition technique, you may create a gift-giving timeline primarily based on particular work-related accomplishments or anniversaries.

- Set worth limits on items. Define particular worth limits in your reward coverage. Take into account setting worth ranges for numerous reward sorts and events. For instance, a piece anniversary may warrant a $50 plaque whereas a retirement reward may very well be dearer. Keep in mind your items might range primarily based on availability or the aim of the reward.

- Determine any unacceptable reward concepts. Present flexibility for the forms of items that may be given, however acknowledge that some items ought to by no means be given. For instance, gifting a pair of denims with no relevance or branding to your corporation may very well be inappropriate and unprofessional. Make an inventory of particular reward gadgets that shouldn’t be given beneath any circumstances.

Make provisions for this coverage to be adjusted sooner or later, if needed. It’s tough to incorporate every part, and chances are you’ll encounter a novel state of affairs sooner or later that calls so that you can revisit your coverage. To visualise the way you may put these key parts collectively in a single, complete coverage, let’s go over a template!

Company Present-Giving Coverage Template

In the event you need assistance getting began, fill on this template along with your firm’s distinctive info:

[Company’s name] acknowledges gifting as a customary observe and a significant approach to present appreciation. To keep away from perceptions of bribery, favoritism, and different conflicts of curiosity, this coverage will define the rules and acceptable norms for giving and receiving items.

-

- Definitions

“Present” refers to money, items, or companies of economic worth which can be given to a person for private profit with none anticipated return of cost. - Scope

This coverage applies to [list roles that should follow this policy]. At [Company’s name], the next people are licensed to provide or obtain items on behalf of the corporate:

[List individuals allowed to give or receive gifts] - Unacceptable Presents

The next items are unacceptable to be given or acquired on behalf of [Company’s name]:

Presents of pricy digital gadgets, similar to cellphones, laptops, or TVs.

Private items of clothes or jewellery are inappropriate and strictly prohibited.

[List any other unacceptable gifts] - Worth Limits

[Company’s name] shall adhere to the next worth ranges when giving items:

Worker recognition items mustn’t exceed [Amount].

Work anniversary items for any worker mustn’t exceed [Amount].

Presents accepted from shoppers/prospects mustn’t exceed [Amount]. - Present Receipts

After giving or receiving a present, any worker at [Company’s name] ought to document the reward by [Process for recording gifts].

- Definitions

Take into account additionally creating a present refusal letter template that workers or management can use to appropriately characterize your organization within the occasion they have to decline a present.

Company Present Concepts

Developing with an inventory of acceptable items may also help you additional standardize the method of rewarding workers and stewarding prospects. Take into account the next reward concepts.

Matching items

Whereas matched donations aren’t tangible or deliverable by way of a present bag, they’re a good way to indicate workers that your organization cares about the identical causes they do. Incorporate a matching reward program into your organization’s present philanthropic efforts and add pointers to your worker handbook or portal so your crew is aware of the right way to take part.

To encourage workers to take part in your program, spend money on CSR software program with auto-submission capabilities. This can join your organization’s info and matching reward request kind to matching reward databases, permitting workers to mechanically submit a match request upon making a donation.

Consequently, your organization will see the next advantages:

- Elevated worker engagement: Staff will likely be extra engaged once they know your organization values them—and the causes they worth. Automating matching reward requests demonstrates your organization’s eagerness to provide and assist the causes your workers care about.

- Elevated program impression: Auto-submission streamlines the administration of your organization’s company giving applications. Plus, you’ll make it simpler for workers to provide and finally improve your firm’s social impression.

Add to the impression of your matching reward program by additional constructing out your CSR initiatives. For instance, you may launch a company volunteer program through which your crew can volunteer for nonprofits collectively or a volunteer grant to donate monetarily in response to their particular person volunteer hours.

eCards

Whether or not you’re celebrating an worker’s birthday, wishing a buyer a cheerful vacation season, or thanking a crew chief for his or her exhausting work, thank-you messages might be easy but significant items.

eCard software program lets you create customizable, digital greeting playing cards for any event, that means your organization can develop an arsenal of greeting playing cards for birthdays, work anniversaries, celebrating accomplishments, or another state of affairs warranting a present.

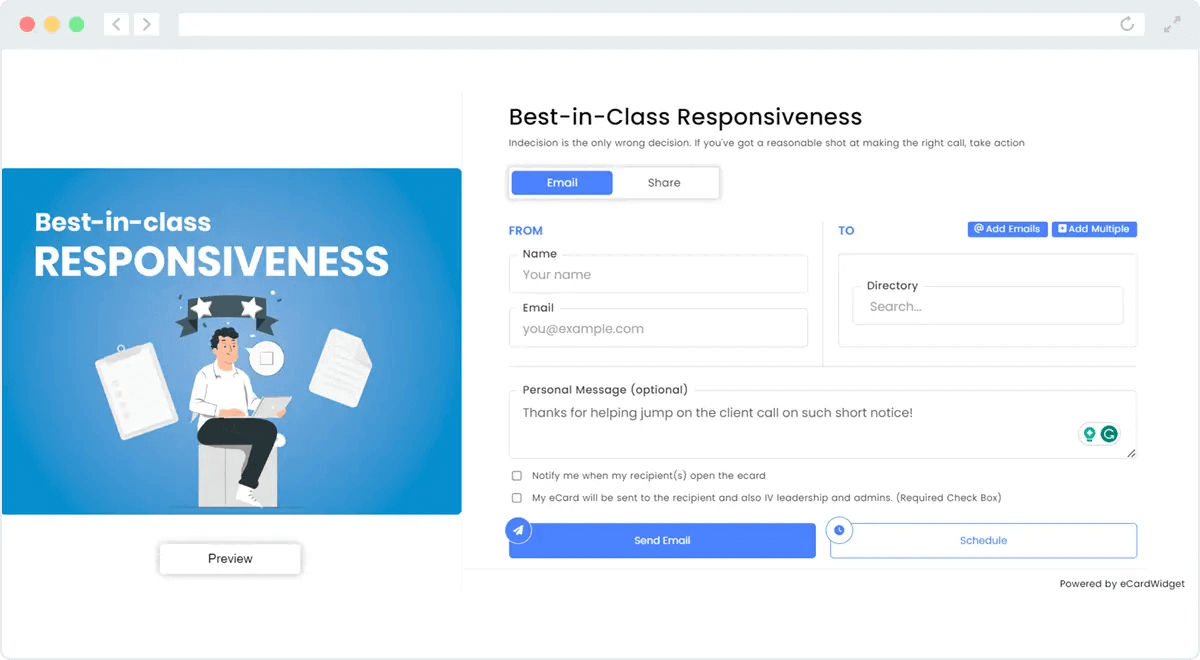

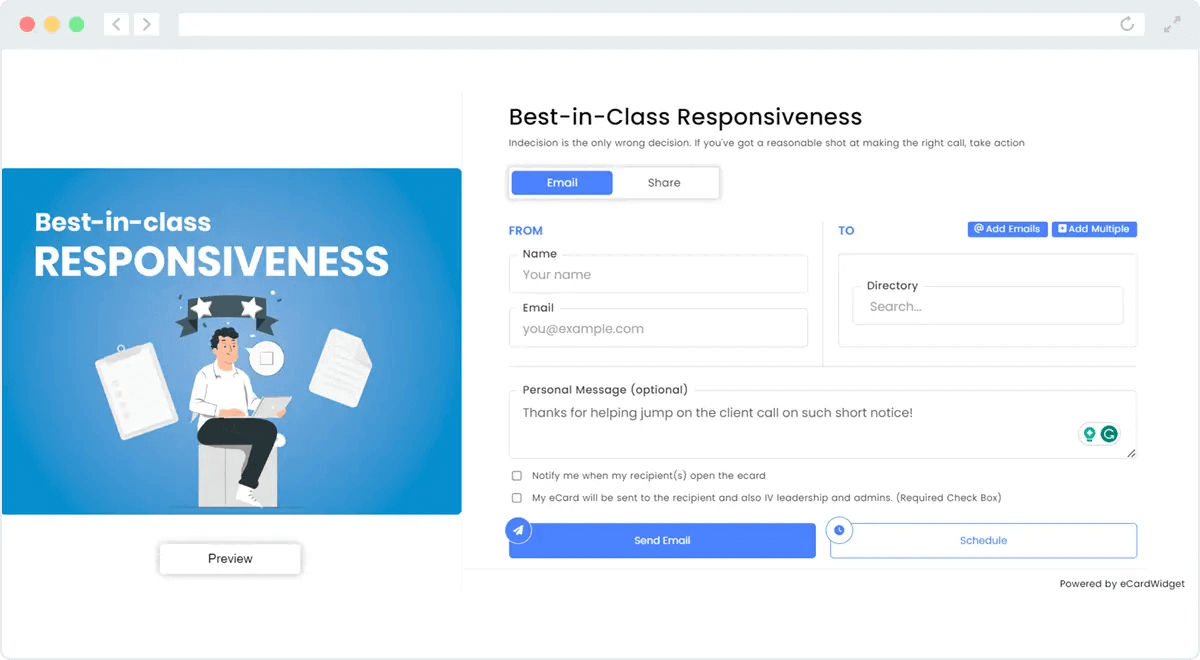

For instance, let’s say you need to acknowledge an worker for going above and past of their urgency and responsiveness. Right here’s how you can create an eCard to thank them:

- Design the eCard: Create a design for the eCard that calls out the aim of the message. On this instance, you can title the cardboard, “Greatest-in-class responsiveness” to thank an worker for immediate communication.

- Add a private message: Personalize the cardboard with a message so the recipient is aware of precisely what they did to obtain a card and why their actions mattered. For instance, you may write, “Thanks for serving to bounce on the shopper name on such brief discover!”

- Choose-in to notifications: eCard software program can notify you when the recipient opens their eCard, permitting you to trace how and when workers have interaction along with your appreciation messages.

With these options, you’ll be capable to ship distinctive eCards to workers and shoppers alike. Plus, by making the software out there to your crew, you’ll encourage your employees to ship eCards to one another and acknowledge their friends.

Tangible items

Whereas any tangible items you give will likely be distinctive to the event and the recipient, listed below are a number of concepts to kickstart your procuring:

- Present baskets

- Wellness packing containers

- Customized stationery

- Pattern merchandise from your corporation

Tangible items are difficult to navigate since they require a cautious stability between being personally significant {and professional}. You should definitely define any related necessities for selecting tangible items in your company gift-giving legal guidelines to offer clear pointers for selecting these items.

Tribute items

Other than matching workers’ donations, your corporation may give on their behalf to the causes they care about! For instance, if you understand that an worker volunteers at a neighborhood animal shelter, take into account donating to that shelter on their behalf as an appreciation reward.

Further Sources for Creating Company Present-Giving Legal guidelines

Company gift-giving legal guidelines are distinctive to the group that creates them, which is why your coverage ought to foremost tackle your group’s wants. For instance, smaller, close-knit groups may need extra flexibility whereas bigger corporations will want strict pointers to make sure gift-giving is honest.

Take into account the place your organization goals to be sooner or later and depart room in your insurance policies to adapt to those adjustments. For instance, do you propose to double your employees? Will you serve a brand new shopper base? As you take into account your organization’s development and the insurance policies that you just’ll want in place to account for it, look over the next assets for extra suggestions: