Nvidia and Amazon Net Companies, the profitable cloud arm of Amazon, have a stunning quantity in frequent. For starters, their core companies emerged from a contented accident. For AWS, it was realizing that it may promote the interior providers — storage, compute and reminiscence — that it had created for itself in-house. For Nvidia, it was the truth that the GPU, created for gaming functions, was additionally nicely suited to processing AI workloads.

That ultimately led to some explosively rising income in current quarters. Nvidia’s income has been rising at triple digits, transferring from $7.1 billion in Q1 2024 to $22.1 billion This fall 2024. That’s a fairly superb trajectory, though the overwhelming majority of that progress was within the firm’s knowledge heart enterprise.

Whereas Amazon by no means skilled that sort of intense progress spurt, it has constantly been an enormous income driver for the e-commerce large, and each firms have skilled first market benefit. Through the years, although, Microsoft and Google have joined the market creating the Massive Three cloud distributors, and it’s anticipated that different chip makers will ultimately start to realize significant market share, too, even because the income pie continues to develop over the subsequent a number of years.

Each firms have been clearly in the proper place on the proper time. As net apps and cell started rising round 2010, the cloud supplied the on-demand assets. Enterprises quickly started to see the worth of transferring workloads or constructing functions within the cloud, reasonably than working their very own knowledge facilities. Equally, as AI took off over the past decade, and huge language fashions extra not too long ago, it coincided with the explosion in using GPUs to course of these workloads.

Through the years, AWS has grown right into a tremendously worthwhile enterprise, presently on a run charge near $100 billion, one which even separate from Amazon can be a extremely profitable firm. However AWS progress has begun to decelerate, whilst Nvidia’s takes off. It’s partly the regulation of huge numbers, one thing that may ultimately have an effect on Nvidia, too.

The query is whether or not Nvidia can maintain that progress to turn into a long-term income powerhouse like AWS has turn into for Amazon. If the GPU market begins to tighten, Nvidia does produce other companies, however as this chart reveals, these are a lot smaller income mills which might be rising rather more slowly than the GPU knowledge heart enterprise presently is.

Picture Credit: Nvidia

The short-term monetary outlook

Because the above chart notes, Nvida’s income progress has been astronomical in current quarters. And based on each Nvidia and Wall Road analysts, it’s set to proceed.

In its current earnings report overlaying the fourth quarter of its fiscal 2024 (the three months ending January 31, 2024), Nvidia advised its traders that it anticipates $24 billion price of income in its present quarter (Q1 FY25). In comparison with its year-ago first quarter, Nvidia expects to publish progress of round 234%.

That’s merely not a quantity we frequently see from mature public firms. Nevertheless, given the corporate’s huge income ramp in current quarters, its progress charge is anticipated to say no. From a 22% income achieve from the third to fourth quarter of its not too long ago concluded fiscal yr, Nvidia anticipates a extra modest 8.6% progress charge from the ultimate quarter of its fiscal 2024 to the primary of its fiscal 2025. Definitely, on a year-over-year comparability and never a glance again at simply three months, Nvidia’s progress charge stays unimaginable for the present interval. However there are different progress declines on the horizon.

For instance, analysts count on Nvidia to generate $110.5 billion price of income in its present fiscal yr, up simply over 81% from its year-ago outcomes. That’s dramatically decrease than the 126% achieve it posted in its not too long ago concluded fiscal 2024.

To which we ask: So what? For no less than the subsequent a number of quarters, Nvidia is anticipated to proceed scaling its income previous the $100 billion annual run charge mark, spectacular for a corporation that in its year-ago interval at present noticed complete revenues of simply $7.19 billion.

Briefly, analysts, and to a extra modest diploma Nvidia, see large buckets of progress forward for the corporate, even when a few of the eye-popping income progress figures will sluggish this calendar yr. It’s unclear what occurs on a barely longer timeframe.

Momentum forward

It appears that evidently AI could possibly be the present that retains on giving for Nvidia for the subsequent a number of years, whilst extra competitors from AMD, Intel and different chipmakers begins to emerge. Very similar to AWS, Nvidia will face stiffer competitors ultimately, nevertheless it controls a lot of the market proper now, it could actually afford to cede some.

Taking a look at it purely on the chip stage, not at boards or different adjacencies, IDC reveals Nvidia firmly in management:

Picture Credit: IDC

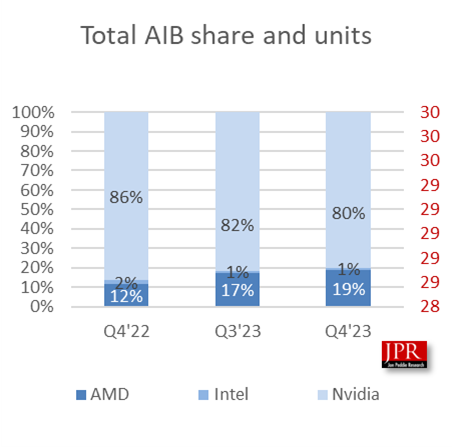

If you happen to have a look at the board stage with these market share numbers from Jon Peddie Analysis (JPR), a agency that tracks the GPU market, whereas Nvidia nonetheless dominates, AMD is approaching stronger:

Picture Credit: Jon Peddie Analysis

C Robert Dow, an analyst at JPR, says a few of these fluctuations need to do with when new merchandise are launched. “AMD positive factors share factors right here and there relying on cycles available in the market — when new playing cards are launched — and stock ranges, however Nvidia has been in a dominant place for years, and that may proceed,” Dow advised TechCrunch.

Shane Rau, an IDC analyst who follows the silicon market, additionally expects the dominance to proceed, whilst traits shift and alter. “There are traits and countertrends, the markets wherein Nvidia participates are massive and getting larger, and progress will proceed, no less than for an additional 5 years,” Rau stated.

A part of the rationale for that’s Nvidia is promoting extra than simply the chip itself. “They’ll promote you boards, methods, software program, providers and time on considered one of their very own supercomputers. So any of these markets are massive and rising and Nvidia is hooked up to all of them,” he stated.

However not everybody sees Nvidia as an unstoppable drive. David Linthicum, a longtime cloud marketing consultant and writer, says that you simply don’t at all times want GPUs, and firms are starting to understand that. “They are saying they want GPUs. I have a look at it, do a few of the again of the envelope math, they usually don’t want them. CPUs are completely advantageous,” he stated.

As this occurs, he thinks Nvidia will start to decelerate and competitors will loosen its stronghold in the marketplace. “I believe that we’re going to see Nvidia morph right into a weaker participant over the subsequent couple of years. And we’re going to see that as a result of there’s too many substitutes which might be being constructed on the market.”

Rau says different distributors may even profit as firms broaden AI use circumstances with Nvidia merchandise. “What I believe you’ll see going ahead is rising markets that’ll create tailwinds for Nvidia. However then there’ll be different firms that additionally comply with in these tailwinds that may profit from AI notably.”

It’s additionally potential that some disruptive drive will come into play and that might be a constructive end result to maintain one firm from turning into too dominant. “You virtually hope disruption will occur as a result of that’s the way in which markets and capitalism work greatest, proper? Somebody will get an early lead, different suppliers comply with, the market grows. You get established gamers, who’re ultimately disrupted by a greater method to do the identical factor inside their market or inside adjoining markets which might be crossing into theirs,” Rau stated.

In reality, we’re starting to see that occuring at Amazon as Microsoft positive factors floor by way of its relationship with OpenAI and Amazon is pressured to play catch-up on the subject of AI. No matter occurs to Nvidia in the long term, it’s firmly within the driver’s seat proper now, creating wealth hand over fist, dominating a rising market and having nearly the whole lot going its method. However that doesn’t imply it would at all times be this fashion or that there received’t be extra aggressive stress down the street.