With credit score development grinding to a close to halt and delinquency charges on the rise, it’s clear that Canadian debtors are feeling the pinch of excessive rates of interest and a slowing economic system.

But, CIBC Deputy Chief Economist Ben Tal sees some silver linings amidst these challenges, which he says counsel we’re heading for extra of a spending freeze somewhat than a big credit score danger occasion.

First, let’s have a look at among the regarding tendencies happening in Canada’s credit score market proper now.

On the forefront is the dramatic slowdown in credit score development to ranges not seen for the reason that double-dip recession of the Eighties.

This slowdown is especially pronounced within the mortgage sector, the place the sensitivity to price hikes has led to a dramatic lower in new lending exercise to what Tal says are recessionary ranges.

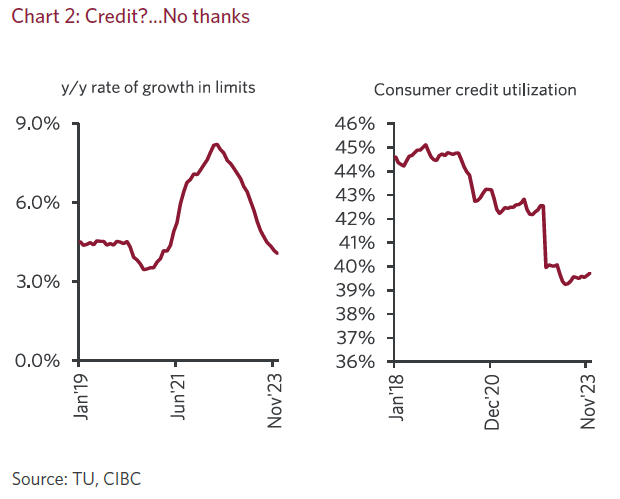

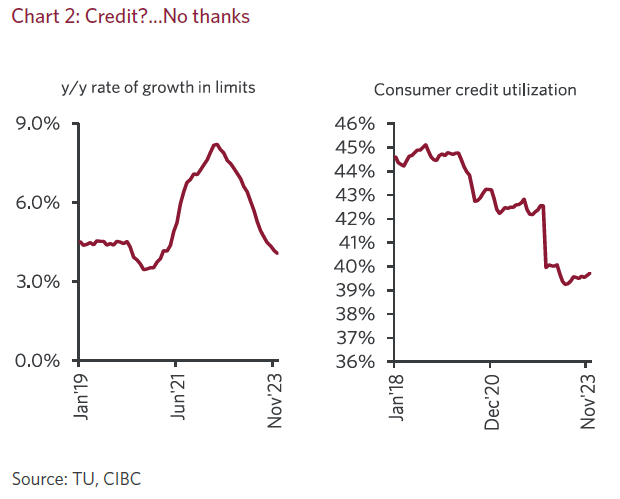

“The speedy and aggressive slowing within the tempo of credit score development displays each provide and demand forces,” he writes, pointing to Financial institution of Canada information exhibiting a tightening of credit score availability in comparison with in the course of the pandemic. “The year-over-year development price in credit score limits obtainable to households is now rising by half the tempo seen in mid-2022 and under the pre-pandemic price. In actual phrases, limits are hardly rising.”

Households are additionally extra reluctant to make use of that obtainable credit score, Tal provides, with utilization charges falling in latest months.

Incoming wave of mortgage renewals

Moreover, delinquencies are on the rise, signalling rising monetary stress amongst debtors. Tal notes that arrears are rising throughout varied types of client credit score, from bank cards and auto loans to mortgages.

As has now been extensively reported, challenges for mortgage debtors are solely anticipated to accentuate within the coming years as a result of massive variety of low-interest price fastened phrases which can be set to resume.

CIBC’s analysis suggests 50% of excellent loans have reset to increased charges, which nonetheless leaves greater than $1 trillion price of mortgages to resume within the coming years.

“Based mostly on time period distributions and our rate of interest forecast, we estimate that the typical curiosity cost shock in 2024-26 will quantity to round 15% a 12 months,” Tal writes. Nonetheless, he says the important thing phrase is “common,” with some debtors who are actually in shorter phrases seeing their charges truly fall within the coming years, and others experiencing a a lot sharper cost shock.

The common “masks the ache on the margins — the place credit score danger resides,” Tal notes.

Whereas one has to “dig deep” to seek out early indicators of credit score vulnerability, Tal says they do exist. Early-stage delinquencies within the below-prime mortgage house are “rising strongly;” non-mortgage debt held by householders is properly above 2019 ranges with half of all mortgages but to be repriced; and renters are being impacted to a better diploma by the weakening labour market and rising rents.

Causes for optimism

In opposition to this backdrop, Tal has discovered some silver linings that counsel we could also be headed for extra of a “squeeze on spending” versus a “massive potential credit score danger occasion.”

For one, whereas insolvencies are up over 20%, Tal says they’re rising from a “very tame” stage. Moreover, a document excessive of 80% of these insolvencies are proposals, which contain restructuring the debt, somewhat than outright bankruptcies.

“That’s essential as a result of the authorized prices and the losses per proposal are decrease for lenders

than in bankruptcies, and the restoration price is far increased,” he says, which means monetary establishments aren’t seeing their loss charges spike.

There additionally seems to be “elevated communication and coordination” between lenders and debtors primarily based on the truth that 30-60 day delinquencies are rising, whereas the share of these transferring to the 60-90 day class is definitely on the decline.

“Additionally encouraging is the truth that the share of mortgages which can be in a set off price

place (a state of affairs through which curiosity funds account for 100% of debt service funds) has been falling steadily in latest months,” Tal provides. “That early therapy of the signs was not seen in earlier recessions.”

The underside line? Sure, there are indicators of stress amongst debtors—each householders and renters alike—and delinquencies are anticipated to proceed to rise within the coming quarters.

“However the truth that we needed to dig deep to seek out indicators of stress, mixed with our expectations that the unemployment price won’t exceed 6.5% — miles under the speed seen throughout recessionary intervals prior to now, implies that upcoming credit score losses will probably be manageable,” Tal says.