Monetary advisors stay largely optimistic in regards to the near-term route of each the financial system and the monetary markets.

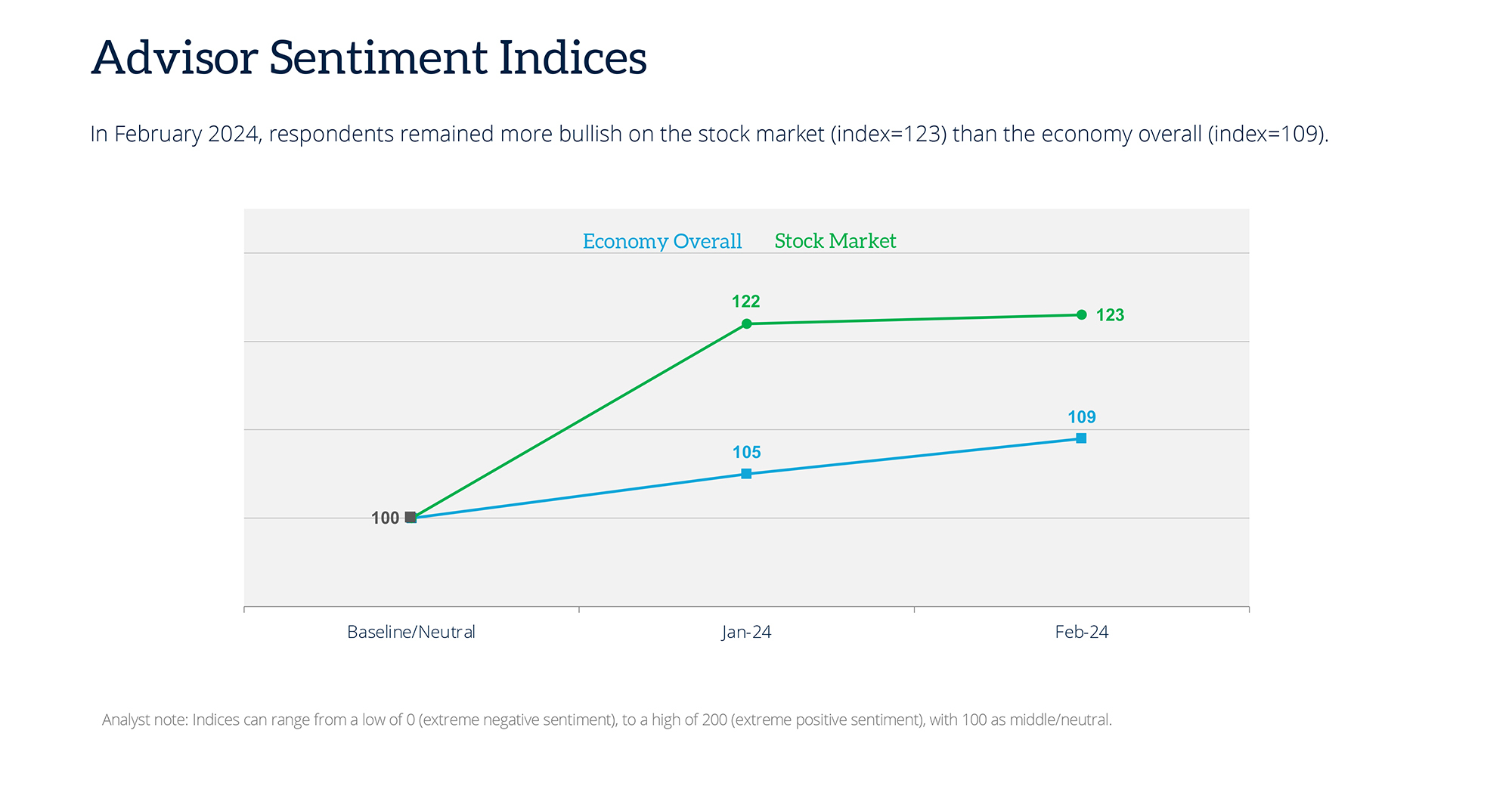

Sentiment ticked up marginally on each fronts in February, based on Wealthmanagement.com’s Advisor Sentiment Index, a month-to-month gauge of advisor’s views on the well being of the financial system and the inventory market.

Optimism over the state of the markets ticked up one level over January, from 122 to 123. (A studying of 100 displays a impartial view.) Whereas advisors take a extra cautious view of the financial system, sentiment on that entrance rose by 4 factors, from 105 to 109.

Click on to enlarge

The Advisor Sentiment Index is a month-to-month ballot of over 120 retail-facing monetary advisors meant to gauge their present views on the state of the financial system and the inventory market and the place they assume each are headed—over the following six months and presently subsequent yr.

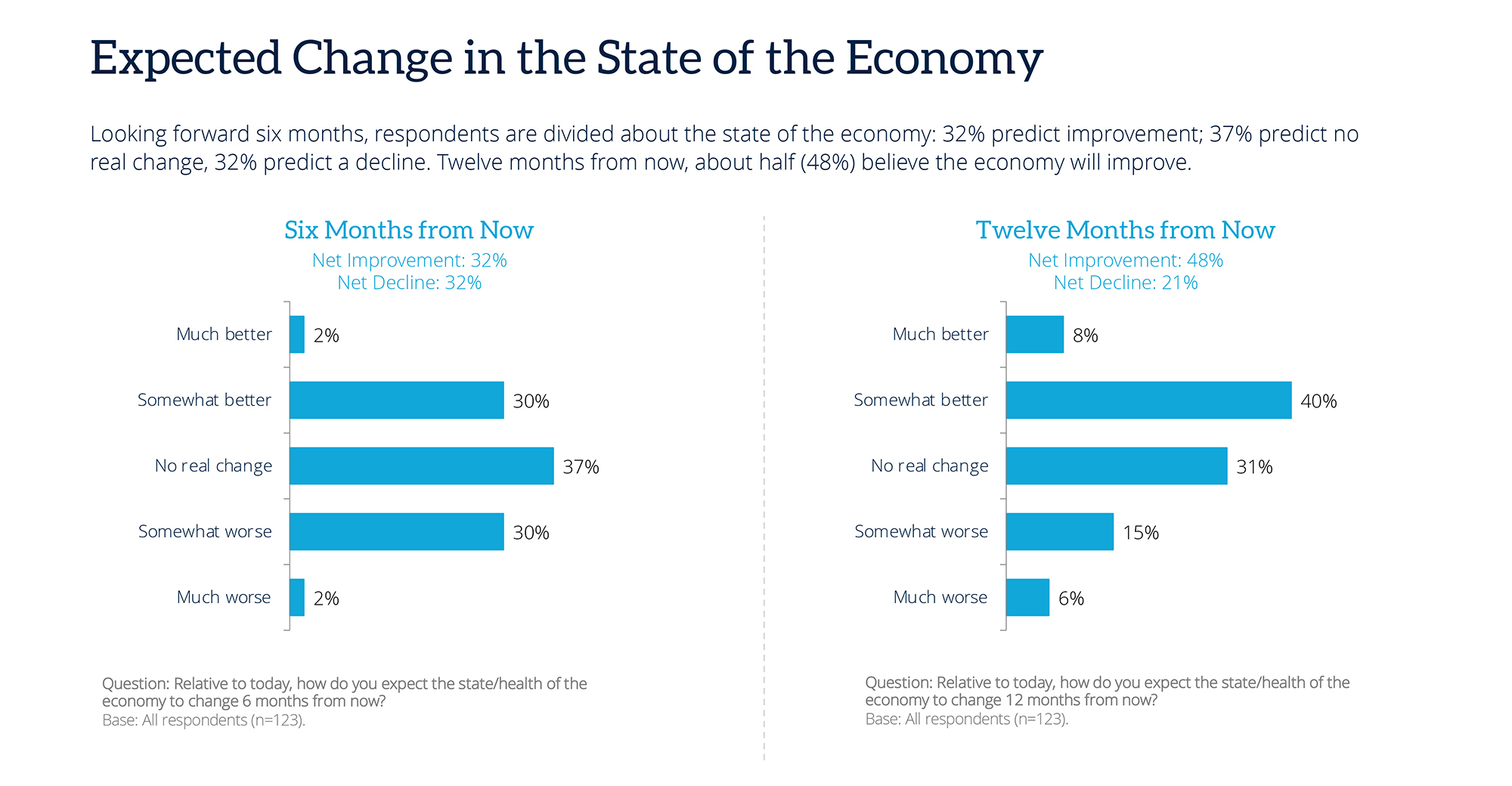

When requested about their present views, 40% of advisors have a good view of the financial system, whereas one other 40% have a “impartial” view. Solely 20% contemplate the present financial system in a unfavourable mild.

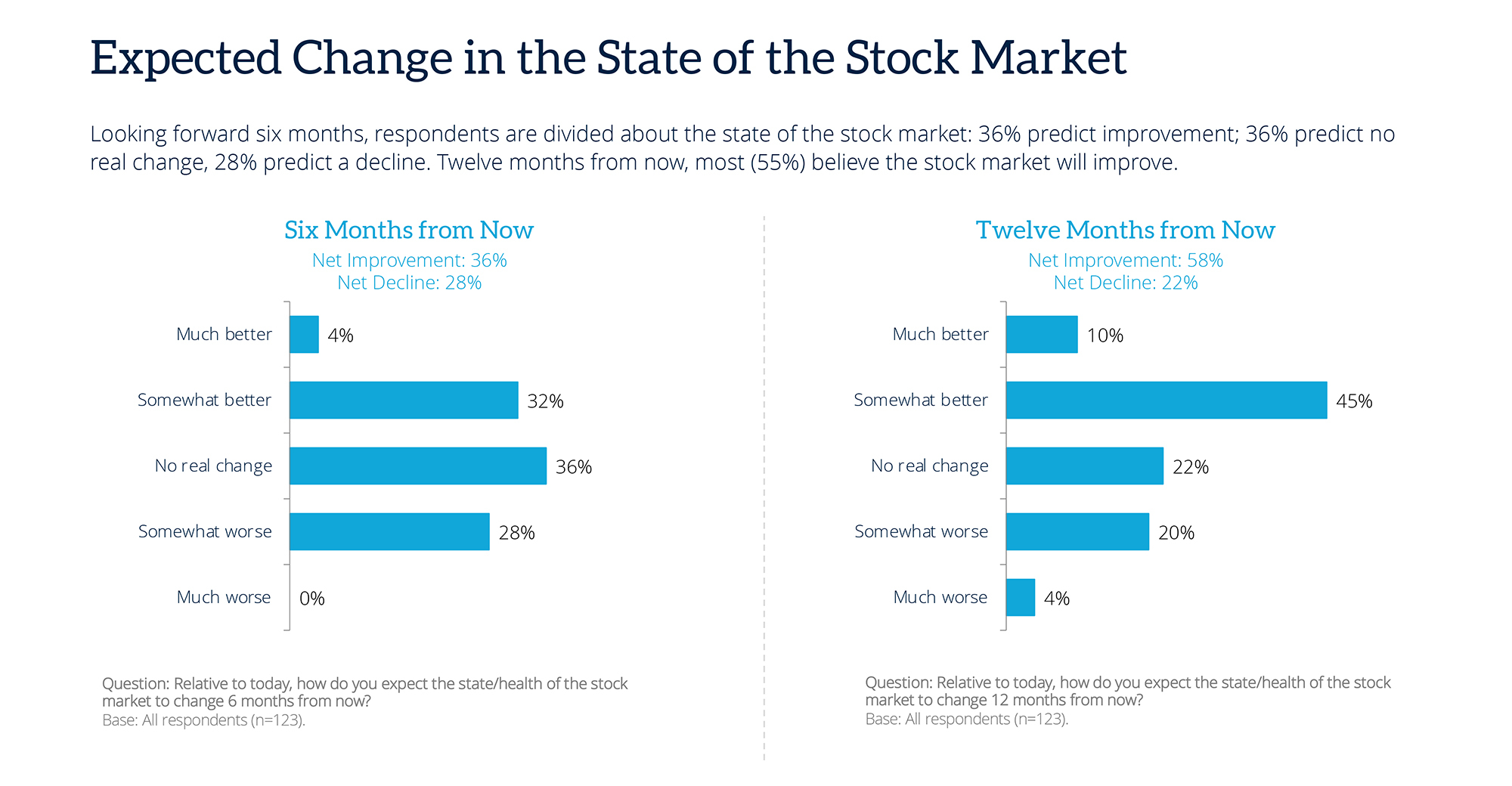

The financial system isn’t the inventory market, nonetheless, and optimism over the present state of the markets is significantly greater. Some 69% of advisors contemplate the state of the market to be constructive. In accordance with the survey, solely 5% of advisors have a unfavourable view.

Trying into the longer term, extra advisors anticipate a barely gloomier image to emerge over the following six months main up to what’s positive to be divisive nationwide elections. Some 32% predict a decline. They flip rather more optimistic when trying to February 2025, with virtually half anticipating enchancment.

Click on to enlarge

Most advisors take a parallel view of the inventory market, with over 1 / 4 anticipating a web decline in six months. But when requested for his or her views on the markets wanting towards February 2025, as elections recede into the rear-view mirror, Virtually six out of 10 advisors anticipate enchancment.

Click on to enlarge

Methodology, knowledge assortment and evaluation by WealthManagement.com and Informa Have interaction. Information collected February 22-28, 2024. Methodology conforms to accepted advertising analysis strategies, practices and procedures. Starting in January 2024, WealthManagement.com started selling a short month-to-month survey to energetic customers. Information can be collected inside the closing ten days of every month going ahead, with a objective of at the least 100 monetary advisor respondents per thirty days. Respondents are requested for his or her view on the financial system and the inventory markets each at present, in six months and in a single yr. Responses are weighted and used to create an index tied to a impartial worth of 100. Over time, the ASI will present directional sentiment of retail-facing monetary advisors.