Shares in the USA are costlier than they was once. Like, much more.

You used to have the ability to purchase a blue-chip firm for fifteen occasions earnings. There was a time, a standard non-recessionary time, when you possibly can purchase the S&P 500 for fifteen occasions earnings.

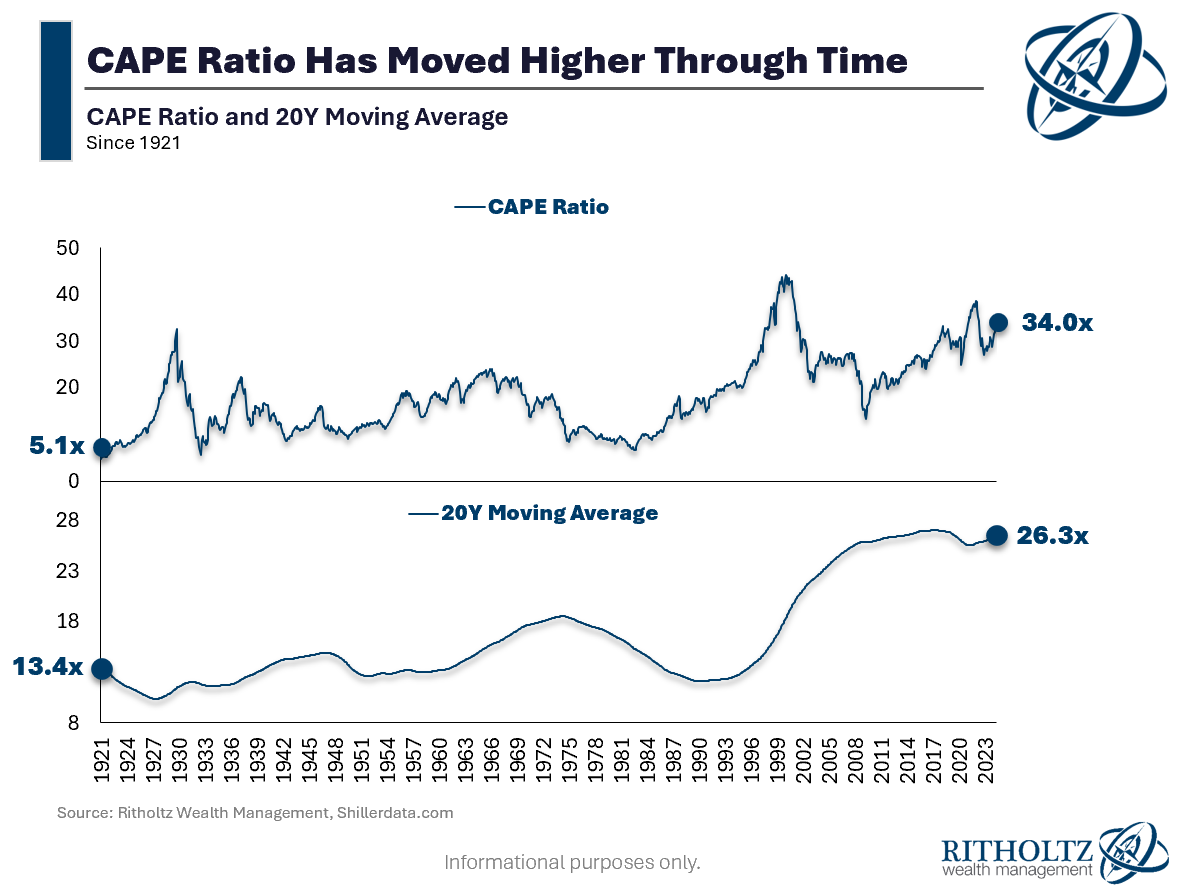

Previous to the dotcom bubble, there was just one occasion when U.S. shares traded at 25x occasions inflation-adjusted earnings over the earlier decade. That was the height of the speculative mania of the Roaring 20s, which was adopted by the inventory market crash and a Nice Melancholy. The late 90s expertise an identical boom-bust cycle. Prior manias, as measured by the CAPE Ratio, seem like the brand new regular state, with a CAPE buying and selling at 26x on common for the final twenty years.

So, will we ever return to the way in which issues have been? Are excessive valuations right here to remain? It’s inconceivable to say for positive. We are able to’t even pinpoint with certainty why that is taking place. And that’s as a result of it’s not only one factor driving the market to larger multiples than they’ve been prior to now. One offender that will get plenty of airtime are flows into index funds. There’s an ignored facet of this that I’d like to debate, which is the place the flows are coming from. Josh wrote in regards to the relentless bid a decade in the past, saying :

Virtually it doesn’t matter what occurs, every week advisors of each stripe have cash to place to work they usually’re more and more agnostic in regards to the information of the day. They’ve all acquired the identical actuarial tables in entrance of them they usually’re properly conscious that their purchasers reside longer than ever – therefore, a gently elevated proportion of their managed accounts are being allotted towards equities. And they also invariably purchase after which purchase extra.

Ten years later and this concept nonetheless holds up. I noticed one other taste of this just lately in a publish about Michael Saylor, of all issues. “Zack Morris” described the U.S. inventory market as having earned a financial premium, saying:

Once you contribute cash to your 401k each month, what are you actually doing? Are you saving? Or are you investing?

I might contend most individuals are saving. They’ve little interest in risking what they’ve already earned, but when they don’t, they’re sure to lose it to inflation and debasement.

If persons are saving their wealth within the S&P 500 as a substitute of cash, which means the fairness market has attained a financial premium.

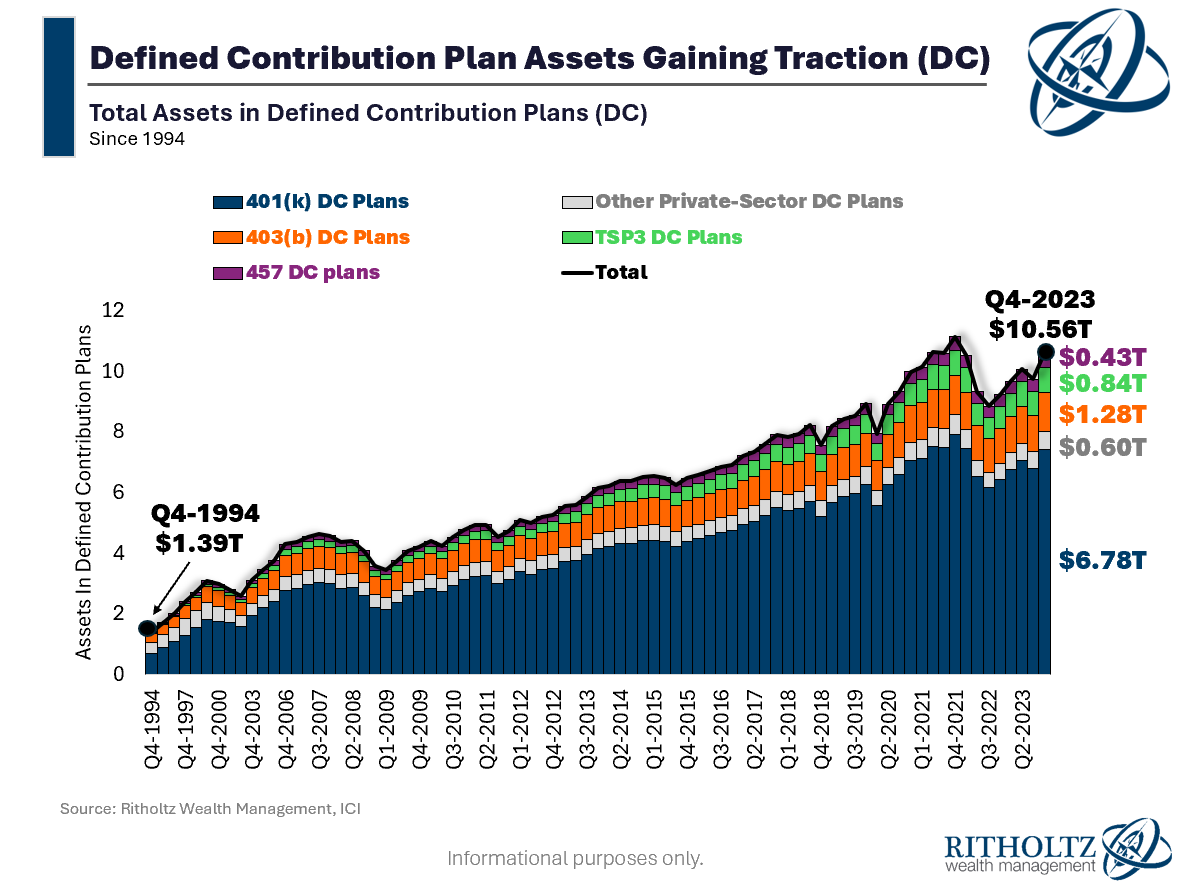

A tidal wave of cash is pouring into the market with each paycheck hundreds of thousands of Individuals obtain. On the finish of the 4th quarter, there was $10.56 trillion in Outlined Contribution Plans. I don’t assume it issues a lot* whether or not this cash goes into actively managed mutual funds or index funds. The truth that it’s coming in, on this dimension, each two weeks come hell or excessive water, is completely having an affect on the worth of shares. Particularly, the worth relative to whichever underlying basic metric you favor to measure.

The inventory market is an infinitely sophisticated machine, making it tough to say something with 100% confidence. So possibly let’s invert, and describe what this image doesn’t say.

It doesn’t imply we will’t have corrections or bear markets. Since Josh wrote The Relentless Bid, there have been three separate 15% drawdowns.

It doesn’t imply that shares will commerce at these multiples endlessly.

It doesn’t imply that cash coming into the market is assured to result in constructive returns over the subsequent three to 5 years or past.

However I do assume Zack Morris is correct to explain the U.S. inventory market as a financial savings car as a lot as an investing one, thereby incomes a financial premium. One of many greatest takeaways from this concept, assuming you agree with some or all of it, is that multiples don’t need to revert to the place they’d traded traditionally.

Like I stated earlier, nothing ever occurs available in the market for one purpose alone. There are at the very least a dozen slices of the “why are shares costly” pie chart, and I feel the financial savings element is only one piece, albeit a big one.

*I do know it issues on the micro degree. I’m unsure it issues as a lot at a macro degree.

This content material, which comprises security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here shall be relevant for any explicit info or circumstances, and shouldn’t be relied upon in any method. You must seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital belongings, or efficiency information, are for illustrative functions solely and don’t represent an funding advice or supply to supply funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.