It’s more and more trying like a soft-landing for the U.S. financial system. Whereas most individuals have been hesitant to present the Fed credit score, I went a special route and have been singing their reward for months.

In the event you’ve been following my posts, you’ll keep in mind that on the finish of September and in mid-November, I dove into the information to elucidate why I felt a soft-landing appeared seemingly. Quick ahead to immediately and a soft-landing has arguably change into the market consensus thanks partly to the current information.

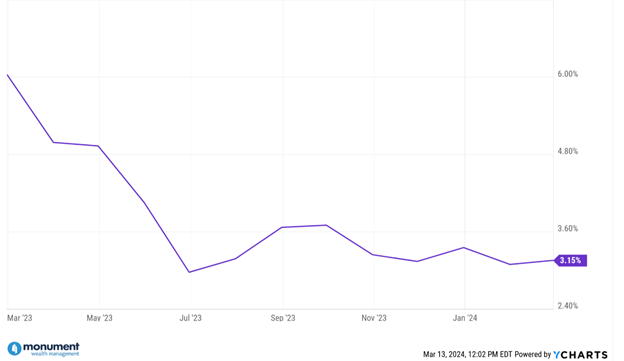

Let’s have a look at the inflation information from earlier this week:

The chart beneath reveals that the annual CPI inflation fee is now down to three.15% in February 2024 after clocking in at simply over 6% this time final 12 months.

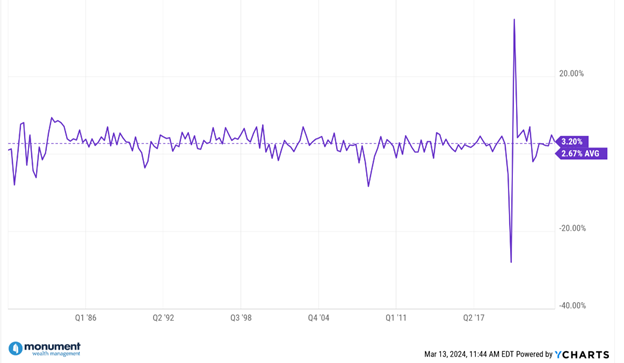

This subsequent chart beneath reveals how the decline in inflation coincided with a 3.20% actual GDP progress fee for the U.S. in calendar 12 months 2023. For context, the common GDP progress fee going again to 1980 is 2.67%, so 2023 skilled above common progress.

That is precisely what you’d count on to see in a soft-landing state of affairs: robust financial progress with a falling inflation fee. A real “chef’s kiss” second for economists.

However when you concentrate on it – this appears counterintuitive.

The Fed has been actively making an attempt to decelerate financial progress by aggressively climbing rates of interest, which in principle ought to result in decrease inflation. Properly, they bought the decrease inflation they wished, however the place are the unfavorable financial results that usually come from larger rates of interest?

I’m assured the impacts from a restrictive Fed are being felt and components of the financial system are certainly slowing down, however total, the U.S. GDP information has remained strong. Regardless that the newest GDP report didn’t level in the direction of an impending recession, some traders nonetheless really feel like one is coming.

However to me it appears there are larger forces on the market contributing to our current financial energy and our actual GDP progress – notably productiveness good points.

The Two P’s of GDP: Inhabitants and Productiveness

There are quite a few advanced inputs that go into calculating a rustic’s actual GDP, however in case you’re making an attempt to take a look at the place its GDP is headed, I personally prefer to give attention to a few key elements: #1. Inhabitants and #2. Productiveness.

GDP measures the full worth of products produced and providers supplied in a rustic, and a wholesome financial system has sustainable GDP progress. To oversimplify, if you wish to improve your GDP, you both want extra folks doing/making extra stuff, otherwise you want your present workforce to provide stuff/do work extra effectively. Once more, for me it all the time comes again to the 2 P’s, Inhabitants and Productiveness, when making an attempt to shortly assess a rustic’s potential GDP.

A Productive 2023 for the U.S.

Sturdy, above-average productiveness in 2023 appears to be a key purpose why the financial system has been so resilient within the face of upper charges and a restrictive Fed.

If you have a look at the U.S.’s 2023 actual GDP report, the expansion we noticed was partly pushed by giant good points in productiveness. There’s an official productiveness measure calculated by the U.S. Bureau of Labor Statistics (BLS) that makes an attempt to measure the financial output per hour labored from a U.S. employee. You may try the BLS methodology right here, however briefly, it’s greatest at serving to traders observe adjustments in employee output per hour over time and thru historical past.

The latest report got here out final week and noticed U.S. productiveness improve by 2.6% in 2023, which was above each the current 5-year common of round 1.8% and the historic common of round 2.1% going again to 1948.

Even with the drags from financial coverage, U.S. firms and staff had been in a position to generate extra output whereas utilizing much less assets in 2023. It’s unimaginable to pinpoint precisely the place the elevated productiveness got here from, however anecdotally I believe it’s straightforward to elucidate: the AI revolution has begun.

The Productiveness Advantages of AI

It’s no shock {that a} main driver of productiveness good points previously have come from new applied sciences and improvements. At this time we appear to be on the precipice of the following generational know-how shift with AI. It’s seemingly going to take many years to really maximize the advantages of AI—so buckle up.

For all of the unfavorable press the AI-boom has gotten, it looks as if the advantages and efficiencies are lastly beginning to present up in the actual financial information, and admittedly, they’re coming at a good time. They seem like serving to offset among the unfavorable impacts from Fed fee hikes and are supporting the soft-landing narrative.

Trying forward I believe there’s additionally the potential for continued productiveness good points that may stay a tailwind for the U.S. particularly since we seem like within the early innings of the AI-era. There appears to be limitless prospects for much more widespread future productiveness progress as every firm and trade implements AI in their very own distinctive approach.

For instance, right here’s how AI has begun to have an effect on the insurance coverage trade. This clip is barely speaking concerning the adjustments for a single trade, however I really feel assured in saying that is taking place in every single place. For my part, each job, firm, and nation will change into extra environment friendly due to AI.

When used responsibly, AI might help you be a greater problem-solver and be extremely extra productive. And, as I’ve written about earlier than , it could actually increase collaboration between man and machine and improve creativity.

Man & Machine Working Collectively

I’ve repeatedly referred to as for the Fed to get some reward for what they’ve achieved to this point, however I believe it’s time to unfold the love.

AI and the efficiencies they create have helped make a soft-landing for the U.S. financial system doable by offering a major increase to employee productiveness. I hope this pattern continues – and I believe it could actually.

Productiveness good points like this might be a key driver in serving to increase our financial progress into the longer term. A extra environment friendly and productive financial system is one poised for progress.