Picnic Tax is a platform that matches tax filers with licensed accountants who may help them file their returns. It covers private tax submitting, small enterprise tax submitting, and self-employed tax returns. Individuals may also request tax planning and tax recommendation from Picnic CPAs.

Right here’s what else it’s essential to know in regards to the platform in 2024. You may as well see how Picnic Tax compares to one of the best tax software program right here.

Picnic Tax – Is It Free?

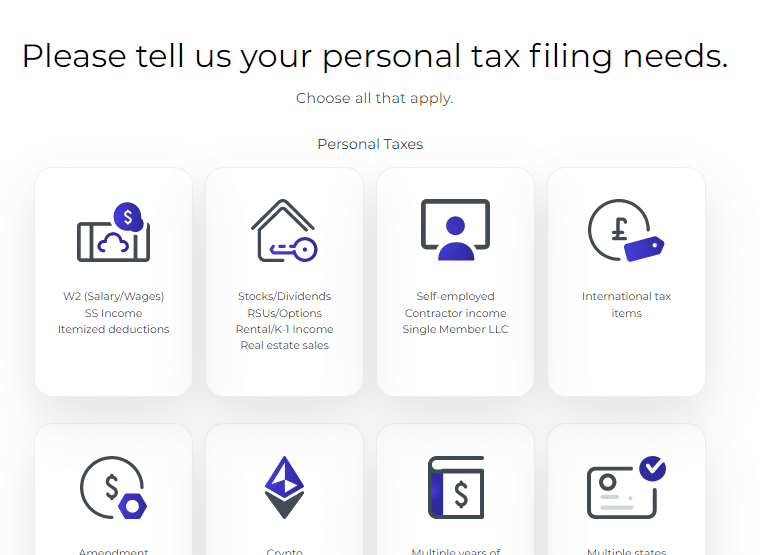

Picnic Tax doesn’t provide free providers but it surely does provide free worth quotes to all customers. Individuals eager about utilizing the service can full a questionnaire to find out prices. Customers who decide to make use of the service pay the payment upfront. Then, Picnic matches the filer with their customized accountants. Submitting begins at $225 for federal submitting and one state.

Quick interview to find out prices

What’s New In 2024?

For 2024, your accountant will use up to date tax brackets and limits for deductions and credit as set by the IRS. Since you’re not submitting with tax software program, you don’t have to fret about these particulars.

The opposite main replace we observed was for small companies. Small enterprise tax prep pricing is up by $250 this yr, now beginning at $750. That is expensive in comparison with FlyFin however nonetheless cheaper than a standard CPA.

Does Picnic Tax Make Tax Submitting Simple In 2024?

Picnic Tax simplifies tax submitting as a lot as attainable. Customers can add their tax paperwork to the corporate’s web site. Accountants can then ask questions and request extra info earlier than making ready returns on shoppers’ behalf.

Filers don’t want to fret about whether or not they’re maximizing deductions or claiming issues appropriately. The CPA they join with will maintain these particulars.

Picnic Tax Options

Picnic Tax is a bit just like the Uber of tax submitting, but it surely matches accountants and tax filers as an alternative of connecting riders with drivers. Since it is not conventional tax software program, the options highlighted right here showcase how Picnic Tax differs from conventional tax prep providers and tax software program.

Safe Doc Add

Customers can add all their tax paperwork by way of a safe on-line portal. They don’t want to fret about emailing or hand-printing tax paperwork and sending them within the mail.

On-line Or Offline Communication With CPAs

Picnic Tax customers can talk through Zoom, electronic mail, or safe chat with a devoted CPA. The corporate ensures filers can simply talk all of the pertinent info to their accountants.

CPAs Put together And Submit Returns

Picnic Tax makes submitting as simple as attainable. CPAs tackle the heavy lifting related to making ready tax returns. Filers solely have to convey their tax scenario to the CPAs earlier than the CPA does the work.

Picnic Tax Drawbacks

As a web-based tax preparation firm, Picnic Tax has just a few notable drawbacks.

Excessive Price In contrast To DIY

Private tax submitting can price as much as a number of hundred {dollars}. TurboTax Full Service (the place an agent prepares consumer returns) prices much less for comparable service ranges.

Multi-Issue Authentication Not Enforced

Customers solely want an electronic mail deal with and password to signal into Picnic Tax. A number of types of authentication usually are not required. This could possibly be a safety threat, so be additional positive to make use of a novel password to maintain your knowledge protected.

Picnic Tax Plans And Pricing

Pricing for Picnic Tax begins at $225 for federal submitting. Customers can add state returns for $50 per state. The ultimate worth of the service will increase relying on the complexity of a submitting scenario. The software program will increase in worth by $100 for every extra service.

Picnic will file each small enterprise and private tax returns. Enterprise returns begin at $750 and go up with extra submitting wants and necessities. In comparison with utilizing tax prep software program, this can be dearer. Nevertheless, in comparison with enlisting the assistance of a standard CPA, Picnic Tax is a discount.

Lastly, customers can arrange Tax Planning and Recommendation appointments with their Picnic CPA. These consultations begin at round $300.

|

Small Enterprise Tax Submitting |

|||

|---|---|---|---|

|

Anybody who needs a tax skilled to deal with their return, however needs an inexpensive worth and on-line service. |

Small enterprise homeowners who need assist maximizing their enterprise deductions and staying on prime of IRS necessities. |

Anybody who needs to optimize their taxes |

|

How To Get Began With Picnic

The Picnic Tax course of begins with a fast onboarding course of to find out about your tax prep wants. The questions requested are easy, direct, and straightforward to reply. The onboarding course of goals to get you matched with an accountant as quickly as attainable so the accountant can do the laborious give you the results you want.

As soon as your onboarding is full, you’ll see your customized worth quote. After cost, the app matches you along with your accountant.

When you’re matched, you might be directed to a doc add web page. The web page has clear directions for organizing and including your recordsdata. It’s quick and environment friendly to add your info right here.

A number of totally different file codecs are supported, and the web site helps drag-and-drop uploads. All you need to do is add your paperwork and reply the questionnaire. Then, you possibly can sit again, chill out, and revel in a chilly beverage whereas another person completes your tax types.

As soon as your docs are uploaded, you possibly can entry a dashboard to speak instantly along with your accountant. This user-friendly interface has a standing replace field indicating how far alongside your accountant is along with your return.

How Does Picnic Tax Evaluate?

Picnic Tax provides CPAs for all tax conditions. It covers every part from crypto buying and selling to actual property gross sales. It provides a comparable service to full-service on-line tax prep manufacturers like TurboTax Full Service and Visor.

The chart beneath compares costs and providers provided by these firms. Picnic is a little more costly than TurboTax Full Service, but it surely’s similar to the costs from Visor.

|

Header |

|

|

|

|---|---|---|---|

|

$1,000+ Federal & |

$389 Federal & |

$694+ Federal & |

|

|

Self-Ready or |

|||

|

Similar Tax Preparer Every 12 months |

|||

|

Cell |

Is It Protected And Safe?

Picnic Tax has first rate on-line safety. It makes use of robust knowledge encryption and permits customers to securely add paperwork solely their CPA can entry. It additionally provides safe communication channels for discussing the return.

One attainable downside to Picnic Tax is its authentication course of. Customers solely want an electronic mail and a password to create an account. Multi-factor authentication (akin to including an electronic mail or telephone quantity) isn’t required.

Filers should be cautious every time they’re working with an accountant. If the filer emails paperwork to their accountants, the doc is now not safe. The filer should additionally belief that the CPA won’t by accident retailer paperwork in an unsecured server.

How Do I Contact Picnic Tax Help?

As soon as you have related along with your CPA, you possibly can attain out any time through Zoom, electronic mail, or safe chat. However earlier than then, your Picnic Tax help choices are restricted.

When you have questions on how the corporate’s providers work, you may have to electronic mail information@picnictax.com or help@picnictax.com.

Is It Price It?

Most individuals can file their very own taxes on-line utilizing tax software program. Nevertheless, some folks have very complicated tax conditions and need assistance from a professional. Picnic Tax is right for these conditions.

The service ensures that filers could have assist from a professional CPA. And it shows pricing earlier than a consumer begins submitting. When you have a fancy submitting want, I like to recommend Picnic Tax in 2024.

FAQs

Can Picnic Tax assist me file my crypto investments?

Sure, the platform’s accountants may help all forms of tax filers. Lively crypto merchants can discover accountants who’ve expertise making ready crypto returns. Filers could also be required to add a spreadsheet with all trades or an IRS Kind 8949 to the Picnic Tax web site.

Can Picnic Tax assist me with state submitting in a number of states?

Sure, it helps submitting in all states. Filers should pay $50 per state.

Does Picnic Tax provide refund advance loans?

No, it doesn’t provide refund advance loans.

Picnic Tax Options

|

|

|

Import Tax Return From Different Suppliers |

Will differ by the tax software program that your particular accountant makes use of |

|

Deduct Charitable Donations |

|

|

Refund Anticipation Loans |

|

|

Net/Desktop Account Entry |

|