Homeownership is a life-changing occasion. So is having a considerable amount of debt. Whether or not you personal a house or are planning to purchase one, figuring out your choices for managing your debt is essential.

In case you’re struggling to make month-to-month funds in your debt, you might be investigating totally different debt reduction choices to do away with that debt so you may have sufficient leeway to make mortgage funds. Submitting for chapter makes it extremely troublesome to qualify for a mortgage. So, as an alternative of chapter, you could be contemplating debt consolidation.

Right here’s the important query: does debt consolidation have an effect on your home-buying capability? Beneath, we’ll evaluate how debt consolidation works, the way it can have an effect on shopping for a house, and a few methods for balancing your debt administration together with your mortgage.

Understanding Debt Consolidation

Debt consolidation is a blanket time period for quite a lot of methods that mix a number of types of debt right into a single month-to-month fee. There are three main methods to contemplate: debt consolidation packages, debt consolidation loans, and rolling debt into your mortgage.

Every of those methods can affect your credit score rating and skill to purchase a house or keep your present mortgage.

About Debt Consolidation Packages

A debt consolidation program (DCP) is whenever you work with an authorized credit score counsellor to barter together with your collectors to cut back (and even get rid of) the curiosity in your debt. Then, you make a single month-to-month fee to your credit score counselling company, which then redistributes funds to your collectors.

It ought to be famous {that a} DCP can solely cowl unsecured money owed. Secured money owed with some type of collateral, similar to a automobile mortgage, can’t be included in this system.

Whereas on a DCP, your collectors might apply an R7 score to your credit score report during this system plus two years after this system is full. Additionally, you can be required to give up any unsecured bank cards as part of this system.

About Debt Consolidation Loans

A debt consolidation mortgage is whenever you apply for a private mortgage to get the cash it’s essential to repay your present money owed. You then begin repaying the mortgage as an alternative of the high-interest bank cards, excellent payments, and different money owed that you simply’ve paid off.

The advantages of a debt consolidation mortgage embrace an general decrease rate of interest in your debt and, in the event you make funds on time, serving to you enhance your credit score rating.

Nonetheless, it’s essential to get authorised for the mortgage. This could be troublesome if in case you have a low credit score rating. In case you don’t have a superb credit score rating, you would possibly get supplied loans with greater rates of interest than the debt you already maintain. Alternatively, some loans would possibly require you to safe them with collateral that the lender can declare in the event you fall behind in your reimbursement schedule.

About Rolling Debt right into a Mortgage

If you have already got a house, a 3rd choice is to roll your debt into your mortgage. Generally referred to as a “debt consolidation mortgage,” it is a debt consolidation technique that leverages your house fairness (the distinction between how a lot your property is price and the way a lot you owe on it) to repay your money owed. Nonetheless, this isn’t only for present householders—potential patrons can even apply for a mortgage bigger than they should buy the house and use the additional cash to repay their high-interest bank card debt and different payments.

One of many greatest benefits of consolidating debt into your mortgage is lowering the curiosity in your debt much more than with an unsecured mortgage. Why is that this? Mortgages are inclined to have decrease rates of interest than unsecured loans as a result of the mortgage is secured with collateral, and the unsecured mortgage is just not.

Nonetheless, to consolidate your debt into your mortgage, it’s essential to have sufficient fairness in your house to cowl the debt and pay charges for breaking your present mortgage settlement. In case you’re rolling your debt right into a brand-new mortgage, then the most important impediment could also be qualifying for a mortgage that covers each the price of your new house and your excellent debt.

Moreover, this type of debt consolidation means delaying paying off your property in full as you add to the mortgage’s principal stability (i.e., the sum of money owed that isn’t curiosity) or if the rate of interest and phrases of the mortgage are modified.

Debt to Revenue Ratio and Shopping for a Residence

Once you’re making use of for a mortgage, the mortgage firm will wish to study your debt-to-income ratio or DTI. Sometimes, a lender will need a borrower to have a back-end DTI of 35% or much less. Nonetheless, some lenders might have stricter DTI pointers or settle for debtors with a better DTI.

That is one cause why debt consolidation might be important for purchasing a house. By consolidating money owed in a manner that lowers your rate of interest (or finishing a DCP and eliminating your money owed), you may cut back your DTI and make qualifying for a mortgage simpler.

What Is Debt to Revenue Ratio and How Is It Calculated?

The debt-to-income ratio permits lenders to check how a lot of a borrower’s month-to-month earnings is being put in the direction of month-to-month debt funds.

For instance, in the event you made $10,000 a month and needed to spend $3,000 on debt funds, your DTI can be 30%.

Some debtors would possibly specify a distinction between “front-end” DTI (which solely covers housing bills) and “back-end” DTI (which incorporates all debt obligations).

Debt Consolidation and Residence Shopping for

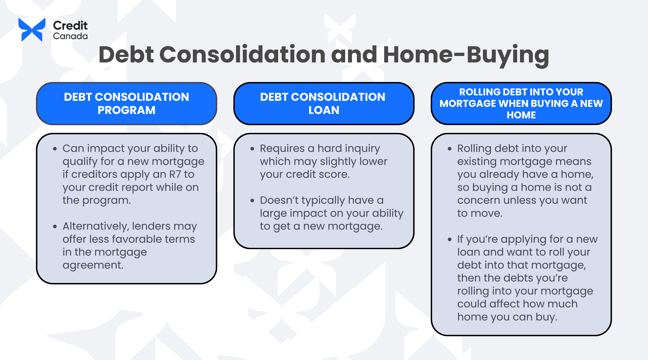

So, does debt consolidation have an effect on shopping for a house? The reply depends upon the kind of debt consolidation you utilize as a result of every type of consolidation has a distinct affect in your credit score.

Debt Consolidation Packages and Shopping for a Residence

A debt consolidation program can affect your capability to qualify for a brand new mortgage. It’s because collectors might apply an R7 score to your credit score report whereas on this system (some collectors might apply totally different scores, however R7 is the most typical). When this occurs, lenders may even see the merchandise in your credit score historical past and resolve to not work with you because the score signifies an account the place you could have made an alternate association to repay your collectors.

Alternatively, they could provide much less beneficial phrases within the mortgage settlement. This consists of issues like charging a better rate of interest or lowering how a lot you may borrow. This will make it tougher to purchase the house that you really want.

Debt Consolidation Loans and Shopping for a Residence

A debt consolidation mortgage doesn’t usually have a big affect in your capability to get a brand new mortgage. Whereas the laborious inquiry in your credit score report can have a adverse affect in your rating, credit score inquiries solely account for 10% of your credit score rating. That is much less impactful than objects like your fee historical past, which accounts for 35% of your rating, and credit score utilization ratio, which accounts for 30% of your credit score rating.

Actually, by making constant month-to-month funds on the consolidation mortgage on time, you may construct a constructive credit score historical past and enhance your credit score rating—making it simpler to qualify for a mortgage over time.

Rolling Debt into Your Mortgage When Shopping for a New Residence

In case you’re rolling debt into your present mortgage, you have already got a house, so shopping for a house might be not a priority except you wish to transfer. Nonetheless, in the event you’re making use of for a brand new mortgage and wish to roll your debt into that mortgage, then the money owed you’re rolling into your mortgage might have an effect on how a lot house you should purchase.

It’s a superb debt administration technique to spend even much less on your property than the mortgage worth you qualify for. It’s because taking a smaller mortgage than what you’re authorised for can assist you repay your mortgage even sooner and allow you to put apart extra money for the longer term because you’re not paying as a lot curiosity on the mortgage.

Methods for Balancing Debt Consolidation and Residence Buy Objectives

So, how are you going to stability the necessity to handle your debt together with your objective of buying a brand new house (or paying off your mortgage)? Some methods for minimizing the affect of debt consolidation in your objective of shopping for a house embrace:

Leveraging a Debt Consolidation Mortgage

Contemplate making use of for a debt consolidation mortgage as a primary choice for clearing your excellent debt. Whereas the laborious inquiry has a small affect in your credit score rating, the regular reimbursement of your mortgage can assist you construct a constructive historical past and enhance your credit score rating.

Don’t Purchase Extra Residence Than You Can Afford

How a lot are you able to afford to spend in your mortgage each month? Earlier than getting down to get a mortgage for a brand new house, take a while to create a month-to-month finances so you may observe your earnings and bills.

How a lot are you spending on requirements like meals or hire? How a lot cash do you presently spend on hire? Are you able to put aside sufficient cash to cowl your month-to-month minimums on debt funds? What bills might you reduce on, if essential?

Utilizing a finances planner and expense tracker software can assist you clearly set up how a lot you may afford on your month-to-month fee.

Contemplate Paying Off Excessive-Curiosity Money owed Earlier than Shopping for a Residence

In case you can’t safe a debt consolidation mortgage or roll your money owed into your new mortgage, think about focusing in your money owed with the best rates of interest earlier than making use of for a mortgage.

By making bigger, common funds towards your highest curiosity money owed whereas sustaining the minimal funds on different money owed, you do two issues that will help you enhance your credit score rating:

- You create a constructive historical past of creating on-time funds; and

- You enhance your credit score utilization ratio.

These are each main components that have an effect on your credit score rating.

Make a listing of your money owed, the entire quantity you owe, and the rates of interest for every type of debt you maintain so you may determine a very powerful money owed to repay first.

Set Apart Further Cash for Your Down Cost

In case you’ve cleared your high-interest money owed (like bank cards) and nonetheless can’t discover a house that’s inexpensive for you, think about setting apart extra money on your down fee. Saving up cash to make a bigger down fee means you will want a smaller mortgage mortgage when making a purchase order—making it simpler to purchase your dream house.

Moreover, it will probably function an emergency fund whilst you look forward to the prime fee (the rate of interest that banks cost their finest prospects) to enhance. This can assist you cowl emergency bills with out going into extra debt.

What’s the Finest Possibility for You? Attain Out to a Licensed Credit score Counsellor for Recommendation!

The affect of debt consolidation in your capability to purchase a house can fluctuate relying on the consolidation technique that works finest for you. When you’ve got good credit score, it’s best to attempt to get a debt consolidation mortgage or roll your money owed into your mortgage, as these strategies have a small affect in your credit score rating.

Within the case of a debt consolidation mortgage, securing the mortgage after which constantly making funds on it will probably allow you to enhance your credit score rating to get a greater mortgage.

A debt consolidation program is an efficient different for individuals who don’t have nice credit score and want a possibility to clear their unsecured money owed to allow them to begin constructing a constructive credit score historical past. In case you be a part of a DCP, think about ready for at the least two years after this system ends earlier than making use of for a mortgage.