Europe is affected by a giant hangover after the tech funding social gathering of the 2020-2021 interval. That stated, in comparison with pre-pandemic ranges, VC funding in European startups is up, traditionally talking, and reached $60 billion, in keeping with a brand new report. Nonetheless, the anomaly of the surge in funding over the pandemic stands in marked distinction to that progress and has created vital headwinds, though there are indicators of ‘inexperienced shoots’.

International regulation agency Orrick analyzed over 350 VC and progress fairness investments its purchasers accomplished in Europe final 12 months.

The Whole capital raised in Europe was $61.8 billion. 2023 marked a reset and main correction in funding ranges globally. Of the highest 3 world areas for VC – Europe, Asia, and North America – Europe is the one one to exceed 2019 ranges in 2023.

In line with the report, Europe is sitting on “file ranges of dry powder” and “producing extra new founders than the U.S.”, funding stays sluggish.

Solely 11 new unicorns emerged from Europe final 12 months, the fewest in a decade, and a rising variety of unicorns misplaced their standing.

Local weather Tech overtook FinTech as Europe’s hottest sector

AI’s share of complete funding in Europe soared to a file excessive of 17percent5.

Orrick discovered that buyers — emboldened by the downturn in funding — are ‘turning the screws’, exercising higher management over investments, with founders being required to face behind warranties in 39% of enterprise offers.

There was a transparent drop in later-stage financings, deal quantity dropped, and founders have been thrown in direction of different methods akin to various financing strategies, or racing in direction of revenues and earnings.

There was an “unprecedented spike” within the means of recent buyers to enter tech, as founders seemed for brand new lead buyers, and an “uptick” in convertible debt, SAFEs, and ASAs, with convertible financings representing 23% of rounds in 2023.

Traders typically centered on managing their current portfolios, secondary transactions elevated, and SaaS and AI continued to be fashionable. Apparently, the variety of FinTech investments declined.

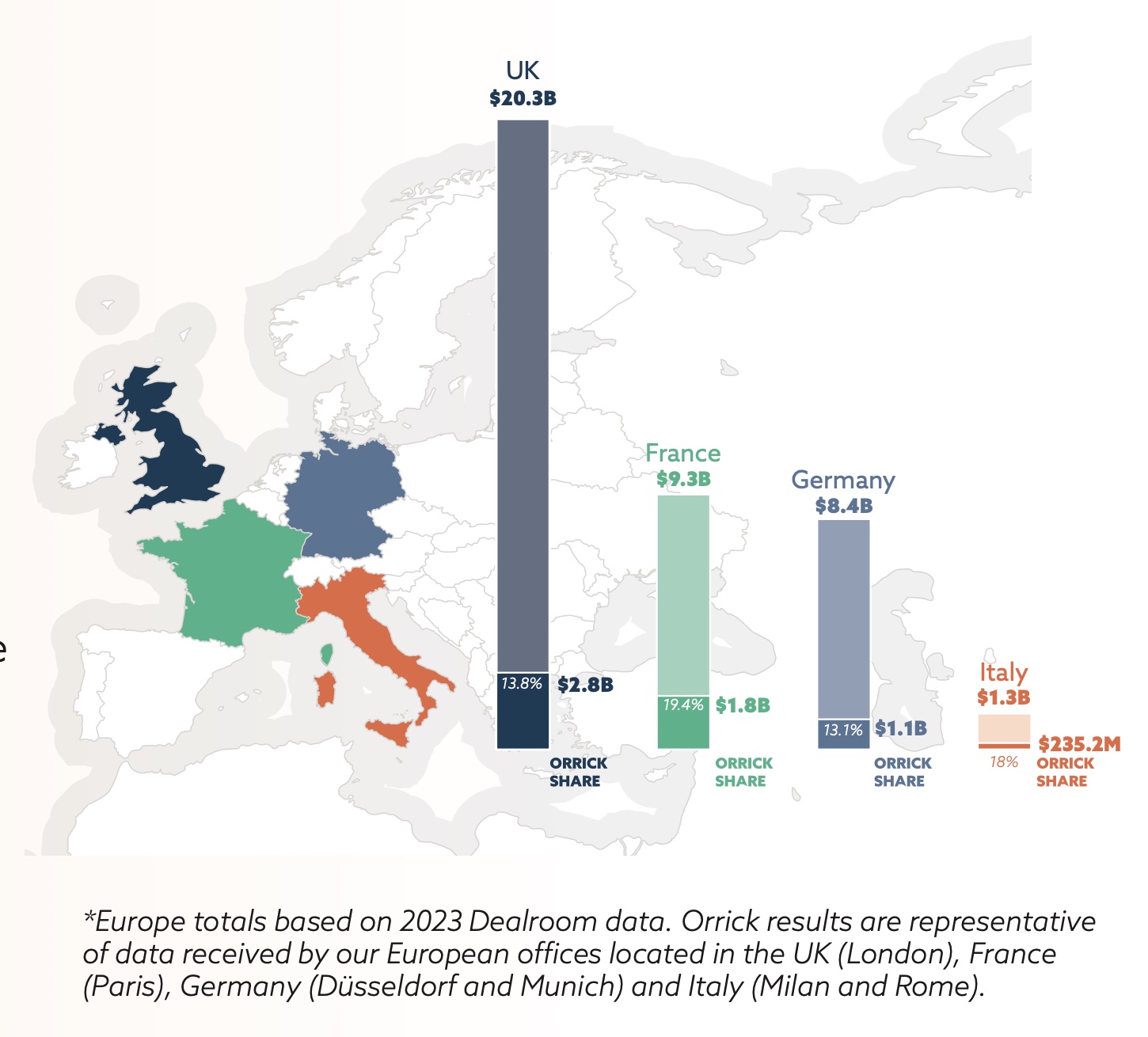

European 2023 tech funding offers (Orrick)

At every stage, deal worth is down, with essentially the most dramatic fall in later-stage offers.

Early-stage deal worth dropped by 40%, though early-stage buyers are nonetheless essentially the most lively.

There was a decline in ‘mega-rounds’ exceeding $100M+. Nonetheless, the IPO panorama confirmed “indicators of life” with ARM’s $55 billion IPO, and M&A exercise confirmed “inexperienced shoots.”

Within the UK, VCs are below stress to ship returns, which is prone to result in elevated demand for secondaries, higher M&A exercise and consolidation.

In France there’s been a shift from ‘founder-friendly’ phrases in direction of extra investor-friendly phrases, in marked distinction to the Uk, the place the alternative is true.

In Germany, a rising demand from LPs for liquidity is anticipated to “energize the tech M&A pipeline.”