Wagely, a fintech out of Indonesia, made a reputation for itself with earned wage entry: a means for staff in Southeast Asian nations to get advances on their salaries with out resorting to higher-interest loans. With half 1,000,000 folks now utilizing the platform, the startup has expanded that enterprise right into a wider “monetary wellness” platform, and to provide that effort an additional push, the corporate’s now raised $23 million.

The information is particularly notable given the funding crash that startups in Indonesia have confronted within the final couple of years, underscoring how creating nations have been hit even tougher than developed markets in within the present bear marketplace for expertise. Indonesia’s Monetary Providers Authority in January stated that Indonesian startup funding was down 87% in 2023 in comparison with a 12 months earlier than, all the way down to $400 million from $3.3 billion.

That financial stress is just not unique to startups: strange individuals are underneath much more stress.

Whereas the consumption of products and companies has grown considerably, wage progress throughout sectors has not stored up. Staff are looking out for options together with credit score to satisfy their wants between fixed-payroll cycles.

However entry to credit score is just not all-pervasive.

Hundreds of thousands of staff are underbanked and lack credit score historical past. In some circumstances, such staff are pressured to seek out alternate options, which might be to discover a job that pays wages in a shorter interval than a conventional pay cycle of a month. This leads to a better attrition price for employers. Equally, staff who can’t mortgage cash from a financial institution or monetary establishment within the occasion of an emergency usually get trapped by mortgage sharks, who cost exorbitant rates of interest and observe predatory practices. It’s no shock that earned wage entry has been held up by world banking establishments like JP Morgan as a monetary panacea: it’s necessary for each staff and employers.

The idea of earned wage entry has been prevalent amongst firms in developed markets just like the U.S. and U.Ok. — particularly after the COVID-19 pandemic impacted jobs and family incomes for a lot of people. In 2022, Walmart acquired earned wage entry supplier Even to supply early pay entry to its staff. Different massive U.S. firms, together with Amazon, McDonald’s and Uber, additionally provide staff early wage entry applications.

Wagely, headquartered in Jakarta, introduced that mannequin to Indonesia in 2020 and entered Bangladesh in 2021. The startup believes providing earned wage entry in these markets is even essential, since 75% of Asian staff stay paycheck to paycheck and have considerably decrease salaries than their counterparts within the U.S. and different developed nations.

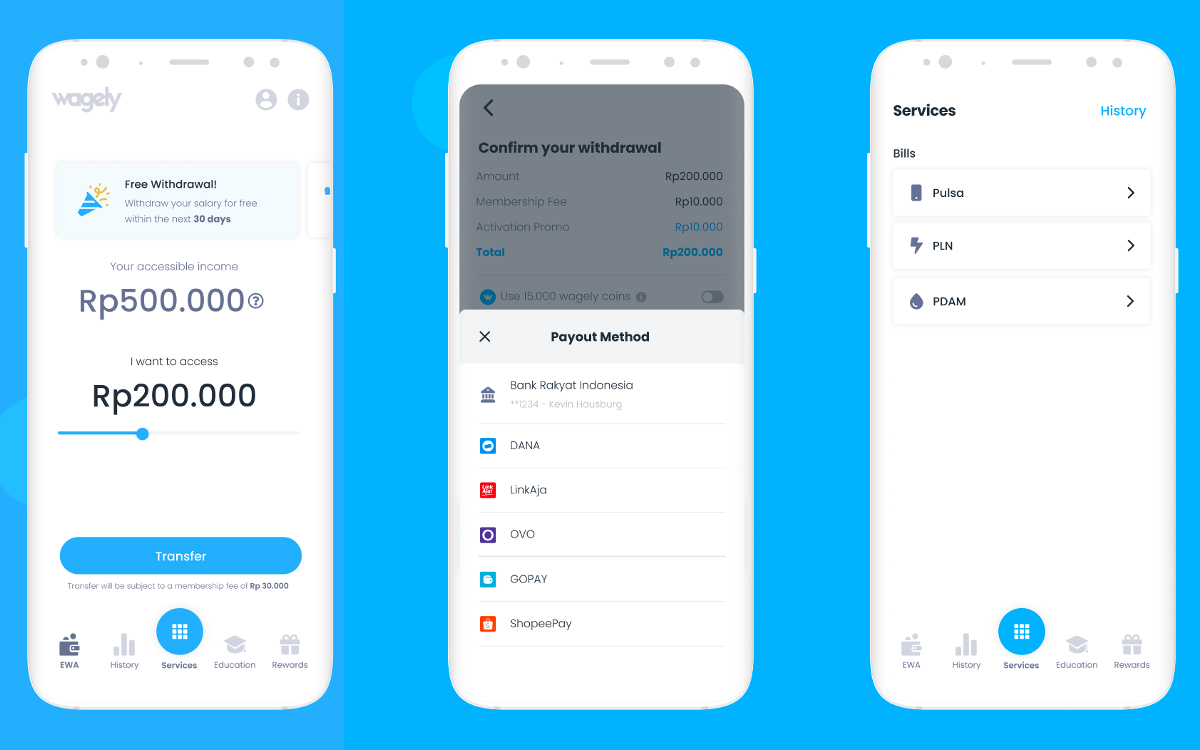

Picture Credit: Wagely

“We’re partnering with firms to supply their staff a technique to withdraw their salaries on any day of the month,” Kevin Hausburg, co-founder and CEO at Wagely, stated in an interview.

Like different earned wage entry suppliers, Wagely costs a nominal flat membership price to staff withdrawing their salaries early.

Hausburg advised TechCrunch the price, which he describes as a “wage ATM cost,” usually stays between $1 and $2.50, relying on the partial wage staff withdraw, in addition to their location and monetary well-being.

Wagely, which has a headcount of about 100 staff, with roughly 60 in Indonesia and the remaining 40 in Bangladesh, has disbursed over $25 million in salaries in 2023 alone by way of almost a million transactions and serving 500,000 staff.

Since its final funding spherical introduced in March 2022, the startup, the founder stated, noticed about 5 occasions progress in its revenues and tripled its enterprise from final 12 months, with out disclosing the specifics. These revenues come solely from the membership price that the startup costs staff. Nonetheless, it nonetheless burns money.

“We’re burning money as a result of it’s a quantity sport,” stated Hausburg. “Nonetheless, the margins and the enterprise mannequin itself is sustainable at scale.”

Whereas Wagely has been Southeast Asia’s early earned wage entry supplier, the area has added a couple of new gamers. This implies the startup has some competitors. Additionally, there are world firms with the potential to tackle Wagely by coming into Indonesia and Bangladesh over time.

Nonetheless, Hausburg stated the comfort makes the startup a definite participant. It takes three faucets from downloading Wagely’s app or accessing its web site by way of a browser to having cash in your checking account, the founder acknowledged.

“That is one thing that no different competitor is even near as a result of different earned wage entry firms are specializing in various things,” he stated.

One of many areas the place world earned wage entry suppliers have shifted their focus these days is lending — in some circumstances, to lend cash to employers. Some platforms additionally embrace promoting to generate revenues by providing totally different merchandise they cross-sell to staff. Nonetheless, Hausburg stated the startup didn’t go together with promoting or every other companies that didn’t make any sense for the employees it companies.

“Deal with what your prospects want. Don’t get distracted, and don’t attempt to optimize for short-term income,” he famous.

Wagely’s enterprise mannequin works on economies of scale. That’s, to change into worthwhile, it must broaden from half 1,000,000 folks to a number of thousands and thousands.

With Capria Ventures main this newest spherical, the startup plans to make the most of the funding to go deeper into Indonesia and Bangladesh, broaden into monetary companies, together with financial savings and insurance coverage, and discover generative AI-based use circumstances, together with automated doc processing and native language conversational interfaces for staff.

Lately, Wagely partnered with Bangladesh’s industrial financial institution Mutual Belief Financial institution and Visa to launch a pay as you go wage card for workers within the nation, which has a smartphone penetration price of round 40% however an unlimited infrastructure for card-based funds and ATMs. It’s keeping track of different Asian nations however doesn’t have quick to enter any new markets anytime quickly, the founder stated.

Wagely is just not disclosing the quantity of debt versus fairness on this spherical however has confirmed it’s a mix of the 2. The debt portion could be particularly used to fund wage disbursements. It was additionally the primary time the startup, which acquired a complete of about $15 million in fairness earlier than this funding spherical, raised a debt.

“It’s unsustainable to develop the enterprise simply with fairness, particularly as a result of we’re pre-disbursing earned salaries to staff, and the one means that you may construct this enterprise sustainably is with having a really robust companion on the debt aspect that gives you that capital. And now was the time,” Hausburg advised TechCrunch.

Employers don’t present advance cost of wages by themselves; as a substitute, they reimburse Wagely for the quantity disbursed to staff on the finish of the pay cycle. This requires the startup to take care of a ample reserve to cowl advance wages for workers registered on the platform. The startup conducts “rigorous checks” on employer companions and works with publicly listed and well-compliant, respected non-public firms to mitigate the danger of non-repayment by employers for the superior wages supplied to staff after the pay cycle concludes.

“The Wagely workforce has demonstrated glorious execution with spectacular progress in offering a sustainable and win-win monetary answer for underserved blue-collar staff and employers,” stated Dave Richards, managing companion, Capria Ventures, in a ready assertion.