A reader asks:

What’s the largest danger within the markets proper now?

The easy reply right here is the one everybody has been making ready for over the previous 24 months — a recession.

Within the post-WWII period, the U.S. financial system has slipped right into a recession roughly as soon as each 5 years or so, on common.

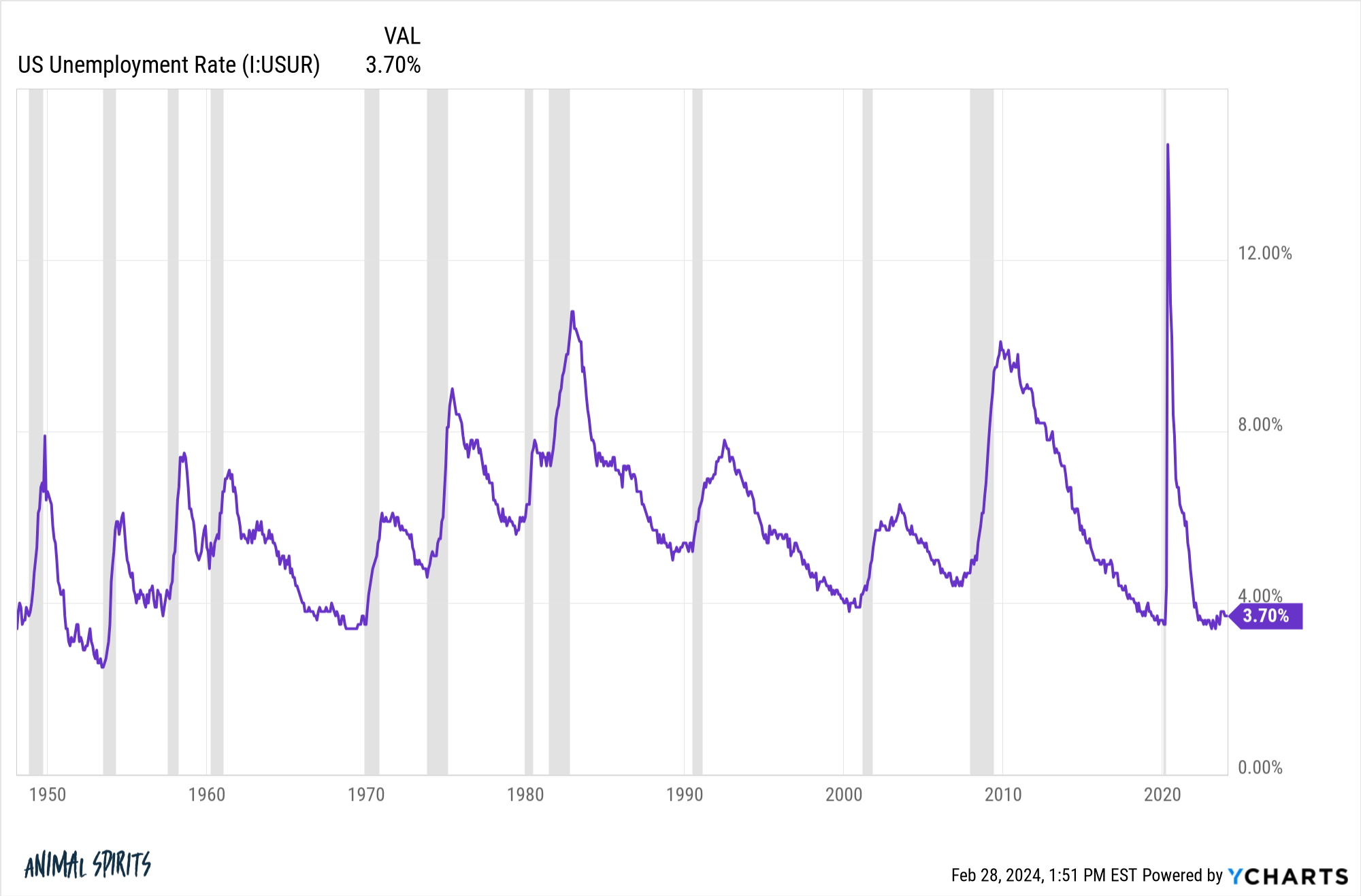

Have a look at how spaced out these recessions (the gray bars) have turn out to be in current a long time:

From the late-Nineteen Forties by way of the early-Nineteen Eighties, there was a recession as soon as each three-and-a-half years, on common. Since 1990, there was one recession each 9 years, on common.

We went virtually 11 years between the tip of the Nice Monetary Disaster downturn in 2009 and the Covid collapse within the spring of 2020. But that two-month recession in the course of the pandemic was self-induced. It wasn’t a part of the conventional enterprise cycle.

If we exclude that two-month interval, we’re now taking a look at virtually 15 years because the final true financial contraction in america. There was a tough reset within the financial surroundings within the spring of 2020 however this growth has been occurring for a while now.

I’m not prepared to exit on a limb and predict a recession this 12 months as a result of the financial system stays sturdy by most measures. An surprising financial slowdown from here’s a market danger, although.

Some would say inflation re-accelerating can be a danger.

That is smart if it means the Fed could be compelled to lift charges once more. Nevertheless, with provide chains healed from the pandemic craziness, greater inflation would additionally seemingly imply a stronger financial system for longer.

That looks like excellent news to me so long as inflation doesn’t transfer meaningfully greater.

The least satisfying reply for the largest danger proper now could be one thing popping out of left discipline. The most important dangers are at all times those you don’t see coming. By definition you’ll be able to’t predict these dangers prematurely.1

I’m certain I may give you another macro or micro variables like rates of interest, valuations or the Fed screwing one thing up.

The way in which I see it, any of those financial or market dangers are the value of admission when investing. Nobody ever is aware of the timing or the magnitude of recessions or bear markets however they are going to occur sooner or later. These dangers are ever current even when they don’t occur fairly often.

Subsequently, the largest danger for many buyers has nothing to do with the financial system or markets in any respect — the largest danger is you.

There’s a danger that you just’ll abandon your funding plan and make a giant mistake on the worst potential time.

There’s a danger FOMO will trigger you to observe others right into a awful funding you don’t perceive.

There’s a danger you’ll turn out to be too complacent when the markets are going up and too scared when markets are taking place.

There’s a danger you’ll promote your entire shares and by no means get again into the market since you turn out to be paralyzed with worry of constructing one other mistimed determination.

Danger is available in totally different kinds at totally different occasions however by no means utterly disappears, no matter the way you place your portfolio.

Warren Buffett as soon as wrote, “Danger comes from not figuring out what you’re doing.”

Among the finest danger controls you may have as an investor is figuring out what you personal, why you personal it and the way lengthy you’ll personal it for.

We spoke about this query on the newest version of Ask the Compound:

Jonathan Novy joined me on the present this week to debate a plethora of insurance-related questions: time period vs. complete life, when it is smart to make use of insurance coverage merchandise as funding automobiles and the various kinds of life insurance coverage.

Additional Studying:

Idiots, Maniacs & the Complexities of Danger

1This is perhaps contrarian of me however I feel even an alien invasion could be bullish within the long-term. It might require enormous infrastructure spending and we may probably steal a few of their technological capabilities after we defeat them. Win-win.

This content material, which incorporates security-related opinions and/or data, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here shall be relevant for any specific info or circumstances, and shouldn’t be relied upon in any method. You need to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or provide to supply funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.