Over the previous few years, many individuals have been on the lookout for options to the 60/40 portfolio (a portfolio allocation of 60 p.c equities/40 p.c mounted earnings)—and for good cause. The Fed’s large intervention to decrease rates of interest made the 40 p.c allocation to mounted earnings within the 60/40 portfolio a lot much less enticing. With inflation reaching ranges we haven’t seen in many years and the Fed set to push rates of interest greater, individuals have been questioning whether or not mounted earnings nonetheless gives the safety of principal that many traders are on the lookout for. The Bloomberg U.S. Mixture Bond Index’s worst quarter in additional than twenty years has definitely elevated this concern. This ache, nonetheless, has put mounted earnings in a a lot more healthy place going ahead, with greater beginning yields capable of cushion traders from additional declines in worth.

Why Use the 60/40 Portfolio?

Within the context of a 60/40 portfolio, mounted earnings is supposed to decrease the volatility of an all-equity portfolio whereas nonetheless permitting the investor to hunt an inexpensive fee of return. In the long term, equities ought to outperform mounted earnings, so if development was the one long-term concern, traders would find yourself with equity-only portfolios. For a lot of traders, although, volatility can be a priority, so mounted earnings performs a big half within the portfolio.

Because of this the 60/40 portfolio grew to become a well-liked and balanced investing technique. However when charges fell to very low ranges, we noticed that mounted earnings traders have been involved with two issues:

-

Portfolios wouldn’t generate excessive sufficient returns.

-

There was the next threat of charges rising than falling, so mounted earnings wouldn’t present the identical draw back safety as prior to now.

This led to some traders implementing a number of totally different methods with a purpose to tackle these considerations.

60/40 Options

To sort out low return expectations, traders might have adjusted their 60/40 allocation to incorporate extra equities, moved into extra illiquid merchandise like non-public fairness or non-public credit score, or adjusted their 40 p.c allocation to incorporate higher-risk areas of the mounted earnings market. Every of those choices has its trade-offs, however all of them add threat to the portfolio. This assumed that the investor may have taken on that threat or that the chance of these asset courses wasn’t a priority with the assist of fiscal and financial coverage.

For traders fearful that mounted earnings wouldn’t defend on the draw back, they might have moved into bonds with shorter maturities to guard in opposition to rising charges, used derivatives to assist defend in opposition to a market downturn, or added commodities to assist hedge in opposition to rising inflation. Wanting forward, every possibility has its drawbacks, so conventional mounted earnings might present higher relative worth than these options.

Getting Again to Impartial

Each methods listed above supply instruments to deal with sure market situations and supply an argument for making adjustments to your allocation when market situations change. However portfolios ought to have a goal allocation that may be met underneath “regular” circumstances. Whereas each fairness and stuck earnings suffered throughout the first quarter, a balanced 60/40 method should still make sense as a reasonably aggressive portfolio for some traders. The equities can present upside potential, whereas mounted earnings might help defend on the draw back whereas nonetheless providing the possibility for a optimistic yield.

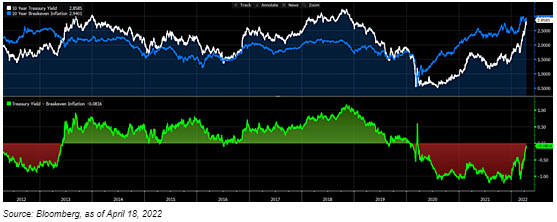

Each equities and bonds fell within the first quarter as actual yields and inflation expectations rose; this was an unusual mixture since rising actual yields can be anticipated to gradual inflation. The chart beneath is certainly one of my favorites to indicate what degree of curiosity you possibly can anticipate after inflation. The white line is the 10-year Treasury, the blue line represents 10-year inflation expectations, and the underside panel exhibits the distinction, which represents the true fee of curiosity.

Within the backside panel, it’s obvious that actual rates of interest are near zero and really near pre-pandemic ranges. Wanting on the elements of actual charges, we see that inflation expectations (the blue line) are the best they’ve been prior to now 10 years, whereas nominal charges are lower than 50 bps from their 10-year excessive, a degree that was maintained solely briefly earlier than the pandemic. This fee spike is probably going inflicting many to query whether or not the conservative investments they’ve been investing in are literally conservative.

The pace at which charges rose precipitated the ache within the first quarter, however will probably be troublesome for the market to repeat that spike on condition that it has priced in a big variety of Fed fee hikes. Whereas it’s definitely doable for the Fed to grow to be much more hawkish and inflation to stay stubbornly excessive, these dangers are beginning to be balanced out by the potential for a recession or a slowdown in development.

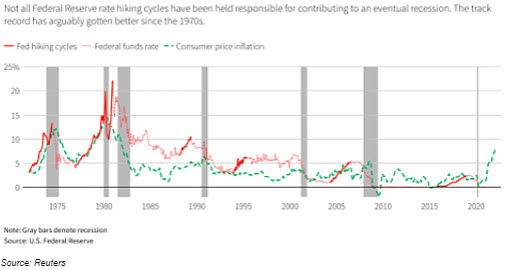

One other concern is that the Fed received’t be capable to engineer a tender touchdown (i.e., deliver down inflation with out inflicting a recession). Wanting again, you possibly can see within the graph above that recessions have adopted climbing cycles a number of instances, so this could possibly be a state of affairs the place mounted earnings may profit. Alternatively, there have been optimistic examples of soppy landings as nicely, resembling in 1994 (when the Fed doubled rates of interest in simply 12 months) and the newest cycle beginning in 2016. With corporations and customers in nice form, a tender touchdown is an efficient chance and one the place equities may carry out nicely, which might assist offset any potential weak point of mounted earnings.

Wanting Ahead, Not Backward

The advantages of a 60/40 portfolio are because of the historic monitor report of low correlation between bonds and equities described above, which prepares it for a broad vary of outcomes. We don’t need to solely put together for what simply occurred, particularly in a really rare state of affairs. So, whereas the options to a 60/40 portfolio may be helpful instruments within the toolkit, if charges are shifting again towards impartial, as all the time, traders ought to take a long-term perspective; take into account their funding goal, threat tolerance, and funding targets; and resolve whether or not shifting again to impartial is sensible for them.

Investments are topic to threat, together with the lack of principal. Some investments should not acceptable for all traders, and there’s no assure that any investing aim will probably be met.

Editor’s Word: The unique model of this text appeared on the Unbiased Market Observer.