Rossby Monetary, a Melbourne, Fla.-based registered funding advisor launched in March 2023, has added three female-led wealth administration practices to its platform with a mixed AUM of about $150 million. All three be part of from Cambridge Funding Analysis, and cited Rossby’s subscription payment construction as one attraction.

Pink Oak Advisors, led by Jennifer Szeklinski, joins Rossby, and is predicated within the better Milwaukee space. Szeklinski’s agency focuses on monetary teaching and generational wealth constructing.

Rossby additionally added Life Methods Monetary Companions, a agency primarily based in Augusta, Ga. and led by Kelly Renner. The agency offers monetary planning for small enterprise homeowners, widows, retirees and army or former service members.

The RIA additionally welcomed EViE Monetary Group, an Higher Marlboro, Md.-based apply led by Melissa Reaktenwalt. The agency focuses on socially accountable investing.

Rossby Monetary was created early final yr by Andrew J. Evans, a former government vice chairman at Tag Advisors, a $14 billion AUA workplace of supervisory jurisdiction with Cambridge Funding Analysis.

Evans stated he was bored with ready for the business to meet up with the remainder of the world by way of know-how and “antiquated” pricing. He thought advisors ought to have extra flexibility round how they choose and pay for the instruments and companies that finest go well with the wants of their apply.

“It was time for a change,” he advised WealthManagement.com. “Most companies are simply doing steady enhancements inside the programs they have already got, versus biting the bullet when one thing doesn’t work and saying, ‘Let’s burn it down and construct a brand new one.’ They could have put cash into it, but when it’s not working, eliminate it. The angle I had was, ‘why are we ready round for this stuff? Why don’t we simply make it higher?’” he stated, explaining that the brand new enterprise is an try to do precisely that.

Evans filed a Type ADV with the U.S. Securities and Alternate Fee that permits for a broad vary of service choices and buildings, laid the groundwork to supply an ever-evolving menu of know-how instruments and revamped the normal fee construction. The objective is to allow advisors to offer a bespoke set of household office-type companies with out working into compliance roadblocks or spending cash on parts they gained’t use.

Headquartered an hour south of the Kennedy House Heart on Florida’s east coast, Rossby has a complete of $185 million in belongings. It at present has 10 advisors throughout six companies on the platform, together with Evans’ personal small, personal apply. That doesn’t embrace EViE Monetary Group, which remains to be transitioning about $50 million in belongings to Rossby.

It might appear modern within the wealth administration house however, as Evans will inform you, his method to pricing is nothing new.

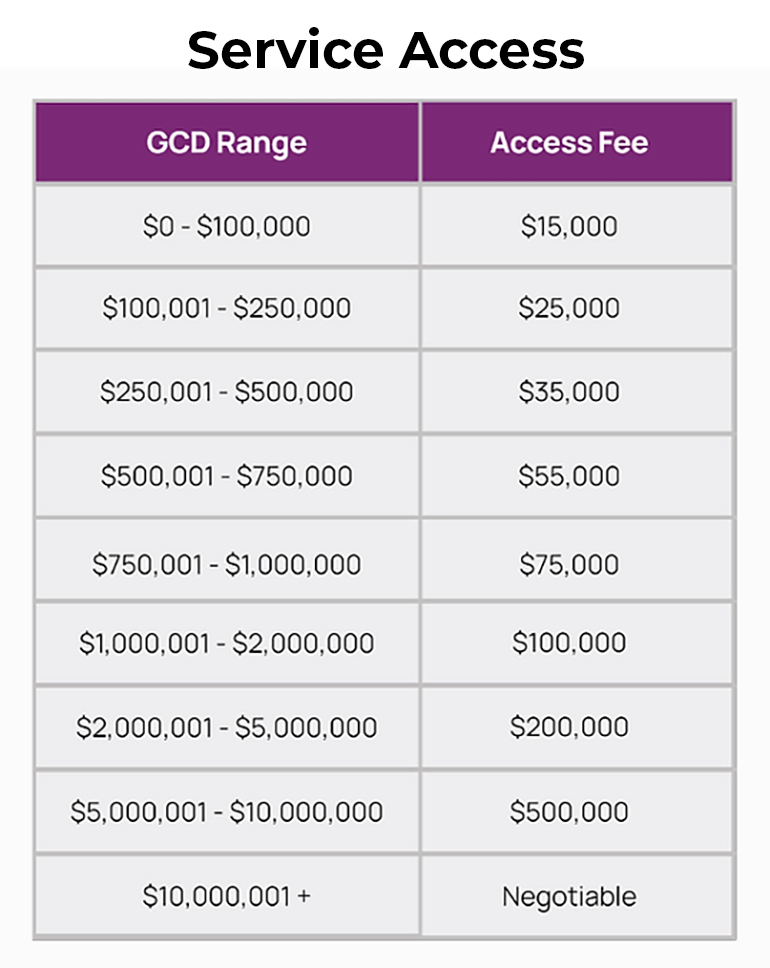

“We don’t have foundation factors,” he stated. “We do not have payouts. You might have an entry payment, you could have a knowledge cost, and you’ve got a per advisor cost.”

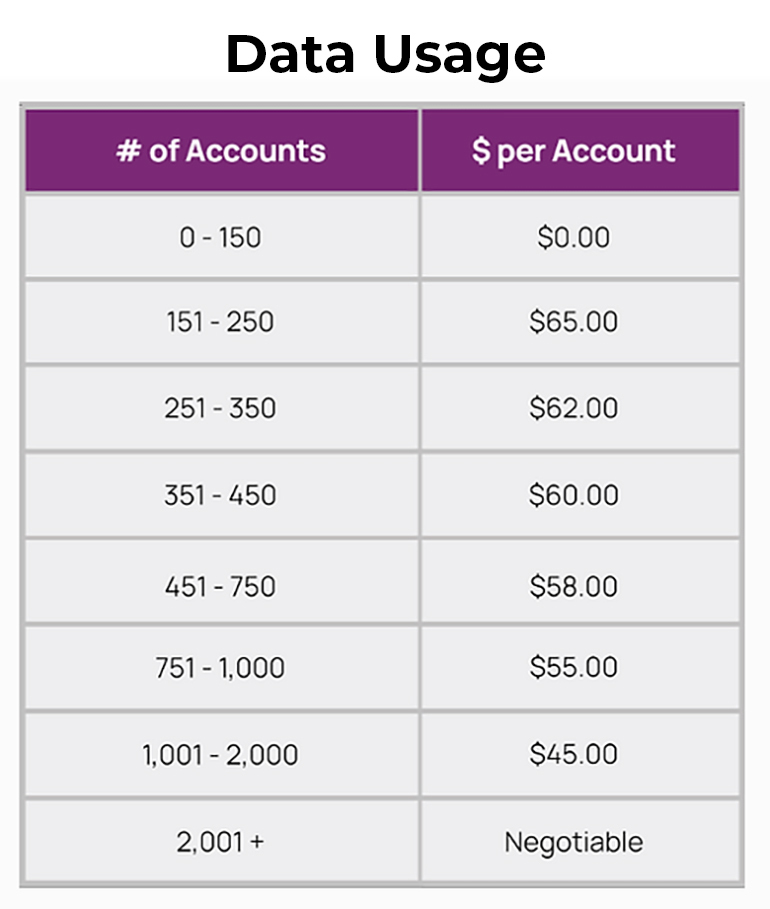

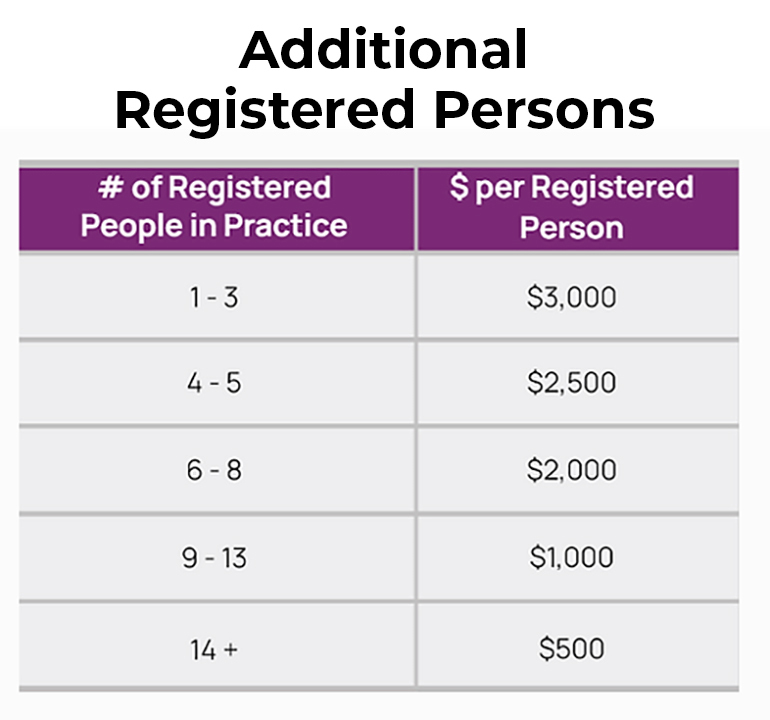

The construction is modeled after mobile phone contracts. The entry payment covers the naked necessities, akin to recordkeeping and regulatory instruments, together with compliant textual content messaging, whereas the info prices apply to any further instruments they select to entry and what number of consumer accounts they help. Levied to offset the price of E&O insurance coverage, the per advisor cost applies to any further registered advisors utilizing the platform, however not help workers.

“You are paying for what you want at a baseline stage, after which every little thing else is yours to do with what you please,” Evans stated. “I don’t care what CRM you could have; I do not care what device you could have. So long as it stories to me, it does not matter.”

Rossby’s overhead is overwhelmingly composed of mounted prices. It is going to additionally allow him to supply fractional packets of sure companies and negotiate giant group pricing on others, he added, which is able to finally enable him to scale back platform costs as extra companies be part of.

“I like the concept,” stated Nexus Technique President Tim Welsh. “I believe it’s extremely clear and all that good things, nevertheless it’s extraordinarily costly.”

Welsh gave the agency credit score for “modern unbundling of bundles.”

Christopher Marsico, proprietor of the primary agency to affix Rossby and an fairness accomplice, identified that low cost offers can be found, together with a 15% worth break for signing a three-year contract and a “kickstarter” promotion for advisors early of their careers—a flat annual payment of $5,000 over the primary three years.

Rossby is prepared so as to add nearly any desired device that passes its due diligence course of, Evans famous. The agency’s major custodian is Charles Schwab, however advisors are welcome to attach with any (and as many) others as they want, together with SEI.

Because the Black Diamond-based platform grows and extra suppliers plug in, Evans stated he plans so as to add new workers at across the similar price as he provides new companies to the platform. He expects to rent eight or 9 this yr, bringing the agency to not more than 16. The plan is to pair seasoned professionals with rising expertise to make sure the agency’s longevity and continuity.

He prolonged fairness possession to all early joiners, a restricted window anticipated to shut early this yr.

Rossby is open to M&A alternatives, he added, however isn’t concerned with serving finish purchasers. Slightly, the bought agency could be absorbed, and its ebook of enterprise could be transferred to a youthful platform advisor.

Evans stated the agency might contemplate taking over a non-public fairness accomplice or different exterior capital down the street. However he stated there’s no want for that within the close to time period, and he could be cautious of giving up greater than a small minority.

Echelon Companions Managing Director Mike Wunderli stated the enterprise mannequin reminds him of a small turnkey asset administration program.

“Many different pseudo-TAMPs have the same pricing construction,” he advised WealthManagement.com, describing an ostensible markup as “good and justifiable.” He additionally famous the obvious use of a “personalized API wrapper” to supply a spread of third-party apps on a single platform, in addition to Rossby’s stance on M&A.

“That’s additionally consistent with most of the TAMPs that we’re talking to not too long ago,” Wunderli stated. “It’s a stable mannequin as a result of it’s a value-add to their purchasers, grows their consumer base, could possibly be a worthwhile lending enterprise, and will finally be a strategy to get fairness possession of their purchasers’ companies in the event that they resolve to go that path.”

“The place I imagine we’ll win is with the under-50 advisor who could be very tech-forward and planning-focused, and actually desires to stay and function within the true digital nomad sense,” stated Evans. “Somebody who actually embraces flexibility and transparency, with full and honest disclosure into what it’s they’re paying for.”

The agency is known as after Nineteen Thirties meteorologist Carl Rossby, who laid the groundwork for understanding atmospheric turbulence along with his work on “Rossby waves,” which in the end made it safer to journey by each air and sea. Evans stated he needed a reputation that may replicate “calm, blue ocean and clear skies.”

Managing Editor Diana Britton contributed to this report.