A reader asks:

Josh is correct that I’m inclined to belief my cash with somebody that I like, which I’m positive was the thought behind all of the content material you place out. My query is – when do I do know it’s time to make that decision? I’ve a aim quantity in thoughts which I’m monitoring in the direction of properly. However I’d hate to be underneath/over-aggressive as I attain the purpose of approaching retirement. I’m at the moment seemingly 14-16 years away from retirement. However when do I make the decision for assist? 5 years away from retirement? One yr? Six months?

It is a query tens of millions of individuals will likely be asking themselves within the coming years.

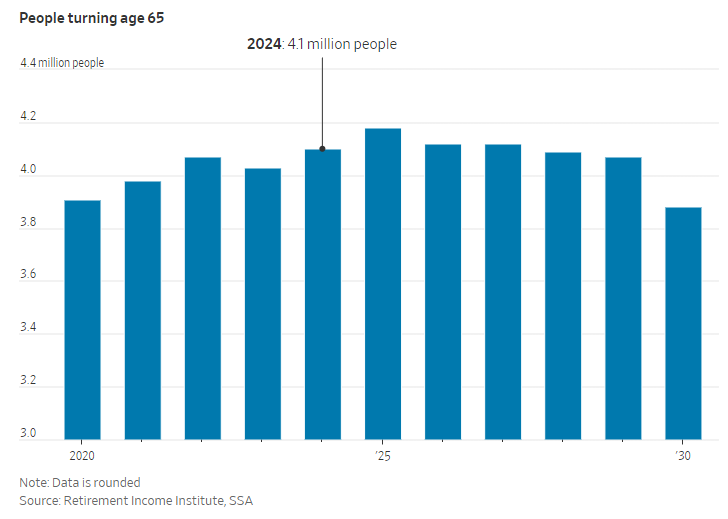

The Wall Road Journal notes there are extra People turning 65 this yr than at any level in historical past:

There are going to be 4+ million individuals reaching conventional retirement age yearly for the remainder of this decade.

The child boomer era controls greater than $70 trillion of wealth. They’re retiring in droves. We’ve by no means seen a wave of older individuals management this a lot cash earlier than.

This is among the causes I’m so bullish on the wealth administration business. Many of those new retirees will likely be looking for out monetary recommendation within the years forward.

In fact, not everybody wants an advisor.

I’ve spoken to a whole bunch (possibly 1000’s?) of DIY traders through the years who research these things themselves, have a plan, and observe that plan. Many of those individuals can deal with it on their very own.

That’s tremendous.

However there are many individuals who can not or don’t wish to.

Listed below are the largest causes you must rent a monetary advisor:

You’ve an enormous life occasion. For many individuals it’s retirement however it might be a loss of life within the household, marriage, youngsters, inheritance, the sale of a enterprise, inventory choices, and many others.

Generally life forces your hand and it is advisable to search outdoors counsel.

Your monetary scenario is getting extra advanced. As you develop your wealth the stakes are inclined to get larger as a result of you’ve extra to lose.

Folks hunt down monetary consultants when their monetary circumstances turn into extra advanced to cope with.

You don’t have the time or inclination. There are many individuals who merely don’t have the bandwidth of their life to handle their funds successfully.

In order that they outsource.

These things could be exhausting in the event you don’t know what you’re doing or produce other stuff occurring in your life that requires your full consideration.

Many individuals have higher issues to spend their time on than enthusiastic about their portfolio or monetary plan on a regular basis.

You too can let another person stress about your cash so that you don’t need to.

You’re apprehensive about key particular person danger. I’ve talked to loads of prospects through the years who’re completely comfy and able to managing their very own cash.

However typically occasions they’ve bought a monopoly over the household funds. They know the varied accounts the place the cash is saved. They’ve all of the passwords. They handle the portfolio. They deal with the taxes.

And their partner is out of the loop.

I perceive how this occurs. A number of relationships divide and conquer.

What occurs to your loved ones if one thing occurs to you? What when you have a well being scare or get hit by a bus?

Having a crew that may assist your loved ones is a type of insurance coverage on your dependents.

You’ve made an enormous mistake. I do know a solo practitioner who runs his personal RIA and recurrently turns down enterprise. He tells prospects: You aren’t able to be my shopper but. Come again to me in just a few years after you’ve made some errors.

He solely desires to work with shoppers he deems prepared to purchase into his type of wealth administration.

Some individuals solely come to the conclusion they need assistance after they’ve made a crippling error with their cash.

You’re confronted with an enormous monetary determination. Huge monetary choices are not often black or white however slightly a shade of gray. You possibly can go down the rabbit gap of trade-offs and turn into paralyzed with concern you’ll make the flawed selection.

One of the best monetary advisors don’t simply let you know what to do; they offer you a greater decision-making framework to make good selections time and again.

Some individuals search monetary recommendation to assist make extra knowledgeable choices.

You want a monetary plan or assist defining your objectives. The quantitative stuff is the straightforward a part of the method. There are many advisors who can stroll you thru the spreadsheets and Monte Carlo simulations.

It’s the qualitative features of economic planning that really matter.

What are you going to do together with your time?

What’s your relationship with cash?

What are your desires and aspirations, and the way can your monetary plan make it easier to fulfill them?

How are you going to use your cash to fund contentment in life?

The timing of the advisor determination is dependent upon how a lot your causes for looking for recommendation are weighing on you.

The excellent news is there is no such thing as a hurt in having a handful of conversations with totally different advisors. You don’t need to signal a blood oath after your first assembly.

You possibly can store round a little bit to see how totally different advisors deal with issues like monetary planning, portfolio administration, tax planning, property planning, insurance coverage providers, and many others.

Belief is a key element in any service enterprise and monetary recommendation is not any totally different in that respect.

You need to definitely discover somebody you belief to handle your cash however be sure that it’s additionally somebody who may also help relieve no matter cash stresses you’ve in life.

We lined this query on the newest version of Ask the Compound:

Josh Brown joined me once more this week to debate questions on profession recommendation for youthful advisors, when it is sensible to rent a monetary advisor for retirement, 401ks vs. brokerage accounts and methods to deploy money within the face of all-time highs within the inventory market.

Additional Studying:

How Wealthy Are the Child Boomers?