You begin out making a funds with one of the best intentions, then life occurs. You get carried away swiping your card and earlier than you realize it your funds is blown…..once more! Or perhaps you unintentionally overspend on the grocery retailer? You then throw your funds away as a result of the sudden expense or overspending causes you to blow your funds.

You could have even uttered the phrases, “Oh, I’ll begin over subsequent month.” I do know I can’t be the one one which does this! You suppose your funds will solely work if it’s good, so that you scrap it each single time you overspend.

To be completely sincere, our household acquired into this unhealthy behavior once we first began budgeting. As quickly as one thing went mistaken (as a result of one thing at all times comes up), we might throw within the towel and vow to do higher subsequent month.

The issue?

Then we’d overspend and revert again to our previous habits. This was holding us from reaching our monetary targets sooner. The expectation to have every thing good with our cash and our funds 24/7 was inflicting us to fail with budgeting.

It solely took a number of months of repeatedly “beginning over” to comprehend we have been setting ourselves up for failure. We have been actually dropping out and giving up month after month.

Know that you’re not alone. In actual fact, Individuals on common spend $7,400 greater than they make every year. That statistic isn’t to encourage you to spend greater than you make, however to let you realize that you’re not alone in your battle. And guess what! Your funds won’t ever be good, and that’s okay!

Budgeting is much less concerning the math and extra about your flexibility and willingness to keep it up even once you overspend.

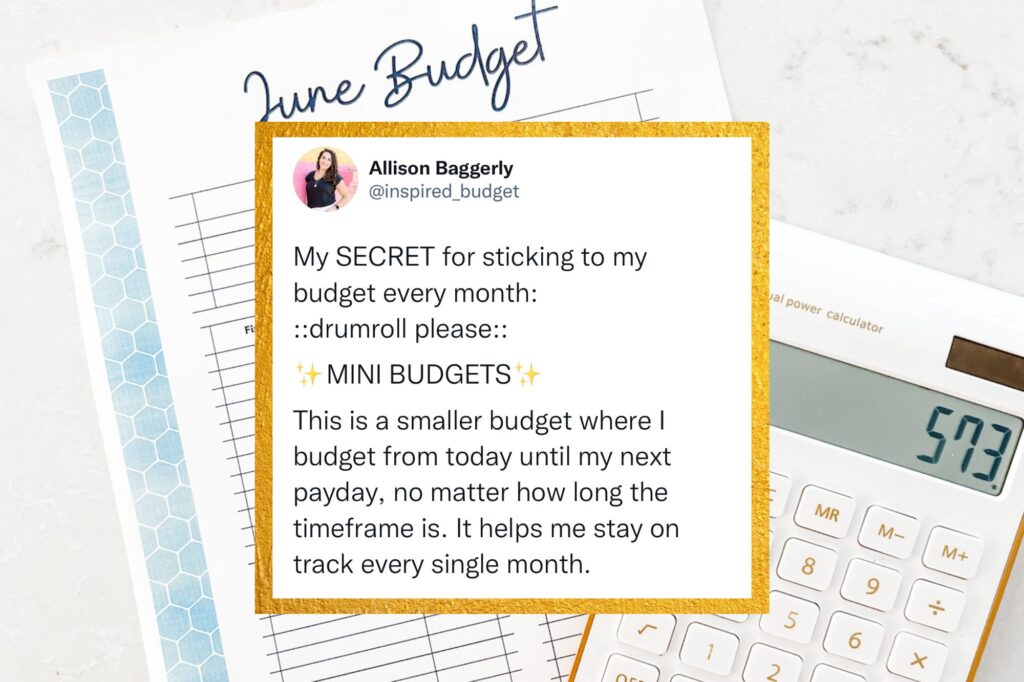

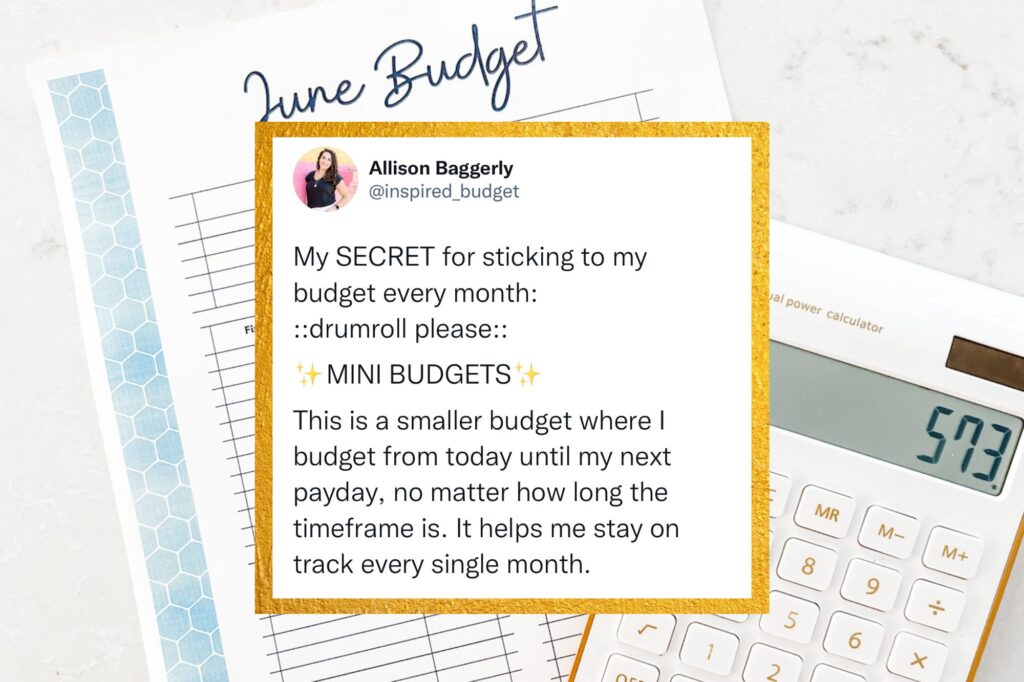

So as an alternative of beginning over the following month, we discovered a strategy to simply preserve going once we felt like dropping out. We began writing mini-budgets!

Mini budgets have saved our household’s funds month after month. They gave me peace of thoughts and have compelled me to really know what’s happening with my funds.

What Is A Mini-Finances?

An everyday funds is a funds that you simply make from one payday to the following. So for those who receives a commission on Friday, you’ll make a funds from Friday till your subsequent examine is available in.

However what in case your funds doesn’t go as deliberate? What if there’s an sudden physician’s go to? Otherwise you overspend on a Goal buying journey? That’s the place mini-budgets are available in!

A mini-budget is a smaller funds the place you funds from at this time till your subsequent payday, irrespective of how lengthy the timeframe is.

As an example, my husband and I used to receives a commission as soon as a month (on the identical day). That’s a lengthy time to stay to a funds. A LOT can occur in a month! The possibilities of our funds completely matching what we anticipated was not nice.

Prior to now, I’d throw out the funds as quickly as we went over in a sure class. I felt like a failure, so I’d toss it out. Nonetheless, I discovered that as an alternative of throwing away your complete funds, I might simply rewrite a very new mini-budget.

Why You Want A Mini-Finances

A mini-budget helps you’re taking again management of your funds once you’ve gotten off monitor. As a substitute of throwing the funds out the window, you create a mini-budget that will help you get again on monitor together with your monetary targets.

It’s just like getting off monitor together with your meal plan at Thanksgiving. You don’t simply say “Oh effectively. I’ll begin over subsequent month”. You get again to meal planning and preserve going. In the event you miss a day on the gymnasium, you don’t simply cease going. You make your strategy to the gymnasium and preserve figuring out. In the event you’re late to work, you don’t cease going to work. You determine why you have been late and repair it.

That’s what a mini-budget does to your funds. It helps you repair any issues that got here up in the course of the month. Making a mini-budget and getting again on monitor once you simply wish to wallow and beat your self up takes self-discipline. It makes you uncomfortable since you’re not used to it, however guess what?

“Discomfort is the forex to your goals.” – Brooke Castillo

“If you’d like one thing you’ve by no means had, you have to be keen to do one thing you’ve by no means achieved.” – Thomas Jefferson

Don’t anticipate it to really feel good proper now. Anticipate it to really feel good once you have a look at your funds on the finish of the month and also you solely went off monitor for 4 days as an alternative of 15 such as you did final month. That’s when it’ll really feel good.

A mini-budget can also be an effective way to dip your toes into the world of budgeting. You don’t have to attend till payday. You don’t have to attend till Monday. Begin now. Begin at this time.

How To Write A Mini-Finances

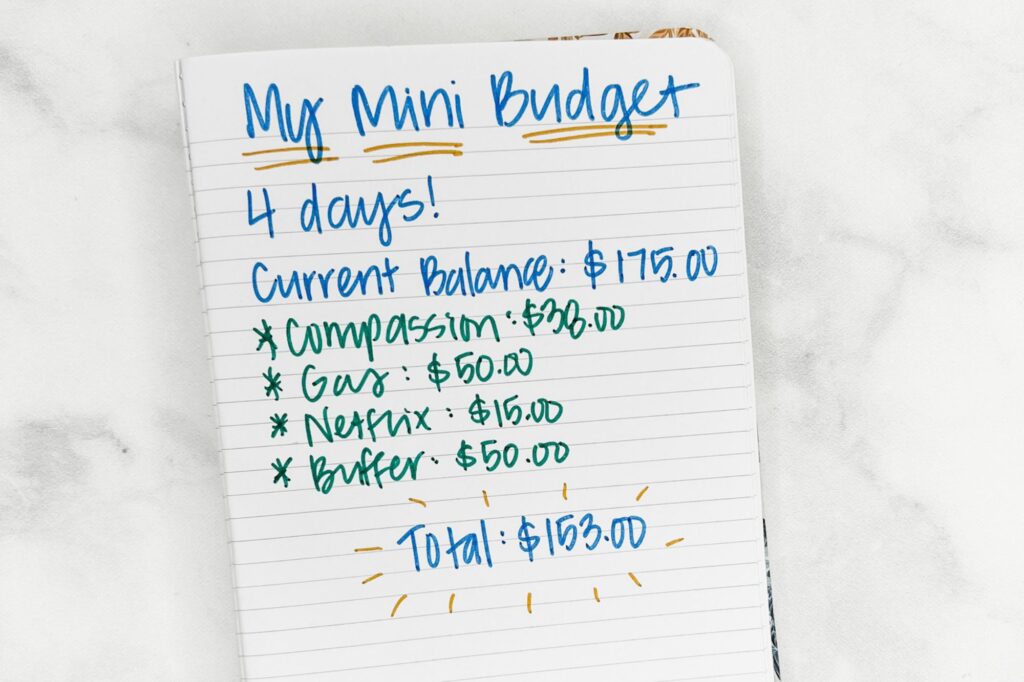

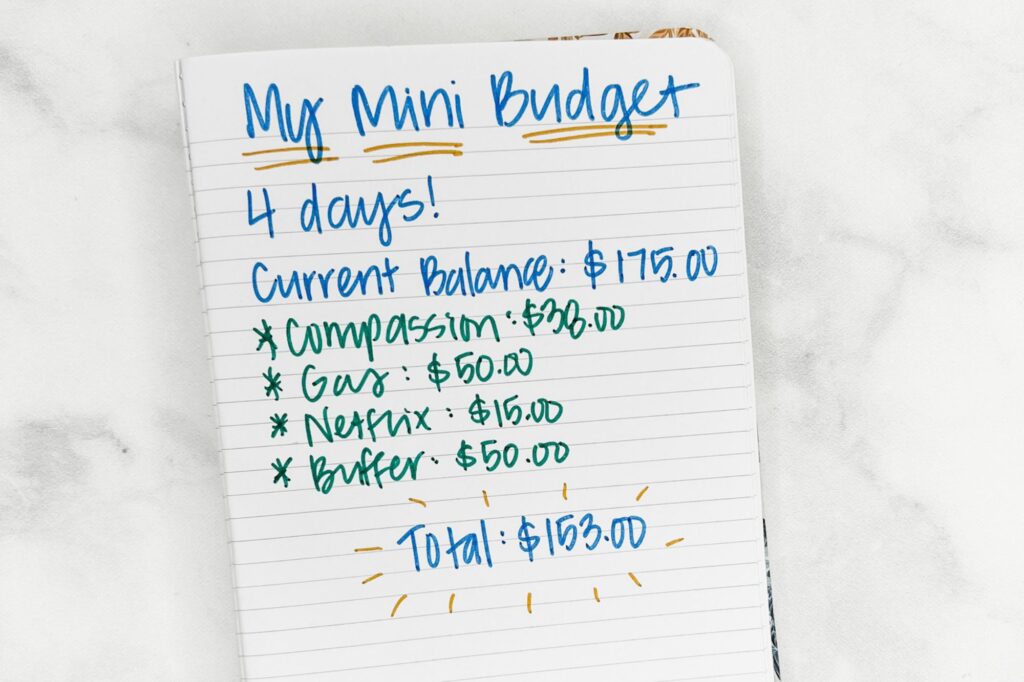

Step 1: Write down the present stability in your checking account.

This may be the toughest step, however it’s the most important. Whenever you overspend, you may be tempted to disregard your downside. In the event you ignore the issue, it doesn’t exist, proper? Improper. That’s what we prefer to suppose to ease the frustration of coping with the issue, however it could possibly’t be farther from the reality.

Sit down, pull out your telephone, and open your on-line banking app. Write down your stability. When you’ve got any checks or transactions that must clear, remember to deduct these from the stability.

A fast tip to see if any checks are nonetheless excellent: Get your checkbook and determine what the examine quantity is for the final examine you wrote. Search that examine quantity in your app. You could have to broaden the times within the filter. Work backward about 10 checks and see in the event that they cleared.

You need to now have your actual updated stability to your checking account.

Step 2: Decide what number of days you will have till your subsequent payday.

Have a look at your calendar and determine when your subsequent payday is. What number of days from at this time till that date?

This step will assist you determine what number of days your mini-budget might want to final.

Step 3: Checklist out your bills.

Make an inventory of bills you anticipate to have from now till payday. Don’t neglect to incorporate payments on auto-draft too. In the event you aren’t positive which payments you will have arising, try your final month’s financial institution assertion or your funds binder for steerage.

Don’t neglect to examine your calendar and be sure you don’t have any occasions arising that you simply’ll must funds for (like birthdays, Christmas events, and so on).

Step 4: Create your funds

Create your funds utilizing the cash you will have left in your account and the bills you will have leftover to pay by means of your subsequent payday.

In the event you don’t come up with the money for to cowl your bills, listed below are some choices for you:

Step 5: Put up your funds the place you possibly can see it day by day.

Put up your funds the place you possibly can see it day by day. Return and reference it typically to be sure you’re not on monitor. If you end up off monitor once more, write one other mini-budget.

A fast strategy to see for those who’re off monitor is to put your funds right into a budgeting app. I personally use and love Quicken for this. It’s going to assist let you know in real-time for those who’re on monitor or not.

PS: for those who hate balancing your checkbook, Quicken will assist you preserve monitor of your precise stability in your checking account so you possibly can ditch your examine register.

3 Advantages Of A Mini-Finances

1). Mini-budgets help you preserve going and salvage the funds.

Mini-budgets assist you to only preserve going. As a substitute of giving up, you’re getting again on monitor! You understand there’s a downside (a blown funds) and also you got down to repair it as an alternative of simply saying you’ll begin over subsequent month.

This step creates a lot psychological progress!! Giving up is simple. To only preserve going is the place the actual work and progress is.

2). Mini-budgets maintain you accountable.

Mini-budgets are wonderful as a result of not solely do they maintain you accountable to your funds, however they help you be versatile together with your funds. Nobody is ideal and no funds is ideal. Each funds will must be tweaked some and that’s okay!

You’ll be able to see what occurred and take steps to forestall it from taking place sooner or later. Kinda like once I saved overspending on my bank card once more.

Take into account that is NOT to beat your self up. Nobody has ever talked so unhealthy to themselves that they only magically modified all of their unhealthy habits. It’s important to be good and compassionate to your self. Say to your self, “I’m studying to handle my cash higher”.

3). They set you up for fulfillment.

Writing a mini-budget helps you set your self up for fulfillment. You’ll be extra conscious of the place you stand financially and learn how to proceed rising nearer to your cash targets!

Everyone knows ignoring your funds received’t make them get any higher. Whenever you dig down deep and get your arms soiled is the place the magic occurs. You begin slowly turning into higher and higher with cash.

The objective is NOT to be good. The objective is to maintain enhancing. Hold placing one foot in entrance of the opposite.

What To Do If You Don’t Have Sufficient Cash Till Payday

There could come a time once you don’t come up with the money for to make it till payday. If that occurs, then observe these thee steps under.

1. Pay to your 4 partitions first.

Pay for your home, energy, water, groceries, fuel, automobile fee, and telephone first. Don’t fear about every thing else.

2. Reduce bills.

Drastically minimize your bills. Create a bare-bones funds if you must.

Different methods to chop bills:

- Reduce down your telephone plan.

- Attempt to make do with the meals you will have at residence or solely get restricted groceries.

- Reduce out cable for those who nonetheless have it.

- Promote stuff on Fb Market.

- Do some odd jobs. (Cleansing, baking, reducing grass, and so on.) for more money.

- Alter a few of your funds classes and spend much less.

Concepts that will help you get began:

- Lower your fuel class by not driving as a lot to save lots of on fuel.

- Transfer your hair appointment out a number of weeks.

- Cancel the household restaurant journey.

- Return some objects you don’t must the shop.

3. Give your self grace.

Give your self grace. It took guts and braveness to tear off that band-aid and create a mini-budget. Give your self props for getting began! You deserve it. Do no matter it’s essential to do to make your funds equal out. Don’t be afraid to get inventive.

What NOT To Do When You Create A Mini-Finances

1. Don’t beat your self up.

Everybody has blown their funds. Most individuals have handled overdraft charges. Everybody has spent greater than they needed to. Everybody has been in your sneakers earlier than. Don’t speak all the way down to your self. Be keen to offer your self grace.

2. Resist the urge to switch cash out of your emergency fund.

Make this the last-ditch effort. You don’t wish to get into the behavior of regularly transferring cash from financial savings because of overspedning. You wish to construct self-discipline. You don’t wish to preserve relying in your financial savings account to bail you out of minor emergencies.

3. Don’t get a money advance.

Don’t take cash off of your bank card. This prevents you from constructing that self-discipline muscle of sticking to your funds. You don’t want to begin relying in your bank cards to pay your payments. It is advisable to discover ways to funds with the cash you’re paid. You don’t wish to get into the behavior of residing off greater than you make.

4. Don’t get a 401k Mortgage.

Once more, that is NOT an emergency. You simply overspent cash. You don’t want to take cash out of your 401k. There are a ton of early withdrawal and tax penalties for withdrawing out of your 401k. It’s not price it. It prices you WAY TOO MUCH cash.

5. Don’t ignore your issues.

This may sound so easy, however don’t ignore your issues. Ignoring your issues is rarely an excellent plan. Whenever you ignore your issues, they compound on prime of one another and you find yourself with an even bigger mess than once you first began.

Making a mini-budget will assist you in additional methods than you possibly can think about. It’s going to assist you simply as a lot mentally as it’s going to together with your cash. It’s going to assist you study to develop and face your issues as an alternative of ignoring them and brushing them underneath the rug. Be keen to study out of your errors and get higher. Know higher. Do higher. That’s all it’s essential to do.

The Backside Line

Look, budgeting isn’t a stroll within the park, and all of us mess up typically. That’s okay! In the event you discover you’ve blown by means of your month-to-month funds, don’t simply surrender and await a brand new month to begin. Strive making a “mini-budget” to get your self again on monitor. Belief me, it’s a game-changer. This manner, you’re not simply ignoring the issue, however tackling it head-on, so that you’re much less prone to make the identical errors subsequent time.

The purpose is to not be good, however to maintain enhancing. Overlook about feeling responsible or pressured; a mini-budget helps you get management again and units you up for a extra financially safe future. So, cease ready for the right second to begin budgeting, and provides mini-budgets a strive. You’ve acquired this!