What is going to 2024 deliver? It may be enjoyable to make predictions about what’s to come back (The Bear besting fan favourite Ted Lasso for excellent comedy collection? A Tremendous Bowl with out the Kansas Metropolis Chiefs & Taylor Swift?), however the considered an unsure future also can deliver anxiousness. Elections and the adjustments they might deliver, together with ongoing geopolitical tensions and questions concerning the Fed’s rate of interest coverage and its affect on the economic system are sufficient to invoke nerves in even probably the most assured buyers heading in to 2024.

The excellent news is that our monetary success over the long run doesn’t must be decided by these externalities. Whether or not you might be accumulating wealth for objectives like retirement or making a legacy, having fun with the life-style that your wealth allows, otherwise you simply wish to be financially unbreakable, constant conduct and a deal with what’s in our management is essential. Learn on for some issues to contemplate as the brand new 12 months unfolds.

1. Save & Make investments No Matter the Atmosphere

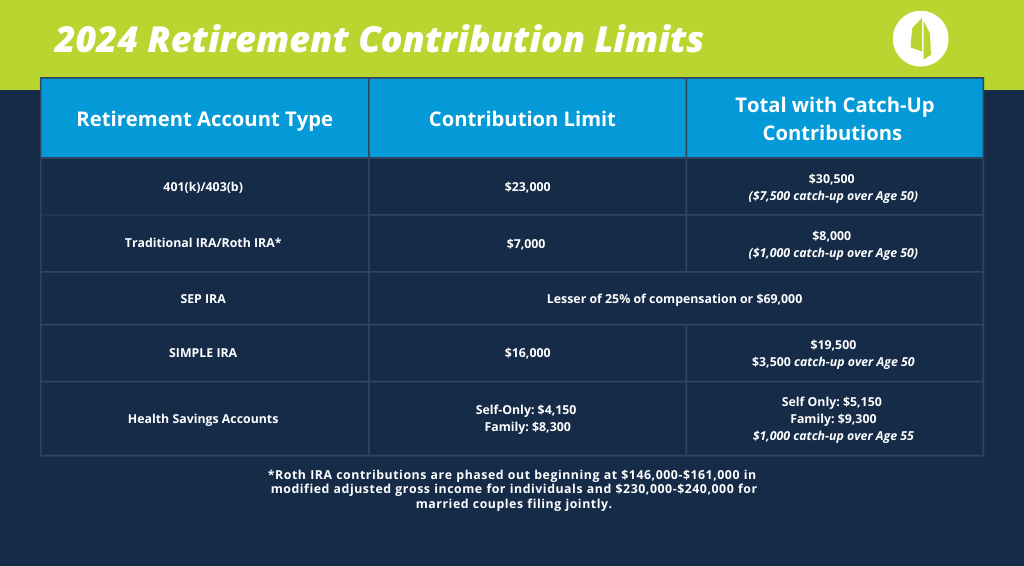

The beginning of the 12 months is a superb time to evaluate present contribution limits for tax-deferred accounts like retirement accounts and Well being Financial savings Accounts. Be sure you are set to effortlessly maximize these as you’re able. Organising common automated contributions to retirement and even taxable funding accounts makes it extra possible that you’ll proceed investing and never get derailed when issues get robust out there. Automated doesn’t imply “set it and overlook it” although. Contribution limits change yearly, and varied provisions of the Safe Act 2.0 kick in over a lot of years, altering the retirement financial savings panorama.

2024 Contribution Limits:

Just a few issues to know from the Safe Act 2.0 in 2024 and past:

- Employers can begin making Roth matching contributions to an worker’s 401(okay). Beforehand, employers may solely make matching contributions on a pre-tax foundation. Not all employer plans have a Roth choice – however this may occasionally compel extra companies to incorporate this of their plan design.

- Excessive earnings earners over 50 have just a few extra years earlier than catch-up contributions to a 401(okay) are required to be Roth vs. pre-tax. This provision was supposed to start in 2024, limiting a chance for these whose wages exceeded $145,000 in 2023 to scale back their taxable earnings with pre-tax contributions past the usual 401(okay) deferral restrict.

- Catch-up contributions for IRAs and Roth IRAs will enhance with inflation in $100 increments somewhat than remaining a flat $1,000/12 months beginning in 2024.

- By 2025, catch-up contributions to office retirement accounts will enhance much more for these between 60-63, permitting you to avoid wasting extra in what could also be your highest-earning years. The improved catch-up would be the higher of $10,000 or 150% of the catch-up contribution quantity from the earlier 12 months. Remember the fact that the Roth catch up guidelines will apply to these with wages above a certain quantity (possible $145,000 adjusted for inflation).

2. Get a Deal with on Spending & What’s Regular Past Inflation

It’s been straightforward guilty greater spending on inflation the previous few years. Nevertheless, inflation doesn’t inform the total story. Way of life creep occurs very simply, particularly as salaries enhance annually. As you begin to earn more money, you possible start spending more cash with out actually feeling like issues have modified. One of many largest drivers we see in relation to long-term success of a wealth design is spending, which is one thing all of us have management over to some extent. In case your earnings has elevated over time however your saving hasn’t, it could be time to take a step again and get a deal with on the place the cash goes, ensuring that it’s according to your reply to the query “What’s the cash for?” not solely as we speak however sooner or later. Greater spending isn’t essentially a foul factor (and a latte right here and there isn’t going to derail the high-income earner’s monetary success it doesn’t matter what common media personalities let you know) – it’s simply one thing to pay attention to and perceive the way it impacts your capacity to satisfy your objectives over a lifetime.

3. Maximize the Advantages of a Traditionally Excessive Exemption for Reward & Property Taxes

As of now, elevated lifetime present and property exemption quantities ($13.61M/individual in 2024) are set to run out on the finish of 2025 if Congress doesn’t act to increase them. I gained’t opine on the chance of Congress passing something to increase them, as it will possibly actually be anybody’s guess. When you’ve accrued important wealth over your lifetime and also you want to see that wealth profit the following technology with minimal tax affect, 2024 would be the 12 months to take motion or at the least begin growing a plan so that you simply perceive how a lot your property could develop over time and what choices can be found to you to scale back it in a approach that lets you steadiness your priorities.

- Annual gifting to family members when you are dwelling may be an effective way to scale back your property over time whereas additionally seeing their enjoyment of the present. In 2024, you may give as much as $18,000 to anyone particular person ($36,000 for married {couples}) with out submitting a present tax return.

- If offering funds for training for the following technology is necessary, 529 contributions may be an effective way to earmark funds for that objective and likewise make a large present (5 years’ price of the exclusion quantity) unexpectedly.

- Irrevocable trusts, reminiscent of Spousal Lifetime Entry Trusts (SLATs), can also be an choice for these whose property exceed the exemption quantity who even have adequate property to satisfy their private spending objectives while not having any property transferred to a belief. These trusts may be complicated and require deep thought in relation to deciding the way you need the funds to profit your family members – getting began now will enhance the chance that you simply and your lawyer can execute a belief and fund it with time to spare earlier than the top of 2025.

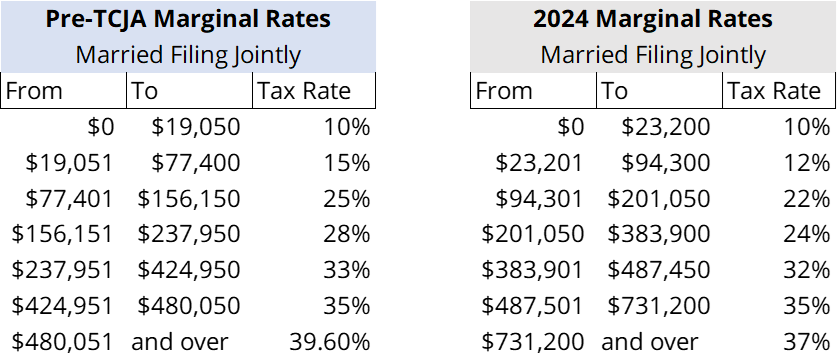

4. Begin Planning for Greater Taxes

Just like the upper exemption quantities, our present tax brackets are reflective of the Tax Cuts and Jobs Act handed in 2017 and are set to sundown on the finish of 2025. Whereas the pre-2017 brackets can be adjusted for inflation, it’s possible that extra of your earnings can be topic to greater tax charges than they’re as we speak by 2026. Somebody within the 24% bracket as we speak may simply see a superb quantity of their earnings taxed at 33% after we revert again to pre-2017 brackets, decreasing the disposable earnings they’ve grown accustomed to with decrease tax charges and impacting the quantity of portfolio property which are actually out there for spending sooner or later vs. being a tax legal responsibility.

Pre-TCJA Brackets vs. 2024 Brackets:

- Greater charges aren’t the one piece of the puzzle – greater deductions can also be allowed after 2026 for many who have been restricted to $10,000 in deductions for state and native taxes and property taxes (SALT), bringing total taxable earnings down.

- Those that are comfortably within the 24% bracket now could wish to think about changing pre-tax retirement cash (Conventional IRAs and 401(okay)s) to Roth, paying taxes at as we speak’s charges on distributions vs. unsure future tax charges. It gained’t take a lot in retirement earnings to drive greater tax charges sooner or later if there isn’t an extension of present charges or some future tax reform.

- For these over the age of 70 ½ who don’t count on to wish all of their IRA cash for his or her private spending, Certified Charitable Distributions as much as $105,000 could also be made. This may help meet a charitable intent and likewise cut back the quantity of taxable earnings that should be distributed from pre-tax retirement accounts.

- There’s no higher time than the current to take a look at your funding portfolio and the way it’s managed to make sure tax effectivity in case you are a high-income earner.

5. Evaluate Dangers Past the Market

Many individuals solely take into consideration inventory market returns as a supply of danger in relation to assembly their monetary objectives. The fact is that on a regular basis life presents dangers that may change the monetary image in a single day in the event that they aren’t deliberate for and managed. Whereas we are able to’t management what’s going to occur to us, we are able to management how we shield ourselves towards danger. When you haven’t checked out your insurance coverage portfolio shortly (life, property, legal responsibility, incapacity, and many others.) now could be a superb time to brush off these coverage paperwork and evaluate them with an expert who has your finest curiosity in thoughts.

- Inflation has pushed up development prices, and many individuals took on dwelling enchancment initiatives from 2020-2021 whereas rates of interest had been low. It’s attainable that the substitute value in your property insurance coverage is inadequate and must be adjusted.

- Life occurs quick and we don’t at all times take the time to step again and reassess our wants. When you’ve added youngsters to your loved ones, taken on liabilities, or skilled a major enhance in earnings that your loved ones depends on, chances are you’ll want to determine or enhance your life insurance coverage protection.

Comply with Your Personal Plan & Path, Not Somebody Else’s Predictions

Your imaginative and prescient and plans for the long run are uniquely yours, however it may be tempting to behave on the predictions which are little question flooding your inbox and assaulting your ears this time of 12 months. Sticking to a wealth plan and specializing in the issues which are in your management isn’t at all times enjoyable or glamorous, however it’s going to have a excessive chance of success for serving to you get to the place you most wish to go, no matter what’s occurring on the earth round you. Partnering with a wealth advisor who understands your huge image and the aim of your wealth can go a good distance in serving to you achieve the readability to focus on the controllable features of your monetary journey, paving the best way for extra favorable outcomes. I hope that 2024 brings pleasure, prosperity, and wellness. If something right here resonated with you, make 2024 the 12 months that you simply prioritize actions that allow you to understand your wealth’s objective.