Optima Tax Reduction is a legit tax aid firm that gives companies nationwide by way of a web based portal. In case your tax downside is comparatively easy, you could be higher off addressing it by yourself, however when you’re overwhelmed by the prospect of coping with the IRS, Optima Tax Reduction gives an choice. You’ll be taught extra concerning the execs and cons on this Optima Tax Reduction overview.

Essential observe: when you’re contemplating any tax aid firm, handle your expectations. No person could make all tax debt disappear. Skilled assist could get you a greater deal, however the consequence will rely in your scenario. In case you anticipate magic, you’re prone to be disenchanted.

Professionals

Outstanding firm with a nationwide presence

Trade-standard pricing and phrases

Free preliminary session

In-house attorneys and tax accountants

Cons

No public disclosure of pricing

Refunds are solely doable inside two weeks of begin.

Not all companies can be found in all states.

A number of buyer critiques complain of poor outcomes and repair

About Optima Tax Reduction

Optima Tax Reduction describes itself because the nation’s largest tax aid firm. It claims to have resolved over $3 billion in shopper tax liabilities.

The Firm is predicated in Santa Ana, CA, and has workplaces in Scottsdale, AZ, and Chandler, AZ. On-line companies can be found nationwide (besides Colorado and Minnesota).

Optima Tax Reduction employs an in-house workers of enrolled brokers, CPAs, and tax attorneys. Some tax aid firms could go your case on to an out of doors regulation agency and maintain a part of your payment.

Optima Tax Reduction was based in 2010 by Harry Langenberg and Jesse Stockwell, each of whom stay with the agency as managing companions.

How Optima Tax Reduction Works

Optima Tax Reduction will work with federal and state taxes, however state tax companies aren’t out there in all states. You want at the least $10,000 in tax debt to qualify for his or her companies.

Optima Tax Reduction works with many kinds of tax issues, together with the next.

- Tax liabilities

- Again taxes

- Levies and liens

- Penalties and curiosity

- Wage garnishment

- Tax settlement

- Audit Protection

- Payroll tax negotiation

The corporate makes use of a three-step course of.

- Session. You’ll have a free preliminary session with no obligation. A consultant will overview your case, lay out your choices, and provide you with a sensible evaluation of what Optima Tax Reduction can do for you.

- Investigation. Optima Tax Reduction will talk with the IRS, look at your data intimately, and select applicable decision choices. You’ll have to authorize entry to non-public monetary data.

- Decision. The corporate will pursue the chosen choices and attempt to deliver you into full IRS compliance. This doesn’t imply you’ll have no tax debt. The aim is to scale back your debt as a lot as doable and work out a possible fee plan for the remainder.

There are various methods to resolve tax debt, and you’ll work with Optima Tax Reduction to pick those most applicable for you. Listed here are among the choices out there.

- Installment agreements won’t cut back your money owed however will make them simpler to repay.

- Supply in compromise is accessible to taxpayers experiencing monetary misery.

- Penalty abatement or adjustment can cut back the penalties charged for earlier points.

- Extension requests could provide you with extra time to pay with out incurring penalties.

- Catastrophe-related aid gives tax breaks for folks affected by pure disasters.

- Coronavirus tax aid could also be out there at each federal and state ranges.

- Presently not collectible standing could apply when you’ve got no earnings or property with which to pay your tax debt.

- The statute of limitations could apply in some instances coping with older tax money owed.

- Harmless partner aid applies to taxpayers who’re being held accountable for a partner’s errors or transgressions.

- A tax lien discharge removes a tax lien from a selected property, which can can help you promote that property.

- A financial institution levy launch means the IRS will now not seize funds out of your checking account. It normally happens when you’ve got agreed to a fee plan or different settlement.

It’s essential to notice that each one of those gadgets are open to anybody. You don’t want a tax aid firm to use for them. Nonetheless, the method of assessing your eligibility, selecting choices which might be prone to be authorized, and making use of will be complicated and difficult.

Skilled help doesn’t assure success, however it could enhance the likelihood of success.

Availability

Optima Tax Reduction gives federal tax aid companies on-line in all states besides Colorado and Minnesota.

State tax companies can be found on-line in all states besides Arizona, Georgia, Delaware, and Connecticut.

The Price of Optima Tax Reduction: Is It Value It?

Optima Tax Reduction doesn’t disclose pricing data on its web site. Pricing data given right here is sourced from third-party web sites and buyer critiques. Costs fluctuate in response to the specifics of your case and you could be quoted costs larger or decrease than these mentioned right here.

Optima Tax Reduction seems to evaluate charges at two phases of the tax aid course of.

- Investigation: you possibly can anticipate an investigation payment of $295.

- Decision: Decision charges can fluctuate broadly with the circumstances of your case. Reported charges fluctuate from $995 to $5000 and could also be larger for complicated instances with massive tax liabilities.

These charges are substantial, however they’re in step with charges throughout the tax aid business. Optima Tax Reduction isn’t providing a screaming nice deal, however pricing seems to be truthful relative to opponents.

Whereas the general pricing scheme seems to be truthful, it’s not clear: there’s no constant pricing components disclosed on the corporate’s web site. Some buyer critiques include complaints indicating that the shoppers imagine they had been overcharged, and a few critiques report funds a lot bigger than these referenced above.

Optima Tax Reduction will refund funds for the investigation part inside 15 days after the initiation of the investigation part. No refunds are doable after 15 days or for the charges paid for the Decision part.

Optima Tax Reduction: Buyer Critiques

Buyer critiques are a great tool, however they’ve limitations. It’s essential to know easy methods to consider buyer critiques. Some critiques could also be based mostly on unrealistic expectations, and a few firms have been identified to govern critiques.

Let’s take a look at what main overview websites can inform us about Optima Tax Reduction.

Higher Enterprise Bureau (BBB)

Optima Tax Reduction has an A+ ranking from the Higher Enterprise Bureau (BBB). BBB rankings are based mostly on the corporate’s responsiveness to complaints, not on the typical of buyer critiques.

The BBB website lists 686 complaints closed within the final three years and 209 within the final 12 months. The corporate has responded to all complaints and most look like resolved to the shopper’s satisfaction

Optima Tax Reduction will get 3.88 out of 5 stars from a complete of 1,164 buyer critiques on the BBB website. The critiques break down into two classes, very constructive and really detrimental, with only a few in between.

It’s essential to keep in mind that the BBB tends to draw detrimental critiques, because it’s a spot the place folks historically go to complain when they don’t seem to be happy.

Trustpilot

On Trustpilot, Optima Tax Reduction will get 4.1 out of 5 stars from 3,116 critiques. 89% of the critiques are five-star or four-star, and 9% are one-star, with negligible percentages in between.

Listed here are some typical constructive critiques.

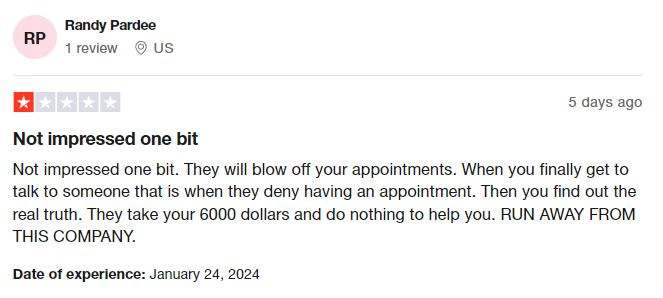

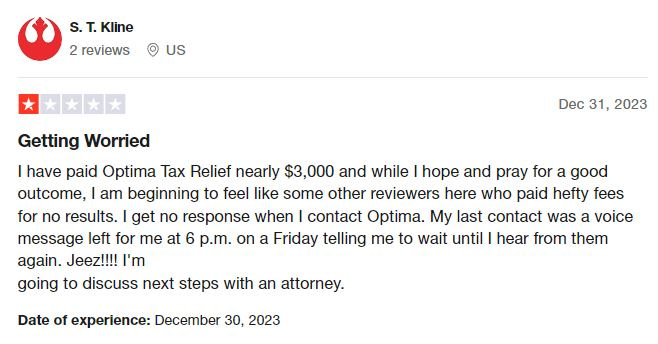

Listed here are a number of pattern detrimental critiques.

Outcomes on most overview websites appear to observe a constant sample: massive numbers of constructive critiques blended with a smaller variety of extremely detrimental critiques. Most prospects who go away critiques appear happy, however when issues go improper they appear to go severely improper.

Among the detrimental critiques could come from prospects who’ve unrealistic expectations, however that is unimaginable to determine. In case you’re contemplating retaining Optima Tax Reduction you ought to be conscious that whereas critiques are usually constructive there’s a minority who’ve had very unsatisfactory experiences.

The Backside Line: Is Optima Tax Reduction Proper For You?

Optima Tax Reduction is a legit tax aid firm with an in depth monitor document. Some prospects have left detrimental critiques, however that’s true of just about any tax aid firm, and the quantity represents a comparatively low proportion of buyer critiques.

Does that imply that Optima Tax Reduction is the suitable alternative for you? Possibly, perhaps not. Even one of the best monetary companies firms aren’t at all times the suitable match for a given shopper. To seek out out, ask your self these questions.

- How a lot tax debt do you owe? Optima Tax Reduction gained’t think about your case except your tax debt is $10,000 or above.

- Does Optima Tax Reduction present companies in your state? In case you dwell in a state that isn’t served by the corporate you’ll must search for an alternative choice.

- How complicated is your case? In case you have an easy downside – for instance, when you merely must ask for an installment settlement or an extension – you could be higher off doing it your self. In case you are overwhelmed even fascinated with coping with it, skilled assist might be a good suggestion.

- Have you ever thought of native options? A tax lawyer or agency in your space would possibly give you a aggressive bundle, and also you’d have private contact. In case you’re not comfy coping with a distant service or working by way of on-line customer support, this might be a greater choice for you.

- Have you ever shopped round? Evaluating a number of options is at all times a good suggestion whenever you’re available in the market for a monetary service. There are different tax aid firms on the market, and most supply a free preliminary session. Evaluating a number of gives is at all times worthwhile.

In case you answered “sure” to all of those, you could be a very good match with Optima Tax Reduction.

Do not forget that it is a nationwide firm with many purchasers. Your interactions aren’t prone to be private. A free preliminary session could really feel like a gross sales name, and in the course of the course of, you might be prone to be interacting with customer support representatives, not the tax consultants doing the work.

If it is a downside for you, you could be higher off consulting a neighborhood enterprise or regulation agency with a bodily presence in your space.