Somebody will at all times be getting richer sooner than you. This isn’t a tragedy.

I’ve heard Warren say a half a dozen instances, “It’s not greed that drives the world, however envy.”

Envy is a extremely silly sin as a result of it’s the one one you might by no means probably have any enjoyable at. There’s plenty of ache and no enjoyable. Why would you need to get on that trolley?

Charles Thomas Munger (1924-2023)

Annually I share with readers my unenviable portfolio. By design, my portfolio is supposed to be largely ignored for all durations as a result of, on the entire, I’ve significantly better methods to spend my time, power, and a spotlight. For many who haven’t learn my earlier discussions, right here’s the quick model:

Shares are nice for the long run (assume: time horizon for 10+ years) however don’t present enough reward within the quick time period (assume: time horizon of 3-5 years) to justify dominating your non-retirement portfolio.

An asset allocation that’s round 50% shares and 50% revenue provides you fewer and shallower drawdowns whereas nonetheless returning round 6% a 12 months with some consistency. That’s enticing to me.

“Beating the market” is totally irrelevant to me as an investor and utterly poisonous as a aim for anybody else. You win if and provided that the sum of your assets exceeds the sum of your wants. In the event you “beat the market” 5 years working and the sum of your assets is lower than the sum of your wants, you’ve misplaced. In the event you get crushed by the market 5 years working and the sum of your assets is larger than the sum of your wants, you’ve received.

“Successful” requires having a wise plan enacted with good funding choices and funded with some self-discipline. It’s that easy.

My portfolio is constructed to permit me to win. It isn’t constructed to impress anybody. To date it’s succeeding on each counts. I constructed it in two steps:

- choose an asset allocation that provides me one of the best probability of attaining my objectives. Most buyers are their very own worst enemies, taking an excessive amount of threat and investing too little every month. I attempted to construct a risk-sensitive portfolio which began with the analysis on how a lot fairness publicity – my most risky area of interest – I wanted. The reply was that fifty% equities traditionally generated greater than 6% yearly with a small fraction of the draw back {that a} stock-heavy portfolio endured.

- Choose applicable automobiles to execute that plan. My sturdy choice is for managers who:

- have been examined throughout plenty of markets

- articulate distinctive views that may separate them from the herd

- are loath to lose (my) cash

- have the liberty to zig when the market zags, and

- are closely invested alongside me.

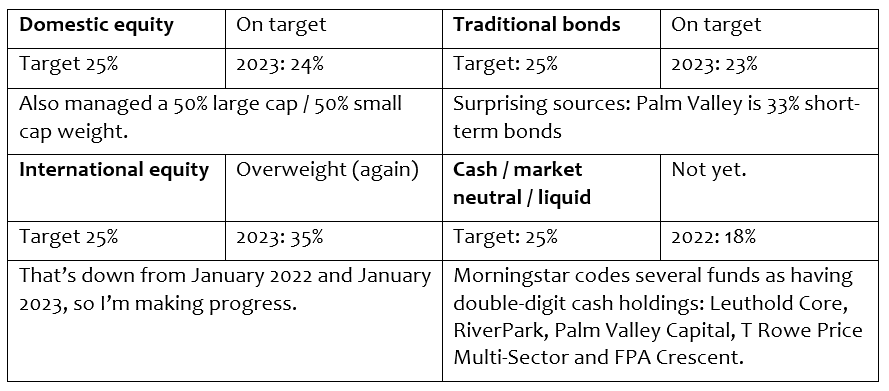

My goal asset allocation: 50% shares, 50% revenue. Inside shares, 50% home, 50% worldwide; 50% giant cap, 50% small- to mid-cap. Inside revenue, 50% cash-like and 50% extra venturesome. I’ve an computerized month-to-month funding flowing to 5 of my 9 funds. Not large cash, however a gentle funding over the course of many years.

So right here’s the place I ended up:

Because it seems, I inadvertently recreated the well-known Vanguard Wellington balanced fund, as least for 2023:

| Fairness | 2023 return | Max drawdown | Normal deviation | Ulcer Index |

Sharpe Ratio |

Martin Ratio |

Yield | |

| Snowball 2023 | 59% | 14.3 | -6.1 | 10.3 | 2.2 | 0.90 | 4.13 | 2.1% |

| Vanguard Wellington | 66 | 14.3 | -6.0 | 11.1 | 2.5 | 0.84 | 3.70 | 2.2 |

My non-retirement portfolio is invested in ten funds. Right here’s the element for the non-retirement piece:

| M-star | Lipper Class | 2022 weight | 2023 weight | 2023 return | APR vs Peer | MAXDD % | |

| FPA Crescent | 4 star, Gold | Versatile Portfolio | 22.0% | 23 | 20.3 | 8.5 | -6.2 |

| Seafarer Abroad Development and Revenue | 5 star, Silver | Rising Markets | 17.0 | 16 | 14.3 | 2.4 | -11.3 |

| Grandeur Peak International Micro Cap | 4 star, Bronze | International Small- / Mid-Cap | 15.0 | 16 | 12.5 | -2.4 | -12.6 |

| T Rowe Worth Multi-Technique Whole Return | 3 star, NR | Various Multi-Technique | 9.0 | 10 | 5.1 | -1.8 | -0.4 |

| Palm Valley Capital | 3 star, impartial | Small-Cap Development | 8.0 | 9 | 9.5 | -7.7 | -1.0 |

| T Rowe Worth Spectrum Revenue | 3 star, Bronze | Multi-Sector Revenue | 7.0 | 6 | 7.9 | 0.1 | -4.3 |

| RiverPark Quick Time period Excessive Yield | 3 star, unfavourable | Quick Excessive Yield | 6.0 | 6 | 5.6 | -4.5 | -0.2 |

| Money @ TD Ameritrade | 6.0 | <1.0 | 0 | o | – | ||

| Brown Advisory Sustainable Development | 4 star, Silver | Multi-Cap Development | 5.0 | 6.0 | 38.9 | 6.5 | -9.6 |

| Matthews Asian Development & Revenue | 5.0 | 0.0 | – | – | – | ||

| RiverPark Strategic Revenue | 4 star, unfavourable | Versatile | 4.0 | 9.4 | -2.4 | 0.5 | |

| Leuthold Core | 5 star, Silver | Versatile | 4.0 | 11.7 | -0.1 | -4.2 |

Issues to note:

-

Portfolio weights are just about unchanged from 2022 to 2023.

That displays the truth that my strategic allocation hasn’t modified.

-

I liquidated Matthews Asian Development & Revenue.

That’s a fund I purchased when Andrew Foster was nonetheless the supervisor; it’s an absolute mannequin of sanity and reliability. Just lately Matthews Worldwide has undergone an enormous variety of adjustments, with new executives and media folks coming in, managers flowing out, funds being liquidated and ETFs being launched. Over the previous 5 years, the fund has earned just below 1% a 12 months. I concluded that (a) I used to be chubby on worldwide and rising shares and (b) MACSX had the dimmest prospects going ahead.

-

I deployed most of my money.

The money at Schwab wasn’t strategic, it was only a residue of an earlier transaction awaiting a brand new dwelling. And I discovered one. Or two.

-

I added Leuthold Core.

I’ve at all times admired LCORX. The managers are exceptionally devoted and risk-conscious. Whereas it sits in the identical “field” as FPA Crescent, its quantitative self-discipline units it aside. It provides some fixed-income publicity to my portfolio and enhances my very own cautious model.

-

I added RiverPark Strategic Revenue.

I famous in our March 2023 concern I used to be searching for further fixed-income publicity, and I’ve resolved to discover a fund whose efficiency shouldn’t be tied to the destiny of the broad fixed-income market. That displays two info:

-

My long-term strategic allocation is out of whack – I’m too uncovered to worldwide shares and too little uncovered to mounted revenue, so extra mounted revenue is nice.

-

I believe most bond methods are silly. Or, on the very least, they’re largely dependent for his or her success on a really hospitable exterior setting, which I doubt will describe the rest of this decade.

That led me to discover funds that bore the title “strategic revenue.” They have been drawn from a half-dozen Lipper classes and used a dozen methods, all with the aim of producing revenue impartial of the broad funding grade bond market.

4 funds stood out for his or her risk-adjusted efficiency over the previous 5 years, together with Osterweis Strategic Revenue and RiverPark.

-

The retirement addendum

My retirement funds are gloriously boring. The huge bulk of my belongings are in two target-date funds. T. Rowe Worth Retirement 2025, a low-cost five-star fund that frequently golf equipment its competitors, and TIAA-CREF Lifecycle 2025 Retirement, a low-cost four-star fund that was one of the best Augie was providing. The latter fund will quickly be renamed “Nuveen.”

The important thing driver of my retirement at this level is momentum. Whereas I proceed to contribute about 18% a 12 months to retirement (go away me alone: I’ve a used Toyota, a small home, and a modest urge for food), I’m shut sufficient to the aim line that market forces fairly than my additions are driving issues. After the primary day on which I misplaced $20,000, I ended wanting.

I’ve about 5% of my retirement in T. Rowe Worth Rising Markets Discovery, an EM worth discover, and about 5% in TIAA Actual Property Account. Actual Property had the second down 12 months in its historical past in 2023 and I might think about shifting that cash into a set annuity as an alternative.

Backside Line

You haven’t any cause to envy my investments. I’ve no cause to envy yours. I don’t understand how a lot my brother-in-law’s portfolio made. I don’t care whether or not I beat the market, I care about whether or not I’ve a very good life and make a distinction within the lives of others. My early modeling mentioned that I wanted to earn 6% a 12 months, minimal, to have the assets to do all that. Fortunately, I’ve gotten there.