“Don’t put all of your eggs in a single basket” is likely one of the easiest methods to clarify the idea of diversification.

Whereas the above assertion places throughout the purpose very superbly, in Nineteen Fifties an individual by the title of Harry Markowitz went on to construct a mathematical mannequin. He even submitted a paper on his analysis to the Journal of Finance. Lastly, he went on to share the Nobel Prize in Economics in 1990.

Because of his effort emerged the Imply-Variance Evaluation, which turned the bedrock of the Trendy Portfolio Idea. Through the years, nearly all of the funding administration chaps use the mannequin to pick out and construct portfolios for his or her purchasers.

What Harry Markowitz put throughout was this:

- There are completely different funding securities with low correlation to one another. They show completely different behaviour at completely different instances by way of outcomes or efficiency as additionally the timing of such returns.

- One can use the previous information on danger and returns and the long run anticipated returns together with person preferences to construct an optimised and environment friendly portfolio that delivers the utmost doable returns on the minimal doable danger.

The straightforward postulation of the paper was that diversification is sweet and will be and needs to be performed scientifically. Here’s a solution to do it.

However did the skilled apply the identical rule to his portfolio?

Apparently not!

When the time got here to use the principles to himself, Markowitz chickened out.

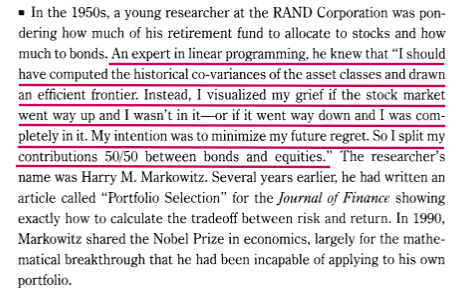

Right here’s an excerpt from Jason Zweig’s, a well-known monetary journalist, ebook Your Cash and Your Brains.

The founding father of the Trendy Portfolio Idea himself went for an equal weightage allocation.

Why did that occur? Whey couldn’t he apply the identical guidelines to himself for which he even went on to win a Nobel Prize?

Easy trumps Advanced.

The mathematical mannequin that received the Nobel Prize was simply too complicated. It calls for inputs of previous information (for a number of years) about danger (or variance) and returns as additionally anticipated future returns which might then be plotted in a number of mixtures to determine which of the mixtures of assorted property are probably to offer probably the most optimum outcomes.

Phew!

The issue begins with the info and it compounds with the truth that the previous can by no means be equal to the current or the long run.

This makes the mannequin impractical.

Our thoughts fails to simply accept this complexity.

What we follow and like to follow is the easy. Advanced freezes us whereas easy triggers motion.

Therefore, Markowitz took the straightforward method for his personal portfolio. A 50:50 allocation to equities and bond, periodically rebalanced.

Is that this excellent? No.

Is that this simple to grasp, implement and monitor? Sure.

At any given level in time, easy will all the time trump complicated in your thoughts.

Isn’t that true?

The consultants don’t have all of the solutions. Even when they are saying there may be a solution, it is probably not sensible.

Discover what works for you and implement it.