In March 2023, the autumn of Silicon Valley Financial institution shocked traders not solely as a result of it was unexpected, but in addition due to the velocity with which it unfolded. That failure has had a domino impact, with Signature Financial institution falling quickly after, adopted by Credit score Suisse in April 2023 and by First Republic final week. The banks which have fallen to this point collectively managed extra deposits than the entire banks that failed in 2008, however in contrast to that interval, fairness markets in the USA have stayed resilient, and even inside banking, the injury has assorted broadly throughout completely different segments, with regional banks seeing important draw downs in deposits and market capitalization. The overarching questions for us all are whether or not this disaster will unfold to the remainder of the financial system and market, because it did in 2008, and the way banking as a enterprise, no less than within the US, can be reshaped by this disaster, and whereas I’m extra a dabbler than an skilled in banking, I’m going to attempt answering these questions.

The Worth of a Financial institution

Banks have been an integral a part of enterprise for hundreds of years, and whereas we have now benefited from their presence, we have now additionally been periodically put in danger, when banks over attain or get into hassle, with their capability to create prices that the remainder of us must bear. After each banking disaster, new guidelines are put into place to cut back or reduce these dangers to the financial system, however regardless of these guidelines or typically due to them, there are new disaster. To grasp the roots of financial institution troubles, it is crucial that we perceive how the banking enterprise works, with the intent of making standards that we will use to separate good banks from common or dangerous ones.

The Banking Enterprise Mannequin

The banking enterprise, when stripped right down to fundamentals, is a straightforward one. A financial institution collects deposits from clients, providing the quid quo professional of comfort, security and typically curiosity earnings (on these deposits which are interest-beating) and both lends this cash out to debtors (people and companies), charging an rate of interest that’s excessive sufficient to cowl defaults and go away a surplus revenue for the financial institution. As well as, banks may make investments a number of the money in securities, normally fixed-income, and with various maturities and levels of default danger, once more incomes earnings from these holdings. The profitability of a financial institution rests on the unfold between its curiosity earnings (from loans and monetary investments) and its curiosity bills (on deposits and debt), and the leakages from that unfold to cowl defaulted loans and losses on funding securities:

To make sure that a financial institution survives, it is homeowners have to carry sufficient fairness capital to buffer towards unanticipated defaults or losses.

The Financial institution Regulators

If you’re questioning the place financial institution regulators enter the enterprise mannequin, it’s price remembering that banks predate regulators, and for hundreds of years, had been self regulated, i.e., had been liable for guaranteeing that they’d sufficient fairness capital to cowl surprising losses. Predictably, financial institution runs had been frequent and the banks that survived and prospered set themselves other than the others by being higher capitalized and higher assessors of default danger than their competitors. Within the US, it was in the course of the civil struggle that the Nationwide Banking Act was handed, laying the groundwork for chartering banks and requiring them to keep up security reserves. After a banking panic in 1907, the place it fell upon J.P. Morgan and different rich bankers to step in and save the system, the Federal Reserve Financial institution was created in 1913. The Nice Despair gave rise to the Glass-Steagall Act in 1933 which restricted banks to business banking, with the intent of stopping them from investing their deposit cash in riskier companies. The notion of regulatory capital has all the time been a part of financial institution regulation, with the FDIC defining “capital adequacy” as having sufficient fairness capital to cowl one-tenth of property. In subsequent many years, these capital adequacy ratios had been refined to permit for danger variations throughout banks, with the logic that riskier property wanted extra capital backing than safer ones. These regulatory capital wants had been formalized and globalized after the G-10 nations created the Basel Committee on Banking Supervision and explicitly created the notions of “risk-weighted property” and “Tier 1 capital”, composed of fairness and equity-like devices, in addition to specify minimal capital ratios that banks needed to meet to proceed to function. Regulators got punitive powers, starting from restrictions of government pay and acquisitions at banks that fell under the best capitalization ranks to placing banks that had been undercapitalized into receivership.

The Basel accord and the brand new guidelines on regulatory capital have largely formed banking for the previous couple of many years, and whereas they’ve supplied a security internet for depositors, they’ve additionally given rise to a harmful sport, the place some banks arrived on the distorted conclusion that their finish sport was exploiting loopholes in regulatory capital guidelines, fairly than construct stable banking companies. In brief, these banks discovered methods of investing in dangerous property that the regulators didn’t acknowledge as dangerous, both as a result of they had been new or got here in advanced packages, and utilizing non-equity capital (debt and deposits), whereas getting that capital categorized as fairness or equity-like for regulatory functions. The 2008 disaster uncovered the ubiquity and penalties of this regulatory capital sport, however at nice value to the financial system and tax payers, with the troubled property aid program (TARP) investing $426 billion in financial institution shares and mortgage-backed securities to prop up banks that had over reached, largely large, money-center banks, fairly than small or regional banks. The phrase “too large to fail” has been over used, but it surely was the rationale behind TARP and is maybe on the coronary heart of at this time’s banking disaster.

Good and Unhealthy Banks

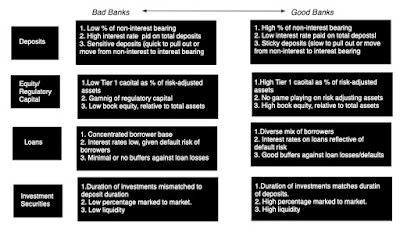

If the banking enterprise is a straightforward one, what’s that separates good from dangerous banks? For those who look again on the image of the banking enterprise, you may see that I’ve highlighted key metrics at banks that may assist gauge not simply present danger however their publicity to future danger.

- Deposits: Each banks is constructed round a deposit base, and there are deposit base traits that clearly decide danger publicity. First, to the extent that some deposits aren’t interest-bearing (as is the case with most checking accounts), banks which have greater percentages of non-interest bearing deposits begin off better off, reducing the typical rate of interest paid on deposits. Second, since a giant deposit base can in a short time turn out to be a small deposit base, if depositors flee, having a stickier deposit base provides a financial institution a profit. As to the determinants of this stickiness, there are quite a few elements that come into play together with deposit dimension (larger and wealthier depositors are usually extra delicate to danger whispers and to rate of interest variations than smaller ones), depositor homogeneity (extra various depositor bases are usually much less more likely to bask in group-think) and deposit age (depositors who’ve been with a financial institution longer are extra sticky). Along with these bank-specific traits, there are two different forces which are shaping deposit stickiness in 2023. One is that the actions taken to guard the most important banks after 2008 have additionally tilted the scales of stickiness in direction of them, because the notion, truthful or unfair, amongst depositors, that your deposits are safer at a Chase or Citi than they’re at a regional financial institution. The opposite is the rise of social media and on-line information made deposits much less sticky, throughout the board, since rumors (based mostly on reality or in any other case) can unfold a lot, a lot quicker now than a number of many years in the past.

- Fairness and Regulatory Capital: Banks which have extra guide fairness and Tier 1 capital have constructed larger buffers towards shocks than banks with out these buffers. Inside banks which have excessive collected excessive quantities of regulatory capital, I’d argue that banks that get all or the majority of that capital from fairness are safer than people who have created equity-like devices that get counted as fairness.

- Loans: Whereas your first intuition on financial institution loans is to search for banks which have lent to safer debtors (much less default danger), it isn’t essentially the suitable name, in relation to measuring financial institution high quality. A financial institution that lends to secure debtors, however costs them too low a price, even given their safer standing, is undercutting its worth, whereas a financial institution that lends to riskier debtors, however costs them a price that comes with that danger and extra, is creating worth. In brief, to evaluate the standard of a financial institution’s mortgage portfolio, it’s worthwhile to take into account the rate of interest earned on loans together with the anticipated mortgage losses on that mortgage portfolio, with a mixture of excessive (low) rates of interest on loans and low (excessive) mortgage losses characterizing good (dangerous) banks. As well as, banks that lend to a extra various set of purchasers (small and huge, throughout completely different enterprise) are much less uncovered to danger than banks that lend to homogeneous purchasers (comparable profiles or function in the identical enterprise), since default troubles typically present up in clusters.

- Funding Securities: Within the aftermath of the 2008 disaster, the place banks had been burned by their holdings in riskier mortgage-backed securities, regulators pushed for extra security in funding securities held by banks, with security outlined round default and liquidity danger. Whereas that push was merited, and banks with safer and extra liquid holdings are safer than banks with riskier, illiquid holdings, there are two different parts that additionally decide danger publicity. The primary is the period of those securities, relative to the period of the deposit base, with a better mismatch related to extra danger. A financial institution that’s funded primarily with demand deposits, which invests in 10-year bonds, is uncovered to extra danger than if invests in business paper or treasury payments. The second is whether or not these securities, as reported on the stability sheet, are marked to market or not, a selection decided (no less than at present) by how banks classify these holdings, with property held to maturity being left at unique value and property held for buying and selling, being marked to market. As an investor, you will have extra transparency in regards to the worth of what an organization holds and, by extension, its fairness and Tier 1 capital, when securities are marked to market, versus when they don’t seem to be.

On the danger of over simplifying the dialogue, the image under attracts a distinction between good and dangerous banks, based mostly upon the dialogue above:

Banks with sticky deposits, on which they pay low rates of interest (as a result of a excessive proportion are non-interest bearing) and large buffers on fairness and Tier 1 capital, which additionally earn “truthful rates of interest”, given default danger, on the loans and investments they make, add extra worth and are normally safer than banks with depositor bases which are delicate to danger perceptions and rates of interest paid, whereas incomes lower than they need to on loans and investments, given their default danger.

Macro Stressors

Whereas we will differentiate between good and dangerous banks, and a few of these variations are pushed by decisions banks make on how they construct their deposit bases and the loans and investments that they make with that deposit cash, these variations are sometimes both ignored or ignored within the good instances by traders and regulators. If typically requires a disaster for each teams to get up and reply, and these crises are normally macro-driven:

- Recessions: By way of banking historical past, it’s the financial system that has been the largest stressor of the banking system, since recessions improve default throughout the board, however extra so on the most default-prone debtors and funding securities. Since regulatory capital necessities had been created in response to probably the most extreme recessions in historical past (the Nice Despair), it isn’t stunning that regulatory capital guidelines are maybe only in coping with this stress check.

- Overvalued Asset Lessons: Whereas banks ought to lend cash utilizing a borrower’s earnings capability as collateral, it’s a actuality that many bankers lend towards the worth of property, fairly than their incomes energy. The protection that bankers provide is that these property might be offered, if debtors default, and the proceeds used to cowl the excellent dues. That logic breaks down when asset lessons get overvalued, because the loans made towards the property can not be lined by promoting these property, if costs right. This growth and bust cycle has lengthy characterised lending in actual property, however turned the idea for the 2008 disaster, as housing costs plunged across the nation, taking down not simply lenders but in addition holders of real-estate based mostly securities. In brief, when these corrections occur, it doesn’t matter what the asset class concerned, banks which are over uncovered to that asset class will take larger losses, and maybe danger failure.

- Inflation and Curiosity Charges: Rising inflation and rates of interest are a combined blessing for banks. On the one hand, as charges rise, longer life loans and long term securities will turn out to be much less invaluable, inflicting losses.. In any case, the market value of even a default-free bond will change, when rates of interest change, and bonds that had been acquired when rates of interest had been decrease will turn out to be much less invaluable, as rates of interest rise. In most years, these adjustments in charges, no less than in developed markets just like the US, are sufficiently small that they create little injury, however 2022 was an unusual 12 months, because the treasury bond price rose from 1.51% to three.88%, inflicting the worth of a ten-year treasury bond to drop by greater than 19%.

Put merely, each financial institution holding ten-year treasury bonds in 2022 would have seen a mark down of 19% within the worth of those holdings in the course of the 12 months, however as traders, you’ll have seen the decline in worth solely at these few banks which categorized these holdings as held on the market. That ache turns into worse with bonds with default-risk, with Baa (funding grade) company bonds shedding 27% of their worth. Then again, banks which have greater percentages of non-interest bearing deposits will acquire worth from accessing these interest-free deposits in a excessive curiosity world. The online impact will decide how rising charges play out in financial institution worth, and will clarify why the injury from the disaster has assorted throughout US banks in 2023.

The Banks in Disaster

It’s price noting that the entire ache that was coming from writing down funding safety holdings at banks, from the surge in rates of interest, was clearly seen initially of 2023, however there was no speak of a banking disaster. The implicit perception was that banks would be capable of step by step notice or no less than acknowledge these losses on the books, and use the time to repair the ensuing drop of their fairness and regulatory capital. That presumption that point was an ally was challenged by the implosion of Silicon Valley Financial institution in March 2023, the place over the course of per week, a big financial institution successfully was worn out of existence. To see why Silicon Valley Financial institution (SVB) was significantly uncovered, allow us to return and take a look at it via the lens of fine/dangerous banks from the final part:

- An Extraordinary Delicate Deposit Base: SVB was a financial institution designed for Silicon Valley (founders, VCs, staff) and it succeeded in that mission, with deposits virtually doubling in 2021. That success created a deposit base that was something however sticky, delicate to rumors of hassle, with virally related depositors drawn from a standard pool and large depositors who had been properly positioned to maneuver cash rapidly to different establishments.

- Fairness and Tier 1 capital that was overstated: Whereas SVB’s fairness and Tier 1 capital seemed strong initially of 2023, that look was misleading, because it didn’t replicate the write-down in funding securities that was looming. Whereas it shared this downside with different banks, SVB’s publicity was better than most (see under for why) and explains its try to lift contemporary fairness to cowl the upcoming shortfall.

- Loans: A big chunk of SVB’s mortgage portfolio was composed of enterprise debt, i.e., lending to pre-revenue and money-losing corporations, and backed up by expectations of money inflows from future rounds of VC capital. Because the anticipated VC rounds are conditional on these younger firms being repriced at greater and better costs over time, enterprise debt is awfully delicate to the pricing of younger firms. In 2022, danger capital pulled again from markets and as enterprise capital investments dried up, and down rounds proliferated, enterprise debt suffered.

- Funding Securities: All banks put a few of their cash in funding securities, however SVB was an outlier when it comes to how a lot of its property (55-60%) had been invested in treasury bonds and mortgage-backed securities. A part of the explanation was the surge in deposits in 2021, as enterprise capitalists pulled again from investing and parked their cash in SVB, and with little demand for enterprise debt, SVB had no selection however to put money into securities. That mentioned, the selection to put money into long run securities was one which was made consciously by SVB, and pushed by the rate of interest atmosphere in 2021 and early 2022, the place brief time period charges had been near zero and long run charges had been low (1.5-2%), however nonetheless greater than what SVB was paying its depositors. If there’s an unique sin on this story, it’s on this period mismatch, and it’s this mismatch that brought about SVB’s fall.

In brief, should you had been constructing a financial institution that may be prone to a blow-up, from rising charges, SVB would match the invoice, however its failure opened the door for traders and depositors to reassess danger at banks at exactly the time when most banks didn’t need that reassessment carried out.

Within the aftermath of SVB’s failure, Signature Financial institution was shut down within the weeks after and First Republic has adopted, and the query of what these banks shared in widespread is one that must be answered, not only for mental curiosity, as a result of that reply will inform us whether or not different banks will observe. It ought to be famous that neither of those banks had been as uncovered as SVB to the macro shocks of 2022, however the nature of banking crises is that as banks fall, every subsequent failure can be at a stronger financial institution than the one that failed earlier than.

- With Signature Financial institution, the set off for failure was a run on deposits, since greater than 90% of deposits on the financial institution had been uninsured, making these depositors much more delicate to rumors about danger. The FDIC, in shuttering the financial institution, additionally pointed to “poor administration” and failure to heed regulatory issues, which clearly point out that the financial institution had been on the FDIC’s watchlist for troubled banks.

- With First Republic financial institution, a financial institution that has a big and profitable wealth administration arm, it was a dependence on these rich purchasers that elevated their publicity. Rich depositors not solely usually tend to have deposits that exceed $250,000, technically the cap on deposit insurance coverage, but in addition have entry to data on options and the instruments to maneuver cash rapidly. Thus, within the first quarter of 2023, the financial institution reported a 41% drop in deposits, triggering compelled sale of funding securities, and the belief of losses on these gross sales.

In brief, it’s the stickiness of deposits that appears to be the largest indicator of banks moving into hassle, fairly than the composition of their mortgage portfolios and even the character of their funding securities, although having a better proportion invested in long run securities leaves you extra uncovered, given the rate of interest atmosphere. That does make this a way more difficult downside for banking regulators, since deposit stickiness will not be a part of the regulatory overlay, no less than in the intervening time. One of many outcomes of this disaster could also be that regulators monitor data on deposits that permit them make this judgment, together with:

- Depositor Traits: As we famous earlier, depositor age and wealth might be elements that decide stickiness, with youthful and wealthier depositors being much less sticky that older and poorer depositors. On the danger of opening a Pandora’s field, depositors with extra social media presence (Twitter, Fb, LinkedIn) can be extra susceptible to maneuver their deposits in response to information and rumors than depositors with out that presence.

- Deposit age: As in different companies, a financial institution buyer who has been a buyer for longer is much less more likely to transfer his or her deposit, in response to concern, than one who turned a buyer lately. Maybe, banks ought to observe subscriber/person based mostly firms in creating deposit cohort tables, breaking deposits down based mostly upon how lengthy that buyer has been with the financial institution, and the stickiness price in every group.

- Deposit development: Within the SVB dialogue, I famous that one purpose that the financial institution was entrapped was as a result of deposits virtually doubled in 2021. Not solely do only a few banks have the capability to double their loans, with due diligence on default danger, in a 12 months, however these deposits, being current and huge, are additionally the least sticky deposits on the financial institution. In brief, banks with quicker development of their deposit bases are also more likely to have much less sticky depositors.

- Deposit focus: To the extent that the deposits of a financial institution are concentrated in a geographic area, it’s extra uncovered to deposit runs than one which has a extra geographically various deposit base. That might make regional financial institution deposits extra delicate that nationwide financial institution deposits, and sector-focused banks (it doesn’t matter what the sector) extra uncovered to deposit runs than banks that lend throughout companies.

A few of this data is already collected on the financial institution degree, however it might be time for financial institution regulators to work on measures of deposit stickiness that may then turn out to be a part of the panel that they use to guage publicity to danger at banks.

The Market Response

Essentially the most stunning characteristic of the 2023 banking disaster has been the response of US fairness markets, which have been resilient, rising within the face of a wall of fear. As an instance how the market response has performed out at completely different ranges, I checked out 4 indices, beginning with the S&P 500, transferring on the S&P Financials and Banks Index to the S&P Choose Financial institution Index and eventually, the S&P Regional Financial institution Index.

The S&P 500 index is up 6.5% this 12 months, indicative of the resilience on the a part of the market, or denial on the a part of traders, relying in your perspective. The S&P Monetary Sectors index is down 5.72%, however the S&P Choose Banks index is down 26.2% and the regional financial institution index has taken a pummeling, down greater than 35%. The injury from this banking disaster, in brief, has been remoted to banks, and inside banks, has been better at regional banks than on the nationwide banks.

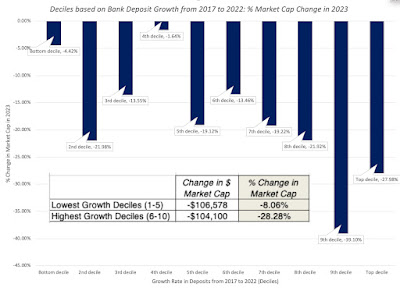

The traditional knowledge appears to bethat large banks have gained on the expense of smaller banks, however the information is extra ambiguous. I seemed on the 641 publicly traded US banks, damaged down by market capitalization initially of 2023 into ten deciles and seemed on the change in mixture market cap inside every decile.

As you may see the largest proportion declines in market cap are bunched extra in direction of the larger banks, with the largest drops occurring within the eighth and ninth deciles of banks, not the smallest banks. In any case, the best profile failures to this point in 2023 have been SVB, Signature Financial institution and First Republic Financial institution, all banks of great dimension.

If my speculation about deposit stickiness is correct, it’s banks with the least stick deposits that ought to have seen the largest declines in market capitalization. My proxies for deposit stickiness are restricted, given the info that I’ve entry to, however I used deposit development over the final 5 years (2017-2022) as my measure of stickiness (with greater deposit development translating into much less stickiness):

The outcomes are surprisingly decisive, with the largest market capitalization losses, in proportion phrases, in banks which have seen probably the most development in deposits within the final 5 years. To the extent that that is correlated with financial institution dimension (smaller banks ought to be extra more likely to see deposit development), it’s not at all conclusive proof, however it’s in keeping with the argument that the stickiness of deposits is the important thing to unlocking this disaster.

Implications

I do imagine that there are extra dominos ready to fall within the US banking enterprise, with banks which have grown probably the most in the previous couple of years on the most danger, however I additionally imagine that in contrast to 2008, this disaster can be extra more likely to redistribute wealth throughout banks than it’s to create prices for the remainder of us. In contrast to 2008, when you can level to risk-seeking habits on the a part of banks because the prime purpose for banking failures, this one was triggered by the seek for excessive development and a failure to stick to first ideas in relation to period mismatches. That mentioned, I’d anticipate the next adjustments within the banking construction:

- Continued consolidation: Over the previous couple of many years, the US banking enterprise has consolidated, with the variety of banks working dropping 14,496 in 1984 to 4,844 in 2022. The 2023 financial institution failures will speed up this consolidation, particularly as small regional banks, with concentrated deposit bases and mortgage portfolios are assimilated into bigger banks, with extra various construction.

- Financial institution profitability: For some, that consolidation is worrisome because it raises the specter of banks going through much less competitors and thus charging greater costs. I could also be naive however I believe that as banks consolidate, they may wrestle to keep up profitability, and maybe even see earnings drop, as disruptors from fintech and elsewhere eat away at their most worthwhile segments. In brief, the largest banks might get larger, however they could not get extra worthwhile.

- Accounting rule adjustments for banks: The truth that SVB’s failure was triggered by a drop in worth of the financial institution’s investments in bonds and mortgage backed securities, and that this write down got here as a shock to in traders, as a result of SVB categorized these securities as being held until maturity (and thus not requiring of mark-to-market) will inevitably draw the eye of accounting rule writers. Whereas I do not foresee a requirement that each funding safety be marked to market, a rule change that may create its personal risks, I anticipate the foundations on when securities get marked to market to be tightened.

- Regulatory adjustments: The 2023 crises have highlighted two features of financial institution habits which are both ignored or sufficiently weighted into present regulatory guidelines on banks. The primary is period mismatches at financial institutions, which clearly expose even banks that put money into default free securities, like SVB, to danger. The opposite is deposit stickiness, the place outdated notions of when depositors panic and the way rapidly they react must be reassessed, given how rapidly danger whispers about banks changed into deposit flight at First Republic and Signature Financial institution. I anticipate that there can be regulatory adjustments forthcoming that may attempt to incorporate each of those points, however I stay uncertain in regards to the kind that these adjustments will take.

I know I’ve mentioned little or no on this put up about whether or not banks are good investments at this time, both collectively or subsets (massive cash heart, regional and so forth.), and have centered totally on what makes for good and dangerous banks. The purpose is easy. Investing will not be about judging the standard of companies, however about shopping for firms on the proper value, and that dialogue requires a give attention to what expectations markets are incorporating into inventory costs. I’ll handle the investing query in my subsequent put up, which I hope to show to very quickly!

YouTube Video