A couple of days in the past, I valued Instacart forward of its preliminary public providing, and famous that the reception that the inventory will get will likely be an excellent barometer of the place threat capital stands out there, proper now. After a buzzy open, when the inventory jumped from its providing worth of $30 a share to $42, the inventory has shortly given up these beneficial properties and now trades at under to its provide worth. On this submit, I’ll have a look at one other preliminary public providing, Birkenstock, that’s prone to get extra consideration within the subsequent few weeks, provided that it’s concentrating on to go public at a pricing of about €8 billion, for its fairness, in a couple of weeks. Fairly than make this submit all about valuing Birkenstock, and evaluating that worth to the proposed pricing, I want to use the corporate to debate how intangible belongings get valued in an intrinsic valuation, and why a lot of the dialogue of intangible valuation in accounting circles is a mirrored image of a mind-set on valuation that always misses its essence.

The Worth of Intangible Property

Accounting has traditionally accomplished a poor job coping with intangible belongings, and because the financial system has transitioned away from a manufacturing-dominated twentieth century to the know-how and providers centered financial system of the twenty first century, that failure has turn into extra obvious. The ensuing debate amongst accountants about learn how to deliver intangibles on to the books has spilled over into valuation apply, and plenty of appraisers and analysts are wrongly, for my part, letting the accounting debate have an effect on how they worth corporations.

The Rise of Intangibles

Whereas the controversy about intangibles, and the way finest to worth them, is comparatively current, it’s unquestionable that intangibles have been part of valuation, and the funding course of, by way of historical past. An analyst valuing Normal Motors within the Twenties was in all probability attaching a premium to the corporate, as a result of it was headed by Alfred Sloan, considered then a visionary chief, simply as an investor pricing GE within the Nineteen Eighties was arguing for a better pricing, as a result of Jack Welch was engineering a rebirth of the corporate. Even a cursory examination of the the Nifty Fifty, the shares that drove US equities upwards within the early Seventies, reveals corporations like Coca Cola and Gilette, the place model identify was a big contributor to worth, in addition to pharmaceutical corporations like Bristol-Myers and Pfizer, which derived a big portion of their worth from patents. In reality, IBM and Hewlett Packard, pioneers of the tech sector, have been priced greater throughout that interval, due to their technological strengths and different intangibles. Throughout the funding neighborhood, there has at all times been a transparent recognition of the significance of intangibles in driving funding worth. In reality, amongst old-time worth buyers, particularly within the Warren Buffet camp, the significance of getting “good administration’ and moats (aggressive benefits, a lot of that are intangible) represented an acceptance of to how essential it’s that we incorporate these intangible advantages into funding selections.

With that stated, it’s clear that the controversy about intangibles has turn into extra intense within the final twenty years. One cause is the notion that intangibles now signify a higher % of worth at corporations and are a big issue in additional of the businesses that we put money into, than up to now. Whereas I’ve seen claims that intangibles now account for sixty, seventy and even ninety % of worth, I take these contentions with a grain of salt, for the reason that definition of “intangible” is elastic, and a few stretch it to breaking level, and the measures of worth used are questionable. A extra tangible strategy to see why intangibles have turn into a scorching matter of debate is to have a look at the evolution of the highest ten corporations on the earth, in market capitalization, over time:

In 1980, IBM was the biggest market cap firm on the earth, however eight of the highest ten corporations have been oil or manufacturing corporations. With every decade, you’ll be able to see the impact of regional and sector efficiency within the earlier decade; the 1990 listing is dominated by Japanese shares, reflecting the rise of Japanese equities within the Nineteen Eighties, and the 2000 listing by know-how and communication corporations, benefiting from the dot-com increase. Trying on the prime ten corporations in 2020 and 2023, you see the dominance of know-how corporations, a lot of which promote merchandise that you simply can’t see, typically in manufacturing amenities which can be simply as invisible.

The opposite improvement that has pushed the intangible dialogue to the forefront is a sea change within the traits of corporations getting into public markets. Whereas corporations that have been listed for a lot of the 20 th century waited till they’d established enterprise fashions to go public, the dot-com increase noticed the itemizing of younger corporations with development potential however unformed enterprise fashions (translating into working losses), and that development has continued and accelerated on this century. The graph under appears to be like on the revenues and profitability of corporations that go public annually, from 1980 to 2020:

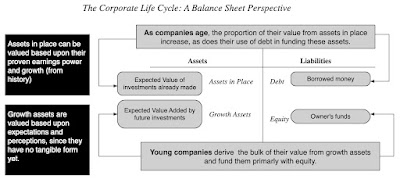

As you’ll be able to see, the % of money-making corporations going public has dropped from greater than 90% within the Nineteen Eighties to lower than 20% in 2020, however on the identical time, whereas additionally reporting a lot greater revenues, reporting the push by personal corporations to scale up shortly. In valuing these corporations, buyers and analysts face a problem, insofar as a lot of the values of those corporations got here from expectations of what they’d do sooner or later, somewhat than investments that they’ve already made. I seize this impact in what I name a monetary stability sheet:

When you can worth assets-in-place, utilizing historic information and the data in monetary statements, in assessing the worth of development belongings, you make your finest assessments of investments that these corporations will make sooner or later, and these investments are formless, no less than for the time being.

The Accounting Problem with Intangibles

The intangible debate is most intense within the accounting neighborhood, with each practitioners and lecturers arguing about whether or not intangibles ought to be “valued”, and in that case, learn how to deliver that worth into monetary statements. To see why the accounting penalties are prone to be dramatic, think about how these decisions will play out within the stability sheet, the accountants’ try and encapsulate what a enterprise owns, what it owes and the way a lot its fairness is value.

There are inconsistencies in how accountants measure completely different courses of belongings, and I incorporate them into my image above, leaving the intangible belongings part because the unknown: Any adjustments in accounting guidelines on measuring the worth of intangibles, and bringing them on the stability sheet, may also play out as adjustments on the opposite facet of the stability sheet, primarily as adjustments within the worth of assessed or ebook fairness. Put merely, if accountants resolve to deliver intangible belongings like model identify, administration high quality and patent safety into asset worth will improve the worth of ebook fairness, no less than as accountants measure it, in that firm.

Of their try and deliver intangible belongings on to stability sheets, accountants face a barrier of their very own creation, emanating from how they deal with the expenditures incurred in increase these belongings. To know why, think about how fastened belongings (similar to plant and tools and tools) turn into a part of the stability sheet. The expenditures related to buying these fastened belongings are handled as capital expenditures, separate from working bills, and solely the portion of that expenditure (depreciation or amortization) that’s assumed to be associated to the present 12 months’s operations is handled as an working expense. The unamortized or un-depreciated parts of those capital bills are what we see as belongings on stability sheets. The bills that lead to intangible asset acquisitions are, for essentially the most half, not handled persistently, with model identify promoting, R&D bills and investments in recruiting/coaching, the bills related to increase model identify, patent safety and human capital, respectively, being handled as working, somewhat than capital, bills. As a consequence of this mistreatment, I’ve argued that not solely are the most important belongings, principally intangible, at some corporations saved off the stability sheet, however their earnings are misstated:

There are methods by which accounting can repair this inconsistency, however it is going to lead to an overhaul of the entire monetary statements, and firms and buyers balk at wholesale revamping of accounting numbers (EBITDA, earnings per share, ebook worth) that they’ve relied on to cost these corporations.

So, how far has accounting are available bringing intangible belongings on to stability sheets? One strategy to measure progress on this challenge is to have a look at the portion of the ebook worth of fairness at US corporations that comes from tangible belongings, within the chart under:

Trying throughout all US corporations from 1980 to 2022, the portion of ebook worth of fairness that comes tangible belongings has dropped from greater than 70% in 1998 to about 30% in 2022. That will counsel that intangible belongings are being valued and integrated into stability sheets far more now than up to now. Earlier than you come to that conclusion, although, chances are you’ll wish to think about the breakdown of the intangible belongings on accounting stability sheets, which I do within the graph under:

There may be one other measure that you should utilize to see the futility, no less than thus far, of accounting makes an attempt to worth intangibles. Within the graph under, I have a look at the aggregated market capitalization of corporations, in 2022, which ought to incorporate the pricing of intangibles by the market, and evaluate that worth to ebook worth (tangible and intangible), by sector, reflecting accounting makes an attempt to worth these identical intangibles.

The sectors the place you’ll anticipate intangible belongings to be the biggest portion of worth are shopper merchandise (model identify) and know-how (R&D and patents). These are additionally the sectors with the bottom ebook values, relative to market worth, suggesting that no matter accountants are doing to usher in intangibles in these corporations into ebook worth shouldn’t be having a tangible impact on the numbers.

In sum, the accounting obsession with intangibles, and the way finest to take care of them, has not translated into materials adjustments on stability sheets, no less than with GAAP in america. It’s true that IFRS has moved quicker in bringing intangible belongings on to stability sheets, albeit not at all times in essentially the most smart methods, however even with these guidelines in place, progress on bringing intangible belongings onto stability sheets has been gradual. To be frank, I do not suppose accounting rule writers will be capable to deal with intangibles in a smart means, and the limitations lie not in guidelines or fashions, however within the accounting mindset. Accounting is backward-looking and rule-driven, making it in poor health geared up to worth intangibles, the place you haven’t any selection, however to be ahead wanting, and principle-driven.

The Intrinsic Worth of Intangibles

I’ve been educating and writing about valuation for near 4 many years now, and I’ve typically been accused of giving brief shrift to intangible belongings, as a result of I haven’t got a session devoted to valuing intangibles, in my valuation class, and I haven’t got total books, and even chapters of my books, on the subject. Whereas it could appear to be I’m in denial, given how a lot worth corporations derive from belongings you can not see, I’ve by no means felt the necessity to create new fashions, and even modify present fashions, to usher in intangibles. On this part, I’ll clarify why and make the argument that in case you do intrinsic valuation proper, intangibles ought to be, with creativeness and little or no modification of present fashions, already in your intrinsic worth.

To know intrinsic worth, it’s value beginning with the easy equation that animates the estimation of worth, for an asset with n years of money flows:

Thus, the intrinsic worth of an asset is the current worth of the anticipated money flows on it, over its lifetime. When valuing a enterprise, the place money flows might final for for much longer (maybe even ceaselessly), this equation could be tailored:

On this equation, for something, tangible or not, has to point out up in both the anticipated money flows or within the threat (and the ensuing low cost price); that’s my “IT” proposition. This proposition has stood me in good stead, in assessing the impact on worth of nearly every thing, from macro variables like inflation to buzzwords like ESG.

Utilizing this framework for assessing intangible belongings, from model identify to high quality administration, you’ll be able to see that their impact on worth has to return from both greater anticipated money flows or decrease threat (low cost charges). To offer extra construction to this dialogue, I reframe the worth equation by way of inputs that valuation analysts ought to be acquainted with – income development, working margins and reinvestment, driving money flows, and fairness and debt threat, figuring out low cost charges and failure threat.

Within the image, I’ve spotlight among the key intangibles and which inputs are principally prone to be affected by their presence.

- It’s the working margin the place model identify, and the related pricing energy, is probably going have its greatest impact, although it will possibly have secondary results on income development and even the price of capital.

- Good administration, one other extremely touted intangible, will manifest in a enterprise with the ability to ship greater income development, but additionally present up in margins and reinvestment; the essence of superior administration is with the ability to discover development, when it’s scarce, whereas sustaining profitability and never reinvesting an excessive amount of.

- Connections to governments and regulators, an intangible that’s seldom made express, can have an effect on worth by lowering failure threat and the price of debt, whereas rising development and or profitability, as the corporate will get favorable therapy on bids for contracts.

This isn’t a complete listing, however the framework applies to any intangible that you simply consider could impact worth. This method to intangibles additionally means that you can separate beneficial intangibles from wannabe intangibles, with the latter, irrespective of how broadly offered, having little or no impact on worth. Thus, an organization that claims that it has a beneficial model identify, whereas delivering working margins effectively under the trade common, actually doesn’t, and the impact of ESG on worth, it doesn’t matter what its advocates declare, is non-existent.

It’s true that this method to valuing intangibles works finest for a corporation with a single intangible, whether or not or not it’s model identify or buyer loyalty, the place the impact is remoted to one of many worth drivers. It turns into tougher to make use of for corporations, like Apple, with a number of intangibles (model identify, styling, working system, person platform). When you can nonetheless worth Apple within the mixture, breaking out how a lot of that worth comes from every of the intangibles will likely be tough, however as an investor, why does it matter?

The Birkenstock IPO: A Footwear firm with intangibles

If in case you have discovered this dialogue of intangibles summary, I do not blame you, and I’ll attempt to treatment that by making use of my intrinsic worth framework to worth Birkenstock, simply forward of its preliminary public providing. As a firm with a number of intangible parts in its story, it’s effectively suited to the train, and I’ll attempt to not solely estimate the worth of the corporate with the intangibles integrated into the numbers, but additionally break down the worth of every of its intangibles.

The Lead In

Birkenstock is primarily a footwear firm, and to get perspective on development, profitability and reinvestment within the sector, I checked out all publicly traded footwear corporations throughout the globe. the desk under summarizes key valuation metrics for the 86 listed footwear corporations that have been listed as of September 2023.

Within the mixture, the metrics for footwear corporations are indicative of an unattractive enterprise, with greater than half the listed corporations seeing revenues shrink within the decade, main into 2022 and greater than quarter reporting working losses. Nonetheless, many of those corporations are small corporations, with a median income at $170 million, struggling to remain afloat in a aggressive product market. Since Birkenstock generated revenues of $1.4 billion within the twelve months main into its preliminary public providing, with an expectation of extra development sooner or later, I zeroed in on the twelve largest corporations within the attire and footwear sector, in market capitalization, and checked out their working metrics:

As you’ll be able to see, these corporations look very completely different from the sector aggregates, with strong income development (median compounded development price of 8.66% a 12 months, for the final decade) and distinctive working margins (gross margins near 70% and working margins of 24%). Every of the businesses additionally has a recognizable or many recognizable model names, with LVMH and Hermes topping the listing. On this enterprise, no less than, model identify appears to be dividing line between success and mediocrity, and having a well-recognized model identify contributes to development and profitability. It’s this grouping that I’ll draw on extra, as I look valuing Birkenstock.

Birkenstock’s Historical past

In my work on company life cycles, I speak about how corporations age, and the way significance it’s that they act accordingly. Usually, as an organization strikes throughout the life cycle, income development eases, margins degree off and there may be much less reinvestment. As a enterprise that has been round for nearly 250 years, Birkenstock ought to be a mature and even outdated firm, however it has discovered a brand new lease on life within the final decade.

Birkenstock was based in 1774 by Johann Adam Birkenstock, a Germany cobbler, and it stayed a household enterprise for a lot of its life. Within the many years following its founding, the corporate modified and tailored its footwear choices, catering to rich Europeans within the rising German spa tradition within the 1800s, and modifying its product line, including versatile insoles in 1896 and pioneering arch helps in 1902. Through the Twenties and Nineteen Thirties, the corporate carved out a market round consolation and foot care, partnering with physicians and podiatrists, providing options for patrons with foot ache. In 1963, the corporate launched its first health sandal, the Madrid, and sandals now signify the center of Birkenstock’s product line.

Alongside the best way, serendipity performed a job within the firm’s enlargement. In 1966, a Californian named Margot Fraser, when visiting her native Germany, found that Birkenstocks helped her drained and hurting ft, and he or she satisfied Karl Birkenstock to strive promoting the corporate’s sandals in California. It’s stated that Karl superior her credit score, and helped her persuade reluctant California retailers to hold the firm’s unconventional footwear of their shops. That proved well timed, since individuals protesting towards the warfare and society’s ills latched on to those sandals, making them them symbolic footwear for the rebellious. within the Nineties, the model had a rebirth, when a really younger Kate Moss wore it for a canopy story, and it grew to become a scorching model, particularly on faculty campuses. Right this moment, Birkenstock will get greater than 50% of its revenues in america, with a number of celebrities amongst its clients. The corporate’s prospectus does an excellent job portray an image of each the product choices and buyer base, main into the IPO, and I’ve captured these statistics within the image under:

In contrast to some in its designer and model identify friends, the corporate’s merchandise usually are not exorbitantly overestimated and the corporate’s finest vendor, the Arizona, sells for near $100. Whereas the corporate sells extra sneakers to girls than males, it sells footwear to a surprisingly various buyer base, by way of earnings, with 20% of its gross sales coming from clients who earn lower than $50,000 a 12 months, and by way of age, with virtually 40% of its revenues coming from Gen X and Gen Z members.

For a lot of its historical past, Birkenstock was run as a household enterprise, capital constrained and with restricted development ambitions, maybe explaining its lengthy life. The turning level for the corporate, to get to its present type, occurred in 2012, when the household, going through inside strife, turned management of the corporate over to exterior managers, selecting Markus Bensberg, an organization veteran, and Oliver Reichert, a advisor, as co-CEOs of the corporate. Reichert, specifically, was a controversial choose since he was not solely an outsider, however one with little expertise within the shoe enterprise, however the selection proved to be impressed. With an help once more from serendipity, when Phoebe Philo exhibited a black mink-lined Arizona on a Paris catwalk in 2012, resulting in collaborations with high-end designers like Dior, the corporate has discovered a brand new life as a development firm, with revenues rising from €200 million in 2012 to greater than €1.4 billion within the twelve months main into the IPO, representing an 18.2% compounded annual development price over the last decade:

The surge in revenues has been notably pronounced since 2020, the COVID 12 months, with completely different theories on why the pandemic elevated demand for the product; one is that folks working from dwelling selected the consolation of Birkenstocks over uncomfortable work sneakers. The corporate’s development has include strong profitability, and the desk under reveals key revenue metrics over the past three years:

|

Be aware that the corporate’s working and gross margins, no less than within the final two years, match up effectively with the working margins of the big, model identify attire & footwear corporations that we highlighted within the final part. It might be early to worth model identify, however the firm definitely has been delivering margins that put it within the model identify group.

The robust development since 2020 present a powerful foundation for why the corporate is planning its public providing now, however there may be one other issue that will clarify the timing. In 2021, the household offered a majority stake within the agency to L. Catterton, an LVMH-backed personal fairness agency, at an estimated worth in extra of €4 billion Euros. That deal was funded considerably with debt, leaving a debt overhang of near €2 billion, in 2023; the prospectus states that each one of of the corporate’s proceeds from the providing will likely be used to pay down this debt. That stated, the pricing for the providing has elevated since information of it was first floated in July, with €6 billion plus pricing in preliminary stories rising to €8 billion in early September and to €9.2 billion in the newest information tales. The corporate has picked up anchor buyers alongside the best way, with the Norwegian sovereign fund planning to purchase €300 million of the preliminary providing.

Birkenstock’s Intangibles

Birkenstock is an effective automobile for figuring out and valuing intangibles, because it has so a lot of them, with some extra sustainable and extra beneficial than others:

- Model Title: It’s simple that Birkenstock not solely has a model identify, by way of recognition and visibility, however has the pricing energy and working margins to again up that model identify. Nonetheless, as is usually the case, the constructing blocks that gave rise to the model identify are advanced and assorted. The primary is the distinctiveness of the footwear makes the corporate stand out, with individuals individuals both hating its choices (ugly, clunky, clog) or loving it. In contrast to many footwear corporations that try to repeat the most popular types, Birkenstock marches to its personal drummer. The second is that the corporate’s deal with consolation and foot well being, in designing footwear, in addition to the usage of high quality components, is matched by actions. In reality, one cause that the corporate makes virtually all of its sneakers nonetheless in Germany, somewhat than offshoring or outsourcing, is to protect high quality, and sticks with time-tested and high quality components, is to protect this status. The third is that in contrast to among the corporations on the massive model identify listing, Birkenstock’s usually are not exorbitantly overestimated, and has a various (by way of earnings and age) buyer base. Briefly, its model identify appears to have held up effectively over the generations.

- Celeb Buyer Base: As I famous earlier, particularly as Birkenstocks entered the US market, they attracted a celeb clientele, and that has continued by way of at this time. Birkenstock attracts celebrities in several age teams, from Gwyneth Paltrow & Heidi Klum to Paris Jackson & Kendall Jenner, and extra impressively, it does so with out paying them sponsorship charges. If the very best promoting is unsolicited, Birkenstock clearly has mastered the sport.

- Good Administration: I have a tendency be skeptical about claims of administration genius, having found that even essentially the most extremely regarded CEOs include blind spots, however Birkenstock appears to have struck gold with Oliver Reichert. Not solely has he steered the corporate in the direction of excessive development, however he has accomplished so with out upsetting the stability that lies behind its model identify. In reality, whereas Birkenstock has entered into collaborative preparations with different excessive profile model names like Dior and Manolo Clean, Reichert has additionally turned down profitable gives to collaborate with designers that he feels undermine Birkenstock’s picture.

- The Barbie Buzz: For an organization that has benefited from serendipitous occasions, from Margot Fraser’s introduction of its footwear to People in 1966 to Phoebe Philo’s sandals on the Paris catwalk in 2012, essentially the most serendipitous occasion, no less than by way of its IPO, could have been the discharge of the Barbie film, this summer time. Margot Robbie’s pink Birkenstock sandals in that film, which has been the blockbuster hit of the 12 months, hyper charged the demand for the corporate’s footwear. It’s true that buzzes fade, however not earlier than they create a income bump and maybe even improve the client base for the long run.

For the second, these intangibles are qualitative and fuzzy, however within the subsequent part, I’ll attempt to deliver them into my valuation inputs.

Birkenstock Valuation

My Birkenstock valuation is constructed round an upbeat story of continued excessive development and sustained working margins, with the main points under:

- Income Development: The corporate is coming into the IPO, with the wind at its again, having delivered a compounded annual development price of 18.2% in revenues within the decade main into the providing. That stated, its revenues now are €1.4 billion, somewhat than the €200 million they have been in 2012, and development charges will come right down to mirror the bigger scale. Whereas the typical CAGR in revenues for large model attire & footwear corporations has been 8.66%, I consider that Oliver Reichert and the administration workforce that runs Birkenstock will proceed their profitable historical past of opportunistic development, and be capable to triple revenues over the following decade. This will likely be completed with an help from the Barbie Buzz in 12 months 1 (pushing the expansion price to 25% over the following 12 months) and a compounded development price of 15% a 12 months within the following 4 years.

- Profitability: Birkenstock has had a historical past of robust working margins, pushed by its model identify and visibility. Within the twelve months main into the IPO, the corporate reported a pre-tax working margin of twenty-two.3%, and its margins over the past decade have hovered round 20%. I consider that the power of the model identify will maintain and maybe even barely improve working margins for the corporate, with the margin rising to 23%, over the following 12 months, and to 25% over the next 4 years.

- Reinvestment: Birkenstock has been circumspect in investing for development, over its historical past, displaying reluctance to maneuver away from its reliance on its German workforce, and in making acquisitions. It has additionally not been an enormous spender on model promoting, utilizing its superstar clientele as a key element of constructing and rising its model I consider that the superstar clientele impact will permit the corporate to proceed on its path of environment friendly development, delivering €2.62 for each euro invested, matching the third quartile of huge model attire corporations.

- Danger: The Catterton acquisition of a majority stake in Birkenstock in 2021 was funded with a big quantity of debt, however the proceeds from the providing are anticipated to be utilized in paying down debt. The corporate ought to emerge from the providing with a debt load on par with different model identify attire & footwear corporations, and the focus of its manufacturing in Germany will cut back publicity to provide chain and nation threat.

- IPO Proceeds: Information tales counsel that Birkenstock is planning to supply about 21.5 million shares to the general public, and use the proceeds (estimated to be €1 billion, on the €45 providing worth) to pay down debt. In conjunction, Catterton plans to promote about the identical variety of shares on the providing as effectively, lowering its stake within the firm, and cashing out on what ought to be an enormous win for the personal fairness participant.

To see how these inputs play out in worth, I’ve introduced them collectively within the (dense) valuation image under. With every of the inputs, I’ve highlighted each the numbers that I’m utilizing, in addition to highlighting how a lot intangibles contribute to every enter:

The worth that I estimate for Birkenstock, with my inputs on development, profitability and threat, is about €8.38 billion, about 10% lower than the rumored providing pricing, however nonetheless effectively inside shouting distance of that quantity. In case you’re tempted to make use of the corporate’s many intangibles as the reason for the distinction, word that I’ve already integrated them into my inputs and worth. To make express that impact, I’ve remoted every intangible and its impact on worth within the desk under:

To worth every intangible, I toggle the enter that displays the intangible on and off to find out how a lot it adjustments worth. The intangible that has the most important impact on worth is model identify, adopted by the power of the administration workforce, with the Barbie Buzz and Celeb Results lagging. One other means of visualizing how these intangibles play into worth is to construct as much as estimated worth of fairness of €8.38 billion in items:

These worth judgments are based mostly upon my estimates, and they’re, after all, open for debate. For example, you may argue that the impact of fine administration on income development is kind of than my estimate, and even that the results spill over into different inputs (value of capital, margins and reinvestment), however that could be a wholesome debate to have.

Pricing Components

It’s simple that the Birkenstock IPO will likely be priced, not valued, and the query of how the inventory will do is simply as a lot dependent, maybe extra so, on market temper and momentum, as it’s on the basics highlighted within the valuation.

- Taking a look at information in regards to the firm, the timing works effectively, for the reason that firm is coming into the market on a wave of fine publicity. Nearly each information story that I’ve learn in regards to the firm paints a optimistic image of it, with laudatory mentions of Oliver Reichert and the corporate’s merchandise, intermixed with footage of not solely Barbie’s pink Birkenstock however a bunch of different celebrities.

- It’s the market temper that’s working towards the corporate, no less than for the time being that I’m scripting this submit (October 6, 2023). As I wrote in my submit on bipolar markets only a few days in the past, the market temper has soured, with the optimism that we had dodged the bullet that was so broadly prevalent only a few weeks in the past changed with the pessimism that darkish days lie forward for the worldwide financial system and markets.

At its providing pricing of €9.2 billion (€45 to €50 per share), the corporate and its bankers appear to be betting that the nice vibes in regards to the firm will outweigh the dangerous vibes out there, however that’s gamble. As somebody who has tried and rejected the Arizona sandal, I’m unlikely to be a buyer for Birkenstock footwear, however this can be a firm with a very distinctive model identify and a administration workforce that understands the fragile stability between using a model identify effectively and overdoing it. It’s, for my part, a attain at €45 or €50 per share, but when the market turns bitter, and the inventory drops to under €40, I’d be a purchaser.

YouTube Video

Attachments