Avert your eyes! My Sunday morning have a look at incompetency, corruption and coverage failures:

• Palm Seashore Is Having a Class 5 Identification Disaster: The aura of a sandswept playground of like-minded individuals of means. The enchantment of a light winter. (Annual common: greater than 230 days of sunshine.) Decrease taxes. The promise of a pandemic-era refuge from all of the COVID restrictions up north. The presumed immunity from the each day horrors of life in all these messy blue-state cities—in favor of a supposedly protected, sheltered group in a state that sells itself as a final bastion of “particular person freedom.” Collectively, these attracts—and the brilliant, if tarnished, model of a neighborhood resident named Trump—have proved a strong magnet for MAGAs with cash and the nouveau riche of all stripes. (Self-importance Honest)

• The Brutal Actuality of Plunging Workplace Values Is Right here: Business-property offers within the US are beginning to decide up — at deep reductions which might be forcing lenders around the globe to brace for souring loans. (Bloomberg) see additionally A $560 Billion Property Warning Hits Banks From NY to Tokyo: Lenders face debt maturities, decrease values after thaw in offers Multifamily additionally a spotlight following change in New York hire legislation (Bloomberg)

• You paid extra in revenue taxes final yr than a company with billions in earnings. Working Individuals, for essentially the most half, pay federal revenue taxes. Salaried staff have a portion of their pay withheld for federal revenue taxes each pay interval. Small enterprise homeowners and unbiased contractors are required to submit funds to the federal authorities all year long primarily based on their projected revenue. These federal taxes quantity to a major proportion of staff’ earnings, an efficient tax fee of ~13.6%. However some large firms with billions in earnings have a a lot completely different expertise. (Widespread Info)

• He Grew Up within the Shadow of the ‘Wolf of Wall Avenue.’ Then He Bought Into Debt Settlement. Ryan Sasson constructed a enterprise that reaped tons of of tens of millions of {dollars} in charges for serving to individuals negotiate down their money owed. However former shoppers — and prosecutors — say it was exploitative. (New York Instances)

• The Life and Demise of the American Mall: The indoor suburban procuring heart is a particular form of deserted place. (Atlas Obscura)

• Is the Media Ready for an Extinction-Stage Occasion? Adverts are scarce, search and social visitors is dying, and readers are burned out. The long run would require basically rethinking the press’s relationship to its viewers. (New Yorker)

• Kara Swisher Is Sick of Tech Folks, So She Wrote a E book About Them: Silicon Valley’s high pundit dishes on her memoir Burn E book, immature billionaires, and whether or not she’s truly imply. (Wired)

• GoFundMe Is a Well being-Care Utility Now: Resorting to crowdfunding to pay medical payments has turn out to be so routine, in some instances well being professionals suggest it. (The Atlantic) see additionally The Albatross Round America’s Neck: How health-care opacity neutralizes competitors and fuels a company race to nook health-care markets. Bought affect has led to regulatory seize, shaping laws to persistently favor the health-care trade’s pursuits. (Well being Care Un-Lined)

• The Authorized Coup: New Paperwork Reveal How Trump Legal professionals Sought ‘Chaos’ to Power SCOTUS, or Whoever Else, to Anoint Trump. (TPM)

• Why Individuals Out of the blue Stopped Hanging Out: An excessive amount of aloneness is making a disaster of social health. (The Atlantic)

You should definitely take a look at our Masters in Enterprise this week with Invoice Dudley, former president and chief government officer of the Federal Reserve Financial institution of New York, the place he additionally served as vice chairman and a everlasting member of the Federal Open Market Committee. He was government vice chairman of the Markets Group on the New York Fed, the place he additionally managed the System Open Market Account. Beforehand, he was chief US economist at Goldman Sachs (the agency’s first) in addition to a associate and managing director.

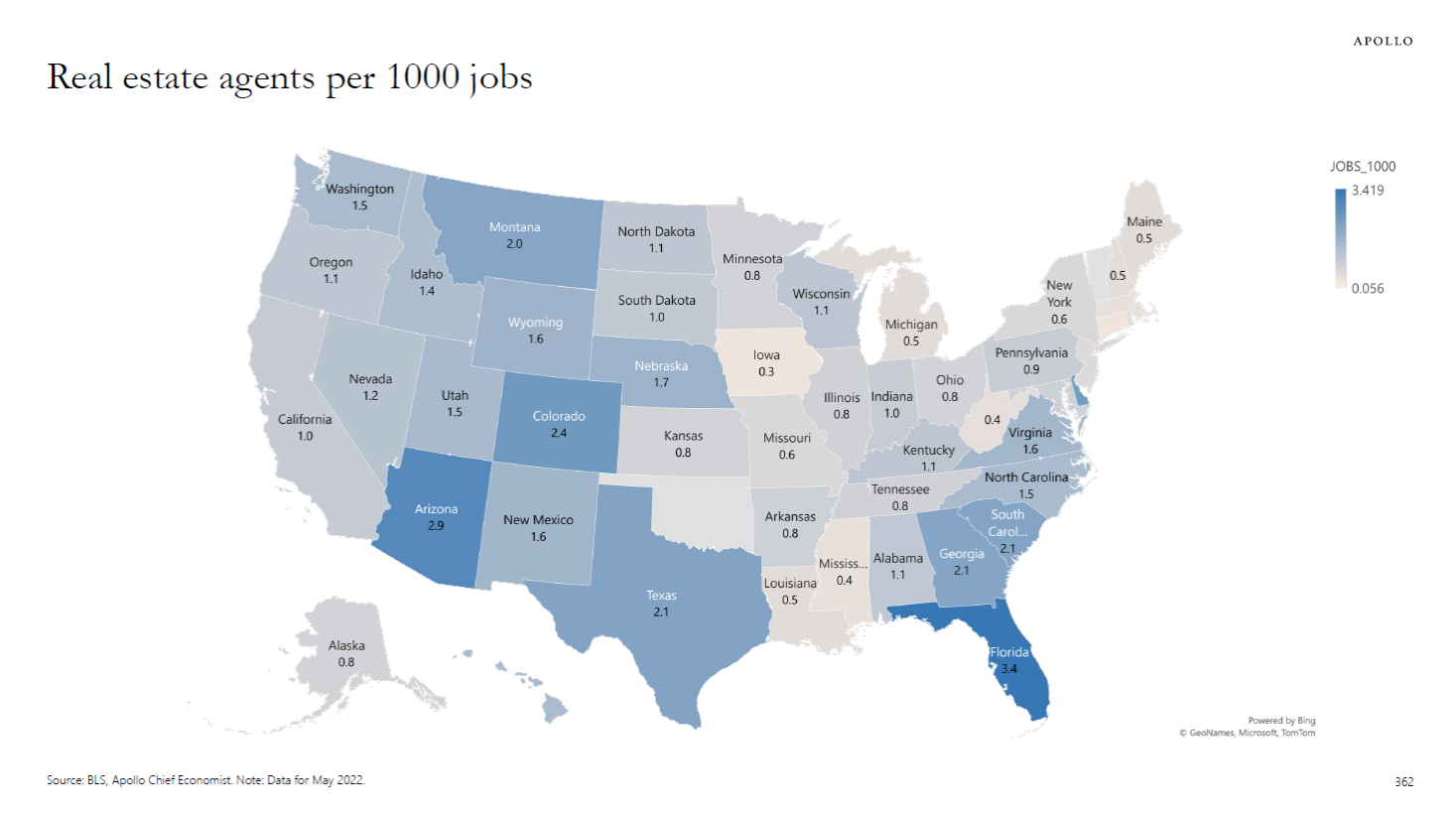

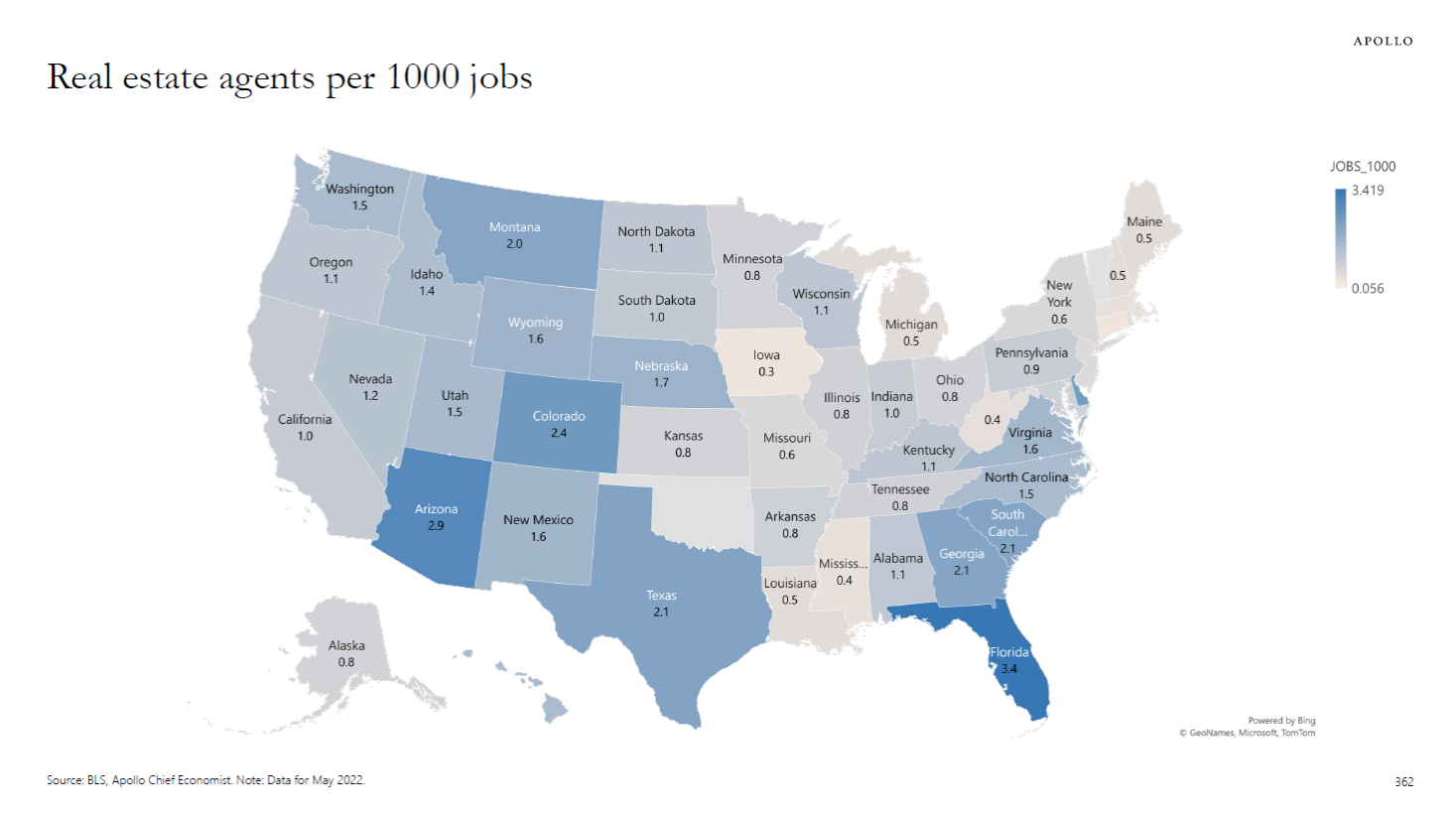

Actual property brokers are much less busy

Supply: Torsten Slok, Apollo World

Join our reads-only mailing checklist right here.

~~~

To learn the way these reads are assembled every day, please see this.